- Home

- »

- Advanced Interior Materials

- »

-

North America Freestanding Canopy Market Report, 2030GVR Report cover

![North America Freestanding Canopy Market Size, Share & Trends Report]()

North America Freestanding Canopy Market Size, Share & Trends Analysis Report By Type (High-end Residential/Commercial, Others), By Application (Residential, Non-residential), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-111-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

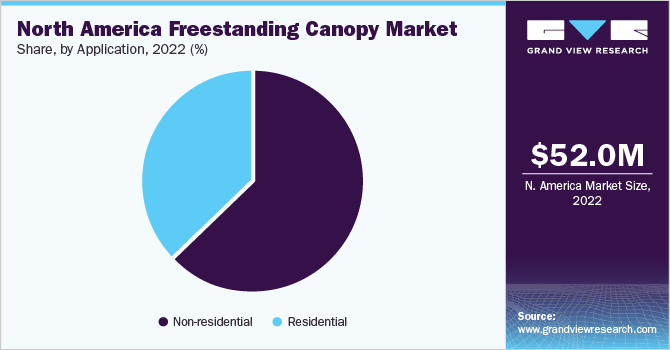

The North America freestanding canopy market size was estimated at USD 52.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The market is anticipated to be driven by the growing tourism and hospitality industry across the region. Moreover, the growing trends of outdoor living among people with large backyard spaces is expected to further drive the growth of the freestanding canopy market in North America. Moreover, the market demand for freestanding canopies in urban areas is comparatively higher due to the limited space. As the population of cities is rising, the availability of outdoor spaces is decreasing, leading to a growing demand for luxury outdoor structures.

A freestanding canopy is a practical solution to maximize the use of compact outdoor areas, including small backyards and limited restaurant spaces. It can be installed and adjusted as per the requirements and allows utilization of available space while providing sufficient shade. These features are anticipated to benefit its market demand in urban areas over the coming years.

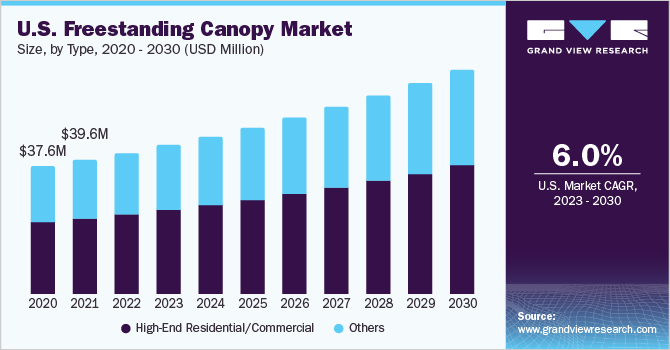

The U.S. freestanding canopy market is growing at a significant rate. The rising outdoor living trends and the growth of the tourism and hospitality industry are expected to drive the demand for freestanding canopies in the U.S. Furthermore, rising disposable incomes of consumers have resulted in people spending more on outdoor leisure activities, thereby supporting the industry growth.

The market for the freestanding canopy is expected to face competition from alternative shade solutions. This includes structures such as retractable awnings, shade sails, and pergolas. These alternatives provide different designs, functionalities, and aesthetics than a freestanding canopy, offering a variety of options for consumers for outdoor shade solutions.

Moreover, the demand for freestanding canopy is also likely to be negatively affected on account of its higher cost, which restricts its usage. It is positioned as a high-end product, resulting in a smaller customer base and potentially lower sales volume. It can only attract buyers who prioritize high-quality materials and products with advanced features, thus limiting industry growth. However, there has been a growing demand for freestanding canopies in commercial spaces such as poolside and outdoor dining areas, patios, and decks, owing to their flexibility, functionality, and convenience. These factors are likely to lower the negative impact of alternative shade solutions.

The players in the market are emphasizing the expansion of their product portfolios. They are also investing in material and technological development in terms of designs, sizes, fittings, and automated systems. Companies in the industry are focusing on maintaining strong relationships with distributors to gain access to other markets. These strategies used by the market players help them to gain a competitive edge in the industry.

Type Insights

The high-end residential/commercial type segment of the North America freestanding canopy market is expected to expand at a CAGR of 6.2% over the forecast period. The rising popularity and trend of outdoor living spaces, especially in high-income groups, is resulting in the growing adoption of freestanding canopy and luxury cantilever umbrellas near the poolside or over the patio in residential spaces. In addition, the rising per capita income in developed countries, including the U.S. and Canada, has further escalated consumer spending on outdoor leisure activities, thus influencing the demand for a freestanding canopy market.

