- Home

- »

- Medical Devices

- »

-

Palliative Care Market Size, Share & Trends Report, 2030GVR Report cover

![Palliative Care Market Size, Share & Trends Report]()

Palliative Care Market Size, Share & Trends Analysis Report By Condition (Cancer, HIV), By Age Group (Geriatric, Adult), By Provider (Home-based, Hospitals & Clinics), By Diagnostic Group, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-154-5

- Number of Pages: 191

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Palliative Care Market Size & Trends

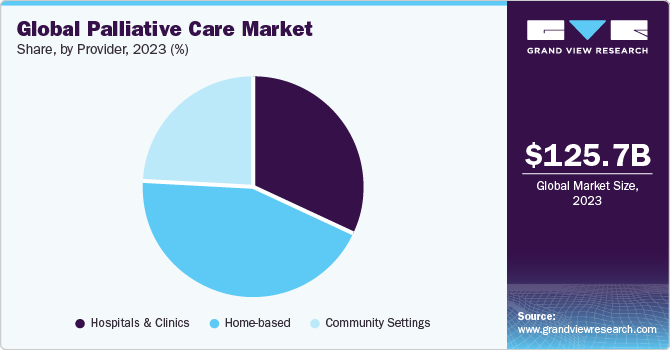

The global palliative care market size was estimated at USD 125.7 billion in 2023 and is anticipated to grow a compound annual growth rate (CAGR) of 9.93% from 2024 to 2030. Palliative care involves comprehensive services for patients with conditions that do not respond to curative treatments. It enhances the quality of life for individuals and their families dealing with life-threatening illnesses. The major factors contributing to market's growth include rising prevalence of life-threatening disorders, supportive government policies & initiatives to promote services as an integral part of healthcare services, and rising number of providers globally. Moreover, the rising number of private and public providers in developing countries is expected to contribute to market's growth.

In addition, increasing awareness about these services is expected to boost the demand for these services. According to the Australian Institute of Health and Welfare, in 2021, 177 palliative care facilities of the Australian Palliative Care Outcomes Collaboration (PCOC) program provided services to 58,700 patients. Supportive government initiatives, such as funding, setting up policies, and promoting awareness, are expected to drive the market's growth. Many countries provide special funding to programs to enhance the quality and accessibility of the services. For instance, in May 2023, the Albanese government funded USD 53 million in Australia for 14 national palliative care projects developed for Australians. Also, USD 15.9 million in funding was provided for the national End of Life Directions for Aged Care (ELDAC) service to train & support service providers & GPs regarding advanced care planning & improving skills.

The COVID-19 pandemic has significantly impacted the market growth as hospitals and healthcare systems faced challenges, including resource shortages, high demand, and a focus on critical care for COVID-19 patients. This shortage of healthcare staff led to reduced availability of services for non-COVID-19 patients, limiting their access to essential end-of-life care and symptom management. Moreover, the COVID-19 pandemic accelerated the adoption of telehealth and remote technologies. The providers adapted to this shift by offering virtual consultations and support to patients and their families. This, in turn, expanded the access to services, especially for those in remote areas or who could not visit healthcare facilities due to lockdowns.

Provider Insights

Based on provider, the market is segmented into hospitals & clinics, home-based, and community settings. The home-based providers segment accounted for the largest revenue share of 44.6% in 2023 and is projected to expand further at the fastest growth rate from 2024 to 2030. This can be due to the high preference of elderly patients for home-based care. Moreover, many providers are launching home-based centers offering services to patients with special needs. For instance, in February 2021, Mount Sinai Health System partnered with Contessa Health, Inc. to launch Palliative Care at Home.

The new program provides patients with at-home services for serious conditions. The hospitals & clinics segment is expected to grow significantly over the forecast period. This is due to the well-established infrastructure and high capacity of hospitals & clinics to cater to complex health conditions. Hospitals & clinics are expanding service offerings, and payers are expanding reimbursement for these services, contributing to the segment’s growth. According to Yale University, more than 1,700 hospitals with more than 50 beds offer palliative care programs in the U.S.

