- Home

- »

- Advanced Interior Materials

- »

-

North America Plastic Injection Molding Machine Market Size Report, 2030GVR Report cover

![North America Plastic Injection Molding Machine Market Size, Share & Trends Report]()

North America Plastic Injection Molding Machine Market Size, Share & Trends Analysis Report By Technology (Hydraulic, Hybrid), By End-use (Automotive, Medical), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-035-2

- Number of Pages: 137

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The North America plastic injection molding machine market size was estimated at USD 1.96 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. The industry is being driven by the increased demand for plastic injection molding equipment in end-use sectors including healthcare, consumer goods, automotive, electrical & electronics, packaging, and others. Moreover, rapid growth in demand for automotive components has boosted global automobile production, resulting in a high demand for plastic injection molded parts in the automotive industry.

Companies have begun to use industry 4.0 networks and Artificial Intelligence (AI) to ensure their reduced vulnerability to the COVID-19 spread. Key companies are implementing automation to ensure the uniformity of their operations and increase their productivity and efficiency. For instance, WITTMANN Technology GmbH’s Servo-hydraulic Injection Molding Machine VM 60-200 Series is a completely automated series with a clamping force ranging from 60 to 200. The growing adoption of automation in the medical, automotive, and consumer goods sectors is expected to fuel the demand for plastic injection molding machines in the coming years.

Growing demand for on-the-go packaged products owing to increasing purchasing power and busy lifestyle is expected to have a positive impact on the packaging industry growth in the U.S. Plastic injection molding machine is used for manufacturing various packaging products, such as containers, bottles, caps & closures, and covers. Growth in the packaging industry, coupled with the rising adoption of plastic injection molding machines for manufacturing packaging products, is expected to drive market growth in the country. The increasing need for additional floor space in numerous industries has increased the number of new construction and renovation projects nationwide.

In addition, an increasing number of large-scale infrastructure investment projects, including hotels and hospitals in Missouri, New York, and Los Angeles, is likely to boost the construction industry growth, thereby driving the demand for plastic injection molded components used in the construction industry. For instance, in November 2021, the U.S. Government announced a USD 1.2 trillion Infrastructure Bill that is expected to revamp the construction industry and transportation in the country to recover from the economic downturn caused by the pandemic. This is expected to positively impact the market in the country.

The automotive end-use category accounts for a sizable portion of the industry. A variety of automobile parts, such as outer body panels, bumpers, spoilers, dashboards, and electrical housings, are made using plastic injection molding machines. Many automotive interior parts are manufactured using plastic injection molding. Instrumentation components, interior surfaces, glove boxes, dashboard faceplates, air vents, and other items are included in this space. Rapid growth in demand for automotive components has boosted global automobile production, resulting in a high demand for plastic injection molded parts in the automotive industry.

Technological improvements, shorter production cycles, and increased productivity are changing the patterns of new-age plastic injection molding machines. New technological breakthroughs, such as the ability to shape different raw materials through the plastic injection molding process and boost the energy efficiency of plastic injection molding machines, have displaced traditional molding machines from the industry. As a result, the demand for automated and energy-efficient plastic injection molding equipment is increasing globally.

For instance, in November 2022, HAITIAN INTERNATIONAL introduced a new MAIII technology that enhances the precision molding of small home appliances. The new Mars series incorporates various innovative hardware and software; for instance, to enable complete closed-loop management of the injection process, a new optimized high-drive servo-hydraulic power system is integrated with sophisticated motion control technology. This improves injection accuracy, resulting in the development of an efficient injection molding machine.

