- Home

- »

- Medical Devices

- »

-

Nucleic Acid Therapeutics CDMO Market Size Report, 2030GVR Report cover

![Nucleic Acid Therapeutics CDMO Market Size, Share & Trends Report]()

Nucleic Acid Therapeutics CDMO Market Size, Share & Trends Analysis Report By Type, By Service (Process Development & Optimization, Manufacturing Services), By End-user, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-125-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global nucleic acid therapeutics CDMO market size was valued at USD 11.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. The market is majorly driven by the advancements in nucleic acid therapeutics, complex manufacturing processes, and increased investment. Moreover, rising regulatory approval for nucleic acid therapeutics and increasing demand for personalized medicine across the globe are going to push the demand for cost-effective CDMO services, thereby fueling market growth. Nucleic acid treatments provide personalized medical care by adapting to a patient’s genetic profile.

The outbreak of the COVID-19 pandemic was a major contributor to the growth of the market for nucleic acid therapeutics CDMO. The COVID-19 pandemic accelerated the R&D efforts in nucleic acid therapeutics. Several governments and private organizations increased funding for COVID-19-related research, directly supporting the growth of CDMOs in the field. Moreover, the success of COVID-19 vaccines based on mRNA, such as those created by Pfizer-BioNTech and Moderna, attracted considerable attention to mRNA technology. This has raised awareness and confidence in nucleic acid treatments, increasing the demand for CDMO services in this industry.

Furthermore, the increasing prevalence of genetic diseases, Cystic Fibrosis, and the rapid shift of pharma companies towards novel biologics are expected to drive market growth in the coming years. According to a report by the CF Foundation in July 2022, there was a notable rise in the number of individuals affected by cystic fibrosis over the previous decade. Approximately 40,000 children and adults reside with cystic fibrosis within the U.S. as of 2022, while globally, approximately 105,000 individuals have been diagnosed with CF across 94 countries.

Companies are increasing their focus on partnerships, new product launches, collaborations, and other initiatives for the availability of new therapeutics, which is expected to propel market growth. For instance, in January 2022, the Center for Breakthrough Medicines (CBM) partnered with the University of Pennsylvania Gene Therapy Program (GTP). This collaboration aims to assist small biotech firms, universities, and major pharmaceutical companies in advancing their gene therapy programs through clinical development.

Type Insights

The RNA-based therapies segment dominated the global market with a revenue share of 65.85% in 2022. According to data published by ClinicalTrials.gov, more than 3,500 RNA therapies are currently in the clinical trial phase for multiple diseases. The promising outcomes observed in recent clinical trials highlight the significant potential of RNA-based medications for addressing a range of illnesses. Such factors are expected to drive segment growth.

On the basis of type, the market is divided into gene therapy and RNA-based therapies. The gene therapy segment is anticipated to expand at the fastest CAGR of 9.7% during the forecast period. There is a rapidly expanding pipeline of gene therapy candidates for several disorders, including inherited diseases, rare genetic disorders, and certain types of cancer. Several of these gene therapies are in late-stage clinical trials, indicating their potential to reach the market in the coming years.

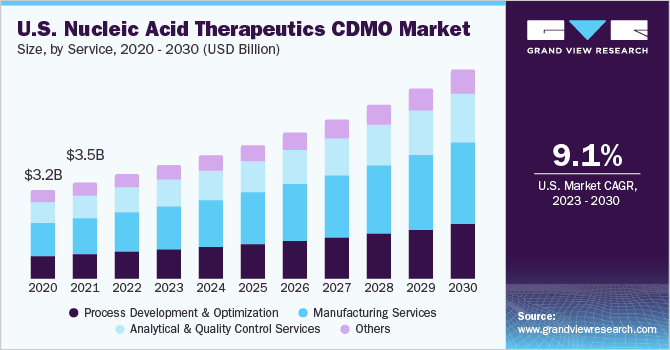

Service Insights

The manufacturing services segment held a major revenue share of over 38% in 2022. Nucleic acid-based therapies, including RNA and gene therapies, require highly specialized knowledge and expertise in manufacturing. CDMOs that focus exclusively on nucleic acid manufacturing have developed a deep understanding of these therapies, giving them a competitive advantage. On the basis of service, the nucleic acid therapeutics CDMO market has been further categorized into process development and optimization, manufacturing services, analytical and quality control services, and others.

