- Home

- »

- Clinical Diagnostics

- »

-

North America Molecular Diagnostics Market Report, 2030GVR Report cover

![North America Molecular Diagnostics Market Size, Share & Trends Report]()

North America Molecular Diagnostics Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Others), By Test Location, By Technology (PCR, ISH, INAAT, Sequencing), By Application, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-073-6

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

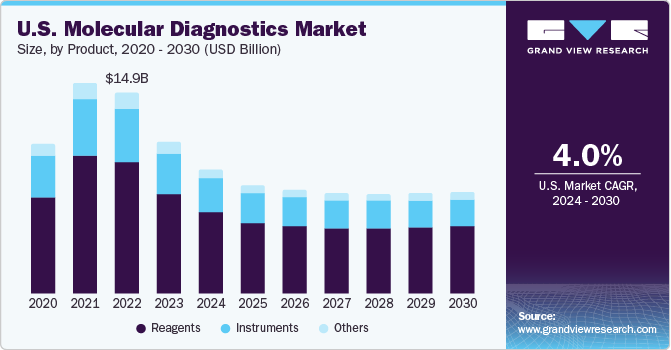

The North America molecular diagnostics market size was valued at USD 16.41 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of -5.2% from 2023 to 2030. The negative growth can be attributed to the decrease in COVID-19 tests in the coming years. However, increasing demand for advanced molecular diagnostics methods, rising demand for point-of-care facilities, and increasing external funding for R&D are the key factors driving the regional market. Furthermore, the region's high prevalence of chronic and infectious diseases such as cancer, STIs, and genetic diseases, among others, is anticipated to support the molecular diagnostics market expansion.

The geriatric population in North America region is rapidly increasing. As per the United Health Foundation report, the U.S. population over 65 years is expected to increase substantially in the coming years, from around 54 million in 2021 to around 85.7 million by 2050. This would be roughly 20% of the entire U.S. population. Aging has become a considerable risk factor for several diseases, including diabetes and obesity, which in turn, significantly escalates the risk of targeted diseases. The geriatric population is susceptible to numerous diseases like cancer, cardiovascular diseases, neurological disorders, and diabetes among others. Thus, the growing geriatric population is anticipated to be a high-impact rendering driver of the market.

Increasing demand for patient-centric healthcare services and growing adoption of technologically advanced testing products at point-of-care facilities such as clinics, retail pharmacies, physician offices, and others are further projected to drive the market expansion over the forecast period. Moreover, market players are continuously involved in developing novel POC testing products to capture market opportunities. For instance, in February 2023, Huwel Lifesciences developed a portable RT-PCR instrument to test different types of viruses. The company claimed that the test takes around 30 minutes and can be used to conduct the test for respiratory and other infections using blood and gastrointestinal samples. Such initiatives are projected to drive the market in the coming years.

Technological advancements in instruments are further increasing the adoption of molecular diagnostic tests, as they provide portability, greater accuracy, and cost-effectiveness. For instance, in February 2023, Thermo Fisher Scientific launched QuantStudio Absolute Q AutoRun dPCR suite to facilitate lab automation, ease of use, and high flexibility. Moreover, in January 2023, QIAGEN launched EZ2 Connect MDx platform to propel its capabilities of automation in sample processing. The advancement would be compatible with PCR, dPCR, and other downstream applications.

The increasing prevalence of genetic disorders in the region is likely to drive the molecular diagnostics market in the coming years. According to a report published by CDC, congenital heart defects were the most common birth defects in the U.S., affecting approximately 1% of births every year. Early detection of genetic variations via prenatal testing can help in rapid disease diagnosis, prevention, and selection of suitable treatment. Changing lifestyle and environmental factors are increasing the incidence of genetic diseases. Moreover, increasing incidence of cancer, neurological diseases, and others are further projected the demand for novel molecular diagnostics tests.

Product Insights

The reagents segment accounted for the largest revenue share of 65.61% in 2022. Reagents including test kits & consumables, are employed in a variety of molecular diagnostic procedures, such as PCR, DNA sequencing, microarrays, and amplifying nucleic acids. These agents allow the identification and diagnosis of diseases by detecting & analyzing genetic sequences or proteins. The novel product launch by the industry's key players boosts the segment growth. For instance, in April 2023, Cepheid, a subsidiary of Danaher, announced to introduce novel tests for a range of infectious diseases, including respiratory diseases and tuberculosis.

Moreover, standardized results, improved efficiency, and cost-effectiveness are anticipated to support market growth. Furthermore, the introduction & commercialization of new tests and reagents are expected to boost the market expansion. For instance, in March 2023, Atila Biosystems and Atila Biosystems signed an agreement to market digital PCR kits. The kits and assays, produced by Atila, will be used on naica, which is Stilla’s lead PCR instrument to perform tests.

