- Home

- »

- Beauty & Personal Care

- »

-

Organic Personal Care Market Size & Share Report, 2030GVR Report cover

![Organic Personal Care Market Size, Share & Trends Report]()

Organic Personal Care Market Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care), By Distribution Channel (Hypermarket/Supermarket, E-Commerce), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-151-1

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global organic personal care market size was estimated at USD 21.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. Increasing concerns regarding the adverse effects of chemicals on the skin such as skin irritation, dryness, and dullness, have been the key factors fueling the market growth. The rising awareness regarding the benefits of organic products has encouraged consumers to seek eco-friendly, sustainable, skincare products that come with greater product ingredient transparency. The outbreak of COVID-19 has drastically impacted the usage of chemical-free personal care products due to rising health, wellness, and sustainability-related concern among consumers.

The increasing use of online purchasing platforms by home-bound consumers is likely to upscale the demand for these beauty products. This factor has also paved the path for multiple growth opportunities for numerous industry participants. With more consumers focusing on their appearance, adopting healthier lifestyles, and overall well-being, personal care products are expected to become an integral part of their lives. Parameters such as chemical-free ingredients and green credentials are now a priority for many beauty product users. According to a survey published in July 2021 by Prodge-marketing Company, more than 34% of consumers in the U.S. preferred buying organic beauty products over synthetic products.

Millennials globally have reshaped the personal care industry and have been increasingly focusing on attributes such as “healthy”, “clean”, “organic”, and “natural”. Many skincare and haircare brands/ companies are responding by incorporating stricter environmental standards, greater transparency, and more natural and organic products across their spectrum of brands. Rising awareness regarding the harmful effects of ingredients such as BHA (butylated hydroxyanisole), parabens, phthalates, and coal tar globally is supplementing the market growth.

Moreover, increasing investments in the research & development of products, coupled with the rising trend of herbal ingredient-based products, have encouraged manufacturers to launch new products. For instance, in April 2021, Refresh Botanical expanded its market reach to India by launching its product line formulated for sensitive, aging, and acne-prone skin types. The product line would include facial cleansers, toners, moisturizers, eye and face makeup remover, intensive serum, night restore complex, and premium eye serum. These products would further be available for purchase at brick-and-mortar operations, retail shopping malls in major cities across India, and e-commerce platforms such as Amazon; Flipkart; Nykaa; and Smytten.

The COVID-19 pandemic has made consumer attention gravitate toward online stores at a faster rate than ever. Witnessing such current trends, major brands in the market have been investing in providing a standout experience for customers in the digital space. For instance, in October 2021, award-winning filmmaker, actor, and activist Olivia Wilde participated in an online campaign on the fifth anniversary of her partnership with eco-luxury organic skincare brand, True Botanicals. This campaign showcased the unexpected duality of safe, sustainable skincare, and the importance of natural ingredients.

Such collaborations and partnerships are likely to influence consumers and convince them to buy certified products. Additionally, millennials who spend a lot of time on the internet have a high inclination toward trending online articles, product launches, and celebrity endorsements. The Global Web Index (GWI) report published in June 2020 stated that the daily online engagement of consumers increased during the pandemic on all social media platforms. Approximately, 63% of skincare buyers visited YouTube, followed by Facebook (56%) and Instagram (49%). All the aforementioned factors are likely to improve the digital performances of key brands in the market.

Additionally, numerous companies within the beauty industry are actively driving innovation in their existing product lines by enhancing packaging, product quality, and marketing strategies, including strategic product placements. A noteworthy example of this is Forest Essentials, an Indian brand under the global beauty brand's portfolio, which recently launched exclusively on lookfantastic.com in October 2021. This strategic move allows Forest Essentials to provide its authentic Ayurvedic products to customers residing in the UK, expanding its market reach and catering to a new customer base.

Product Insights

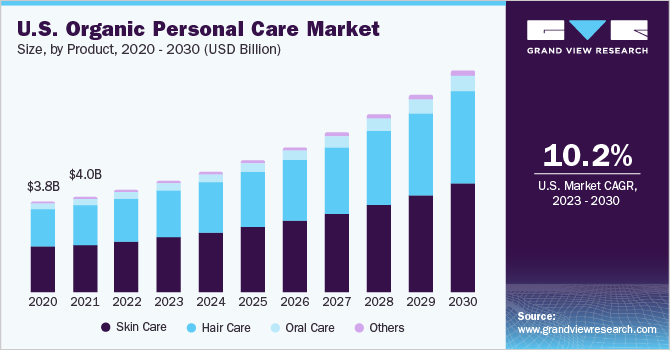

The skin care segment held the largest market share of 50.2% in 2022 and is expected to maintain dominance during the forecast period. The rising skin concerns, such as dry and aging skin, are driving product demand. Product launches by regional and international brands in this segment are likely to benefit the overall market growth. For instance, in May 2021, Sukin, an Australian organic beauty brand, launched an age-defying product line. These products include active ingredients such as pure ribose, para cress extract, Crambe oil, white hibiscus & baobab, which help reduce wrinkles and maintain smooth skin. Hence, increasing awareness regarding these ingredients for fighting skin concerns is expected to fuel product demand during the forecast period.

