- Home

- »

- Renewable Chemicals

- »

-

Palm Oil Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Palm Oil Market Size, Share & Trends Report]()

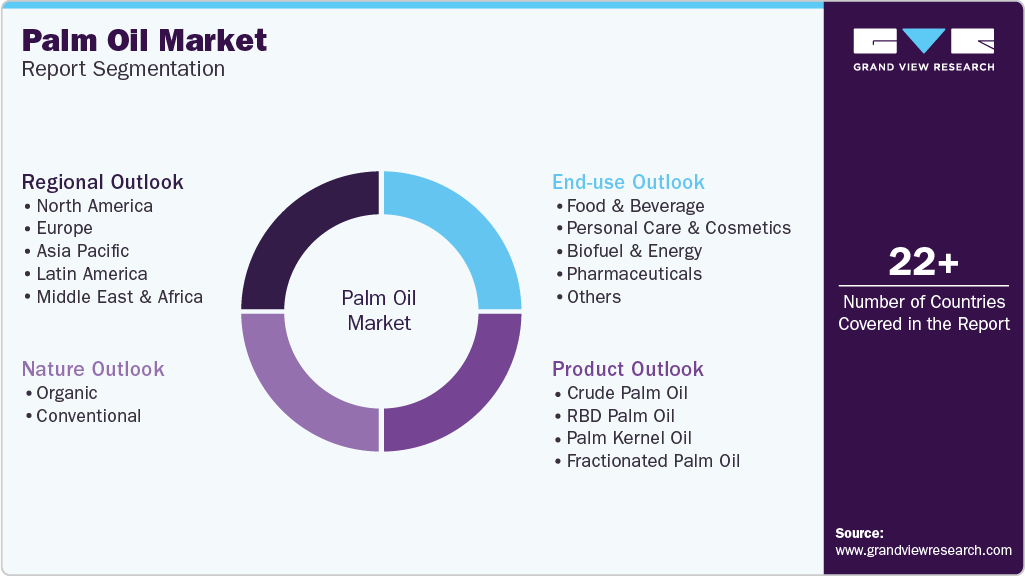

Palm Oil Market Size, Share & Trends Analysis Report By Nature (Organic & Conventional), By Product (RBD Palm Oil, Palm Kernel Oil), By End-use (Pharmaceuticals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-462-8

- Number of Pages: 106

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

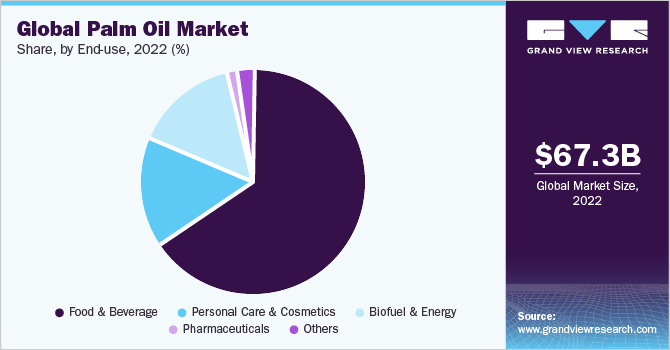

The global palm oil market size was valued at USD 67.3 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. The market is driven by exponentially growing demand from the food, beverage, biofuel, energy, personal care, and cosmetics industries. Major manufacturers are in Asia Pacific region due to the ease of availability of raw materials in the region. The market is highly competitive as well as comprehensive in nature owing to the presence of a large number of all scale players which try to gain a competitive edge over others with their high production, superior distribution networks, product quality, and various competitive strategies.

Indonesia is the largest palm oil producer as well as exporter of the same. The country exports the product globally. The government also supports the cultivators of palm oil plant. It is a major source of income for many small and medium scale producers in the region. The industry is majorly responsible for development and upliftment of the cultivators in the region.

Similarly, the product has witnessed increasing demand from the biofuel industry. It is used in the production of biofuel which is further used as a sustainable alternative to crude oil in many applications such as engine oil. Biofuel industry is a budding industry with limited applications for now.

