- Home

- »

- Renewable Chemicals

- »

-

Oleochemicals Market Size, Share & Growth Report, 2030GVR Report cover

![Oleochemicals Market Size, Share & Trends Report]()

Oleochemicals Market Size, Share & Trends Analysis Report By Product (Specialty Esters, Fatty Amines), By Application (Personal Care & Cosmetics, Consumer Goods, Healthcare & Pharmaceuticals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-282-2

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global oleochemicals market size was valued at USD 22.66 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. The demand for oleochemicals is projected to be driven by the growing utilization of these products in various end-use industries like industrial, personal care & cosmetics, textiles, pharmaceuticals, and food processing. The market for oleochemicals witnessed a sharp fall amid the COVID-19 outbreak. The personal care and cosmetics business, which accounts for the most significant portion of oleochemicals end-use, witnessed a steep fall due to the enforced lockdown across economies. Due to the ongoing demand for necessities, the personal care sector has continued to function mediocrely; nevertheless, the market for color cosmetics, makeup products, perfumery, and fragrances has fallen dramatically.

Products made from fats and oils are known as oleochemicals. In addition, they can be manufactured from fossil fuel sources like petrochemicals and natural sources like plant & animal oils and fats. Manufacturers can make oleochemicals through a variety of chemical or enzymatic reactions.

Fatty acids, fatty acid methyl esters, fatty amines, and glycerol are a few of the fundamental oleochemical compounds. The production of intermediary chemicals like sugar esters, structured triacylglycerol (TAG), diacylglycerol (DAG), monoacylglycerol (MAG), quaternary ammonium salts, alcohol ether sulfates, alcohol sulfates, and alcohol ethoxylates are also carried out using these fundamental oleochemicals.

The increasing demand for biodegradable products is driving the restrictions on petrochemical, which is expected to have a favorable impact on the market for specialty oleochemical derivatives over the forecast period. The risk of using vegetable oil for industrial uses has increased due to the erratic pricing of essential oils and the growing worries about food security in many developing countries.

Some primary feedstocks utilized to produce oleochemicals are palm oil and palm kernel oil. Due to refiners' conventional stronghold on farmers and plantation firms, they enjoyed substantial profit margins of approximately 50-80%. As plantation businesses took over conventional palm cultivation and acquired enormous tracts of land, refiners had fewer opportunities to transfer suppliers. Hence, the cost of doing business has increased tremendously for refiners. Gathered palm fruit bunches are crushed to produce crude palm kernel and palm oil. The Asia Pacific region, particularly Malaysia and Indonesia, is where most of the world's palm oil is grown. As a result, most industry participants are based in this area and export mainly to North America and Europe.

Product Insights

Glycerol esters dominated the global oleochemicals industry with the highest revenue share of 35.6% in 2022. This is attributed to its rising application in end-user industries such as food & beverages and personal care & cosmetics owing to its chemical composition. Furthermore, these products are emulsifiers and thickeners in exotic confectionery and food items.

For various uses, specialty esters can be used instead of chemicals and materials made using petroleum. The use of bio-based resources in environmentally sensitive applications to reduce the carbon footprint is encouraged by the Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) guidelines, which manufacturers and consumers enforce. As a result, the use of specialty esters is expected to rise over the forecasted period.

Alkoxylates are used as wetting agents, dispersing agents, detergents, stabilizers, emulsifying agents, and cleaning agents. Ethoxylates of methyl ester, fatty amine, fatty acid, and fatty alcohol are among the nonionic surfactants that make up the alkoxylate group. These surfactants are emulsifiers in producing home cleaners, agrochemicals, and fabric softeners. Over the projection period, increasing surfactant applications across several industrial sectors will likely fuel alkoxylate demand.

