- Home

- »

- Animal Feed and Feed Additives

- »

-

Pet Food Ingredient Market Size, Share & Growth Report 2030GVR Report cover

![Pet Food Ingredient Market Size, Share & Trends Report]()

Pet Food Ingredient Market Size, Share & Trends Analysis Report By Ingredients (Specialty Protein, Amino Acid, Phosphates, Vitamins, Acidifiers, Antioxidants, Mold Inhibitors), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-772-8

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Specialty & Chemicals

Report Overview

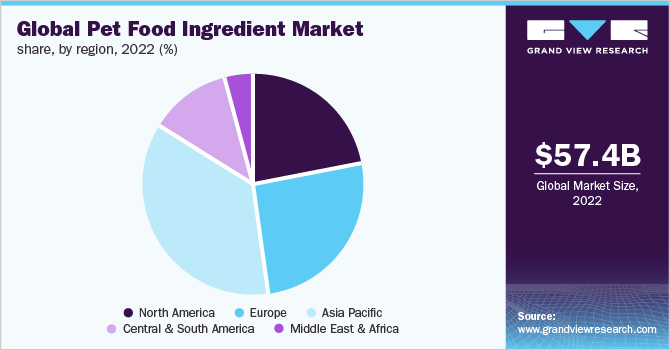

The global pet food ingredient market size was estimated at USD 57.4 billion in 2022 and is expected to expand at a CAGR of 4.8% from 2023 to 2030. The increasing adoption of pets globally and pet humanization due to the work-from-home trend, which affected consumer perception regarding the pet’s nutritional needs, are driving the demand for the pet food ingredient market. The COVID-19 pandemic had a positive impact on the growth of the pet food ingredients market. During the pandemic, most consumers adopted pets, resulting in a spike in sales of pet food ingredients. This sales spike was witnessed during the first lockdown, as consumers stocked up on food in anticipation of future shortages. The growing trend of pet humanization was witnessed during the pandemic as consumers could spend more time bonding with their pets.

The increasing consumer awareness of pets' health-specific needs and the work-from-home trend resulted in an increase in the adoption of pets across the globe. Due to the work-from-home trend, pet parents have been able to bond with their pets and see them as a member of their family. This results in taking care of the specific needs of pets and becoming more aware of their nutritional needs, as different nourishment is required for pets that are sedentary, spayed, ill, or very active. These factors drive the demand for quality pet food in the pet market.

Manufacturers of all sizes, from start-ups to the most extensive pet retailers in the U.S., are introducing new goods and services such as human-grade fresh meals, activity monitors, and medical diagnostic tools. Many brands that market human-grade food for dogs and cats have emerged due to the rising pet humanization trend. Some of those meals include a whole wheat food diet, squash, and sweet potatoes. Animal-based pet food ingredients are associated with various health advantages, including improved skin and coat condition, improved cognitive benefits for older pets, and efficient support for digestive and intestinal health. For instance, Farmina, a global pet food manufacturer, manufactures various animal-based pet food items such as chicken, lamb, duck, and fish.

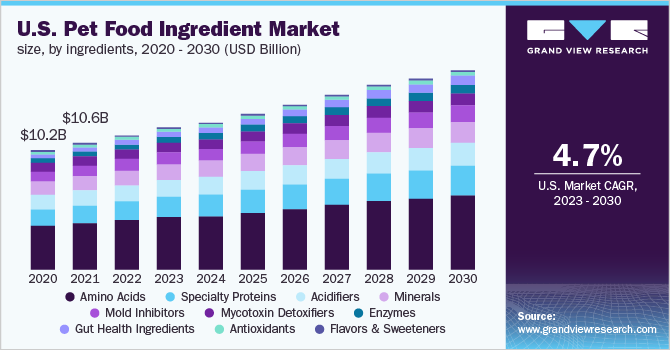

Ingredient Type Insights

Based on ingredient type, the market has been segmented into amino acids, acidifiers, vitamins, specialty proteins, minerals, flavors and sweeteners, gut health ingredients, mold inhibitors, phosphates, and carotenoids. The amino acids segment accounted for the largest market share of 30.9% in 2022 in terms of revenue and is expected to expand at a CAGR of 6.3% in the forecast period. This is owing to the efficiencies offered by the ingredient, including supporting good vision, cardiac and immune system function, heart health, preventing infections, and slowing the growth of bacteria and pathogens among pets.

The gut health ingredient segment is expected to advance at the fastest CAGR of 10.9% during the forecast period of 2023-2030. As consumers today are looking for products having ingredients that support the gut health of pets and farm animals, the segment is expected to proliferate in the coming years. The increased awareness about pet health-specific ingredients and their availability in the market has given rise to this segment.