Although the industry is expected to attain development as many players are involved in research and development of the industry. As the industry will gain ground the demand for palm oil from the industry is expected to increase and drive the product market.

Nature Insights

Conventional segment dominated the market for palm oil with a revenue share of more than 99% in 2022. This is attributable to the low price and easy availability of the segment. Conventional oil palm farms are a crucial source of income for small and medium sized cultivators as they can increase production with the help of synthetic chemicals. The conventional nature segment is more popular in low-income countries with high populations.

Contemporary to the conventional nature segment is the organic nature segment, which holds a very small share of the market due to difficulties in production which reduce the availability of products in the market. The stringent regulations for production as well as very expensive products necessary for the production such as specialized soil maintenance products, makes it financially infeasible and difficult for the manufacturers to produce in large quantities. Although increasing awareness about the benefits of organic products is anticipated to attain rapid growth rate.

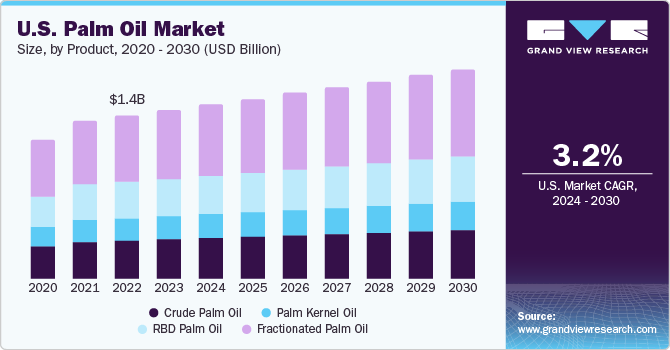

Product Insights

Fractionated palm oil segment dominated the market with a revenue share of over 39% in 2022. This is attributable to the ease of availability of the product and economically feasible prices. It is very popular in low-income countries as it is abundantly available as well as affordable for the masses. Constituent nature of the product makes it more affluent to manufacture in large quantities.

Another major product segment following the fractionated palm oil product segment is the Crude Palm Oil (CPO) product segment, which added a substantial share of 25% to the global revenue owing to its major end use application in the food & beverage industry. The presence of vitamin A gives this product segment edge over the other segments making its utilization in edible products more desirable.

Its extensive use in the food industry is expected to drive market demand. There is also significant demand for CPO from the cosmetics, and pharmaceutical end-use industries, as it is a crucial ingredient for the production of many products from these industries.

End-use Insights

Food & beverages dominated the palm oil market with a revenue share of more than 65% in 2022. Its high share is attributable to increasing usage of the product in end use applications of the industry and increasing product portfolios that demand palm oil as a raw material. The rise in the global population has also affected global product growth boosting product demand in the international market.

With a scanty difference in their revenue share following the food and beverage end use segment are personal care & cosmetics and biofuel & energy end use segments. These are growing segment and are expected to attain prompt growth in the coming years as the advancement of technologies will occur.

The personal care & cosmetics end use segment has a moderate growth rate and is expected to contribute significantly to the global revenue share by the end of the forecast period. In 2022, the segment contributed 16% to the global revenue share of the product market. The diversification in the product portfolios and increasing demand for organic and sustainable products that are plant based are expected to drive the demand from this segment.

On the contrary to the personal care & cosmetics segment, which is an established market, biofuel is a budding market which is expected to gain its full potential in the foreseen period as the advancement of technology will take place. In the near future as the deposits for non-renewable resources are declining biofuel which is an environment friendly alternative to conventional fuels can become a light of hope for the energy industry.