Application Insights

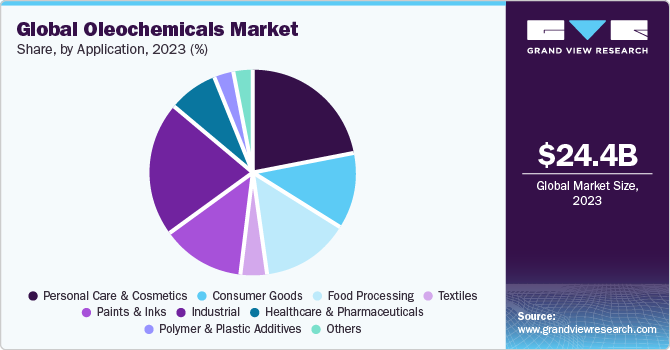

The personal care & cosmetics application segment dominated the global market with the highest revenue share of 22.1% in 2022. Its high share is attributable to the rising demand for various personal care products such as skin care creams, hair care, sun care, and oral care products, as these chemicals are used in formulating such personal care & cosmetics products.

Industrial use is another primary end-use application in which oleochemicals are utilized frequently. Oilfield chemicals, pulp & paper chemicals, construction chemicals, lubricant additives, metalworking fluids, agrochemicals, water management chemicals, and rubber processing are some examples of products in the industrial section. Specialty oleochemical derivatives are in high demand across various industries, including construction, rubber processing, metalworking, oilfield, and pulp & paper. This is due to the physicochemical properties of these derivatives, which have spurred their demand to produce lubricants and oil additives.

Specialty oleochemical derivatives are utilized in the food processing sector to process frozen foods, confectionery, and beverages. The food processing sector uses a variety of product derivatives, such as alcohol ethoxylates sulfates, sucrose esters, and glycerol esters.

Furthermore, the product demand for food additives and processing applications is anticipated to be influenced by changing consumer preferences for better diet intake and consumer propensity toward weight reduction programs.

Regional Insights

The Asia Pacific dominated the market with the highest revenue share of 41.0% in 2022. This is attributed to the substantial presence of manufacturers in the marketplaces, especially in Malaysia and Indonesia. In addition, manufacturers have been encouraged to expand their capacity in the region by its vast captive market and abundant raw resources like palm oil and palm kernel oil.

Oleochemicals industry growth in Europe is anticipated to be driven by favorable regulatory regulations by Registration, Evaluation, and Authorization of Chemicals (REACH) to promote sustainable chemicals and petrochemical alternatives. In addition, the demand for oleochemicals such as glycerin and methyl ester sulfonate is anticipated to increase due to the increased interest in biodiesel as a substitute for conventional petroleum-based fuel.

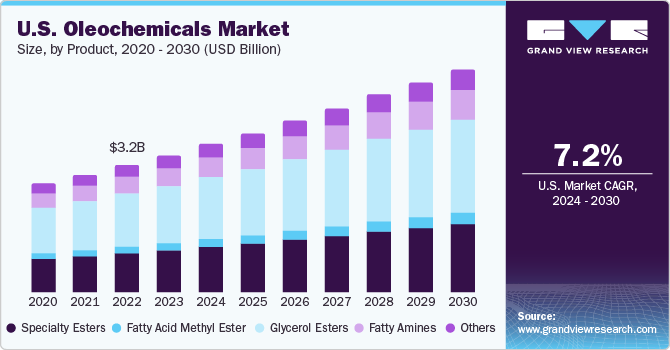

The United States (U.S.) is one of the primary users of oleochemicals, with players like BASF SE; Vantage Specialty Chemicals; Evonik Industries; and Cargill Inc. being the most established in the market. The U.S. is a major producer of soybean oil and a big importer of rapeseed and coconut oils, which are important feedstocks for synthesizing oleochemicals. Additionally, Canada exports more than 80% of its rapeseed oil production, making it one of the biggest producers in the world. Throughout the projection period, demand for bio-based goods is anticipated to grow along with abundant raw materials available.

Key Companies & Market Share Insights

The global oleochemicals industry is highly competitive. The existing players undertake various strategic decisions to hold dominating position in the global market. The production capacity of international manufacturers has increased noticeably in the global oleochemicals industry.

For instance, Evonik Industries AG announced in September 2019 that it was increasing the production of C13 alcohol isotridecanol (ITDA) in the German Marl Chemical Park. Furthermore, one of the main causes of inflated specialized oleochemical prices in North America and Europe is the market's strong dependence on feedstock supplies from Asia Pacific. As a result, manufacturers based on integrated plantations in Asia and the Pacific have tremendous room for growth.

