- Home

- »

- Electronic Devices

- »

-

Non-destructive Testing (NDT) Market Size Report, 2030GVR Report cover

![Non-destructive Testing (NDT) Market Size, Share & Trends Report]()

Non-destructive Testing (NDT) Market Size, Share & Trends Analysis Report By Test Method (Traditional NDT Method, Digital/Advanced NDT Method), By Offering, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-602-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Report Overview

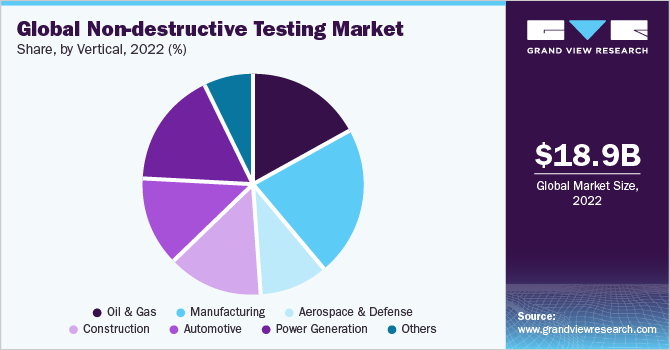

The global non-destructive testing (NDT) market size was estimated around USD 18.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The growing manufacturing activities across the developing and the developed nations is estimated to drive the market over the forecast period. Furthermore, the increasing technological innovations pace have enable the development of advanced non-destructive testing processes with improved & precise safety & fault detection. Furthermore, increasing awareness amongst the manufacturers regarding the use of NDT is expected to improve the penetration of NDT techniques in the coming years.

The utilization of NDT techniques in projects allows for quicker completion due to the detection of faults in complex areas and irregular surfaces. This reduction in the possibility of failures is expected to drive the demand for non-destructive testing in the coming years. Additionally, the ease of operating and efficiency in fault detection provided by ultrasonic equipment, compared to other NDT equipment, is a significant factor contributing to the increasing adoption of the ultrasonic test method. Moreover, advancements in ultrasonic technology anticipated within the next eight years are likely to further boost the adoption of this testing procedure due to its simplicity.

The market is projected to experience significant growth during the forecast period. This growth can be attributed to the increasing urbanization in developing countries like India and China, which involves extensive construction and manufacturing projects. The fast pace of such projects necessitates the implementation of testing processes to ensure the quality of work. This trend is expected to have a positive impact on the growth of non-destructive testing (NDT) in these countries, consequently enhancing its global market penetration.

Increasing oil and gas projects in the Middle East and North America are expected to deploy NDT techniques in order to complete the projects in prescribed timelines and with finesse, thus fueling the demand for NDT equipment over the regions. Besides, the advancements in non-destructive testing technology have led to the development of radiographic testing equipment such as industrial CT scanners, which precisely detect faults in machinery and components. However, the cost of the NDT equipment and the expertise required to perform the tests increases the complexity and difficulty of deploying the radiographic testing method.

The global COVID-19 pandemic has had detrimental and unexpected consequences for various industries worldwide, such as automotive, construction, airlines, and manufacturing, among others. To mitigate the spread of the novel coronavirus and its negative impacts, governments around the world implemented lockdowns as a precautionary measure. This led to disruptions in the global supply chain and a decline in industrial productivity, placing a strain on the global economy. Furthermore, the sudden outbreak of the virus also caused disruptions in companies' production and manufacturing capabilities.

Moreover, the influence of the pandemic on the non-destructive testing (NDT) market arises from the combined response of interconnected industries that utilize NDT for their operations. One such example is the defense industry, which has experienced a relatively mild impact compared to other sectors. This can be attributed to government budget allocations that safeguard the supply and demand ecosystem. While certain defense companies have been significantly affected by the financial shock, the impact is comparatively lesser than that observed in the aerospace sector.

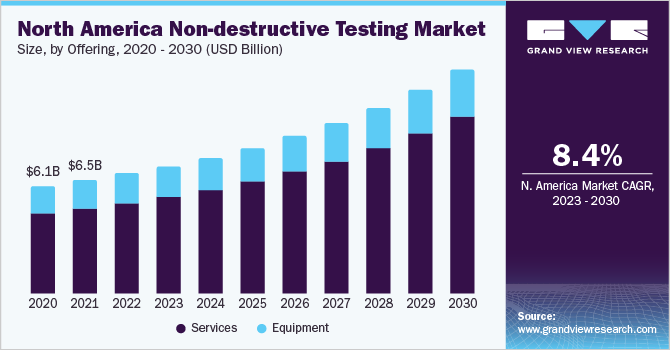

Offering Insights

The services segment dominated the market and accounted for the largest revenue share of 75.2% in 2022 and is expected to remain dominant over the forecast period. The primary factor that drives end-users to outsource their NDT operations is the significant upfront cost associated with non-destructive equipment, combined with the technical complexities involved in their deployment and installation. Additionally, the shortage of skilled workforce proficient in non-destructive testing acts as another constraint, limiting the widespread adoption of NDT equipment worldwide. Furthermore, stringent government regulations pertaining to workplace safety further encourage end-users to outsource their NDT operations to third-party service providers.

