- Home

- »

- Advanced Interior Materials

- »

-

North America Rainscreen Cladding Market Size Report, 2028GVR Report cover

![North America Rainscreen Cladding Market Size, Share & Trends Report]()

North America Rainscreen Cladding Market Size, Share & Trends Analysis Report By Raw Materials (Fiber Cement, Composite Material, Terracotta, Ceramics), By Application, By Country, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-3-68038-291-4

- Number of Pages: 126

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Advanced Materials

Report Overview

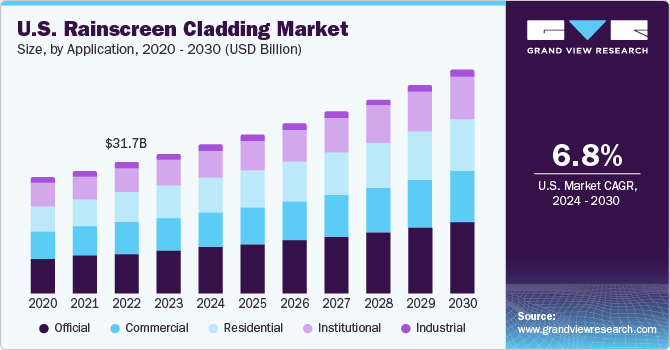

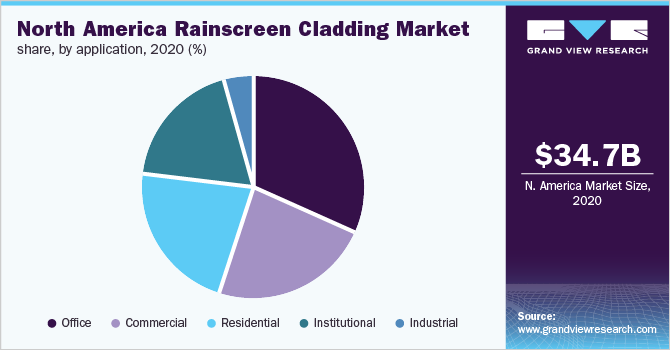

The North America rainscreen cladding market size was estimated at USD 34.7 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2020 to 2028. The rise in the adoption of fire safety equipment for building protection and enhanced thermal management are expected to ascend the market for rainscreen cladding.

The ongoing COVID-19 outbreak in the North America has impacted the construction industry owing to the suspension of construction projects in the second quarter of 2020. However, the industry regained its momentum in late 2020 on account of the resurgence of the construction industry through the restart of large ongoing construction projects for the commercial and office segment.

As per data published by the U.S. Census Bureau, spending on commercial construction applications such as hotels, offices, and entertainment spaces witnessed a significant decline. The construction projects for offices were delayed for longer periods due to the adoption of the work-from-home model by many companies in the service sector. Furthermore, construction spending on industrial facilities decreased by 8.4% in 2020.

The market is driven by factors such as ascending demand for moisture management and energy-efficient solutions. Moreover, the rising demand for environment-friendly infrastructure owing to stringent regulations coupled with rising awareness regarding environmental deterioration is expected to positively impact the demand over the forecast period.

Raw materials used for rainscreen cladding include fiber cement, composite materials, high-pressure laminates (HPL), metal, mineral wool, terracotta, and others. Composite materials are widely used owing to their abundant availability and ability to mold easily into components used for rainscreen cladding. Aluminum composite, zinc composite, and copper composite are the types of materials used in the production of rainscreen cladding.

Technical innovations and improvements in the production process have resulted in the manufacture of rainscreen components with superior durability, custom colors, and low maintenance. Quick installation techniques with superior fastening equipment and the introduction of interlocking panels have surged market competition across the globe. Numerous domestic and international players are focusing on achieving a stronghold in the competition.

Raw Material Insights

The terracotta raw material segment dominated the market and accounted for the largest revenue share of 35.7% in 2020. Terracotta panels offer continuous insulation outside the primary wall and increase the thermal performance of a building. These panels are mortar-free and weatherproof, which, in turn, reduces the maintenance costs over the lifespan of the building.

The demand for fiber cement-based rainscreen cladding is likely to witness a high growth on account of its cost-effectiveness, high durability, and low maintenance cost. These panels are gaining increasing acceptance in the rainscreen cladding market owing to their weatherproof property and easy resistance to high-pressure winds and rainwater.

The demand for composite materials-based rainscreen cladding is likely to witness a high growth on account of the low maintenance cost, durability, and weatherproof and fireproof properties of these materials. Composite materials are manufactured by combining two materials of different properties; when combined, the resultant product has significantly different physical and chemical properties.

Ascending demand for aluminum rainscreen cladding, owing to its beneficial properties including lightweight, resistance to algae and fungi, recyclability, and easy installation, is anticipated to drive the segment over the forecast period. Aluminum panels are widely utilized for sound and thermal insulation, fire resistance, and improving the aesthetic appeal of buildings.