Test Location Insights

The central laboratories segment accounted for the largest revenue share of 79.29% of the regional market in 2022 owing to high market penetration and procedure volumes. Numerous healthcare institutions collaborate with laboratories to integrate different tests, such as microbiology testing. Moreover, most of the key market players offer laboratory-based solutions across the globe to perform a large number of tests simultaneously, and these players are continuously involved in developing novel tests.

The self-test or over-the-counter segment is expected to grow significantly with a CAGR of 6.9% during the forecast period. Self-testing facilitates early diagnosis, constant patient monitoring, and curbs the costs associated with healthcare establishments & practitioners. With the increasing demand for molecular diagnostics, the need for comprehensive testing platforms is growing to assist patients in conducting diagnosis without the guidance of practitioners. For instance, in March 2023, Lucira Health announced the launch of the first and only at-home COVID-19 and flu tests in the U.S. The U.S. FDA gave the COVID-19 & Flu Home Test as the first and only Emergency Use Authorization (EUA) for OTC usage at home and other non-laboratory locations.

Technology Insights

The polymerase chain reaction (PCR) segment held the largest revenue share of 69.51% of the regional market in 2022 and is expected to maintain its dominance throughout the forecast period. The surge in applications of PCR in the fields of pharmacogenomics, drug discovery & development, infectious diseases, and cancer research directly impacts the demand for PCR technologies. Moreover, a significant share held by the PCR segment is attributed to the varied applications and associated benefits of novel PCR and the high penetration of technology in clinical diagnostics applications due to the high accuracy of tests.

The in situ hybridization (ISH) segment is predicted to grow with a significant CAGR of 8.7% during the forecast period. Increasing adoption of ISH to detect genetic abnormalities such as gene fusions, aneuploidy, or chromosome loss, and to track the course of an abnormality or to identify new oncogenes are some of the key factors driving segment growth. For instance, in May 2022, Advanced Cell Diagnostics (ACD) reported creating over 40,000 different RNAscope ISH probes across more than 400 species that will allow important diagnostic applications, next-generation drug development, and others.

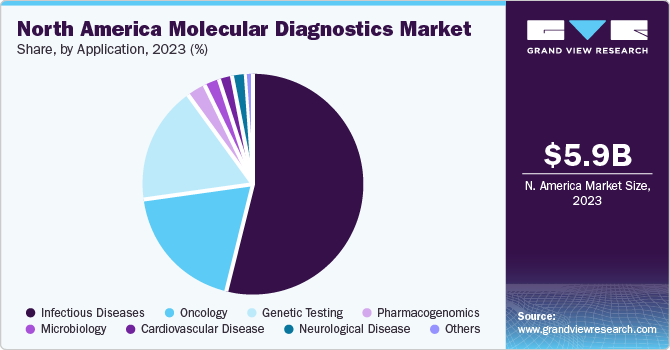

Application Insights

The infectious disease segment accounted for the largest revenue share of 84.19% of the regional market in 2022. The increasing rate of drug-resistant infections is creating an opportunity for cost-effective tests to acquire a higher market share. In addition, increasing investments in the region from government and non-government bodies is increasing access & supporting the growing demand for molecular diagnostics for detecting different pathogens. Moreover, market players are launching novel and technologically advanced products to increase their market presence. For instance, in January 2022, QIAGEN announced significant improvements in developing its QIAstat-Dx syndromic testing solution, which allows hospitals & laboratories to test patients for numerous pathogens from a single sample.

The oncology segment is anticipated to grow at the fastest CAGR during the projected timeframe. The increasing prevalence of cancer is a key factor driving the regional market growth. As per American Cancer Society estimates, in 2022, around 1,918,030 new cases of cancer were reported in the U.S., and around 609,360 individuals in the U.S. died due to cancer. Thus, such a high cancer incidence is anticipated to boost the adoption of cancer diagnostic products during the study period.

Country Insights

The U.S. dominated the overall share in the regional market, owing to the increasing adoption of molecular diagnostics due to its high accuracy, sensitivity, and specificity. Moreover, the increasing requirement of genetic testing for personalized healthcare in disease areas, such as diabetes and cancers, is expected to support the market share. Moreover, strong market players in the country increase the introduction of novel products. For instance, in August 2021, BD announced the launch of a novel, fully automatic high-throughput diagnostic system that uses sample management software algorithms and robotics. The BD COR System's introduction in the U.S. marks a significant milestone in the company's molecular diagnostics roadmap.