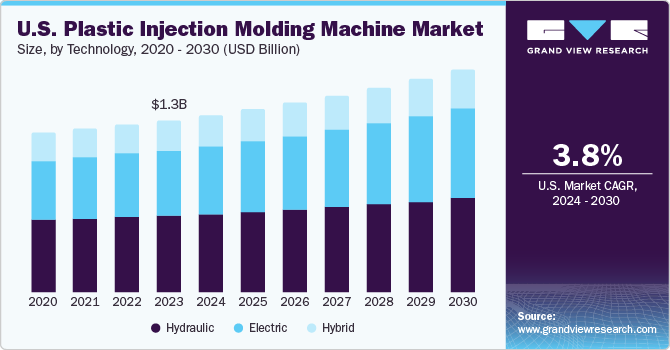

Technology Insights

The hydraulic technology segment led the industry in 2022 and accounted for the largest share of more than 44.50% of the total revenue. The automotive industry is expected to have a high demand for hydraulic technology because manufacturing large & heavy parts requires a strong clamping force. In fields like aerospace, defense, and marine, it is frequently used to make heavy parts. The electric technology segment accounted for a significant revenue share. Electric injection molding machines are highly efficient and require less start-up time and run time compared to hydraulic injection molding machines. Electric injection molding machines use 50 to 75% less energy on average than their hydraulic equivalents because they are tighter, faster, cleaner, and repeatable process production equipment with little waste.

The hybrid technology segment is likely to advance at a steady CAGR over the forecast period. A hybrid injection molding machine combines the best of both hydraulic and electric injection molding machines. A hybrid injection molding machine offers high clamping force of the hydraulic machines and high precision, energy efficiency, reduced noise, and repeatability of the electric injection molding machines, resulting in better performance for both thick- and thin-walled parts. Manufacturers have developed hybrid injection molding machines primarily to increase energy savings through screw recovery. Hybrid machines are expected to play an important role in the fabrication of the telecommunications industry, as many countries push to build infrastructure around 5G. This is expected to drive segment growth over the forecast period.

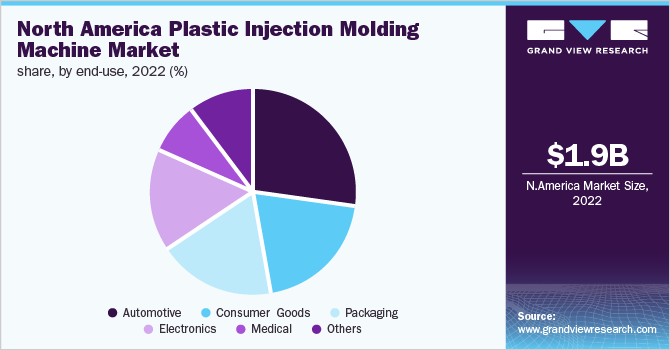

End-use Insights

The automotive application segment led the industry in 2022 and accounted for the maximum share of 27.4% of the overall revenue share, owing to factors such as material compatibility, high precision, repeatability, and surface finish. Furthermore, increasing demand for lightweight automotive components and rising automotive production are expected to propel industry growth. Increasing technological advancements in IMM, such as Electrical Discharge Machining (EDM) and high-speed Computer Numerical Control (CNC) processes, have resulted in reducing the lead times, which has augmented the penetration of IMM in the automotive industry.

Plastic injection molding machine is used to manufacture consumer goods such as personal hygiene products, houseware, travel accessories, furniture, toys, cosmetics, and convenience goods. In the past few years, the demand for high-quality plastics has increased, thereby augmenting the demand for plastic injection molding machines, which are replacing most of the traditional materials, such as glass, wood, and metal. The packaging application segment is likely to progress at a CAGR of 4.2% over the forecast period. The packaging industry contributes significantly to market growth.

Injection molding has various applications in the packaging industry; it is used to make dairy juice & water packaging, thin wall containers, beverage caps & closure, and specialty closures, among others. Increasing consumption of packaging products in the healthcare, consumer goods, personal care, and cosmetics industries is expected to boost segment growth over the forecast period. Electronics is one of the fastest-growing segments because of the wide application scope of plastic IMM in the manufacture of smartphones, tablets, laptops, connectors, and sensors. These parts require high levels of accuracy and quality. An injection molding machine fulfills all these requirements, and thus finds a variety of applications in the electronics industry.

Country Insights

The North America regional market will expand at a steady CAGR from 2023 to 2030, as a result of factors such as continuously rising consumer spending power, shifting consumer food preferences, ongoing industrialization, and urbanization. In the coming years, this industry is anticipated to be driven by the expansion of the packaging market in North America as well as the growing use of plastic injection-molded goods for creating packaging solutions. The U.S. led the regional market in 2022 and accounted for the maximum share of more than 65.40% of the overall revenue. Factors, such as easy access to new and advanced technologies in the EV industry, availability of a highly skilled workforce, presence of advanced processing capabilities, and expanded R&D projects have accelerated the adoption of Electric Vehicles (EVs) in the U.S.

