- Home

- »

- Consumer F&B

- »

-

Pet Snacks And Treats Market Size & Share Report, 2030GVR Report cover

![Pet Snacks And Treats Market Size, Share & Trends Report]()

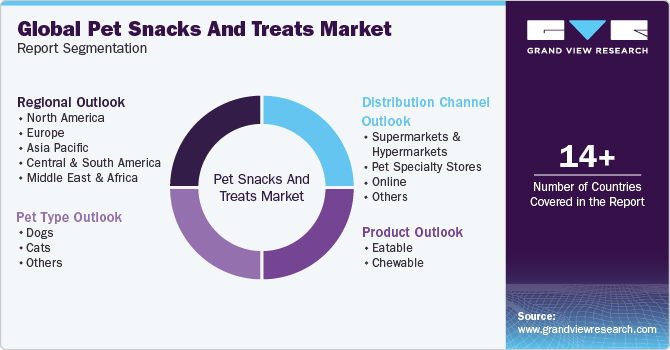

Pet Snacks And Treats Market Size, Share & Trends Analysis Report By Product, By Pet Type (Dogs, Cats), By Distribution Channel (Supermarket & Hypermarkets, Specialty Pet Stores, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-948-1

- Number of Pages: 122

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global pet snacks and treats market size was valued at USD 8.12 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. In recent years, pet owners across the U.S. have been spending significantly on their pets’ well-being and nutrition. According to statistics provided by the American Pet Products Association (APPA), in 2019, owners spent around USD 97.1 billion on pets in the U.S. This trend correlates with the growth of certain pet food segments, including healthy treats, snacks, specialty pet foods, and other premium options. Even amid the COVID-19 pandemic and the global economic crisis that ensued, pet industry sales exceeded USD 29.17 billion in 2020. This growth can largely be attributed to the growing number of pet ownerships, as many people sought out pets during the pandemic for comfort and companionship.

Due to this surge in adoption rates, pet treats represented a high growth category, and pet food manufacturers were being innovative with the launch of new products to stay ahead of the competition. On the flip side, pet food makers were forced to address new ingredient sourcing and transportation challenges, according to Dana Brooks, president & CEO of the Pet Food Institute (PFI), as the entire food system faced major disruptions.

The increasing number of pets across the U.S. is driving the demand for pet snacks & treats in the country. For instance, according to the U.S. Pet Food Industry’s pet ownership study, in 2020, pet ownership rose from 67% of households to an all-time high of 70%, which is confirmed by the APPA. The booming pet treats market in the U.S. will continue to create opportunities for market players, particularly from a supplier viewpoint. As consumers continue to be price-conscious, developing premium lines that also tap into other categories, such as breed, age, and lifestyle, are seen as an opportunity for manufacturers to offer added value.

Well-established players such as Mars, Incorporated and its affiliates, Nestlé, and Wellness Pet Company conduct the sales of their products through their sales force and/or third-party brokers and distribution partners. Notable growth in e-commerce portals is likely to lead to more growth prospects for the pet snacks & treats market owing to wider distribution networks. This has influenced manufacturers, especially in the U.S., to sell their products through online players like Amazon; Walmart; Chewy, Inc.; Petco Animal Supplies, Inc.; and BarkBox.

According to a report by the U.S. Food Export on the U.S. Foods, in March 2022, millennials and Gen Z make up the majority of the pet owners in the U.S, which reflect their increased willingness to spend on pet foods and other products. These figures are expected to grow in the coming years. The growth is driven by several factors, including developing new products and formats designed to satisfy a much wider variety of needs.

The high pet adoption rate has increased the demand for pet care products, including pet treats such as chewable and cookies. Pet owners have also been making frequent visits to veterinarians for their companion animals’ overall health and wellbeing. The COVID-19 pandemic saw a surge in puppy adoptions and training and more time was spent at home with pets due to the imposition of lockdown measures; this has significantly propelled the demand for training treats and snacks for pets across the globe.

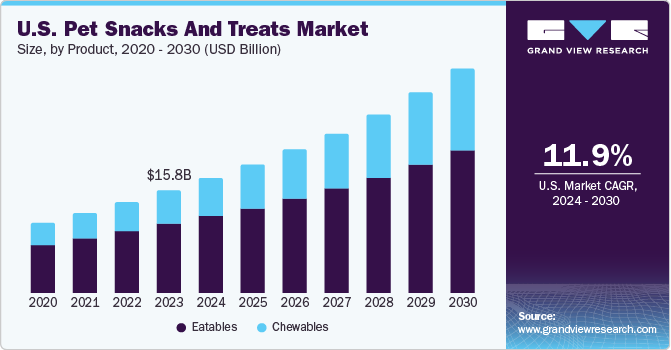

By Product

The eatables segment accounted for a larger share of 70.2% of the global revenue for 2022. The growth of the market is characterized by constant product launches to keep up with the surge in demand and increasing product adoption, which is boding well for the segment growth.