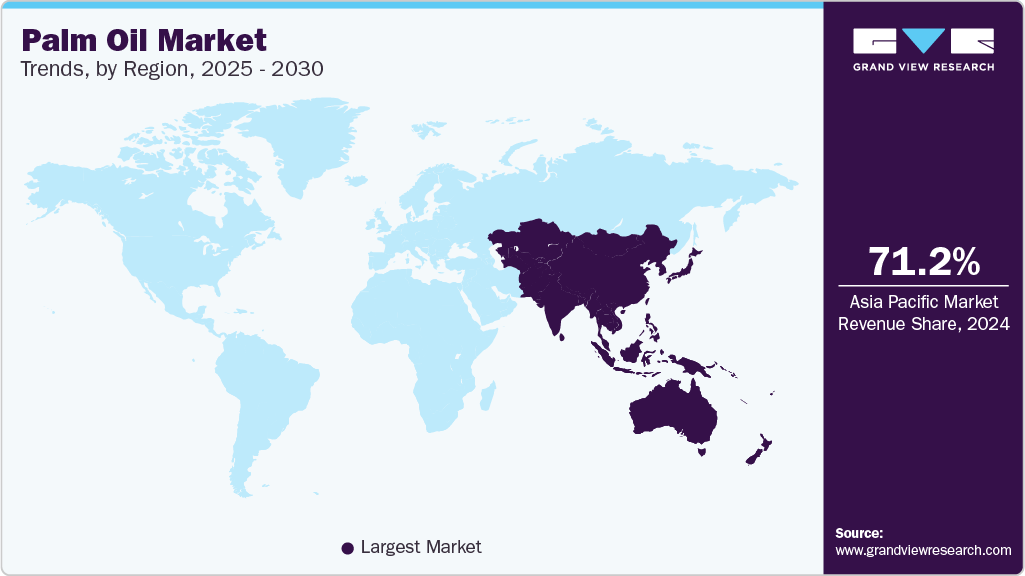

Regional Insights

Asia Pacific region dominated the market with a revenue share of over 71% in 2022. This is attributed to the growing consumption by the rising population of the region as well as high demand from the end use applications industries, such as food & beverage industries. Rapid increase in population, changing demographic trends, and diverse food application in India and China is accountable for high consumption of palm oil in the region.

This product is a major source of income for countries like Indonesia and Malaysia, which are large producers globally. Income from this business had helped the countries producing palm oil to develop and advance. Small and medium players in these countries are solely dependent on revenue from this oil for their livelihood. Over the forecast period the product market in the region of expected to grow rapidly owing to increased demand from a growing population.

North America region is anticipated to exhibit exponential growth in the near future, due to the distinguished demography of the region, change in eating habits of the mass and increase in the demand from food industry for making various delicacies. The North America market has a lot of untapped potential currently which is another reason for the rapid growth of the product in the region.

Key Companies & Market Share Insights

The market is consolidated and highly competitive in nature. The prices of the product on the international market are highly volatile and are affected by international crude oil prices. The market has the presence of multinational companies such as ADM and Wilmar International Ltd. which make the market more competitive. Major players have acquired plantations or contracts with the cultivators to ensure constant supply of raw materials. Volatility in prices of the raw material adversely affect the profitability of the product.

The products manufacturers are engaged in continuous R&D activities, capacity expansion, mergers & acquisitions, and other strategies to gain a competitive advantage over others. For example, In November 2019, PT. Mahkota Group acquired a palm oil mill in South Sumatra, through subsidiary, PT Berlian Inti Mekar. This plant produces CPO based products such as cooking oil or olein and processing about 400 tons of palm kernel oil per day. Some prominent players in the global palm oil market include:

-

ADM

-

Wilmar International Ltd.

-

Sime Darby Plantation Berhad

-

IOI Corporation Berhad

-

Kuala Lumpur Kepong Berhad

-

United Plantations Berhad

-

Kulim (Malaysia) Berhad

-

IJM Corporation Berhad

-

PT Sampoerna Agro, Tbk

-

Univanich Palm Oil Public Company Ltd.

