- Home

- »

- Medical Devices

- »

-

Patient Positioning Systems Market Size, Share Report, 2030GVR Report cover

![Patient Positioning Systems Market Size, Share & Trends Report]()

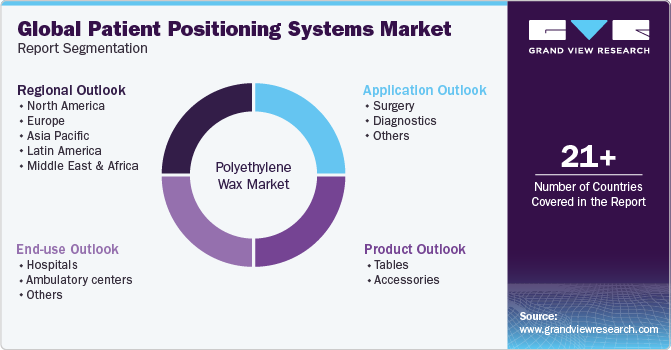

Patient Positioning Systems Market Size, Share & Trends Analysis Report By Products (Tables, Accessories), By Application (Surgery, Diagnostics), By End-use (Hospitals, Ambulatory Services), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-066-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global patient positioning systems market size was valued at USD 1.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The growing geriatric population, increasing prevalence of cancer, rising awareness among the patient population, and surging expenditure on diagnostic procedures are expected to boost the market during the forecast period. Technological innovations and the rising prevalence of non-communicable diseases are the major driving factors for this patient positioning equipment market. For instance, in February 2022, Mireye introduced its intelligent imaging technology that automates the patient positioning process for X-ray examinations.

Increasing hospital investments to upgrade operating rooms further drives the patient positioning equipment market. For instance, in March 2020, the Alberta government committed USD 100 million to upgrade hospital operating rooms. Due to the COVID-19 pandemic, there was major growth in the hospitalization of individuals. The healthcare industry wasn’t prepared for this extent of hospitalization, and most healthcare infrastructure collapsed under the immense burden of COVID-19-affected patients.

As the pandemic subsided, the sector returned to normalcy, and governments started focusing on recognizing the cracks in their healthcare infrastructure and taking initiatives to bolster the same. The patient positioning systems market is projected to benefit from this up-gradation of healthcare establishments worldwide. For instance, in July 2021, A J Hospital, based in Mangaluru, India, revealed the installation of an Ultra-Modern CT system, the 128 Slice Dual Energy CT scanner with AI (artificial intelligence). This machine uses AI to optimize patient positioning and provide scanning support to technologists.

Technological advancements in sensors, such as optic fiber, cancer tracking, and MEMS sensors, are expected to fuel market growth. These systems help keep patients in a comfortable and stable position during radiotherapy as well as treatment delivery. The increasing prevalence of cancer further supplements the growth of this market. According to the WHO, Cancer is a leading cause of death globally, reporting almost 10 million deaths in 2020, or nearly one in six. While as per the National Cancer Institute statistics, there were approximately 181.1 million cancer survivors in the U.S. by January 2022. Cancer survivors are expected to increase to 22.5 million by 2032. This steady increase in disease prevalence is expected to act as a market driver throughout the forecast period.

Increasing awareness and rising expenditure on diagnostic procedures are also expected to increase the market demand for patient positioning systems. According to the National Health Services (NHS), 43.8 million imaging tests were performed in England from April 2021 to March 2022. In addition, many awareness campaigns regarding early cancer diagnosis include the National Awareness and Early Diagnosis Initiative (NAEDI) in the UK. This, in turn, is expected to increase the demand for patient positioning systems.

Application Insights

Based on application, patient positioning systems are segmented into diagnostics/imaging, surgery, and others. The surgery segment held the largest share in 2022 owing to the increasing prevalence of chronic diseases such as cancer. In addition, there is an increase in healthcare expenditure globally, which is anticipated to supplement this application's growth further. Besides, an increasing number of surgical procedures and technological advancements are anticipated to drive the market.