For instance, in May 2022, Wellness Pet Company introduced the Good Dog by Wellness brand that manufactures treats formulated with premium, natural ingredients to provide functional benefits and promote good behavior among dogs. These are available in three varieties: Happy Puppy, Training Rewards, and Tender Toppers. The growing ethical preference for a vegan diet among pet owners is expected to represent a positive outlook for the vegetarian/vegan eatables segment.

The chewable segment is anticipated to expand at a higher CAGR of 5.5% during the forecast period. The rising concern among dog owners regarding undigested food due to loose or broken teeth, especially in older dogs, is expected to drive the growth of the segment in the coming years. Hence, key players in the market are launching products that address these concerns to increase their market share. For instance, in February 2022, Big Heart Pet Brands added new crunchy treats and chewable goodies in the varieties Stacked and Stuffed to its lineup of chews in the flavors Twists and Braids.

By Pet Type

The cats segment is anticipated to advance at a higher CAGR of 5.2% over the forecast period. Furthermore, market players are capitalizing on the rising awareness about the health of pet animals, including cats. For instance, Inaba Foods (USA) Inc. is one of the most popular brands of premium cat dinners and treats in Japan, with products available across the globe.

Similarly, Mars, Incorporated and its affiliates, in June 2021, expanded its cat food range, including snacks & treats, in India. The new product range is available across pet shops, grocery stores, and e-commerce sites and is backed by a 360-degree marketing campaign across media channels, including collaboration with celebrity cat parents.

The dogs segment accounted for the largest share of 48.9% of the global revenue for 2022 and is expected to maintain dominance during the forecast period. The growing shift among dog parents toward vegan food, including snacks and treats, owing to food allergies (itchy skin, paws & ears) or digestive disturbances (vomiting & diarrhea) would bolster the growth of the segment.

For instance, in June 2022, Jinx partnered with Pressed to launch its new plant-based, limited-edition dog treats. The new Jinx X Pressed dog biscuits are formulated with limited, plant-based ingredients to cater to dogs with food sensitivities, and are free from corn, wheat, soy, fillers, and artificial preservatives. The biscuits are available in two flavors: Peanut Butter & Banana and Pumpkin.

The flavored beverages segment is expected to register the fastest CAGR from 2023 to 2030. The steady development of such products has led to the introduction of several flavored beverages in the market. Presently, these products are available in strawberry, French vanilla, coconut, berry, chocolate, banana, coconut, hazelnut, and several other flavors.

Manufacturers are introducing and combining several flavors to stimulate the adoption of beverages in different applications, such as smoothies, protein shakes, yogurt drinks, and other beverages with favorite inclusions. An increasing number of developments and product launches are expected to drive segment growth over the forecast period.

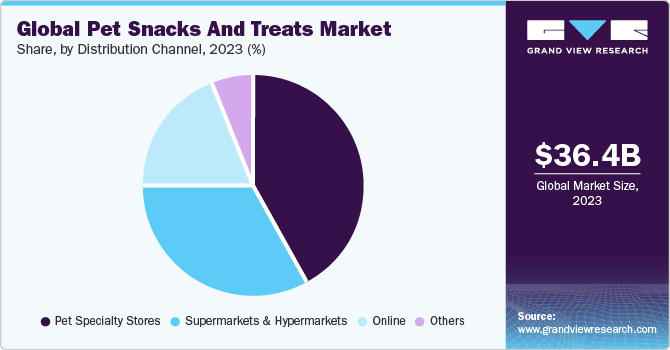

By Distribution Channel

The supermarkets & hypermarkets segment accounted for the largest share of 36.5% in 2022. An increasing number of supermarkets & hypermarkets in the U.K. have started offering pet foods, including snacks and treats, which propels the growth of the segment. For instance, in December 2021, leading supermarket chain Tesco debuted its first vegan pet food range.

The U.K.’s largest supermarket chain introduced its first range of vegan dog treats, which includes ‘Denzel’s Plant-Based Bites For Dogs’, made with ingredients like peanut butter, banana, carrot, and kale, which are hand-baked, grain-free, and free from artificial colors, flavors, and sweeteners. Such an increase in the number of product offerings by major supermarket & hypermarket chains across the globe is expected to propel the market growth during the forecast period.

The online segment is anticipated to register the highest CAGR of 5.3% during the forecast period. E-commerce has changed people’s shopping habits substantially, providing various advantages such as doorstep delivery, lucrative discounts, and the availability of various items on a single site. The availability of a dynamic range of pet snacks and treats and the increasing customer loyalty through ‘Subscribe & Save’ programs are expected to bolster the online channel.

