- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Nutraceuticals Market Size, Share & Growth Report, 2030GVR Report cover

![Nutraceuticals Market Size, Share & Trends Report]()

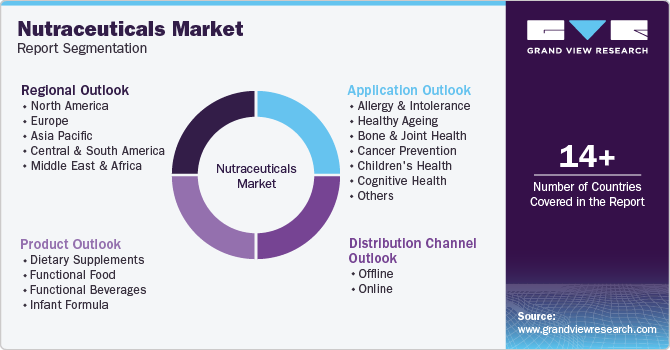

Nutraceuticals Market Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Foods, Functional Beverages), By Ingredient, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-059-0

- Number of Pages: 220

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Nutraceuticals Market Size & Trends

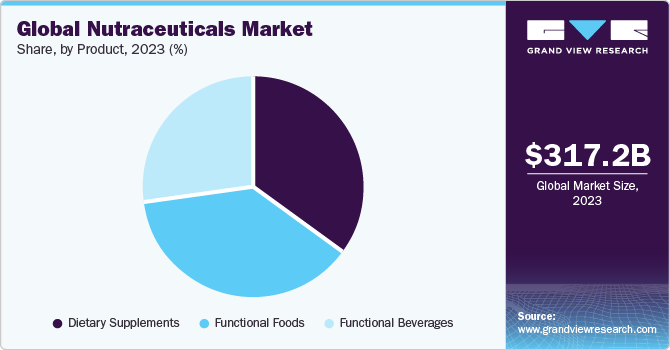

The global nutraceuticals market size was USD 291.33 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. The primary factors driving the market growth are preventive healthcare, increasing instances of lifestyle-related disorders, and rising consumer focus on health-promoting diets. Additionally, increasing consumer spending power in high-growth economies is projected to contribute to the growing demand for nutraceutical products. The growing demand for dietary supplements and nutraceuticals is also attributed to consumer preferences shifting towards self-directed care in the treatment of lifestyle disorders such as cardiovascular disorders and malnutrition.

Nutraceuticals are associated with various medical and health benefits, which is driving their increased adoption among consumers globally. Rising healthcare costs, coupled with the increasing geriatric population across the world, are anticipated to assist the global nutraceutical industry growth over the forecast period. Consumers’ attitude is very positive towards functional foods mainly because of the added health and wellness benefits offered by these products. The rising geriatric population, increasing healthcare costs, changing lifestyles, food innovation, and expectations regarding higher prices have aided overall growth.

In the wake of the COVID-19 pandemic, the demand for dietary supplements and functional foods has soared. Immunity-boosting supplements have become mainstream over the past year, significantly changing buying patterns and consumer behavior. Moreover, after the COVID-19 pandemic, preventive healthcare measures such as dietary supplements will become a part of people’s everyday lives. Thus, the COVID-19 pandemic across the globe has paved the way for nutraceuticals to build a strong presence in the global market.

Growing technological advancements in the nutraceutical industry are projected to influence consumer demand positively. The growing innovation in the market has led to the adoption of AI, which will enable more personalized solutions based on a consumer's dietary and health data. Therefore, AI will be pivotal in the growth of the nutraceuticals industry globally.

Ingredient Insights

Based on ingredients, in 2022, probiotics held a dominant position in the market, accounting for a share of 26.47%. This is primarily attributed to changes in dietary patterns and consumer preferences for probiotic-based dairy foods and supplements owing to rising gut health awareness globally. Increasing gut health issues and food sensitivities have led to a positive outlook toward probiotic supplements. These supplements are further beneficial for immunity and preventive healthcare, which will likely drive its growth during the forecast period.

The probiotics segment is also projected to exhibit the fastest growth rate of 14.0% during the forecast period. The demand for probiotics is mainly attributed to their potential as health promoters and gut microbiota stabilizers. Manufacturers in the food and beverage industry are offering probiotics in different ready-to-drink formats, snacks, and cereals with strong promotion strategies. However, probiotic ingredients are most effective at cool temperatures, so refrigeration is needed throughout the distribution channel, which can possibly be a challenge to the growth of the probiotics segment.