Regional Insights

Asia Pacific dominated the market with a share of 35.6% in 2022 and is also expected to witness the fastest CAGR of 5.3% over the forecast period. China dominated the Asia Pacific market and is expected to expand at the fastest CAGR of 5.8%% during the forecast period. The trend of grain-free & natural pet food and functional ingredients in pet food markets has been growing in popularity, which is gaining the interest of consumers in China. The regulations for pet food labeling in China include standardized tables with exact amounts of different ingredients that must be declared on a label. For instance, pet food must include at least 26% chicken to be designated a Chicken Formula. Additionally needed are declarations of moisture content.

Europe accounted for a significant market share in 2022 and is anticipated to progress at a CAGR of 4.6% over the forecast period. Western Europe dominated the region with a significant market share. This is attributed to several factors, including the increasing cat population over dogs, the pet humanization trend, growing consumer demand for high-quality pet food providing good health to pets, and the palatability of the ingredients. Countries such as Germany, the U.K., and France are significant contributors to the growth of the regional market.

Key Companies & Market Share Insights

The pet food ingredient market features various global and regional players, which makes it a competitive market. The world’s leading companies are using partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share.

In July 2022, Symrise announced the acquisition of Wing Pet Food, one of the leading companies in China in Pet Food palatability enhancers and suppliers of Pet Food ingredients. With this acquisition, the company’s market position is expected to strengthen in pet food palatability and will extend Symrise’s presence in APAC. Some of the prominent players operating in the global pet food ingredient market are:

-

FoodSafe Technologies

-

Symrise

-

AFB International

-

DuPont Nutrition & Health

-

Biorigin

-

Lallemand, Inc.

-

Eurotec Nutrition

-

Impextraco Ltda Brazil

-

Pancosma

-

Alltech

-

Vitablend Nederland B.V.

-

Elanco

Pet Food Ingredient Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 60.5 billion

Revenue forecast in 2030

USD 83.6 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume (Kilotons), and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredients, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Western Europe; Germany; France; U.K.; Russia; China; Japan; Thailand; Australia; Taiwan; South Korea; Brazil; Argentina; Chile; Colombia; Turkey; Morocco; Saudi Arabia; South Africa

Key companies profiled

FoodSafe Technologies; Symrise; AFB International; DuPont Nutrition & Health; Biorigin; Lallemand Inc.; Eurotec Nutrition; Impextraco Ltda Brazil; Pancosma; Altech; Vitablend Nederland B.V.; Elanco

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Food Ingredient Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global pet food ingredient market report based on ingredients and region:

-

Ingredients Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

Specialty Proteins

-

Beef Proteins

-

Egg Proteins

-

Blended Proteins

-

Hydrolyzed Proteins

-

Pork Protein

-

Fish Protein

-

Poultry Protein

-

Ovine Proteins

-

Cervine Proteins

-

Other Animal Proteins

-

Plant Proteins

-

Algal proteins

-

-

Amino Acids

-

Lysine

-

Methionine

-

Threonine

-

Cysteine

-

Others

-

-

Mold Inhibitors

-

Gut Health Ingredients

-

Beta-Glucan

-

Cereals

-

Mushroom

-

Yeasts

-

Seaweed

-

-

Phosphates

-

Monocalcium

-

Dicalcium

-

Phospholipids

-

Others

-

-

Vitamins

-

Water-Soluble

-

Fat-Soluble

-

-

Acidifiers

-

Carotenoids

-

Astaxanthin

-

Beta-Carotene

-

Zeaxanthin

-

Lutein

-

Others

-

-

Enzymes

-

Phytases

-

Carbohydrates

-

Proteases

-

Others

-

-

Mycotoxin Detoxifiers

-

Flavors & Sweeteners

-

Antimicrobials & Antibiotics

-

Minerals

-

Antioxidants

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Western Europe

-

Germany

-

U.K.

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

Thailand

-

Australia

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

Turkey

-

Morocco

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet food ingredients market size was estimated at USD 57.4 billion in 2022.

b. The global pet food ingredients market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 83.6 billion by 2030

b. Asia Pacific dominated the pet food ingredients market with a revenue share of 36% in 2022. This is attributed to the presence of major market vendors, availability of raw materials, and labor at a lower price

b. Some of the key players operating in this industry are FoodSafe Technologies, Symrise, AFB International, DuPont Nutrition & Health, Biorigin, Lallemand Inc., Eurotec Nutrition, Impextraco Ltda Brazil, Pancosma, Altech, Vitablend Nederland B.V., and Elanco among others.

b. The key factors that are driving the global pet food ingredients market include pet humanization, pet premiumization, and increased pet ownership.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Restrictions on manufacturing activities due to the advent of the COVID-19 pandemic shall cause a slump in the supply of feed, as well as its additives. The current stagnation in supply is, in turn, detrimental against the backdrop of ever-increasing demand for essential food products such as dairy and meat. The report will account for Covid19 as a key market contributor.