- Home

- »

- Medical Devices

- »

-

Ovulation Testing Kits Market Size And Share Report, 2030GVR Report cover

![Ovulation Testing Kits Market Size, Share & Trends Report]()

Ovulation Testing Kits Market Size, Share & Trends Analysis Report By Product (Urine Ovulation Test, Digital Ovulation Test), By Distribution Channel (E-Commerce, Pharmacies And Drugstores), By Region, And Segment Forecast, 2023 - 2030

- Report ID: GVR-4-68040-134-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Ovulation Testing Kits Market Size & Trends

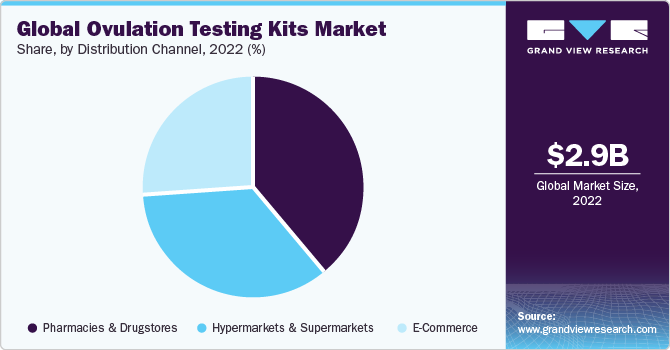

The global ovulation testing kits market size was estimated at USD 2.87 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.84% from 2023 to 2030. The market's growth is attributed to factors such as the increasing prevalence of polycystic ovary syndrome (PCOS) and other hormonal disorders affecting women of reproductive age. Furthermore, the market is anticipated to be driven by an increase in the age of first-time pregnancies, declining fertility rates globally, and growing technological advancement. The primary drivers of this market growth include the increasing success rates of IVF technology, rising awareness regarding IVF procedures, and a trend toward delayed onset of pregnancy. The growing awareness of advanced in vitro fertilization (IVF) techniques and the improving IVF success rates have generated a demand for ovulation kits globally.

The report from the National Perinatal and Statistics Unit published in September 2021 showcased significant improvements in IVF success rates over the past years. The live birth rate per introduced IVF cycle among women utilizing their eggs increased by 18%, with even more substantial improvements in older age groups. The overall live birth rate per embryo transfer increased by approximately 28% in 2020.

In addition, the increasing prevalence of polycystic ovary syndrome (PCOS) is another factor that has led to market growth. PCOS is a common hormonal disorder that often leads to irregular ovulation. Furthermore, the increasing number of women facing fertility issues, particularly those with PCOS who are actively seeking to conceive, is expected to increase the demand for ovulation testing. For instance, according to data published by WHO in June 2023, around 8% to 13% of women of reproductive age are affected by PCOS, with up to 70% of these women remaining undiagnosed globally.

Vendors continuously invest in research and development to innovate and improve their ovulation testing products. This includes developing more accurate, user-friendly, and technologically advanced kits. Innovations may include the integration of digital technology, connectivity with smartphone apps, and enhanced accessibility. In addition, vendors need to constantly upgrade their products due to the growing competition based on affordability and the ability of ovulation test kits that provide 99% accurate results from the home. To prevent unintentional pregnancies and ensure better healthcare for children, the market is expected to increase in the coming years. Geratherm Medical AG, Nectar Lifesciences Ltd, Philippine Blue Cross Biotech Corp, and Swiss Precision Diagnostics GmbH are among the most popular vendors in the market.

Furthermore, the market is experiencing a surge in sales of home testing equipment, and ongoing product development efforts. With ease of access through e-commerce platforms, pharmacies, and brick-and-mortar retail outlets, there is a growing demand for home testing devices. Numerous companies are engaging in strategic partnerships to cater to the needs of women. For instance, In February 2019, NFI Consumer Healthcare extended its partnership with Callitas Health to distribute jointly branded products, including NFI's e.p.t Numeric, which is the top Over the Counter (OTC) digital ovulation test kit in the United States.

Product Insights

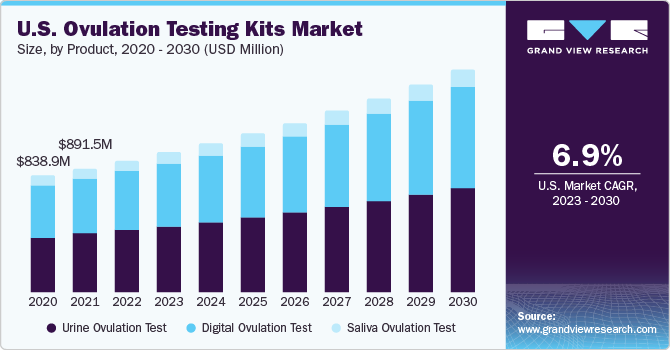

Based on the product, the market is segmented into urine ovulation tests, digital ovulation tests, and saliva ovulation tests. The urine ovulation test segment dominated the global market in 2022 with a maximum revenue share of 47.2%. The growth is attributed to a high level of accuracy as well as determining the presence or absence of hCG (human chorionic gonadotropin), an indicator of pregnancy.

The increase in the patients' inclinations towards self-monitoring of medical conditions is attributed to the accessibility and user-friendly nature of at-home testing equipment. For instance, companies now provide ovulation prediction kits designed for home use, allowing individuals to assess the presence of ovulation-related hormones in saliva or urine. This is expected to boost the demand for ovulation kits during the forecast period.