The equipment segment is expected to experience steady growth throughout the forecast period. This growth can be attributed to technological advancements, which have resulted in the availability of state-of-the-art equipment variants. The availability of these advanced variants has broadened the range of applications for NDT equipment, thereby generating additional demand. Moreover, the resurgence of the industrial sector, particularly in emerging economies such as India and China, is anticipated to stimulate new installations of NDT equipment in the coming years.

Test Methods Insights

The traditional test method segment dominated the market and accounted the largest revenue share of 80.5% in 2022. The notable market growth is attributed to the increasing utilization of traditional non-destructive testing (NDT) methods, including visual testing, magnetic particle testing, liquid penetrant testing, eddy current testing, ultrasonic testing, and radiographic testing. Among these methods, ultrasonic testing stands out as it dominates the market due to its portability, ease of use, and ability to provide precise results compared to other traditional NDT techniques. Consequently, the adoption of ultrasonic testing is experiencing significant growth and is expected to continue improving in the forthcoming years.

Within the ultrasonic testing segment, phased array ultrasonic testing (PAUT) has emerged as the dominant market segment, accounting for the largest share of 21.0% in 2022. This growth can be attributed to the increasing preference for PAUT over other digital NDT methods. The detailed visualization feature offered by the PAUT method enables the identification of defect size, depth, shape, and orientation. PAUT is considered an advanced version of ultrasonic testing as it employs multiple transducers and sets of ultrasonic testing (UT) probes comprised of numerous smaller elements.

Vertical Insights

The manufacturing vertical segment dominated the NDT market and accounted for the largest revenue share of more than 22.0% in 2022. The growth is attributed due to ever-increasing volume of manufacturing across the globe. The manufacturing vertical is expected to deploy numerous NDT processes thereby leading to an increase in demand for non-destructive testing services, globally. Moreover, non-destructive testing has been traditionally used extensively in oil and gas applications. Test methods such as ultrasonic and eddy current have been used to detect cracks in the pipes both underground and elevated. However, with increasing awareness, non-destructive testing techniques are being deployed in several other applications such as aerospace, defense, and automotive.

The oil & gas vertical is further sub segmented into Upstream, Midstream, & Downstream. The downstream activities in the oil & gas industry include refining petroleum products to produce end products, such as gasoline and kerosene. Refineries and petrochemical plants work with large volumes of oil flowing through tubing, pressure vessels, storage tanks, and pipes. Hence, downstream oil & gas companies particularly need to ensure the safety of the environment, workers, and the facility by ensuring the integrity of equipment and spot welding.

The power generation segment comprises numerous industries such as power grids and hydroelectric power plants. The segment is expected to witness healthy growth over the forecast period with a CAGR of more than 8.6%. Continuous increase in the power demand in developing nations is the major reason for the considerable adoption rate of NDT techniques in power generation as the use of NDT techniques guarantees faster production rates.

Regional Insights

North America emerged as the dominant segment in 2022 with a revenue share exceeding 36.0%. This is due to there is widespread acceptance of NDT techniques in various applications, the presence of a proficient workforce, and the presence of multiple non-destructive testing training institutes in the region. Moreover, the growth rate in the region is anticipated to be positively influenced by the utilization of shale oil for power generation in the United States and Canada. Additionally, the increasing emphasis on the application of non-destructive testing (NDT) to prevent unforeseen system failures is expected to drive the regional market.

In Asia Pacific, the market is expected to witness a CAGR of more than 9.3% over the forecast period. This growth is ascribed to an increase in manufacturing, construction, and power generation activities in the region. Despite the current shortage of skilled labor in the region, it is projected to decrease over time as awareness and adoption of non-destructive testing techniques increase in the upcoming years. Furthermore, Middle East, due to the significant presence of the oil and gas industry is expected to be a potential market for NDT techniques.

