- Home

- »

- Advanced Interior Materials

- »

-

North America MRO Distribution Market Report, 2022-2030GVR Report cover

![North America MRO Distribution Market Size, Share & Trends Report]()

North America MRO Distribution Market Size, Share & Trends Analysis Report By Product (Power Transmission, Automation), By End Use (Food, Beverage & Tobacco), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-072-9

- Number of Pages: 153

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

The North America MRO distribution market size was valued at USD 150.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 2.5% from 2022 to 2030. Various initiatives by manufacturers to attain optimum efficiency are expected to drive North America maintenance, repair, and overhaul (MRO) distribution market growth over the forecast period. MRO distribution is one of the critical components of the industry, which is necessary to eliminate downtime. As a result, industries initiate multiple scheduled and preventive maintenance processes. Industries, where supply activities have little direct accountability, might be driven by stock-outs rather than any overarching supply chain plan.

The U.S. exhibits one of the largest MRO sectors in the world and is characterized by the presence of several leading companies. The overall market highlights strategies, such as mergers, acquisitions, joint ventures, and collaborations, to strengthen a company’s business, in terms of production volumes, and meet the desired demand. The manufacturing sector has been worst hit by the current pandemic as manufacturers of non-essential goods have shut down their production facilities in compliance with the government norms for lockdown. This further led to a domino effect on the industry, which has also suspended operations across all the major economies.

Fast delivery and maintenance service plays a major role in gaining clients’ confidence. In addition, beneficial product replacement policies and bulk order discounts are lucrative opportunities for end-use companies. Furthermore, the price can be a major factor deciding the choice of supplier for small- and medium-scale businesses. The market is characterized by the presence of a large number of end-use industries in the region, which decreases the bargaining power of the buyers.

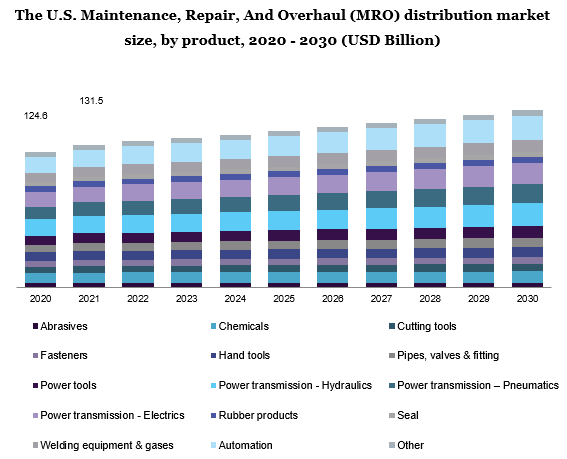

Product Insights

The hydraulic power transmission led the market for MRO distribution and accounted for more than a 12.0% share of the overall revenue in 2021. The hydraulic systems are installed in heavy machinery to ease the lifting and contracting operations. MRO operations related to the hydraulic systems are costly as compared to the other components used in the overall MRO services owing to the expensive mechanism. The repair and maintenance of the machinery in facilities across several industries are anticipated to positively affect the market for fastener replacement. Failure of fasteners can directly affect the machine operations severely, thus requiring regular maintenance. The most widely utilized fasteners include nuts, bolts, screws, rivets, grommets, cable ties, nails, and pins.

The electric power transmission segment is expected to witness a significant CAGR of 3.4% in the market for MRO distribution over the forecast period on account of the extensive use of electric components in manufacturing mechanisms to ease the transmission operations. These components include switches, current devices, fuses, circuits, and other electrical components clubbed with the mechanical assemblies. The rubber products used in maintenance, repair, and overhaul activity include rubber hoses, O-rings, rubber pads, and other products. These products are utilized widely in sealing applications, where they are used in the conjunction of two or more components. Advantages, such as better grip, effective sealing, and shock resistance, are the factors promoting the product demand.

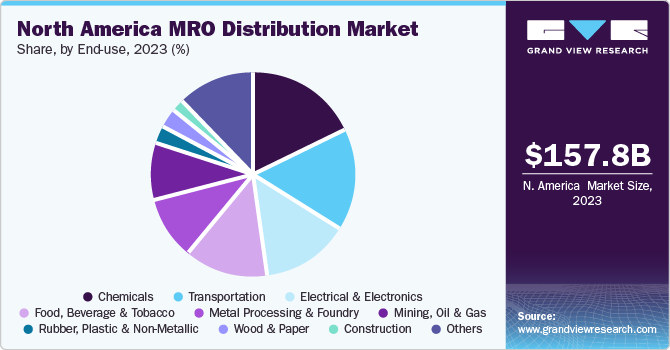

End-use Insights

The chemical manufacturing end-use segment led the market for MRO distribution in 2021 and accounted for a revenue share of more than 18.0%. The U.S. has been one of the attractive locations for the chemicals manufacturers to operate, with capital spending in the sector surging 21% in 2018 and reaching over USD 44.0 billion, which has benefited the market and the trend is expected to continue over the forecast period. The textile industry is expected to generate the least of demands for MRO products from the distributors as compared to the other end-use industries. Less complicated machinery and instrument used in the manufacturing process have limited the component replacement activities for the industry. However, the maintenance and replacement of the essential machinery components are likely to support the market for MRO distribution component distribution.