The segment ‘other type’ accounted for the largest share of 55.4% in terms of revenue in 2022. The other type of segment includes freestanding canopies, which are comparatively cheaper than the high-end residential or commercial type structures. The adoption rate of these lower-cost canopies is higher, especially in restaurants and hotels, and they are procured in larger quantities. There has been a rising trend of outdoor dining in areas with favorable weather conditions, as it enhances the overall dining experience. This has significantly increased the usage of freestanding canopies in restaurants, hotels, and other such spaces.

Application Insights

The residential application segment of the freestanding canopy market in North America is expected to grow at a significant rate over the forecast period. An increase in the outdoor activities such as outdoor dining, entertainment, and relaxation among consumers, as well as the desire to spend more time outdoors, especially during favorable weather conditions, has led to a rise in the demand for freestanding canopies in the North America region.

The non-residential freestanding canopy was the dominant market segment in 2022 in North America, owing to the rising product adoption in commercial spaces such as hotels, resorts, restaurants, and recreational spaces in the U.S. and Canada. Additionally, the desire to improve the overall dining experience, create functional outdoor spaces, and cater to the growing demand for outdoor amenities in commercial spaces is driving the growth of the freestanding canopy market in the region.

Regional Insights

The market for freestanding canopies in the U.S. was valued at USD 41.8 million in 2022, and it is expected to grow at a significant rate over the forecast period. This growth is attributed to the rising popularity of outdoor living and the growing hospitality and tourism industries in the U.S. The tourism industry in the U.S. plays a significant role in terms of contribution to the country's GDP.

Moreover, as the tourism industry is recovering from the impact of the Covid-19 pandemic, the demand for freestanding canopies is expected to grow further. In addition, the hospitality industry accounts for a majority share of the freestanding canopy market in 2022, owing to growing domestic and international tourism and the rising trend of outdoor dining. These factors are likely to contribute to the growth of the market in the U.S.

The Canadian market is expected to register high growth during 2023-2030 owing to the growing outdoor living trends and the rising desire of people to spend more time outdoors, especially in favorable weather conditions. A freestanding canopy offers the necessary shade for outdoor dining, relaxation, recreation, and entertainment. The growing hospitality industry in Canada further supports the market's growth.

Key Companies & Market Share Insights

The competitive rivalry among manufacturers of the freestanding canopy in North America is high as the market is characterized by the presence of a large number of regional players. The major players in the industry typically offer a diverse range of canopies rather than producing only specific types of products. These manufacturers primarily compete based on pricing and brand image. In addition, companies compete for market share by offering specialized installation services.

Major players in the industry are adopting various strategies to gain a competitive edge. There have been rising trends of mergers and acquisitions and collaborations in the market. Major players are opting for the acquisition strategy to enter international markets as most companies have a limited geographical presence confined to specific regions. Some prominent players in the North America freestanding canopy market include:

-

Poggesi

-

ShadeFX

-

FIM S.r.l

-

Tucci

-

The Shade Experts USA

-

BambrellaUSA

-

Galtech International

-

Shademaker

-

Tropitone

-

Hauser Industries Inc.

North America Freestanding Canopy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 54.9 million

Revenue forecast in 2030

USD 83.5 million

Growth Rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

North America

Country scope

U.S., Canada

Segments covered

Type, application, region

Key companies profiled

Poggesi; ShadeFX ; FIM S.r.l; Tucci; The Shade Experts USA; BambrellaUSA; Galtech International; Shademaker; Tropitone; Hauser Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Freestanding Canopy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America freestanding canopy market based on type, application, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

High-End Residential/Commercial

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America freestanding canopy market size was estimated at USD 52.0 million in 2022 and is expected to reach USD 54.9 million in 2023.

b. The North America freestanding canopy market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 83.5 million by 2030.

b. The non-residential segment dominated the North America freestanding canopy market with a share of 62.7% in 2022 owing to the growing hospitality and tourism industry resulting in high utilization of freestanding canopies in restaurants, hotels, and resorts.

b. Some of the key players operating in the North America freestanding canopy market include Poggesi, ShadeFX , FIM S.r.l, Tucci, and The Shade Experts USA.

b. The key factor which is driving North America freestanding canopy market is rising adoption of canopies in restaurants and hotels. Moreover, growing outdoor living trends in U.S. and Canada is further expected to increase the demand for freestanding canopies in coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."