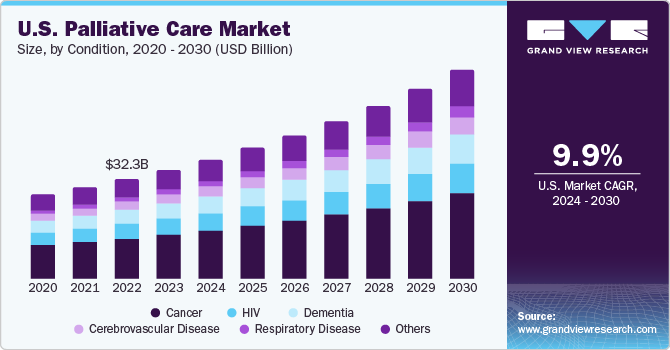

Condition Insights

Based on condition, the market is segmented into cancer, dementia, HIV, cerebrovascular disease, respiratory disease, and others. The cancer segment held the maximum revenue share of 36.9% in 2023. This is attributed to the rising prevalence of cancer globally and increasing focus on palliative care services in improving the quality of life for cancer patients and their families. According to Globocan 2020, 19.3 million new cancer cases were reported globally in 2020, with around 10 million cancer deaths. Palliative service ensures that individuals receive the physical, emotional, and psychological support they need during their cancer journey.

However, the respiratory disease segment is expected to witness the fastest growth from 2024 to 2030 owing to the rising prevalence of respiratory diseases, such as chronic obstructive pulmonary disease & asthma, and rising demand for coordinated respiratory and palliative care services. According to the Institute for Health Metrics and Evaluation, in 2019, chronic respiratory diseases ranked as the third most common cause of death, contributing to 4 million deaths and affecting approximately 454.6 million individuals globally.

Regional Insights

Europe region dominated the global market with a revenue share of 36.5% in 2023. Europe is one of the regions with a highest geriatric population, leading to an increased market demand. This, in turn, creates the need for specialized services to address the unique needs of older people, including end-of-life care. Many European countries, such as Germany, Italy, and the UK, have integrated palliative care into their healthcare systems, recognizing it as an essential component of healthcare delivery. This integration ensures that services are accessible and available to patients as a part of their medical care. According to the World Health Organization, 26% of Central and Eastern and 63% of Western European countries have a standalone national palliative care plan in Europe.

Middle East & Africa is expected to witness the fastest CAGR from 2024 to 2030 due to an increasing prevalence of chronic and non-communicable diseases, such as cancer, cardiovascular diseases, and diabetes. Some countries, such as UAE, Jordan, and Egypt, have been investing in improving their healthcare infrastructure and services, which is also expected to contribute to region’s growth. Healthcare authorities in some MEA countries have taken steps to integrate palliative care into their healthcare systems, emphasizing its role in providing services to patients with life-threatening illnesses. For instance, in March 2023, the Ministry of Health in Jordan launched its strategic plan for 2023 to 2025, which places a strong development of an integrated healthcare system & enhances equal availability of diagnostic, treatment, rehabilitation, and palliative care services.

Diagnostic Group Insights

Based on diagnostic groups, the market is segmented into communicable diseases, non-communicable diseases, injury, poisoning, external causes, and maternal, perinatal, and nutritional conditions. The Non-Communicable Diseases (NCD) segment accounted for the highest revenue share of 68.0% in 2023. This can be attributed to the growing prevalence of NCDs, majorly due to changing and sedentary lifestyles. These conditions include cancer, cardiovascular diseases, diabetes, chronic respiratory diseases, and neurodegenerative diseases. According to the World Health Organization (WHO), 41 million people die yearly due to NCDs, accounting for 74% of the global mortality rate. Many companies are launching specialized centers offering services to patients with special needs, such as cancer patients.

For instance, in January 2022, the Boots Company PLC collaborated with Macmillan Cancer Support and the NHS to provide access to critically ill patients and their caregivers. The collaboration is a significant development in cancer palliative care in the UK. Maternal, Perinatal, and Nutritional Conditions (MPNC) segment is expected to witness the fastest growth over the forecast period due to increasing prevalence of such conditions. According to the WHO, in 2020, around 2.4 million newborn babies died within the initial month of their lives. In addition, around 6,700 newborns died daily, accounting for around 47% of the total deaths of children under the age of 5 years.

