- Home

- »

- Medical Devices

- »

-

Orthopedic Devices Market Size And Share Report, 2030GVR Report cover

![Orthopedic Devices Market Size, Share & Trends Report]()

Orthopedic Devices Market Size, Share & Trends Analysis Report By Product (Implant Holder, Drill Guides, Guide Tubes), By End-use (Hospitals, Out Patient Facilities), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-928-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global orthopedic devices market size was estimated at USD 69.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The market growth is driven by the high incidence of orthopedic disorders, such as the growing aging population, rising cases of degenerative bone disease, and increasing number of road accidents. The early onset of musculoskeletal disorders caused by sedentary routines and obesity is also projected to fuel growth. According to the WHO, in 2022, globally, around 1.71 billion people were suffering from musculoskeletal conditions.

Moreover, the availability of advanced orthopedic devices and rapid development in healthcare infrastructure globally are anticipated to influence market growth positively. The availability ofminimally invasive surgical techniques and rising awareness abouttheir benefits arealso among the key factors driving market growth.In addition, the rising number of sports injuries requiring medical assistance, caused due to the growing participation in sports & physical activities, will likely boost product demand, thereby supporting market growth. The introduction of advanced orthopedic devices reduces the prices of older versions significantly. This helps in increasing their adoption across developing countries, such as Asia Pacific and Middle East, where none to partial medical reimbursement is available. The cumulative effect of these activities is expected to result in increasing procedural volume and market growth in the near future.

COVID-19 has significantly impacted the market as the initial phases saw manufacturing and supply chain disruptions, and elective orthopedic surgeries were postponed to allocate resources for COVID-19 patients. This led to reduced demand for non-urgent orthopedic procedures and devices. However, as healthcare systems adapted, there has been a gradual recovery. The emphasis on infection control and patient safety has driven innovation in implant materials and surgical techniques. Telemedicine also gained prominence for post-operative care and consultations.

The presence of a stringent regulatory framework and an increased number of product recalls are restricting the market growth. According to the Journal of Orthopedic Surgery and Research, an analysis of product recalls between 2011 and 2021 in China, Australia, Canada, and the U.S. recorded recall of 286 joint replacement implants & 315 osteosynthesis implants between 2016 to 2021, and these recalls were classified as Class II medical device recalls. However, key players in the market are investing in research and development of technologically advanced orthopedic devices that are non-corrosive.

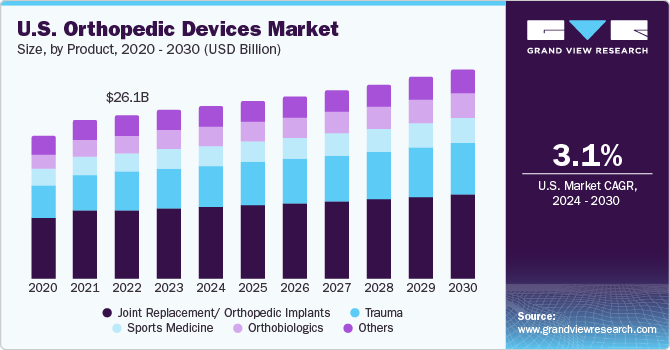

Product Insights

On the basis of products, the market is categorized into drill guides, guide tubes, implant holders, custom clamps, distractors, screwdrivers, accessories, orthopedic implants, and other orthopedic devices. The orthopedic implants segment held the majority share of the market in 2022, with a revenue of USD 35.3 billion, and is anticipated to record the fastest growth with a CAGR of 6.2% over the forecast period.

This can be attributed to the rapidly rising number of knee surgeries, hip replacement surgeries, spinal implant surgeries, dental & cosmetology surgeries, adoption of unhealthy lifestyles, and increasing prevalence of musculoskeletal & bone degenerative disorders. Moreover, the increasing incidence of sports-related injuries and trauma and the increasing adoption of minimally invasive surgeries are anticipated to fuel the market growth from 2023 to 2030. For instance, according to the National Safety Council, recreational and sports injuries increased by 20% in 2021 and 12% in 2022.

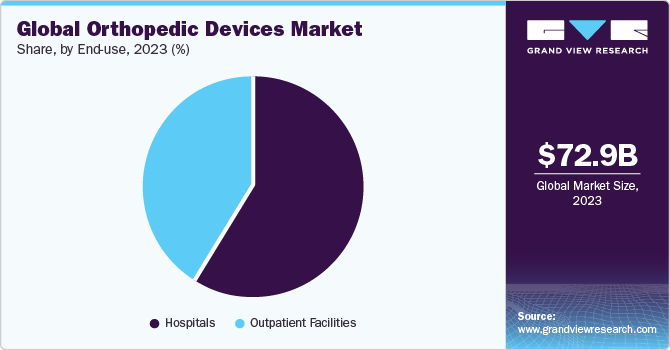

End-use Insights

On the basis of end-use, the market is segmented into hospitals and outpatient facilities. The hospitals segment held the majority share of the market in 2022. This can be attributed to the significant infrastructure advancements and availability of world-class treatment solutions. Furthermore, the rising number of hospital admissions in case of bone fractures and injuries caused by road accidents is estimated to boost the market growth. According to the WHO, every year, around 1.3 million people die due to road accidents, and 20 to 50 million people suffer non-fatal injuries, with many requiring hospitalizations every year.

