- Home

- »

- Medical Devices

- »

-

Pharmaceutical CDMO Market Size & Share Report, 2030GVR Report cover

![Pharmaceutical CDMO Market Size, Share & Trends Report]()

Pharmaceutical CDMO Market Size, Share & Trends Analysis Report By Product (API, Drug Product), By Workflow (Clinical, Commercial), By Application (Oncology), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-064-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 – 2021

- Industry: Healthcare

Report Overview

The global pharmaceutical CDMO market size was estimated at USD 135.85 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. This growth is driven by various factors, including the increasing demand for biopharmaceuticals, technological advancements in manufacturing, and the trend toward outsourcing drug development and production. The contract development and manufacturing organization (CDMO) market is an essential component of the pharmaceutical industry, and its growth is expected to have a positive impact on the overall healthcare industry.

In the upcoming years, the pharmaceutical CDMO industry is anticipated to increase as a result of the pharmaceutical industry's sizable R&D investments and the rising need for biopharmaceuticals. With the aging population expected to open new chances for medication development, the market for pharmaceuticals is predicted to grow. CDMOs are a crucial part of the pharmaceutical business since they offer pharmaceutical companies’ cost-effective options and a quicker time to market through the outsourcing of drug development and production.

Moreover, the biopharma industry's expansion, with China emerging as a major player, is projected to boost the market's growth. The continuous investment in R&D by pharmaceutical companies is driving advancements in biopharmaceuticals, leading to the discovery of new treatments and cures. This trend is expected to continue, with cumulative R&D spending by the top 15 companies reaching a record high in 2020. The increasing incidence of chronic diseases and the development of biosimilars are expected to drive pharmaceutical R&D spending globally, further fueling the growth of the market. Overall, the pharmaceutical CDMO future looks promising, with numerous growth opportunities emerging in the pharmaceutical industry.

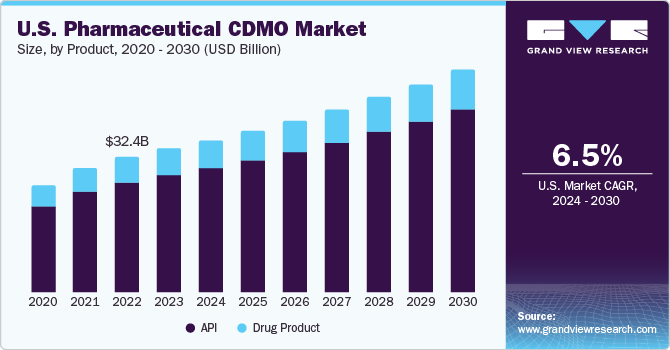

Product Insights

With a growth rate of 6.3% in 2022, the API segment will hold the largest revenue share in the CDMO market. As APIs are an essential part of formulated pharmaceuticals, CDMOs, and CMO, have made major investments to increase their capacity for producing APIs in response to the rising demand for them. Nonetheless, the need for more qualified knowledge and insufficient manufacturing capacity continues to be major obstacles in this market. Companies like Recipharm have made considerable expenditures to increase their small-scale GMP API manufacturing capacity in order to address these issues, which is anticipated to affect the development of this market positively.

In addition, early solid-form investigations play a crucial role in the development of APIs and formulations. They serve as links between API development and formulation and help prevent issues in the late development stage, thereby reducing development costs. The outsourcing of these facilities to CDMOs presents significant opportunities for the pharmaceutical CDMO market, as pharmaceutical firms aim to reduce the cost of development. As a result, the CDMO market is poised to grow further, with numerous opportunities emerging in the API and solid form investigations segments.

Workflow Insights

Based on workflow, the pharmaceutical and biotechnology market is divided into commercial and clinical segments. In 2022, the commercial segment had the biggest market share, with 88.0%. The rising demand for generic medications, the acceptance of biosimilar medications, and regenerative therapies are all factors contributing to this growth. Companies must concentrate on GMP compliance, scaling up processes, and increasing QC testing facilities during the commercial phase to meet standards. This is where CDMOs may help by providing specialized knowledge, saving time, and being cost-effective. Over the projection period, the industry is anticipated to grow even more as the need for commercial pharma CDMO services rises.