Application Insights

In 2022, weight management and satiety segment dominated the market with a revenue share of 20.04% owing to the growing emphasis on fitness and nutrition. Health-conscious consumers are looking for a constant upgrade in their dietary patterns due to the working environment and socioeconomic changes. Rising demand for sports nutrition products due to increasing awareness of muscle improvement among athletes is expected to fuel the demand for nutraceuticals for weight management. This is likely to promote the demand for beverages such as energy drink-mix powders in the near future.

Weight management is one of the crucial application areas, wherein increasing obesity rates due to lifestyle changes has generated immense demand for dietary supplements. According to Trust for America's Health’s (TFAH), 19th annual report, 19 states in the U.S. had obesity rates over 35% in 2022, which was up from 16 states in 2021.

Product Insights

The functional foods segment dominated the market with a revenue share of 37.78% in 2022 and is expected to retain its dominance during the forecast period. Technological upgradation and product development progression are projected to drive the functional foods industry over the coming years. Sports drinks are gaining popularity among athletes and other individuals involved in energetic physical activities. The millennial generation drives the sports drinks market exponentially due to its high buying capacity, willingness to pay for health products, acute interest in sports, and growing inclination toward fitness activities.

Increasing adoption of new technologies such as microencapsulation is driving technological innovations in the functional foods industry. Microencapsulation technology helps in enhancing the taste of the final functional food item. For example, omega-3 fatty acids have an unpleasant odor. However, the fragrance and taste of these ingredients are enhanced with the use of encapsulation technology. This helps the product to be tastier and more appealing to the consumers. Such advancements in line with changing consumer preferences, are projected to drive the growth of functional food products.

Regional Insights

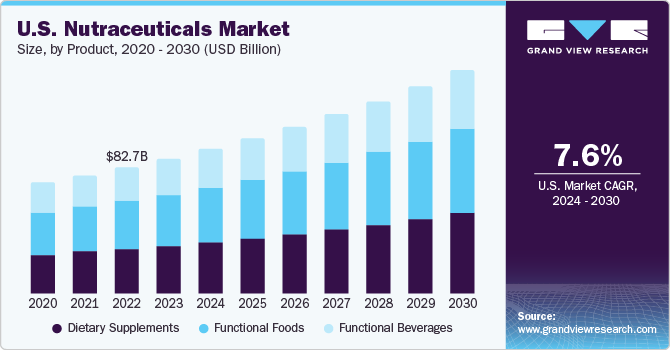

North America accounted for the largest revenue share of over 35.50% in 2022. The growing health concerns amongst consumers and increasing awareness regarding nutraceuticals are likely to be the major drivers of the North American market. Additionally, an increase in the aging population, spending patterns on healthcare products, and changing lifestyles have enhanced the growth of the nutraceutical industry in the region. Vast product portfolio and government regulations regarding nutraceutical products are a few factors that suppress this market. However, the growing trend of food fortification with nutraceutical products is anticipated to create a significant growth opportunity for this market.

Increasing healthcare costs in the U.S., recent regulations on functional food, and increased research and development on functional food are the key factors that are positively affecting the market. Moreover, improper dietary habits, long working hours, and a sedentary lifestyle contribute to poor health and associated healthcare costs. Healthcare accounts for approximately 14% of the U.S. economy's gross national product (GNP). Thus, the increasing cost of healthcare is forcing the U.S. population to opt for preventive healthcare, driving them to shift to dietary supplements and functional foods.

Key Companies & Market Share Insights

The nutraceuticals market is a moderately fragmented industry. The competitive landscape is characterized by the presence of key international players. Key players such as Amway, Nestle, and General Mills are characterized as market leaders owing to their wide and diversified product portfolio and large distribution networks.