The favorable government regulations and initiatives in the form of tax rebates and subsidies have further fueled the demand for EVs in the U.S. Furthermore, increasing demand for plastic injection molded components in conventional and electric vehicles for interior and exterior parts are expected to augment the market growth in the U.S. Canada is likely to expand at a significant CAGR over the forecast period. The demand for plastic injection molding machines in the automotive industry accounted for around 30% of the overall machine revenue share in Canada in 2022, owing to the rising demand for new vehicles, coupled with their ability to manufacture large-volume products with high precision.

Rising investments in R&D projects regarding self-driving or autonomous cars, coupled with increasing adoption of the Internet of Things (IoT) by the people in Canada, have augmented the demand for electronic housings, sensors, actuators, and microcontrollers. The aforementioned products are manufactured through various plastic injection molding techniques, such as over-molding, miniature molding, micro-molding, and insert molding. This, in turn, is anticipated to boost the demand for plastic injection molding machines for manufacturing electronic components.

Key Companies & Market Share Insights

Key manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new product developments, and geographical expansions, to enhance market penetration and cater to the changing technological requirements from various applications, such as automotive, building packaging, consumer goods, and others. For instance, in February 2020, Hennecke Inc. entered into a strategic partnership with the FRIMO Group in polyurethane and other plastic applications in the automobile industry.

Through this partnership, FRIMO is expected to contribute its systems technology and Hennecke is expected to provide metering and mixhead technology for the automotive sector. In addition, in March 2021, Milacron launched an all-electric injection molding machine as part of its FANUC Roboshot ALPHA-SiB series. This machine is offered by Milacron to molders across North America. Some of the prominent players in the North America plastic injection molding machine market include:

-

Arburg GmbH + Co KG

-

Haitian International

-

KraussMaffei

-

Milacron

-

Nissei Plastic Industrial Co., Ltd.

-

Engel Austria GmbH

-

Chen Hsong Holdings Ltd.

-

UBE Machinery Corp., Ltd.

-

Husky Injection Molding Systems Ltd.

-

WITTMANN Kunststoffgeräte GmbH

North America Plastic Injection Molding Machine Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2,631.1 million

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, country

Country Scope

U.S.; Canada

Key companies profiled

Arburg GmbH + Co KG; Haitian International; KraussMaffei; Milacron; Nissei Plastic Industrial Co., Ltd.; Engel Austria GmbH; Chen Hsong Holdings Ltd.; UBE MachineryCorp., Ltd.; Husky Injection Molding Systems Ltd.; WITTMANN Kunststoffgeräte GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Plastic Injection Molding Machine Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America plastic injection molding machine market report on the basis of technology, end-use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydraulic

-

Electric

-

Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Goods

-

Packaging

-

Electronics

-

Medical

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The global North America plastic injection molding machine market size was estimated at USD 1.96 billion in 2022 and is expected to reach USD 2,021.6 million in 2023

b. The North America plastic injection molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 2,631.1 million by 2030

b. U.S. dominated the North America plastic injection molding machine market with a revenue share of 80.1% in 2022. Growing demand for on-the-go packaged products owing to increasing purchasing power and busy lifestyle in the U.S. is expected to have a positive impact on the packaging industry growth in the country, thereby driving up the demand for plastic injection molding machine.

b. Some of the key players operating in the North America plastic injection molding machine market include Arburg GmbH + Co KG, HAITIAN INTERNATIONAL, KraussMaffei, Milacron, NISSEI PLASTIC INDUSTRIAL CO., LTD, ENGEL AUSTRIA GmbH, Chen Hsong Holdings Limited, UBE MACHINERY CORPORATION, Ltd, and among others.

b. The key factors that are driving the North America plastic injection molding machine market include the increasing adoption of plastic injection molding machines in the automotive, electronics, and packaging industries is likely to be the key driver for the growth of the industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."