Application Insights

The office segment dominated the market and accounted for the largest revenue share of 31.3% in 2020. Rainscreen claddings are used in these constructions to provide weather resistance, thermal insulation, fire resistance, and aesthetic appeal to the building. Moreover, rising demand for energy-efficient office premises is expected to ascend the market in projected time.

The demand for rainscreen cladding is expected to witness high growth in the residential construction segment owing to increasing over-cladding activities, increasing awareness regarding energy-efficient constructions, the need for renovation of old buildings, and government regulations for green buildings.

Commercial constructions are generally large buildings or a cluster of buildings that requires rainscreen cladding structures made from rigid and durable materials for protection against extreme weather conditions. The building structure requires rainscreen cladding for thermal insulation, aesthetic appeal, and protecting the building from rain and wind.

Rapid industrial development and increasing investments from the government as well as private companies are expected to drive the growth of the industrial construction sector. Business expansion of multinational companies coupled with newly established manufacturing plants and processing units is fueling the demand for industrial construction. These factors are expected to drive the demand for rainscreen claddings in industrial applications.

Country Insights

The U.S. dominated the North America rainscreen cladding market and accounted for the largest revenue share of 78.8% in 2020. Increasing awareness regarding sustainable construction and energy-efficient residential and commercial structures are expected to boost the demand for rainscreen cladding over the forecast period.

As per U.S. Census Bureau, the spending on commercial construction projects was USD 194.8 billion in 2020. High spending towards the construction of commercial complexes such as offices, retail centers, warehouses, and hotels is expected to create new growth avenues in the rainscreen cladding market in the country.

According to the United Nations Department of Economic and Social Affairs (UNDESA), Canada’s population is expected to reach about 40.3 million by 2030. The population growth in Canada is expected to significantly boost the residential construction sector over the forecast period. Thus, is likely to influence the market for rainscreen claddings.

The National Infrastructure Program (NIP) was initiated by the Mexican government under the National Development Plan to boost the infrastructural growth in the country as a strategic move to increase productivity and improve the competitive market of the construction industry. NIP is anticipated to reduce the regional differences across the country and increase the overall standard of living in Mexico, resulting in augmenting the demand for rainscreen cladding in the residential sector.

Key Companies & Market Share Insights

The market is competitive owing to the presence of well-established companies operating across the region. These players are aiming to offer cladding products and installation services to construction-specific applications. The players majorly focus on residential and commercial construction applications as the product demand is high in these applications.

Key industry participants, including Trespa International B.V., Cladding Corp, ROCKWOOL International A/S, OmniMax International, Inc., and Kingspan Group, are focusing on the introduction of claddings with enhanced moisture management properties and aesthetics. New patents and technologies adopted by these players are being followed by new entrants. Some of the prominent players in the North America rainscreen cladding market include:

-

Trespa International B.V.

-

Cladding Corp.

-

Kingspan Group

-

Rockwool International A/S

-

Rieger Architectural Products

-

OmniMax International, Inc.

-

TERREAL Group

-

SFS Group

-

James Hardie Building Products

-

DuPont de Nemours, Inc.

North America Rainscreen Cladding Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 35.7 billion

Revenue forecast in 2028

USD 54.9 billion

Growth Rate

CAGR of 6.3% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Volume in thousand square meters, revenue in USD million, and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Trespa International B.V.; Cladding Corp.; Kingspan Group; Rockwool International A/S; Rieger Architectural Products; OmniMax International, Inc.; TERREAL Group; SFS Group; James Hardie Building Products; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the North America rainscreen cladding market report on the basis of raw material, application, and country:

-

Raw Material Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2017 - 2028)

-

Fiber Cement

-

Composite Material

-

Metal

-

High Pressure Laminates

-

Terracotta

-

Ceramics

-

Others

-

-

Application Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2017 - 2028)

-

Residential

-

Commercial

-

Office

-

Institutional

-

Industrial

-

-

Country Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2017 - 2028)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America rainscreen cladding market size was estimated at USD 34.7 billion in 2020 and is expected to reach USD 35.7 billion in 2021.

b. The North America rainscreen cladding market is expected to grow at a compound annual growth rate of 6.3% from 2020 to 2028 to reach USD 54.9 billion by 2028.

b. Terracotta dominated the North America rainscreen cladding market with a revenue share of 35.7% in 2020. This is attributed to superior fire-resistant properties and fine aesthetics.

b. Some of the key players operating in the North America rainscreen cladding market include Trespa International B.V., Cladding Corp., Kingspan Group, ROCKWOOL International A/S, Rieger Architectural Products, OmniMax International, Inc., TERREAL Group, SFS Group, James Hardie Building Products, DuPont de Nemours, Inc.

b. The key factors that are driving the North America rainscreen cladding market include increasing demand for enhanced moisture management and energy-efficient solutions for commercial buildings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.