The process development & optimization services segment is expected to show significant growth in the coming years. The complex nature of nucleic acid therapies is one of the major factors driving segment growth. Nucleic acid-based therapies, including RNA-based therapies, gene therapies, and mRNA vaccines, often involve intricate and novel manufacturing processes. Optimizing these processes is essential to ensure product quality, efficacy, and safety.

End-user Insights

The biotechnology companies segment held the highest revenue share of over 58% in 2022. This is attributed to their expertise in nucleic acid-based drug development, substantial investment in R&D of innovative therapies, and adoption of emerging technologies. Moreover, increasing strategic initiatives by key players is expected to drive segment growth. For instance, in May 2023, Mustang Bio. announced a collaboration with uBriGene (Boston) Biosciences Inc., the U.S. subsidiary of uBriGene Group. This partnership involves the transfer of the former’s development, manufacturing, and analytical testing facility located in Worcester, Massachusetts, to uBriGene.

The government & academic research institutes segment is anticipated to expand at the fastest CAGR of 9.7% during the forecast period. This is attributed to the crucial role of these institutions in driving early-stage research and innovation, supported by significant public funding for drug development initiatives. These entities actively engage CDMOs for manufacturing, development, and analytical services in their quest to advance the nucleic acid therapeutics space, collaborate with industry partners, and address specific research priorities and public health initiatives.

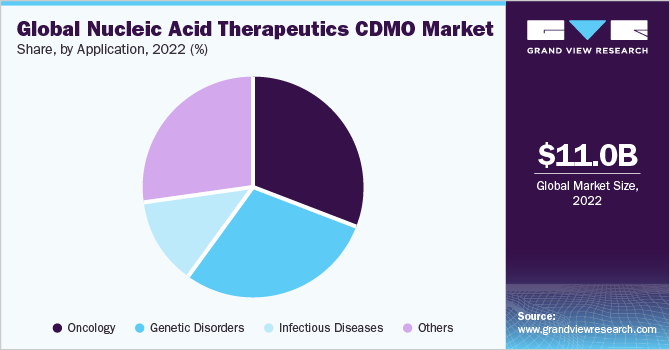

Application Insights

The oncology segment dominated the global market with a revenue share of 31.17% in 2022. The increasing adoption of gene therapy and RNA-based therapeutics and the high number of candidates entering clinical trials for various forms of cancer are factors expected to drive segment growth. According to data published by the American Society of Gene & Cell Therapy, more than 14 gene and RNA therapies are approved for cancer. Moreover, according to clinicaltrial.gov, over 1,500 RNA therapies are under clinical trials.

On the other hand, the genetic disorders segment is expected to hold a significant market share in the coming years. This is attributed to several factors, such as the rising need for effective treatments for rare and debilitating genetic conditions, the precision of nucleic acid therapeutics in targeting specific genetic mutations, and regulatory incentives for orphan drug development.

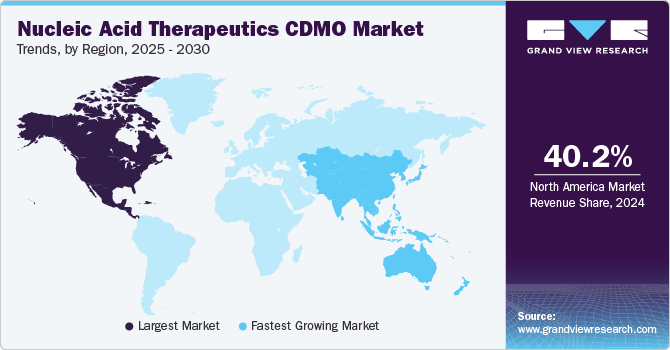

Regional Insights

North America dominated the market for nucleic acid therapeutics CDMO with a share of 38.49% in 2022. This is attributed to its robust biotech industry, advanced healthcare ecosystem, substantial investment & funding support, solid clinical trial infrastructure, and strong academic and research institutions. Moreover, the global expansion of CDMOs, the presence of key players, a proactive regulatory environment, and increasing approval for nucleic acid therapeutics are other factors boosting regional growth. For instance, in June 2023, the FDA granted approval for the first gene therapy aimed at treating specific patients with Duchenne Muscular Dystrophy.