The diagnostics segment is estimated to grow at a lucrative rate over the forecast period due to increasing global expenditure on diagnostics/imaging. Diagnostics tests represent more than 3.0% of total healthcare spending. These tests also play a major role in a doctor's decision-making process. Almost all cancer diagnoses are based on laboratory tests and their results. Furthermore, the growing demand for chronic disease diagnosis and rising aging demographics are expected to boost the demand for diagnostics, supporting market growth.

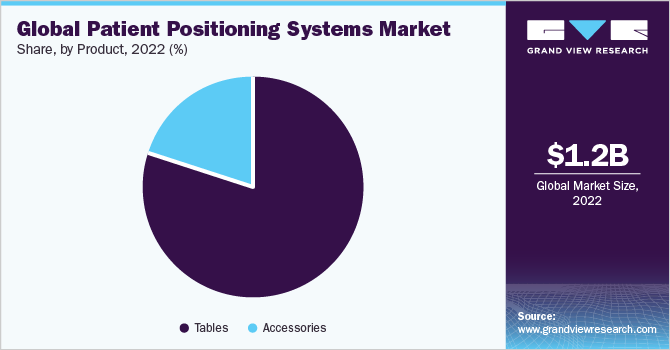

Product Insights

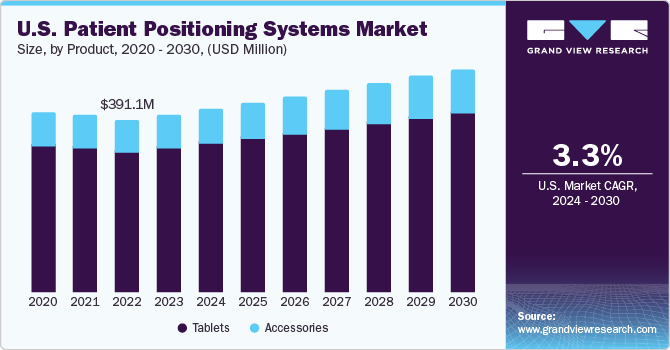

The products analyzed in this study include tables and accessories. The tables segment dominated the market with a revenue share of 79.9% in 2022, owing to increased demand and a rising number of hospitals, ambulatory centers, and other settings such as specialty and diagnostics centers. The tables segment is expected to retain its lead over the forecast period due to the rising demand for efficient and accurate diagnostic imaging, creating growth opportunities for the segment.

The accessories segment is expected to witness the fastest CAGR of 4.5% in the market, owing to the increasing number of patients undergoing different surgeries and diagnoses. There is a greater demand for diagnosis in developing countries such as India and China, which may drive sales of patient positioning systems over the forecast period. Hill-Rom Services, Inc., STERIS, and others offer various accessories to cater to market demand.

End-use Insights

By end use, the market for patient positioning systems is categorized into hospitals, ambulatory centers, and others. Hospitals are identified as the largest revenue segment owing to increasing healthcare expenditure globally. Additionally, increasing the number of hospitals globally is anticipated to drive demand in this market. Thus, hospitals are an integral part of the healthcare industry and are a major revenue source for the entire sector, fueling research and innovation. Therefore, multiple companies invest significant efforts, both in terms of revenue & marketing strategies, to promote their product/services among the hospitals.

The ambulatory centers segment is expected to grow at a significant CAGR. As the number of these centers soars in developed and developing countries, they help alleviate the pressure on hospitals and clinics. There are more than 5,800 Ambulatory Surgical Centers (ASCs) certified by Medicare in the U.S. Soaring healthcare costs are a major concern plaguing the industry, and with it comes the fact that not many patients can afford the treatment they need, including surgical procedures. This has compelled healthcare providers to develop new ways to make such services more affordable while focusing on quality. ASCs have proven to be an effective solution in this scenario.

