- Home

- »

- Advanced Interior Materials

- »

-

North America Decks Market Size And Share Report, 2030GVR Report cover

![North America Decks Market Size, Share & Trends Report]()

North America Decks Market Size, Share & Trends Analysis Report By Material (Wood, Composite), By Type (Freestanding, Attached), By Deck Level, By Deck Installation Level, By Size, By Construction Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-154-4

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

North America Decks Market Size & Trends

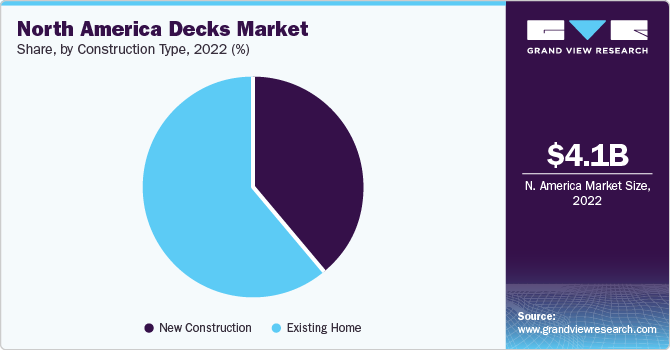

The North America decks market size was estimated at USD 4.10 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This growth can be attributed to the increasing awareness about building aesthetics among consumers. Increasing public and private investments in the development of new infrastructures, residential spaces, and commercial spaces in the region are expected to fuel market growth. The use of decks in new commercial and residential constructions is growing due to the increasing disposable income and improving standards of living. This is expected to promote the demand for decks for outdoor entertainment and recreational activities, including parties and get-togethers. Adding decks to commercial spaces increases the aesthetic appeal of the building structures. These factors are expected to boost the demand for decks over the coming years.

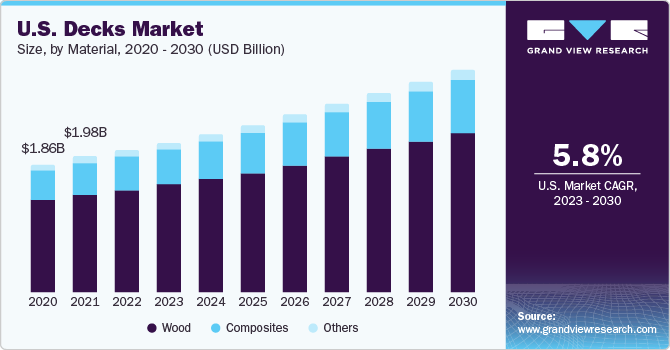

The U.S. decks market accounted for a total revenue of USD 2.07 billion in 2022 and is expected to grow at the highest CAGR of 5.8% over the forecast period owing to the growing construction sector in the country. According to the U.S. Census Bureau, monthly new residential construction in the country as of March 2022 stood at 1,873,000 building permits, 1,793,000 housing starts, and 1,303,000 housing completions. The increasing number of residential buildings in the region is predicted to foster the growth of the construction industry, thereby driving the demand for decks over the forecast period.

The North America decks industry is competitive and fragmented due to the presence of a large number of small- and medium-sized manufacturers operating at regional, country, and state levels. Major players in the market have established a global supply chain through in-house supply channels or third-party distributors. In order to obtain a competitive edge and exploit the untapped market for decks, industry players are expanding their geographic reach.

Material Insights

The wood material segment dominated the regional market with a revenue share of 71.4% in 2022. Wood is one of the oldest materials used for manufacturing decks. Wood is a natural and renewable resource available and does not contribute to any environmental degradation like plastic. Wooden material is commonly used for building decks, as it is naturally available, easy to install, and strong. Furthermore, the availability of wood and the trend of wood construction in countries such as the U.S. and Canada keep up the demand for wood for deck construction. These factors are expected to fuel the demand for wooden decks in the region over the coming years.

Type Insights

The attached deck segment dominated the market in 2022, and is expected to grow at a CAGR of 4.6% over the forecast period. The increased real estate prices in North America are driving the demand for attached decks in the region. As real estate prices are rising, residents are maximizing the use of their existing properties. The attached decks act as appealing options for expanding living spaces without requiring significant structural alterations. This makes these decks an enticing choice for homeowners aiming to increase the value of their property.

In addition, the increased popularity of outdoor entertainment and recreational activities is driving the demand for attached decks in the North American region. With a large number of users looking for outdoor spaces for socializing, family time, and outdoor dining, attached decks act as great platforms for these activities in the region. This contributes to their appeal, thereby leading to the surged adoption of these decks in North America.

Deck Level Insights

The single-level segment accounted for the highest market share in 2022. The growth can be attributed to the growing demand for residential construction and renovation projects. Homeowners prefer single-level decks as they meet the growing demand for outdoor living spaces that mix seamlessly with the interior of the home. They provide an accessible and practical extension of the living room, functioning as adaptable platforms for a variety of activities including hosting parties and providing a relaxing recreational area. The increasing demand for modernization and personalization in single-level deck construction is driving the market.

Deck Installation Level Insights

The raised deck segment is anticipated to grow at a CAGR of 5.8% over the forecast period. A well-designed, high-end patio with a raised deck can significantly enhance a property's visual appeal. In a competitive housing market, this aesthetic advantage is compelling homeowners to invest in raised decks as a means of improving their property's market value and desirability. In addition, the growing importance of curb appeal in real estate is driving the demand of the market.