The oral care segment is projected to register the fastest growth during the forecast period with a CAGR of 11.1% from 2023 to 2030. Owing to the rising consumer focus on dental health and wellness, people of all ages are opting for such products. According to an article published by World Health Organization (WHO) in 2020, nearly 3.5 billion people were affected by oral diseases. The proliferation of effective and routine mouth-keep products, a rise in the number of service providers, and widespread acceptance of the concept of oral hygiene are driving the market. Consumers prefer good oral hygiene as it prevents cavities & gum diseases and aids in keeping the body’s natural defenses and bacteria under control.

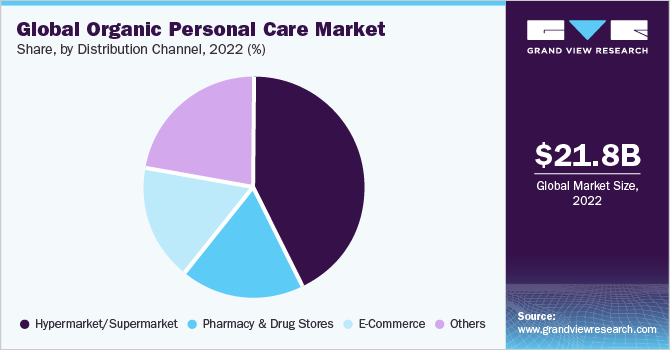

Distribution channel Insights

Hypermarket/supermarkets was the largest distribution channel segment with a revenue share of more than 43.5% in 2022. With an increased inclination of consumers toward the organic beauty products regime, many brands are expanding their offerings to hypermarkets/supermarkets. For instance, in February 2022, Thayers Natural Remedies, which was acquired by L’Oréal in 2020, expanded its product offering to Walmart, with distribution in more than 3,500 stores in the U.S. The brand would offer exclusive new sizes of its Certified Organic Witch Hazel Facial Toners (8.5 oz) and Facial Mists (4 oz) at the retailer. The e-commerce distribution channel segment is anticipated to register the fastest CAGR from 2023 to 2030.

Benefits offered by online channels, such as shopping from anywhere globally, doorstep delivery, free shipping, and discounts, are attracting consumers to opt for this channel. In addition, the increasing familiarity and rising dependence of millennials & generation Z on the Internet are expected to drive product sales through distribution channels. Moreover, it was witnessed that consumers buying skin products online gradually increased due to the ‘stay indoor factor’, during the COVID-19 pandemic. According to an article published by Power Reviews, in February 2021, 49% of the total online consumer spends more than USD 50 on beauty products, compared to 16% when they were asked this same question in 2019.

Regional Insights

Europe made the second-largest contribution to the global market with an approximate revenue share of around 25% in 2022. With the growing demand for organic ingredients, consumers are inclined toward organic beauty products, which is expected to drive market growth during the forecast period. Witnessing such trends, key players are launching new products to gain maximum market share. For instance, in October 2021, Estée Lauder-backed luxury Ayurveda brand, Forest Essentials, expanded its footprint to its first international market in the UK. The company plans to open 12 new stores in the UK by the end of 2024 and strengthen its online presence with the local e-commerce website in the next six months. Such expansion strategies will fuel overall regional growth.

Asia Pacific is expected to register the fastest CAGR from 2023 to 2030. The consumer’s growing concern about their health and hygiene has enhanced the demand for chemical-free personal products in the region. Such factors compelled manufacturers to improve their product offerings to match the dynamically changing consumer requirements. Some of the brands offering organic products in the region are L’Occitane; Origins; and Mamaearth. Also, the region holds a potential growth opportunity due to the increasing per capita consumption and the expanding population. Furthermore, a growing number of middle-class households and rising skin consciousness and sustainability knowledge among consumers are expected to fuel the demand for these products.

India organic personal care market is expanding at a substantial CAGR of 10.1% during the forecast period. Natural beauty and personal care products are growing increasingly popular as a safer and preferable alternative, especially in India, a country with a strong preference for herbal and ayurvedic materials for hair care and skincare. Consumers actively seek convenience in their beauty and personal care regimens in 2020, and they are well aware of the negative consequences of harsh chemicals.

According to a survey conducted by The Economics Times, it was found that approximately 71% of customers expressed a preference for face creams or lotions labeled as natural, indicating a willingness to choose such products. Additionally, 38% of customers indicated a desire to purchase shampoos or hair oils formulated with botanical ingredients. These findings highlight the significance of using natural and organic ingredients in beauty and personal care products to cater to consumer preferences and enhance market potential.

Key Companies & Market Share Insights

The market is still developing with more scope for growth in the near future. New entrants and established players are launching innovative products to suffice the increasing demand for sustainable skin care products across the globe. For instance:

-

In June 2021, SO’BiO étic, a beauty brand in France, launched its chemical-free beauty product line in the U.S. The new product range includes a hydrating day cream, organic brightening moisturizing cream, tone correcting serum, and organic cleansing foam.