The clinical market sector is expected to see the quickest CAGR of 7.4% for the forecast period of 2023-2030. Commercial lots are crucial to the future of the company, whereas commercial lots are key for its current performance. Mistakes throughout clinical programs could cause delays or stop items from moving forward in the clinic, which could negatively affect patients. Pharmaceutical and biotechnology companies carry out research-stage investigations, and as they advance through preclinical testing and early clinical trials, they increase their staff to assist development. Yet, due to the ongoing development of clinical manufacturing processes, compliance with GMPs is much more difficult for clinical operations than it is for commercial ones. In order to expedite the clinical process for APIs, CDMOs can offer expertise.

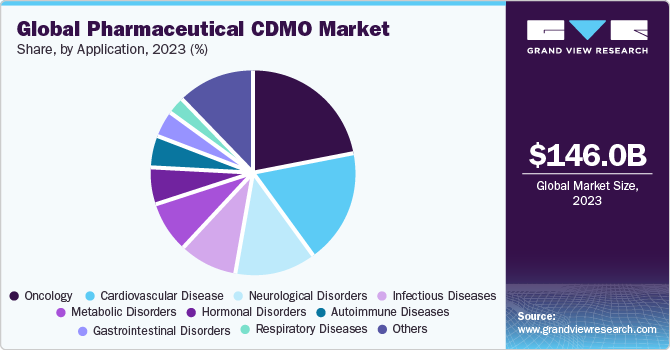

Application Insights

The oncology market had a value of USD 47,683.5 million in 2022 and is projected to expand at a CAGR of 7.5% during the forecast period. The oncology segment accounted for 35.1% of the market share in 2022 and is expected to continue its dominance. The increasing prevalence of cancer worldwide is driving market growth, with cancer being the leading cause of death and accounting for 10 million deaths globally in 2021. The demand for new cancer therapies is expected to rise, presenting opportunities for both pharmaceutical and CDMO companies. The pharmaceutical industry's pipeline for oncology treatments is predicted to account for around 30% of it in 2020. However, despite the advancements in diagnosis and treatment, the oncology field remains challenging, time-consuming, and continuously developing, with over 12.5 million new cases of cancer reported each year.

Due to this collaboration and outsourcing of services by pharmaceutical companies to CDMOs, the market is experiencing tremendous growth. The need for contract research and manufacturing services has increased due to the growing cancer burden in the world and the need for more effective and efficient therapies. By offering specialized services and knowledge, CDMOs are playing a crucial part in the development of innovative cancer medicines and drug delivery systems. Pharmaceutical companies are projected to continue outsourcing their services to CDMOs as a result of the rising demand for cancer medicines and the difficulties associated with oncology research, which is boosting the market for the latter.

Regional Insights

The market is segmented into various regions, with Asia Pacific holding the largest market share of 37.4% in 2022 and anticipated to grow at a fast CAGR of 6.9% during forecast period. The market growth in the APAC region can be attributed to cheaper manufacturing costs in comparison with North America and Europe, making it an attractive outsourcing hub for pharmaceutical development. The presence of university-affiliated pharmaceutical research clusters and a large amount of funding is also driving market growth in the region. India and China are leading the contract development and manufacturing organization market due to favorable legislation and significantly low production costs in North America and Europe.

In addition, the APAC market is anticipated to be driven by various factors, including an enhanced regulatory framework, significant scope for cost reduction, increased complexity, and a robust drug pipeline. The availability of skilled labor at prices cheaper than those in industrialized nations such as the U.S. is also a significant factor driving market growth in the region. While the contract manufacturing market in China is growing at a rate of around 15% annually, only some Western CDMOs have been successful in recruiting local businesses. Hence, there are significant opportunities in the region, and the growth in the APAC market is likely to continue in the coming years.

Key Companies & Market Share Insights

Key market players are undertaking various strategic initiatives such as the signing of the new partnership agreement, collaborations, mergers and acquisitions, and geographic expansion, aiming to strengthen their services, thus providing a competitive advantage. For instance, in 2021, Cambrex Corporation company announced plans to expand the size of its manufacturing hub in High Point, North Carolina. The USD 30 million investment was intended to meet the steadily increasing demand for services related to the development and production of small molecules. Some prominent players in the global pharmaceutical CDMO market include:

-

Bushu Pharmaceuticals Ltd.

-

Nipro Corporation

-

Thermo Fisher Scientific Inc.