The electrical and electronics segment is expected to register a CAGR of 2.5% in the market for MRO distribution from 2022 to 2030. The rising need for advanced technology equipment in household and commercial applications has compelled the manufacturers to make necessary adoptions in the production processes. This has influenced the market for MRO distribution. Rising shale gas operations in the region are further expected to build several facilities across the region, thereby, supporting the component distribution. The increase in domestic onshore oil and gas production and shale gas transportation are expected to propel the demand for MRO activities in the facilities.

Regional Insights

The U.S. dominated the North America Maintenance, Repair, and Overhaul (MRO) market and accounted for over 87.0% of the overall revenue share in 2021. The demand for MRO distribution in the country is primarily driven by the presence of OEMs. The industry is anticipated to progress at a significant rate owing to the growth of service industries in the country. The manufacturing sector in Canada is anticipated to witness considerable growth. Thus, the growing manufacturing of industrial machinery, owing to the rising demand from end-use industries, is expected to promote market growth in the country.

The size and growth of the manufacturing industry in California is marginally higher compared to other states. With the existing industry operations and moderate growth of the manufacturing sector, it is projected to witness significant demand for MRO equipment and machinery over the forecast period, thus pressurizing the distributors to meet the industry demands. The manufacturing industry in Kentucky is also a vital contributor to the region’s economy owing to its favorable geography and export-oriented economy. The development of a large number of new facilities and expansion projects are expected to aid the state’s manufacturing base to generate the demand for the products along with new equipment and machinery.

Key Companies & Market Share Insights

Major companies compete on the basis of distribution networks, delivery efficiency, and competitive pricing. The market is highly fragmented and is characterized by the presence of a large number of players. The product demand is highly dependent on the growth of the end-use industries and is expected to grow moderately due to the limited growth realized by the application industries. Quality, price, and efficiency in delivery are the major competitive factors that are expected to decide the choice of supplier for MRO. Some of the prominent players in the North America MRO distribution market include:

-

Hillman Group, Inc.

-

Wajax Industrial Components

-

FCX Performance

-

SBP Holdings

-

R.S. Hughes Co., Inc.

-

DGI Supply

-

Lawson Products, Inc.

-

AWC

-

Hisco, Inc.

-

Kimball Midwest

-

Bisco Industries

-

Kaydon Corporation

-

BDI

North America MRO Distribution Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 154.1 billion

Revenue forecast in 2030

USD 188.5 billion

Growth Rate

CAGR of 2.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional Scope

North America

Country scope

U.S.; Canada

Key companies profiled

Hillman Group, Inc.; Wajax Industrial Components; FCX Performance; SBP Holdings; R.S. Hughes Co., Inc.; DGI Supply; Lawson Products, Inc.; AWC; Hisco, Inc.; Kimball Midwest; Bisco Industries; Kaydon Corporation; BDI

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the North America MRO distribution market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Abrasives

-

Chemicals

-

Cutting Tools

-

Fasteners

-

Hand Tools

-

Pipes, Valves & Fitting

-

Power Tools

-

Power Transmission - Hydraulics

-

Power Transmission - Pneumatics

-

Power Transmission - Electrics

-

Rubber Products

-

Seal

-

Welding Equipment & Gases

-

Automation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Food, Beverage, & Tobacco

-

Textile

-

Wood & Paper

-

Mining, Oil, & Gas

-

Metal Processing & Foundry

-

Rubber, Plastic & Non-Metallic

-

Chemicals

-

Pharmaceuticals

-

Electrical & Electronics

-

Transportation

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

New England

-

Mid-Atlantic

-

East North Central

-

West North Central

-

South Atlantic

-

East South Central

-

West South Central

-

West Region

-

-

Canada

-

-

Frequently Asked Questions About This Report

b. North America MRO distribution market size was estimated at USD 142.65 billion in 2020 and is expected to reach USD 150.64 billion in 2021.

b. The North America MRO distribution market is expected to grow at a compound annual growth rate of 2.9% from 2021 to 2028 to reach USD 178.85 billion by 2028.

b. Hydraulic power transmission led the market and accounted for more than 11.0% share of the market revenue in 2020, owing to the hydraulic systems being installed in heavy machinery in order to ease the lifting and contracting operations.

b. Some of the key players operating in the North America MRO distribution market include Hillman Group, Inc., Wajax Industrial Components, FCX Performance, SBP Holdings, R.S. Hughes Co., Inc., DGI Supply, Lawson Products, Inc., AWC, Hisco, Inc., Kimball Midwest, Bisco Industries, Kaydon Corporation, and BDI.

What are the factors driving the North America maintenance, repair and overhaul distribution market?b. The key factors that are driving the North America MRO distribution market include expanding the manufacturing sector in North America, Increasing product penetration in the manufacturing industry, and various initiatives by manufacturers to attain optimum efficiency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The manufacturing sector has been worst hit with the current pandemic situation as manufacturers of non-essential goods have shut down their manufacturing facilities in complying with the government norms for lockdown. This has further lead to a domino effect on the MRO industry which has also suspended operations across all the major economies. We at GVR are trying to quantify the impact of this pandemic on the MRO market. Get your copy now to gain deeper insights on the same.