The outpatient facilities segment is expected to record the fastest CAGR of 5.8% over the forecast period owing to the high adoption of outpatient facilities and the growing shortage of hospital beds. Advantages of day-care surgeries at outpatient facilities include a shorter waiting list, quick discharge, reduced procedural cost, and higher efficiency. Moreover, these facilities provide added advantages to the patient with adequate postoperative pain control, rapid patient discharge, minimal side effects, and overall cost containment.

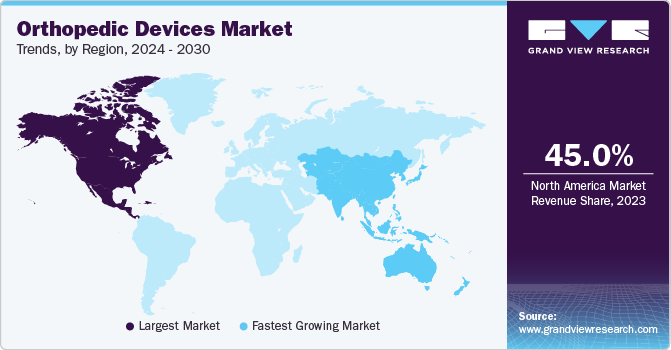

Regional Insights

North America led the global market with a share of 46.8% in 2022. The growth is attributed to the rising need for advanced healthcare services, owing to the presence of major industry players, a well-established healthcare infrastructure, and comprehensive reimbursement coverage. The increasing number of orthopedic surgeries in the region is primarily driven by a continually growing target patient population due to aging and a rising number of car accidents. Moreover, the high incidence of orthopedic conditions and the adoption of advanced treatment methods are expected to contribute significantly to the expansion of the market in the U.S.

Asia Pacific is anticipated to witness the fastest CAGR of 7.6% over the forecast period. China and India boast the world's largest elderly population, making them significant contributors to the increasing demand for orthopedic devices. Furthermore, the growing medical tourism sector, driven by the accessibility of advanced yet affordable healthcare options, is expected to attract the target patient population. In addition, the increasing adoption of technologically advanced orthopedic devices in the region is expected to contribute to the market growth over the forecast period.

Key Companies & Market Share Insights

The global market is oligopolistic, with a few international players holding most of the market share. Companies focus on continuous product development and offering orthopedic devices at competitive prices, especially in developing countries. Minimally invasive orthopedic devices, which do not require repeat procedures, are expected to boost the number of procedures in developed as well as developing regions.

New key developments, such as partnerships, product approvals, acquisitions & product launches, have positively impacted the market. For instance, in June 2022, Smith+Nephew expanded its orthopedic business by opening a manufacturing unit in Malaysia. It was an investment of more than USD 100 million. In January 2023, Zimmer Biomet announced its plan to acquire Embody, Inc. The acquisition is anticipated to complement the company’s product portfolio.Some of the prominent players in the global orthopedic devices market include:

-

NuVasive, Inc.

-

Medtronic PLC

-

Stryker Corporation

-

Zimmer Biomet

-

Smith+Nephew

-

Aesculap Implant Systems, LLC (B.Braun)

-

CONMED

-

DePuy Synthes (Johnson & Johnson)

-

Enovis (DJO, LLC)

Orthopedic Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 72.9 billion

Revenue forecast in 2030

USD 103.9 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

US; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

NuVasive, Inc.; Medtronic plc; Stryker Corp.; Zimmer Biomet; Smith+Nephew; Aesculap Implant Systems, LLC (B.Braun); CONMED; DePuy Synthes (Johnson & Johnson); Enovis (DJO, LLC)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

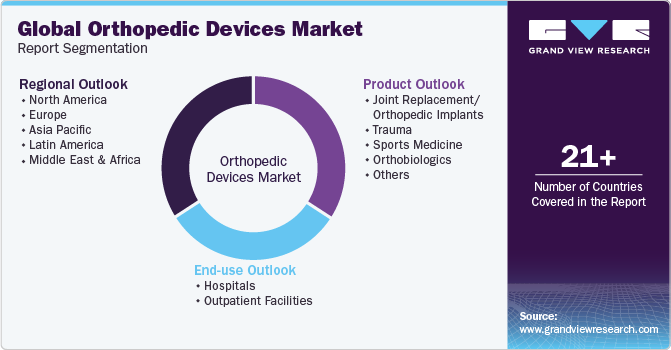

Global Orthopedic Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the orthopedic devices market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Drill Guides

-

Guide Tubes

-

Implant Holder

-

Custom Clamps

-

Distractor

-

Screwdrivers

-

Accessories

-

Braces

-

Others

-

-

Orthopedic Implants

-

Lower Extremity Implants

-

Dental Implants

-

Spinal Implants

-

Upper Extremity Implants

-

-

Other Orthopedic Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the orthopedic devices market with a share of 46.8% in 2022. This is attributable to high demand for advanced healthcare services owing to the presence of well-developed healthcare infrastructure, industry giants, and reimbursement coverage.

b. Some key players operating in the orthopedic devices market include Medtronic PLC; Stryker Corporation; Zimmer-Biomet Holdings, Inc.; DePuy Synthes; Smith and Nephew PLC; Aesculap Implant Systems, LLC; Conmed Corporation; Donjoy, Inc.; and NuVasive, Inc.

b. Key factors that are driving the orthopedic devices market growth are the high incidence of orthopedic disorders such as degenerative bone disease, as well as the growing aging population and the number of road accidents, the early onset of musculoskeletal disorders caused by sedentary routine and obesity, increase in the number of bone-related disorders.

b. The global orthopedic devices market size was estimated at USD 69.7 billion in 2022 and is expected to reach USD 72.9 billion in 2023.

b. The global orthopedic devices market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 103.9 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.