-

Samsung Biologics

-

Laboratory Corporation of America Holdings

-

Siegfried Holding Ag

-

Catalent, Inc

-

Lonza Group AG

-

Recipharm Ab

-

Piramal Pharma Solutions

-

Cordenpharma International

-

Cambrex Corporation

-

Wuxi Apptec

Recent Developments

-

In May 2023, Siegfried acquired a 95% stake in DiNAMIQS to develop and manufacture best-in-class biotech CDMO for cell and gene therapies. Through this acquisition, Siegfried aimed to expand its footprint, and create growth opportunities in the rapidly growing space of cell and gene therapies

-

In August 2022, Catalent, Inc. acquired Metrics Contract Services, a full-service specialty CDMO, to expand its capabilities in integrated oral development and manufacturing. This acquisition further increased Catalent’s ability to provide its customers with immediate, and fit-for-scale capacity for in-demand highly potent drugs

-

In May 2022, Astorg entered into a binding agreement with the International Chemical Investors Group (ICIG) to acquire CordenPharma, a global leading CDMO in pharmaceuticals, from ICIG. As a partner, CordenPharma provideed integrated product offerings, and end-to-end capabilities which helped Astorg to leverage its expertise in pharma services

-

In February 2022, Recipharm acquired Arranta Bio, a prominent advanced therapy CDMO, to expand its biologics offering in the U.S. This acquisition helped Recipharm to provide innovative drug developers with contract services for ATMPs in the biologics market, and expand its presence in the U.S. market with new biologics modalities

Pharmaceutical CDMO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 144.716 billion

Revenue forecast in 2030

USD 232.587 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Product, workflow, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Bushu Pharmaceuticals Ltd.; Nipro Corporation; Thermo Fisher Scientific Inc; Samsung Biologics; Laboratory Corporation of America Holdings; Siegfried Holding Ag; Catalent, Inc; Lonza Group Ag; Recipharm Ab; Piramal Pharma Solutions; Cordenpharma International; Cambrex Corporation; Wuxi Apptec.

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

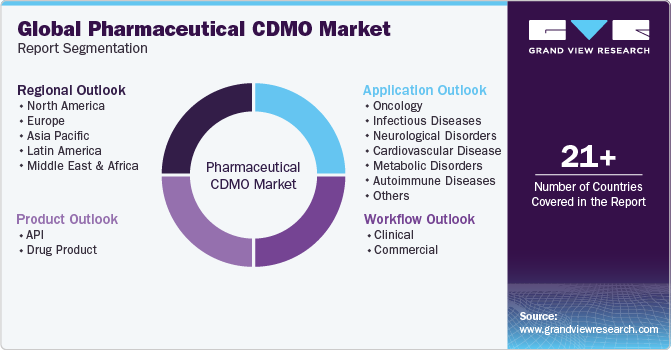

Global Pharmaceutical CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical CDMO market report on the basis of product, workflow, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

API

-

By Synthetic

-

Solid

-

Liquid

-

-

By Type

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Antibody Drug Conjugate (ADC)

-

Others

-

-

By Drug

-

Innovative

-

Generics

-

-

By Manufacturing

-

Continuous manufacturing

-

Batch manufacturing

-

-

Biotech

-

-

Drug Product

-

Oral Solid Dose

-

Semi-solid dose

-

Liquid Dose

-

Others

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Commercial

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Hormonal

-

Glaucoma

-

Cardiovascular Disease

-

Diabetes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical CDMO market size was estimated at USD 135.8 billion in 2022 and is expected to reach USD 232.5 billion in 2030.

b. The global pharmaceutical CDMO market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 232.5 billion by 2030

b. Asia Pacific dominated the pharmaceutical CDMO market with a share of 37,4% in 2022. This is attributable to cheaper manufacturing costs in comparison with North America and Europe, making it an attractive outsourcing hub for pharmaceutical development.

b. Some key players operating in the pharmaceutical CDMO include Bushu Pharmaceuticals Ltd., Nipro Corporation, Thermo Fisher Scientific Inc, Samsung Biologics, Laboratory Corporation Of America Holdings, Siegfried Holding Ag, Catalent, Inc, Lonza Group Ag, Recipharm Ab, Piramal Pharma Solutions, Cordenpharma International, Cambrex Corporation, Wuxi Apptec.

b. Pharmaceutical industry's sizable R&D investments and the rising need for biopharmaceuticals are key growth drivers for this industry. With the aging population expected to open up new chances for medication development, the market for pharmaceuticals is predicted to grow

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."