Key Companies & Market Share Insights

Incumbents of the market remain keen on increasing their market share. As such, they undertake various initiatives and adopt different strategies, such as signing partnerships, making investments engaging in mergers and acquisitions, launching new products and services, and quoting competitive prices. For instance, in October 2022, Eddyfi Technologies launched Ectane 3, powerful NDT equipment for tubing and surface inspection. This instrument supports the remote-field array (RFA) technology. Some of the prominent players in the non-destructive testing (NDT) market include:

-

Previan Technologies

-

Bureau Veritas

-

Fischer Technologies Inc.

-

Mistras Group, Inc

-

Comet Group (YXLON International GmbH)

-

MME Group

-

TWI Ltd

-

Nikon Metrology Inc.

-

Olympus Corporation

-

Sonatest

-

Zetec Inc.

-

Acuren

-

Intertek Group plc

-

CREAFORM

-

Vidisco Ltd

-

SGS S.A.

Non-Destructive Testing (NDT) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.02 billion

Revenue forecast in 2030

USD 34.15 billion

Growth rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, test methods, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Previan Technologies; Bureau Veritas; Fischer Technologies Inc.; Mistras Group Inc; Comet Group (YXLON International GmbH); MME Group; TWI Ltd; Nikon Metrology Inc.; Olympus Corporation; Sonatest; Zetec Inc.; Acuren; Intertek Group plc; CREAFORM ; Vidisco Ltd; SGS S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-Destructive Testing (NDT) Market Segmentation

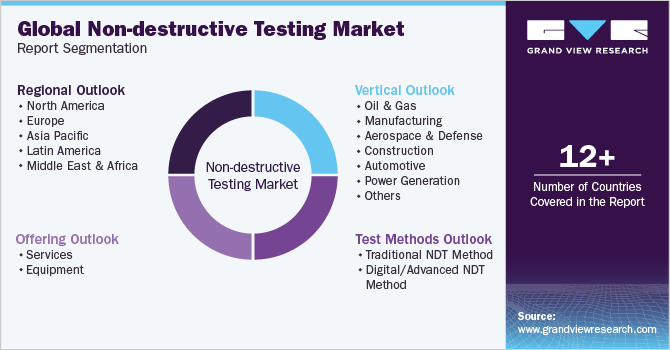

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For the purpose of this study, Grand View Research has segmented the global non-destructive testing (NDT) market based on offering, test methods, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Services

-

Equipment

-

-

Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

-

Traditional NDT Method

-

Visual Testing

-

Magnetic Particle Testing

-

Liquid Penetrant Testing

-

Eddy Current Testing

-

Ultrasonic Testing

-

Radiographic Testing

-

-

Digital/Advanced NDT Method

-

Digital Radiography (DR)

-

Phased Array Ultrasonic Testing (PAUT)

-

Pulsed Eddy Current (PEC)

-

Time-Of-Flight Diffraction (TOFD)

-

Alternating Current Field Measurement (ACFM)

-

Automated Ultrasonic Testing (AUT)

-

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream

-

-

Manufacturing

-

Aerospace and Defense

-

Construction

-

Automotive

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-destructive testing (NDT) market size was estimated at USD 18.9 billion in 2022 and is expected to reach USD 20.02 billion in 2023.

b. The global non-destructive testing (NDT) market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 34.15 billion by 2030.

b. The services segment dominated the NDT market and accounted for the largest revenue share of more than 75% in 2022, and is expected to remain dominant over the forecast period.

b. The ultrasonic testing segment led the NDT market and accounted for the largest revenue share of over 25% in 2022. The segment is expected to emerge as the fastest-growing test method segment at a CAGR of over 8.7% over the forecast period.

b. The manufacturing vertical segment dominated the non-destructive testing market and accounted for the largest revenue share of more than 22% in 2022. The segment is expected to witness a CAGR of more than 9.3% over the forecast period, primarily due to the ever-increasing volume of manufacturing across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry, once thriving with increased investments, has been severely affected by the suspension of the construction activities in the wake of the ongoing pandemic. Shortage of labors coupled with potential supply chain bottlenecks of materials and equipment is expected to cause project delays in the ongoing funded projects and may lead to reduced spending in the upcoming projects. Uncertainty around the actual duration of the prevailing lockdown makes it hard to anticipate how a recovery in the construction industry will unfold. On similar lines, the HVAC industry has been adversely affected by the COVID-19 outbreak due to the shutting down of several component manufacturing facilities across China, European countries, Japan, and the U.S. This has consequently led to a significant slowdown in the production of HVAC equipment. Lockdowns imposed by the governments in the wake of the Covid-19 outbreak has not only affected manufacturing but also pegged back the consumer demand for HVAC equipment. The report will account for Covid19 as a key market contributor.