In addition to the above-mentioned initiatives, these companies have integrated themselves throughout the supply chain to ensure better reach. Integration along the entire value chain has aided the participants in maximizing earnings and avoiding involvement from other parties. For example, by taking part in internal plantations, the acquisition of raw materials, production, and distribution, Vantage Specialty Chemicals and Emery Oleochemicals have vertically integrated their businesses. Similarly, with the aid of their sizable Malaysian palm oil plantations, KLK OLEO and IOI Group have combined their backward operations. Some prominent players in the global oleochemicals market include:

-

Vantage Specialty Chemicals, Inc.

-

Emery Oleochemicals

-

Evonik Industries AG

-

Wilmar International Ltd.

-

Kao Chemicals Global

-

Ecogreen Oleochemicals

-

Corbion

-

Cargill, Incorporated

-

Oleon NV

-

Godrej Industries

-

IOI Corporation Berhad

-

KLK OLEO

-

Evyap Sabun Yag Gliserin San ve Tic A.S.

-

JNJ Oleochemicals, Incorporated

-

Sakamoto Yakuhin kogyo Co., Ltd.

-

Stephan Company

-

Pepmaco Manufacturing Corporation

-

Philippine International Dev., Inc. (Phidco, Inc.)

Oleochemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.42 billion

Revenue forecast in 2030

USD 39.08 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; The Netherlands; Russia; Switzerland; Poland; Sweden; China; India; Japan; South Korea; Malaysia; Singapore; Indonesia; Taiwan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; U.A.E.

Key companies profiled

Vantage Specialty Chemicals, Inc.; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; Corbion; Cargill, Incorporated; Oleon NV; Godrej Industries; IOI Corporation Berhad; KLK OLEO; Evyap Sabun Yag Gliserin San ve Tic A.S.; JNJ Oleochemicals, Incorporated; Sakamoto Yakuhin Kogyo Co., Ltd.; Stephan Company; Pepmaco Manufacturing Corporation; Philippine International Dev., Inc. (Phidco, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oleochemicals Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global oleochemicals market report based on product, application, and region:

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Specialty Esters

-

Fatty Acid Methyl Ester

-

Glycerol Esters

-

Alkoxylates

-

Fatty Amines

-

Others

-

-

Application Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Consumer Goods

-

Food Processing

-

Textiles

-

Paints & Inks

-

Industrial

-

Healthcare & Pharmaceuticals

-

Polymer & Plastic Additives

-

Others

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

Switzerland

-

Poland

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Singapore

-

Indonesia

-

Taiwan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. The global oleochemicals market size was estimated at USD 22.66 billion in 2022 and is expected to reach USD 24.42 billion in 2023.

b. The global oleochemicals market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 39.08 billion by 2030.

b. The industrial application segment accounted for the largest volumetric share of 22% in 2023 in the oleochemicals market. However, the personal care & cosmetics segment is estimated to account for the highest revenue share by 2030, growing at the fastest CAGR over the forecast years.

b. Asia Pacific accounted for the largest revenue share of over 41% in 2022 in the oleochemicals market due to the increased demand for sustainable plastics in various end-user industries, which, in turn, has driven the demand for raw materials such as fatty acids and other bio-based polymers.

b. Specialty esters accounted for the largest volume share of over 33% in 2022 in the oleochemicals market, owing to the wide usage of these products in the production of rubber and cosmetics, and as a lubricant in pharmaceutical applications.

b. Some key players operating in the oleochemicals market include BASF, SABIC, AkzoNobel, Cargill, Kuala Lumpur Kepong Berhad, Evonik, Wilmar International, Emery Oleochemicals, Oleon N.V., IOI Group Berhad, and Ecogreen Oleochemicals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Raw material supply for the oleochemical production has disrupted due to full lockdown situation in India, Malaysia, and Singapore, which are the leading producers of vegetable oils. Despite this, oleochemicals manufacturers are striving to meet the demand from surfactant and cleaning products manufacturers. The updated report will account for COVID-19 as a key market contributor.