Companies have implemented mergers and acquisitions and new product launches as key strategies to compete in the market. Acquisitions and mergers facilitated the companies to expand their product reach and improve product quality. Moreover, introducing new products to the market has supported the companies to offer better quality products, meeting the changing consumer trends across the industry. For instance, in August 2022, one of the key dietary supplement brands, Youtheory, launched a line of new liquid dietary supplements post its acquisition by Jamieson Wellness Inc. The new product comprises ingredients such as B12B6, K2D3, and ashwagandha, offered in liquid and capsule forms. This new launch is in line with the growing consumer demand for nutritional supplements in the U.S. Some of the prominent players in the global nutraceuticals market include:

-

DSM

-

Amway

-

Pfizer Inc.

-

Nestle

-

The Kraft Heinz Company

-

The Hain Celestial Group, Inc.

-

Nature's Bounty

-

General Mills Inc.

-

Danone

-

Tyson Foods

Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 317.22 billion

Revenue forecast in 2030

USD 599.71 billion

Growth rate

CAGR of 9.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredient, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; the Netherlands; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

DSM; Amway; Pfizer Inc.; Nestle; The Kraft Heinz Company; The Hain Celestial Group, Inc.; Nature's Bounty; General Mills Inc.; Danone; Tyson Foods

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global nutraceuticals market report based on ingredient, product, application, and region:

-

Ingredient Outlook (Revenue, USD Million, 2017 - 2030)

-

Aloe vera

-

Amino acids

-

Botanical Ingredients

-

Ashwagandha

-

Curcumin

-

Ginseng

-

Hemp

-

Others

-

-

Cannabidiol (CBD)

-

Carbohydrates

-

Carnitine

-

Food Color

-

Carotenoids

-

Astaxanthin

-

Lutein

-

Lycopene

-

Other carotenoids (Zeaxanthin, Betacarotene)

-

-

Spirulina

-

Collagen

-

Colostrum

-

Cultures and fermentation starters

-

Dairy ingredients

-

Emulsifiers

-

Enzymes

-

Essential oils

-

Fat replacers

-

Fats and oils

-

Fibres

-

Flavours

-

Fruit and vegetable products

-

Glucosamine / Chondroitin

-

Isoflavones

-

Juices and concentrates

-

Krill

-

Lipids / Fatty Acids

-

Marine ingredients

-

Minerals

-

Calcium

-

Iron

-

Magnesium

-

Selenium

- Others

-

-

Omega-3s

-

Marine Derived

-

Plant-derived

-

-

Prebiotics

-

Probiotics

-

Proteins

-

Sweeteners

-

Stevia

-

Monkfruit

-

Others (Honey, sucrose, fructose, etc.)

-

-

Vitamins

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

-

-

Whey proteins

-

Other

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Dietary supplements

-

Functional foods

-

Functional beverages

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Allergy & intolerance

-

Animal nutrition

-

Healthy ageing

-

Bone & joint health

-

Cancer prevention

-

Children's health

-

Cognitive health

-

Diabetes

-

Digestive / Gut health

-

Energy & endurance

-

Eye health

-

Heart health

-

Immune system

-

Infant health

-

Inflammation

-

Maternal health

-

Men's health

-

Nutricosmetics

-

Oral care

-

Personalised nutrition

-

Post Pregnancy and reproductive health

-

Sexual health

-

Skin health

-

Sports nutrition

-

Weight management & satiety

-

Women's health

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nutraceuticals industry is worth USD 291.33 billion in 2022 and is projected to reach USD 317.22 billion in 2023.

b. The nutraceuticals market is expected to grow at a compound annual growth rate of 9.4% from 2023 to 2030 to reach USD 599.71 billion by 2030.

b. Weight management & satiety is projected to account for the largest share of 20.04% in 2022 owing to the increasing demand for sports nutrition production among fitness enthusiasts and sports athletes.

b. Some of the key market players in the nutraceuticals market are DSM, Amway, Pfizer Inc., Nestle, The Kraft Heinz Company, The Hain Celestial Group, Inc., Nature's Bounty, General Mills Inc., Danone, and Tyson Foods

b. Key factors that are driving the nutraceuticals market growth globally are increasing geriatric population, changing consumer habits, rising health consciousness, and shift from pharmaceutical to nutraceutical products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The demand for nutraceuticals & functional foods is expected to witness an upward surge owing to consumers opting for immunity boosting supplements during the COVID-19 pandemic. Furthermore, a decline in the consumption of poultry, meat and seafood products across the globe is expected to increase the demand for plant and animal-based protein supplements in the near future. The report will account for Covid19 as a key market contributor.