However, the increasing incidence of targeted disease in Canada is expected to support the molecular diagnostics market expansion. Moreover, favorable reimbursement policies, the presence for strong local & international market players, and increasing awareness among people are some of the key driving factors driving the country’s market.

Key Companies & Market Share Insight

The key players in North America molecular diagnostics market are adopting strategies such as partnerships, mergers and acquisitions, product and service launches, joint ventures, agreements, expansion, and collaboration to strengthen their position in the market. For instance, in April 2023, Thermo Fisher Scientific Inc. launched CE-IVD marked real-time PCR assay for infectious disease. The product introduction is the first of the declared 37 launches. Such initiatives are expected to boost the market over the forecast period. Some of the major players in the North America molecular diagnostics market include:

-

BD

-

Bio-Rad Laboratories, Inc.

-

Abbott

-

Agilent Technologies, Inc.

-

Danaher

-

Hologic Inc. (Gen Probe)

-

Illumina, Inc.

-

Johnson & Johnson Services, Inc.

-

Thermo Fisher Scientific Inc.

-

F. Hoffmann-La Roche, Ltd.

North America Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.50 billion

Revenue forecast in 2030

USD 8.58 billion

Growth rate

CAGR of -5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test location, technology, application, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

BD; Bio-Rad Laboratories, Inc.; Abbott; Agilent Technologies, Inc.; Danaher; Hologic Inc. (Gen Probe); Illumina, Inc.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche, Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Molecular Diagnostics Market Report Segmentation

This report forecasts regional and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the North America molecular diagnostics market report based on product, test location, technology, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Point-of-Care

-

Self-test or Over the Counter

-

Central Laboratories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

PCR, by Type

-

Multiplex PCR

-

Other PCR

-

-

PCR, by Procedure

-

Nucleic Acid Extraction

-

Others

-

-

PCR, by Product

-

Instruments

-

Reagents

-

Others

-

-

-

In Situ Hybridization

-

Instruments

-

Reagents

-

Others

-

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Instruments

-

Reagents

-

Others

-

-

Chips and Microarrays

-

Instruments

-

Reagents

-

Others

-

-

Mass spectroscopy

-

Instruments

-

Reagents

-

Others

-

-

Sequencing

-

Instruments

-

Reagents

-

Others

-

-

Transcription Mediated Amplification (TMA)

-

Instruments

-

Reagents

-

Others

-

-

Others

-

Instruments

-

Reagents

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Kidney Cancer

-

Liver Cancer

-

Blood Cancer

-

Lung Cancer

-

Other Cancer

-

-

Pharmacogenomics

-

Infectious Diseases

-

Methicillin-resistant Staphylococcus Aureus (MRSA)

-

Clostridium Difficile

-

Vancomycin-resistant Enterococci (VRE)

-

Carbapenem-resistant Bacteria

-

Flu

-

Respiratory Syncytial Virus (RSV)

-

Candida

-

Tuberculosis and Drug-resistant TBA

-

Meningitis

-

Gastrointestinal Panel Testing

-

Chlamydia

-

Gonorrhea

-

HIV

-

Hepatitis C

-

Hepatitis B

-

Other Infectious Disease

-

-

Genetic Testing

-

Newborn Screening

-

Predictive and Presymptomatic Testing

-

Other Genetic Testing

-

-

Neurological Disease

-

Cardiovascular Disease

-

Microbiology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America molecular diagnostics market size was estimated at USD 16.41 billion in 2022 and is expected to reach USD 12.50 billion in 2023.

b. The North America molecular diagnostics market is expected to decline at a compound annual growth rate of -5.2% from 2023 to 2030 to reach USD 8.58 billion by 2030.

b. The U.S. dominated the North America molecular diagnostics market with a share of 91.5% in 2022. This is attributable to the increasing focus on market strategies, such as partnerships between diagnostic companies, fast-paced research progress in this sector.

b. Some key players operating in the global North America molecular diagnostics market include Roche Diagnostics; Qiagen N.V.; Danaher; Hologic, Inc.; Johnson & Johnson; Becton, Dickinson and Company; Abbott laboratories; bioMérieux SA; Illumina, Inc.; Novartis AG; and Cepheid, Inc.

b. Key factors that are driving the market growth include increased adoption of molecular diagnostics (MDx) for infectious diseases, coupled with the advent of new cancer diagnostic solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The most common concern for the governments of all Covid-19 hit nations is the excruciating need to screen for and test large numbers of patients for possible Sars-Cov-2 infection. As a result, most of them are facing major shortages in the supply for diagnostic kits to test for the virus. Diagnostics virology entities are under immense pressure to provide reliable testing kits, and there is a surge in demand for in-vitro or point-of-care testing capacities by labs across a large number of countries. The report will account for Covid19 as a key market contributor.