Size Insights

The small-size segment of the North America decks industry accounted for a revenue share of 25.3% in 2022. The deck sizes ranging from 80-300 square feet are considered under this segment. This segment is expected to grow on account of the availability of minimal space for the construction of homes and commercial units in metropolitan countries such as the U.S.

The demand for medium-sized decks is expected to grow at the highest CAGR of 5.8% over the forecast period. Middle-income groups highly opt for medium-sized decks as they account for low construction charges as compared to large sizes which further allows the option of quality raw materials and basic customization as required. The increasing new construction and refurbishment activities by middle-income populations on account of rising per capita income and living standards are expected to drive the demand for medium-sized decks.

Construction Type Insights

The new construction segment is expected to grow at a CAGR of 5.5% over the forecast period. The increasing demand for new residential construction has significantly driven the growth of the market. As more and more homes are being built to accommodate the expanding population and changing lifestyle preferences, there is a growing need for quality outdoor living spaces. This has resulted in a rise in residential construction activities, which is expected to propel the demand over the forecast period.

Decks are increasingly being viewed as extensions of the living area, and homeowners creating functional and aesthetically pleasing outdoor environments is driving the existing home segment. This has led to a surge in the use of durable and low-maintenance materials for deck construction such as composite decking and metal railings. Moreover, the shift in how decks are constructed, focusing on durability, and their ease of maintenance, has a profound impact on the aesthetics and value of existing homes, thereby fueling the demand in existing homes.

Regional Insights

The growing investments in the construction industry in Canada and the rising number of new manufacturing & maintenance building projects are anticipated to drive the construction industry. According to the Canadian Construction Association, investment in building construction in Canada increased by 4.0% and reached USD 20.0 billion in February 2022. Investments in single-family homes rose by 4.9%, reaching USD 8.0 billion, while multi-unit construction increased by 5.1%, reaching USD 6.9 billion. The rising construction spending is expected to create opportunities for deck construction, thereby fueling the market’s demand.

The market for decks in Mexico is expected to grow at a significant rate over the coming years. The growing trend of urbanization in Mexico, coupled with a consistent rise in both residential and commercial construction endeavors, is driving the growth. The surge in popularity of renovation and remodeling undertakings has exerted added impetus for decks as homeowners actively pursue opportunities to enrich and extend their outdoor environments. This combined effect is serving as a compelling force behind the escalating demand in Mexico, reflecting the dynamic interplay between construction and lifestyle trends.

Key Companies & Market Share Insights

The market is characterized by intense competition owing to the presence of large-scale manufacturers with a wide variety of product portfolios. The manufacturers are involved in offering decks in different colors, sizes, and raw materials such as wood and composites. Companies are constantly introducing new product lines or variations in existing product lines by adding new colors and designs.

Moreover, companies are investing in various strategies such as expansions, collaborations, mergers & acquisitions, and research & development. For instance, in January 2022, The Azek Company, Inc., acquired StruXure Outdoor, Inc., a manufacturer and designer of innovative and high-quality aluminum pergolas and cabanas. The acquisition is expected to expand the company’s position in outdoor living products and benefit its well-developed product portfolio.

Key North America decks Companies:

- Trex Company, Inc.

- Fiberon

- AZEK Company, Inc.

- Lumberock

- Cali Bamboo, LLC

- Deckorators, Inc.

- Wahoo Building Products

- Last-Deck, Inc.

- TRUNORTHDECK

- Nexan Building Products, Inc.

North America Decks Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.32 billion

Revenue forecast in 2030

USD 6.35 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters; revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material, type, deck level, deck installation level, size, construction type, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Trex Company, Inc.; Fiberon; AZEK Company, Inc.; Lumberock; Cali Bamboo, LLC; Deckorators, Inc.; Wahoo Building Products; Last-Deck, Inc.; TRUNORTHDECK; Nexan Building Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global North America Decks Market Report Segmentation

This report forecasts volume and revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America decks market report based on material, type, deck level, deck installation level, size, construction type, and region:

-

Material Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Wood

-

Composites

-

Others

-

-

Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Freestanding Deck

-

Attached Deck

-

-

Deck Level Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Single Level Deck

-

Multi-Level Deck

-

-

Deck Installation Level Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Ground Level Deck

-

Raised Deck

-

-

Size Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Construction Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Existing Home

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America decks market size was estimated at USD 4.10 billion in 2022 and is expected to reach USD 4.32 billion in 2023.

b. The North America decks market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 6.35 billion by 2030.

b. The attached deck type segment of the market accounted for the largest revenue share of 76.2% in 2022 owing to rising popularity of outdoor entertainment and recreational activities in the region. In addition, the attached decks act as appealing options for expanding living spaces without requiring significant structural alterations. This makes these decks an enticing choice for homeowners aiming to increase the value of their property, thereby fueling the attached deck type market’s demand.

b. Some of the key players operating in the North America decks market include Trex Company, Inc., Fiberon, AZEK Company, Inc., Lumberock, Cali Bamboo, LLC, Deckorators, Inc.

b. The key factors that are driving the North America decks market include increasing public and private investments in the development of new infrastructures, residential spaces, and commercial spaces in the U.S. and Canada.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."