-

PT. Bakrie Sumatera Plantations tbk

-

Asian Agri

Recent Development

-

In May 2023, Wilmar International announced a partnership with BanQu for the purpose of advancing a sustainable palm oil value chain and improving the livelihood of smallholder farmers. As part of the palm oil traceability project, Wilmar will leverage BanQu’s platform for eliminating supply chain blind spots and monitor sustainability progress

-

In July 2022, IOI Corporation Berhad announced a green trade finance facility agreement with United Overseas Bank (Malaysia) Berhad. The deal will allow funding of certified palm oil sourcing, which would support the company’s downstream resource-based manufacturing business

-

In April 2023, Kuala Lumpur Kepong Berhad, via its subsidiary KLK OLEO, completed the acquisition of a controlling stake in Temix Oleo SpA. Temix Oleo is a Milan, Italy-based oleochemical company that specializes in the production of esters based on renewable feed stocks, and caters to coating, lubricant, ceramic, and plastic industries

-

In September 2021, Kuala Lumpur Kepong Berhad completed the acquisition of 56.2% of IJM Plantations Berhad (IJMP), making IJMP its subsidiary. The move, which was announced first in June 2021, would help the company in expanding its plantation business

-

In February 2023, Sime Darby Plantation Berhad announced that the import of its palm oil into the United States has been greenlit by the United States Customs and Border Protection (USCBP). This came after the company undertook an extensive process to review and upgrade its protocols concerning the recruitment and management of its workers

-

In November 2022, Sime Darby Plantation Berhad (SDP) announced an undertaking with Intan Hebat Baru Sdn Bhd and the social enterprise Wild Asia Sdn Bhd, for the procurement of certified sustainable fresh fruit bunches from a small independent producer group in Selangor, Malaysia

-

In October 2022, Kulim (Malaysia) Berhad entered into a 2-year purchase agreement of Certified Fresh Fruit Bunch with Wild Asia and Eng Lee Heng Trading. The development would elevate the production of sustainable and traceable palm oil by the company that meets RSPO standards

-

In August 2022, Kulim (Malaysia) Berhad announced that it would be building its palm-fiber oil extraction plant in the Sedenak palm oil mill in the state of Johor, through its plantation subsidiary, Mahamurni Plantations Sdn Bhd. The plant is part of the company’s waste to treasure initiative, involving the extraction of oil from mesocarp fiber from processed fresh fruit bunches to produce red palm oil

Palm Oil Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 70.4 billion

Revenue forecast in 2030

USD 100.0 billion

Growth Rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; Canada; Germany; UK; France; Spain, Italy, Russia, China, India, Japan, South Korea, Malaysia, Indonesia, Brazil, Argentina, Colombia, South Africa, Saudi Arabia, Turkey, UAE, Oman, Yemen, Kenya, Nigeria, Ghana, Egypt

Key companies profiled

ADM; Wilmar International Ltd.; Sime Darby Plantation Berhad; IOI Corporation Berhad; Kuala Lumpur Kepong Berhad; United Plantations Berhad; Kulim (Malaysia) Berhad; IJM Corporation Berhad; PT Sampoerna Agro, Tbk; Univanich Palm Oil Public Company Ltd.; PT. Bakrie Sumatera Plantations tbk; Asian Agri

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Palm Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global palm oil market report based on nature, product, end-use and region:

-

Nature Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Organic

-

Conventional

-

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Crude Palm Oil

-

RBD Palm Oil

-

Palm Kernel Oil

-

Fractionated Palm Oil

-

-

End-Use Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Biofuel & Energy

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

Oman

-

Yemen

-

Kenya

-

Nigeria

-

Ghana

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global palm oil market size was estimated at USD 67.3 billion in 2022 and is expected to reach USD 70.4 billion in 2023.

b. The global palm oil market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 100.0 billion by 2030.

b. Crude palm oil (CPO) dominated the palm oil market with a share of over 55% in 2022. This is attributable to Increasing consumption in oleochemicals production of agrochemicals and cleaning products.

b. Some key players operating in the palm oil market include Wilmar; Sime Darby; IOI Corporation; Kuala Lumpur Kepong; and United Plantations Berhad

b. Key factors that are driving the palm oil market growth include increasing demand for palm oil derivatives and oleochemicals from different end-use industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The COVID-19 pandemic and subsequent halt in manufacturing activities shall have an impact on the supply availability of a variety of renewable chemicals. Furthermore, current disruption in trade shall also gravely impact the availability of chemical stocks in import-dependent countries. The report will account for Covid19 as a key market contributor.