Age Group Insights

Based on age group, the market is segmented into pediatric, adult, and geriatric. The adult segment dominated the market with the largest market share of 51.0% in 2023. The prevalence of chronic and life-threatening illnesses, such as cancer, cardiovascular diseases, and neurodegenerative conditions, is rising in adults. These diseases require palliative care to manage symptoms, provide comfort, and improve quality of life; thus, contributing to the high demand for these services among adults. The pediatric segment is expected to register the fastest CAGR from 2024 to 2030.

There is a growing incidence of chronic and life-threatening diseases among children, including congenital disorders, cancer, and neurological conditions. These diseases require specialized palliative care to enhance the quality of life and offer physical & emotional support. Hence, providers are expanding their business to offer specialized services to patients. For instance, in October 2022, Bai Jerbai Wadia Hospital for Children, in association with Cipla Foundation, launched a pediatric palliative home care service, Titli. It provides comprehensive services to children with serious conditions, including pain & symptom management, emotional support, and practical advice.

Key Companies & Market Share Insights

The market is highly fragmented, with the presence of many local private, public, and community-based providers. The services in many countries are not defined and are provided by family members. Hence, the market is not in the mature phase. However, many private players are entering the market to cater to growing care service demand. These players are adopting several strategies, including partnerships & collaborations, to meet rising demand. For instance, in February 2023, Pallium India and Athulya Senior Care collaborated and launched palliative care services in South India.

Key Palliative Care Companies:

- Adventist Health

- Baptist Health

- Teresa Dellar Palliative Care Residence

- Fonthill Care

- Banksia Palliative Care Service Inc.

- HammondCare

- Alpha Palliative Care

- Drakenstein Palliative Hospice

- VITAS Healthcare

- Amedisys

- Gentiva Health Services (Kindred at Home)

- Genesis HealthCare System

Palliative Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 137.8 billion

Revenue forecast in 2030

USD 243.2 billion

Growth rate

CAGR of 9.93% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Condition, diagnostic group, age group, provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; Jordan; Kuwait

Key companies profiled

Adventist Health; Baptist Health; Teresa Dellar Palliative Care Residence; Fonthill Care; Banksia Palliative Care Service Inc.; HammondCare; Alpha Palliative Care; Drakenstein Palliative Hospice; VITAS Healthcare; Amedisys; Gentiva Health Services (Kindred at Home); Genesis HealthCare System

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Palliative Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the palliative care market report on the basis of condition, diagnostic group, age group, provider, and region:

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Dementia

-

HIV

-

Cerebrovascular Disease

-

Respiratory Disease

-

Others

-

-

Diagnostic Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Communicable diseases

-

Non-communicable diseases

-

Injury, poisoning, external causes

-

Maternal, perinatal and nutritional conditions

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Home-based

-

Community Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Jordan

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global palliative care market size was estimated at USD 125.7 billion in 2023 and is expected to reach USD 135.8 billion in 2024.

b. The global palliative care market is expected to grow at a compound annual growth rate of 9.93% from 2024 to 2030 to reach USD 243.2 billion by 2030.

b. The cancer segment dominated the palliative care market with a share of 36.71% in 2023, owing to the rising prevalence of cancer globally and the increasing focus on palliative care services in improving the quality of life for cancer patients and their families.

b. Some key players operating in the palliative care market are Adventist Health, Baptist Health, Teresa Dellar Palliative Care Residence, Fonthill Care, Banksia Palliative Care Service Inc., HammondCare, Alpha Palliative Care, Drakenstein Palliative Hospice, VITAS Healthcare, Amedisys, Gentiva Health Services (Kindred at Home), Genesis HealthCare System.

b. Key factors that are driving the palliative care market growth include the increasing number of qualified staff for palliative care, rise in geriatric population & chronic disease prevalence, and growing reimbursement for palliative care services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."