Asia Pacific is anticipated to experience maximum growth at a rate of 11.1% over the projection period. Cost-effective manufacturing capabilities, regulatory advancements, increasing investment and partnerships, clinical trial opportunities, and growth in emerging markets are some major factors contributing to regional growth.

The Asia Pacific market for commercial gene therapy applications is poised for substantial growth in the forecast period. This expansion can be attributed to the ready availability of resources, the presence of major companies in the region, and heightened government investments. Technologically advanced nations like Japan and China are actively engaged in conducting clinical trials for the development of multiple gene therapy treatments.

Key Companies & Market Share Insights

Key players operating in the nucleic acid therapeutics CDMO industry are adopting several strategic initiatives such as collaborations, partnerships, new service launches, and mergers & acquisitions to provide a competitive edge. For instance, in April 2023, Exothera partnered with Quantoom Biosciences to leverage Quantoom's innovative Nfinity technology, a cutting-edge continuous production platform designed for RNA. Through this collaboration, Exothera would become the first Contract Development and Manufacturing Organization (CDMO) globally to provide an off-the-shelf service for continuous RNA production, expanding its capabilities in the RNA manufacturing space. Some of the prominent players in the global nucleic acid therapeutics CDMO market include:

-

Catalent

-

Thermo Fisher Scientific

-

Lonza

-

FUJIFILM Diosynth Biotechnologies

-

Cognate BioServices

-

Eurofins Genomics

-

Sirion Biotech

-

Oxford Biomedica

-

Danaher (Aldevron)

Nucleic Acid Therapeutics CDMO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.98 billion

Revenue forecast in 2030

USD 22.42 billion

Growth rate

CAGR of 9.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, end-user, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; India; Japan; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Catalent; Thermo Fisher Scientific; Lonza; FUJIFILM Diosynth Biotechnologies; Cognate BioServices; Eurofins Genomics; Sirion Biotech; Oxford Biomedica; Danaher (Aldevron)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Nucleic Acid Therapeutics CDMO Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nucleic acid therapeutics CDMO market report on the basis of type, service, end-user, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gene Therapy

-

RNA-based Therapies

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Process Development and Optimization

-

Manufacturing Services

-

Analytical and Quality Control Services

-

Others

-

-

End-users Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical Companies

-

Government & Academic Research Institutes

-

Biotech Companies

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Genetic Disorders

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nucleic acid therapeutics CDMO market size was estimated at USD 11.04 billion in 2022 and is expected to reach USD 11.98 billion in 2023.

b. The global nucleic acid therapeutics CDMO market is expected to grow at a compound annual growth rate of 9.04% from 2023 to 2030 to reach USD 22.42 billion by 2030.

b. North America dominated the nucleic acid therapeutics CDMO market with a share of 38.49% in 2022. This is attributable to the robust biotech industry, advanced healthcare ecosystem, substantial investment and funding support, extensive clinical trial infrastructure, and strong academic and research institutions.

b. Some key players operating in the nucleic acid therapeutics CDMO market include Catalent, Thermo Fisher Scientific, Lonza, FUJIFILM Diosynth Biotechnologies, Cognate Bioservices, Eurofins Genomic, Sirion Biotech, Oxford Biomedica, Danaher (Aldevron).

b. Key factors that are driving the market growth include advancements in nucleic acid therapeutics, complex manufacturing processes, and increased investment. Moreover, rising regulatory approval for nucleic acid therapeutics and increasing demand for personalized medicine across the globe are also expected to boost market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."