-

In April 2021, Lacaille Beauty launched its website and natural organic hair care product collection. The product range includes a deep conditioner, fortifying leave-in conditioner, hair repair, vitamin boost hair primer, and anti-frizz and shine curl-forming custard cream made using natural organic ingredients, such as avocado and honey with coconut and organic essential oils.

-

In December 2020, Henkel Beauty Care announced the launch of several product innovations in 2021 for organic brand NAE, Diadermine skin care products, and Schwarzkopf hair dyes.

Some prominent players in the global organic personal care market include:

-

Aveda Corporation

-

Burt’s Bees

-

The Estée Lauder Companies Inc.

-

The Hain Celestial Group

-

Amway Corporation

-

Bare Escentuals Beauty, Inc.

-

Arbonne International LLC

-

Neutrogena Corporation

-

The Body Shop International PLC

-

Yves Rocher SA

Recent Development

-

In June 2023, The Estée Lauder Companies Inc. launched the Responsible Store Design program, which offers a framework for assessing current and new retail outlets, as well as for designing the visual merchandising across several sustainability areas such as energy conservation, waste reduction, water conservation, and responsible material sourcing. By the end of June, 6 stores had aligned with the framework successfully, as part of the pilot program for fiscal year 2023

-

In May 2023, Amway announced that four of its Amway Artistry Skincare products had become the first from the brand to receive ‘The Skin Cancer Foundation Seal of Recommendation’ designation. The products include Artistry Skin Nutrition Balancing Matte Day Lotion SPF 30, Artistry Skin Nutrition Renewing Reactivation Day Cream SPF 30, Artistry Skin Nutrition Hydrating Day Lotion SPF 30, and Artistry Skin Nutrition Renewing Reactivation Day Lotion SPF 30

-

In December 2022, The Hain Celestial Group, Inc. announced that it had completed the divestment of its brand, Westbrae Natural, to Bush Brothers & Company. The company aims to simply its portfolio through this divestiture and focus on the expansion and innovation of its priority brands

-

In December 2022, Amway unveiled its Singapore Business Innovation Hub in the Central Business District, through a collaboration with the Singapore Economic Development Board (EDB). This development would allow Amway to acquire local talent for accelerating product innovation on both regional and global levels and advance its growth in Asia

-

In September 2022, The Estée Lauder Companies Inc. announced a partnership with BALMAIN for the development, production, and distribution of a beauty product line called BALMAIN BEAUTY. The expected launch of this collaboration is in fall 2024

-

In June 2022, The Hain Celestial Group, Inc. announced that its North American business had joined the How2Recycle label program, which is a standardized labeling system based in the U.S. and Canada that allows clear communication regarding package recycling to improve the reliability and the transparency of recyclability claims. The partnership will enable Hain Celestial to support the objectives of the company’s retail partners in the region, of which many support the usage of How2Recycle labels on packaging

Organic Personal Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.55 billion

Revenue forecast in 2030

USD 44.77 billion

Growth rate

CAGR of 9.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; India; China; Japan; Brazil; UAE

Key companies profiled

Aveda Corporation; Burt’s Bees; The Estée Lauder Companies Inc.; The Hain Celestial Group; Amway Corporation; Bare Escentuals Beauty, Inc.; Arbonne International LLC; Neutrogena Corporation; The Body Shop International PLC; Yves Rocher SA.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Personal Care Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global organic personal care market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Skin Care

-

Hair Care

-

Oral Care

-

Others

-

-

Distribution channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarket/Supermarket

-

Pharmacy and Drug Stores

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global organic personal care market size was estimated at USD 21.82 billion in 2022 and is expected to reach USD 23.55 billion in 2023.

b. The global organic personal care market is expected to grow at a compound annual growth rate of 9.4% from 2023 to 2030 to reach USD 44.77 billion by 2030.

b. The Asia Pacific dominated the organic personal care market with a share of 42.35% in 2022. This is attributable to increasing consumption in the region on account of rising awareness regarding the positive effects of natural and organic ingredients in the personal care routine.

b. Some key players operating in the organic personal care market include Aveda Corporation; Burt’s Bees; The Estée Lauder Companies Inc.; The Hain Celestial Group; Amway Corporation; Bare Escentuals Beauty, Inc.; Arbonne International LLC; Neutrogena Corporation; The Body Shop International PLC; and Yves Rocher SA.

b. Key factors that are driving the organic personal care market growth include increasing demand for skin and hair care organic products coupled with the rising e-commerce penetration in developing countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The Beauty and Personal Care (BPC) industry has witnessed a decline in the wake of the Covid 19 pandemic, but the impact is not as severe as seen in other industries. Although discretionary spending has reduced, the BPC market has witnessed a consumer behavioral shift towards safe and reliable products. Products that have a lower risk of contamination owing to automation and longer shelf lives helping the rationing of consumer supplies are expected to stand out in the near future. Brands are also focusing on improving their supply lines in terms of strengthening their E-commerce channel along with offering at-home wellness products, which are highly suited in this volatile business environment. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.