For instance, in May 2022, Amazon continued to focus on the pet food, treat, and other product markets as it launched ‘Pet Day’ amid the pet food e-commerce boom, in which, various pet treat brands such as Purina Friskies cat treats, Stella, Chewy, and Wild Red dog food were available at exclusive discount prices.

Regional Insights

North America made the largest contribution to the market in terms of revenue share in 2022. Around 70% of U.S. households, or about 90.5 million families, own a pet, according to the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA).

The rising trend of the adoption of shelter animals will bolster the demand. The increasing adoption of sustainable packaging among consumers will help the industry gain profit, as pet owners are looking for fresh food including snacks and treats for their pets to maintain a healthy and balanced diet. Premiumization and momentum in treats and toppers will continue to move the category forward in the forecast period.

Central & South America is expected to be the fastest-growing region during the forecast period. The availability of a wide variety of snacks for pets in the region will bolster the market growth in the coming years. For instance, Nestlé Purina Petcare offers a wide range of products including treats, snacks, jerky strips, bones, chews, and others in major countries of the region.

Consumers in the region are becoming more aware of pet health issues such as weight, allergies, and dietary tolerances, hence are opting for a plant-based diet, including snacks and treats, with health benefits. According to the National Library of Medicine, more than 60% of families in Brazil own a pet. An increase in the gross income of consumers would help increase their purchasing power for pet food and care products.

Key Companies & Market Share Insights

The market is characterized by the presence of some large multinational companies with a strong presence across the globe. Some of the key players are Mars, Incorporated and its Affiliates; Wellness Pet Company; Nestlé; SCHELL & KAMPETER, INC.; and Whitehall

Specialties Inc. Companies have been implementing various expansion strategies such as mergers & acquisitions, capacity expansions, strengthening of online presence, and new product launches to gain a competitive advantage. These manufacturers are adopting various strategies, including new product launches, expansion of product portfolios, and mergers & acquisitions. For instance:

-

In July 2022, Globe Buddy ApS announced its first insect and plant-based dog treat line formulated with protein, fruits, and vegetables. Furthermore, “Insect Crunch” is the company’s environment-friendly meat-free alternative, while Veggie Crunch is 100% vegan and vegetable and fruit spirulina crunch. The products are sold through the company’s Shopify website, Amazon, and other retailers

-

In May 2022, Wellness Pet Company introduced Good Dog by Wellness, a brand of all-natural treats for dogs with the mission to create a better life together between dogs and dog parents.

-

In December 2021, Clif Bar & Company entered the pet food category with the launch of its new line of plant-based snacks for dogs. The organic energy bar firm is introducing a new range of vegan pet treats set to hit US shelves in early 2022. The company is planning to launch three recipes of plant-based jerky, including sweet potato and blueberry, pumpkin and apple, butternut squash, and cranberry. Each flavor contains just seven ingredients and is designed for easy digestion.

Some prominent players in the global pet snacks and treats market include:

-

Mars, Incorporated and its Affiliates

-

Nestlé

-

SCHELL & KAMPETER, INC.

-

The J.M. Smucker Company,

-

Hill's Pet Nutrition, Inc.,

-

Addiction Foods

-

Wellness Pet Company

-

Spectrum Brands, Inc.

-

Unicharm Corporation

-

Blue Buffalo Co., Ltd

Pet Snacks And Treats Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 8.51 billion

The revenue forecast in 2030

USD 12.16 billion

Growth Rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, brand share analysis, and trends

Segments covered

Product, pet type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada; Mexico, U.K.; Germany, France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Mars, Incorporated and its Affiliates; Nestlé; SCHELL & KAMPETER, INC.; The J.M. Smucker Company; Hill's Pet Nutrition, Inc.; Addiction Foods; Wellness Pet Company; Spectrum Brands, Inc.; Unicharm Corporation; Blue Buffalo Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Snacks And Treats Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the pet snacks and treats market on the basis of product, pet type, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Eatables

-

Chewables

-

-

Pet Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Pet Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet snacks and treats market size was estimated at USD 8.12 billion in 2022 and is expected to reach USD 8.51 billion in 2023.

b. The global pet snacks and treats market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 12.16 billion by 2030.

b. The North America dominated the market and accounted for 39.1% of the global revenue shares in 2022. The growth of the regional market can be attributed to the increasing adoption of sustainable packaging among consumers will help the market gain profit in the region, as pet owners are looking for fresh food including snacks and treats for their pets to maintain a healthy and balanced diet.

b. Some key players operating in the pet snacks and treats market include Mars, Incorporated, Nestlé, SCHELL & KAMPETER, INC, The J.M. Smucker Company, Hill’s Pet Nutrition. Inc., Addiction Foods, Wellness Pet Company, Spectrum Brands, Inc., Unicharm Corporation, and Blue Buffalo Co., Ltd.

b. The growth of the pet snacks and treats market can be attributed to increasing pet adoption, humanization, and raising awareness of pet health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."