Regional Insights

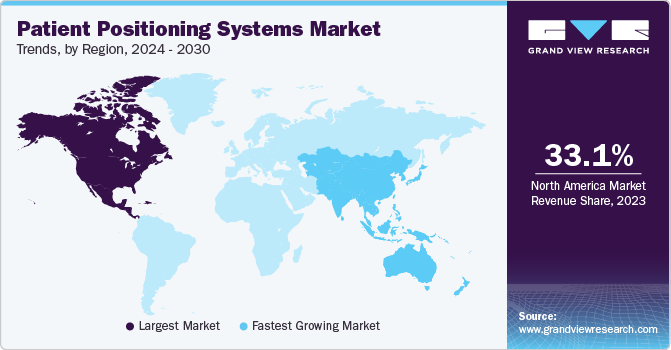

North America held a dominant share of 33.3% in 2022, owing to the rising prevalence of chronic and lifestyle-related diseases and the presence of sophisticated healthcare infrastructure. In addition, the local presence of major market players in the U.S., such as Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; and SchureMed, is expected to boost the growth of the market for patient positioning systems in North America.

Europe is also expected to hold the second-largest market share during the forecast period due to a flourishing medical device industry in the UK, France, and Germany and rising avenues for market participants in this region. Asia Pacific is expected to register the fastest CAGR of 5.8% compared to other regions over the forecast period, which can be attributed to the increasing geriatric population and healthcare expenditure in this region. For instance, according to the Asian Development Bank, the elderly population in Asia is expected to reach approximately 923 million by 2050. This rise in the proportion of the geriatric population is expected to create further opportunities for developing this market.

Key Companies & Market Share Insights

The market has the presence of many big and small industry players. Key players are adopting business strategies, including diverse product offerings, business expansion, joint ventures, regional expansion, and new product launches to gain market share. For instance, in March 2022, Stryker Sage launched a new Multi-Position Mobile Air Transfer System (MATS) to protect nurses during pre- & post-surgical lateral transfers by preventing patients from sliding during tilt procedures. It integrates into the workflow of OR nurses and secures patients in the tilt positions of lithotomy, Trendelenburg, reverse Trendelenburg & lateral tilt.

In October 2021, Esaote, an Italian company in the biomedical sector, entered the world of total body magnetic resonance imaging with the novel system called "Magnifico Open." The open magnet and easy-to-access patient table enable fast and comfortable patient positioning. Likewise, in November 2020, Canon Medical introduced a premium auto-positioning digital radiography system for patient care and optimal productivity.

In addition, in September 2020, Mizuho OSI, one of the leading developers of specialist surgical tables & pressure injury abatement systems, announced the acquisition of Nimbic Systems, Inc.'s Air Barrier System (ABS). The ABS is an infection control device used in spine & hip surgery to protect the operative site from airborne particles & bacteria. The following are some of the major participants in the global patient positioning systems market:

-

Medtronic

-

Hill-Rom Holdings, Inc.

-

Stryker Corporation

-

Medline Industries

-

Skytron, LLC

-

Smith & Nephew

-

STERIS plc

-

Mizuho OSI

-

LEONI AG

-

OPT SurgiSystems Srl

Patient Positioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.3 billion

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; Smith & Nephew; STERIS plc; Mizuho OSI; LEONI AG; OPT SurgiSystems Srl

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Positioning Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global patient positioning systems market report based on product, application, end use, and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Tables

-

Accessories

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Surgery

-

Diagnostics

-

Others

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory centers

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient positioning systems market size was estimated at USD 1.2 billion in 2022 and is expected to reach USD 1.3 billion in 2023.

b. The global patient positioning systems market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 1.8 billion by 2030.

b. North America dominated the patient positioning systems market with a share of over 33.3% in 2022. This is attributable to the rising prevalence of chronic and lifestyle-related diseases and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the patient positioning systems market include Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; OPT SurgiSystems Srl; SchureMed; Smith & Nephew; STERIS plc; and Leoni.

b. Key factors that are driving the patient positioning systems market growth include the growing geriatric population, increasing prevalence of cancer, rising awareness among the patient population, and surging expenditure on diagnostic procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.