Digital ovulation test is anticipated to register the fastest CAGR of 7.0% over the forecast period. The emergence of digital ovulation test kits is anticipated to provide startups with a solid foundation that helps establish their presence in the market. Some digital ovulation tests have built-in memory or smartphone app connectivity, allowing users to track their fertility over time, and gain insights into their menstrual cycles. Such features in digital kits are anticipated to increase the demand for these innovative kits. Furthermore, the evolving landscape of healthcare regulations is creating favorable conditions for new entrants to gain access to these opportunities.

Distribution Channel Insights

Based on the distribution channel, the market is segmented into pharmacies and drugstores, hypermarkets and supermarkets, and e-commerce. The pharmacies and drugstores segment dominated the global market in 2022 with a maximum share of 38.9%. The significant market share can be attributed to the continuous growth in the number of retail pharmacies in countries like Brazil, India, and China.

The market is anticipated to witness growth in the forecast period, primarily driven by a growing trend among market players to offer comprehensive digital ovulation test kits. This trend is driven by the women's preference for conducting ovulation tests at home using these tools, rather than seeking medical assistance at a doctor's office or hospital. The market's growth is further supported by robust distribution channels.

Furthermore, the e-commerce segment is expected to register the fastest CAGR of 7.10 over the forecast period. The growth of the segment is attributed to the prevalence of COVID-19, which has made retail e-commerce websites more convenient to use. This trend is further attributed to the rapid expansion of Internet access and the increasing popularity of online shopping platforms over the past decade. In addition, the availability of diverse product offerings and access to expert customer service personnel for support and information is expected to have a positive influence on the growth of this segment within the market.

Regional Insights

North America dominated the market in 2022 with a revenue share of around 38.20%. This can be attributed to the increasing demand for ovulation test kits, due to the availability of advanced features such as Bluetooth connectivity and smart countdown functions. The presence of a working-class population in the United States is contributing to the increase in unit sales of ovulation test kits, as they often have limited time to visit a healthcare provider. This factor further enhances the regional market.

Moreover, manufacturers are currently focusing on developing new products that can deliver superior results at a more affordable price point, while also ensuring simplicity and reliability in their outputs. Prominent players in the industry are actively participating in collaborations and partnerships to diversify their product portfolios within the region. For instance, in 2022, Sugentech, a prominent manufacturer of digital ovulation test kits, initiated a strategic collaboration with CGETC, Inc., a United States-based company specializing in consumer fulfillment and marketing services. Several digital devices in the market possess innovative features, including Bluetooth connectivity and smart countdown functionality. Notable brands in the market include Clearblue, First Response, and E.P.T.

Asia Pacific is anticipated to register the fastest CAGR of 7.19% over the forecast period. The ovulation test kit market in the region is experiencing growth, primarily attributed to the rapidly increasing number of women dealing with lifestyle disorders. Factors such as the availability of ovulation test kits and the rising investments in the development of fertility and ovulation monitors are expected to drive the demand in various countries. The market is benefiting from the rising demographics of first-time pregnancies, declining fertility rates, increasing disposable incomes, and ongoing advancements in ovulation testing methods.

Key Companies & Market Share Insights

The market players are adopting various strategies, such as new service launches, partnerships & collaborations, and regional expansion to gain higher shares. For instance, in September 2023, Prega News, holding the leading position as India's primary pregnancy detection card with the leading market share, launched a fresh lineup of products. Among these offerings is the Ova News Ovulation Detection Kit, which is designed to assist women in monitoring their ovulation cycles. Some prominent players in the global ovulation testing kits market include:

-

Swiss Precision Diagnostics GmbH

-

Proov

-

Easy@Home Fertility

-

Ro

-

Piramal Healthcare

-

Wondfo

-

Accuquik

-

Fairhaven Health

-

PREGMATE

-

Runbio Biotech Co. Ltd.

Ovulation Testing Kits Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 3.05 billion

The revenue forecast for 2030

USD 4.85 billion

Growth rate

CAGR of 6.84% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Swiss Precision Diagnostics GmbH; Proov; Easy@Home Fertility; Ro; Piramal Healthcare; Wondfo; Accuquik; Fairhaven Health; PREGMATE; Runbio Biotech Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Ovulation Testing Kits Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ovulation testing kits market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Urine Ovulation Test

-

Test Strip Type

-

Cassette Type

-

Midstream Type

-

-

Digital Ovulation Test

-

Saliva Ovulation Test

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets and Supermarkets

-

E-Commerce

-

Pharmacies and Drugstores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ovulation testing kits market size was estimated at USD 2.87 billion in 2022 and is expected to reach USD 3.05 billion in 2023.

b. The global ovulation testing kits market is expected to grow at a compound annual growth rate of 6.84% from 2023 to 2030 to reach USD 4.85 billion by 2030.

b. Urine ovulation test segment dominated the U ovulation testing kits market with a share of 47.16% in 2022 owing to high level of accuracy, to determine the presence or absence of hCG (human chorionic gonadotropin), which is an indicator of pregnancy.

b. Some key players operating in the ovulation testing kits market include Swiss Precision Diagnostics GmbH; Proov; Easy@Home Fertility; Ro; Piramal Healthcare; Wondfo; Accuquik; Fairhaven Health; PREGMATE; runbio biotech co. ltd.

b. Key factors that are driving the ovulation testing kits market growth include the increasing prevalence of conditions such as Polycystic Ovary Syndrome (PCOS) and a rise in other hormonal disorder affecting women of reproductive age.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."