- Home

- »

- Advanced Interior Materials

- »

-

Nitrile Gloves Market Size & Share Analysis Report, 2030GVR Report cover

![Nitrile Gloves Market Size, Share & Trends Report]()

Nitrile Gloves Market Size, Share & Trends Analysis Report By Type (Powder Free, Powdered), By Product (Disposable, Durable), By End-use (Medical & Healthcare, Food & Beverage) By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-104-2

- Number of Pages: 143

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

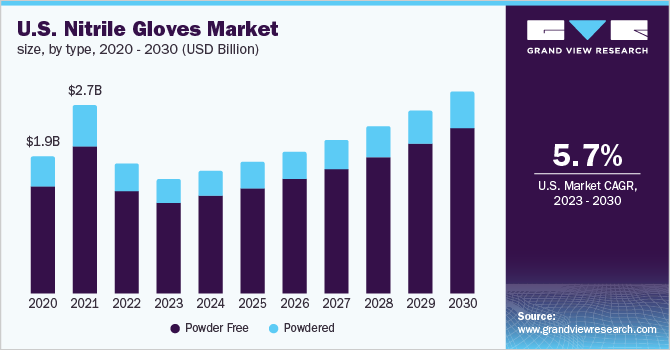

The global nitrile gloves market size was estimated at USD 6.55 billion in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 5.7% from 2023 to 2030. The market growth is expected to be driven by growing healthcare expenditure, increased significance of workplace safety, and rising awareness of healthcare-associated infections.

The COVID-19 pandemic has resulted in an exponential demand for a wide variety of PPE, including gloves. Healthcare professionals to prevent contamination also often use disposable nitrile gloves. This, in turn, is expected to boost demand for disposable nitrile gloves over the forecast period.

The rapid spread of the COVID-19 pandemic in the U.S. is anticipated to drive the demand for hand protection over the forecast period. In addition, post-COVID-19 pandemic, the government authorities are expected to heavily invest in healthcare infrastructure, which is expected to have a positive impact on market growth over the coming years.

Healthcare industry in major developing countries is also expected to witness significant growth owing to several factors including growing investments in both public and private sectors, increasing population, rising geriatric population, and high influx of migrants. In addition, increasing healthcare expenditure is projected to boost the growth of the healthcare industry globally, which, in turn, is anticipated to spur the demand for hand protection over the forecast period.

As compared to latex gloves, nitrile gloves offer various benefits such as long shelf life, less friction, and puncture resistance. Furthermore, rising awareness regarding latex allergies is anticipated to drive the demand for these products over the forecast period. Enhanced resistance of nitrile gloves toward puncture and chemicals as compared to that of vinyl and latex gloves is expected to augment the market growth.

The increasing number of COVID-19 cases globally has resulted in augmenting the demand for medical-grade nitrile gloves. Supply constraints such as the limited capacity of manufacturers, long duration required for setting up new plants, and the limited availability of workforce are anticipated to widen the demand-supply gap of gloves globally.

Type Insights

Powder free nitrile gloves led the market and accounted for 72.8% of the global revenue share in 2022 owing to their increasing preference across various industries. Moreover, strict regulations on powdered gloves by many governments worldwide are likely to have a positive impact on powder free nitrile gloves market over the forecast period.

Powder free gloves are less form fitting as they undergo a chlorination process or polymer coatings such as acrylics, silicones, and hydrogels, resulting in healthcare facilities replacing latex gloves with powder free nitrile gloves. Powder free gloves do not leave any residue, which makes it suitable for use in the automotive industry.

Powdered nitrile gloves market is projected to grow at 3.6% from 2023 to 2030. Powdered nitrile gloves have a coating either of cornstarch or calcium carbonate, which makes them easier to put on, improves grip, and reduces the moisture inside. However, the demand for powdered nitrile gloves is expected to dampen as they may cause skin sensitivities or allergies to the user’s skin if worn for a long time.

The Food and Drug Administration (FDA) in January 2017 imposed restrictions on the use of powdered gloves. Powdered gloves pose serious risks to patients such as post-surgical adhesions, airway & wound inflammations, and allergic reactions. Manufacturers have gradually started discontinuing production which is likely to affect market growth negatively.

Product Insights

Disposable segment led the market and accounted for 72.2% of the global revenue share in 2022. Disposable nitrile gloves are meant for single-use and are discarded after every use. Safety assurance and cost-effectiveness are some of the advantages offered by disposable nitrile gloves. These factors are expected to drive product demand over the coming years.

Disposable nitrile gloves are usually thinner as compared to durable gloves, which offer greater sensitivity. These gloves provide protection against mild chemicals and irritants. However, they are not suited to the usage of harsh chemicals or in harsh environments in industries such as metal & manufacturing or oil & gas.

The demand for durable products is anticipated to grow at a CAGR of 4.7% over the forecast period. Durable nitrile gloves offer advantages such as durability, strength, low generation of waste, and other environmental benefits. Durable gloves are designed for prolonged and more extended usage, especially in heavy-duty work environments in oil & gas, chemical & petrochemical, automotive, and metal & machinery industries.

Durable nitrile gloves are thicker as compared to disposable ones owing to which they offer high durability. However, they are less sensitive than disposable variants and can be uncomfortable during intricate tasks. Moreover, they are required to be cleaned more frequently after use, which makes them less convenient as compared to disposable gloves.

End-use Insights

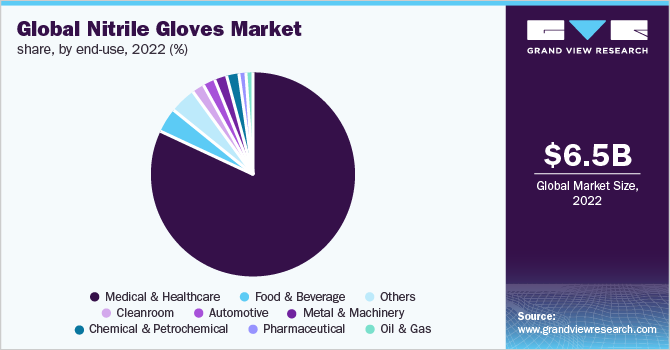

Medical & healthcare segment led the market and accounted for 82.5% of the global revenue share in 2022. The demand for nitrile gloves increased exponentially for preventing cross-contamination and transmission of pathogens during medical examination and surgeries. Disposable nitrile gloves were particularly in demand as they lower the risk of contamination.

The demand for this product is also expected to increase from other end-use industries mainly food & beverage, chemical & petrochemical and pharmaceutical. Increasing awareness and stringent regulations in quality control and hygiene in food processing industries and increasing investments in chemical and pharmaceutical industries are likely to augment market growth.

The demand for nitrile gloves in the automotive industry is expected to witness a growth of 5.3% over the projected period. Awareness regarding associated health complications with prolonged contact with brake oil, grease and other transmission fluids found in automobiles coupled with the need for safety from sharp edges and tools to harmful chemicals and substances is expected to increase the demand for this product in the automotive industry.

Employees working in this pharmaceutical industry face various on-the-job hazards as they are exposed to biological agents, chemical substances, and drugs. The demand for nitrile gloves is likely to increase as they offer advantages in both ways by protecting pharmaceutical products from contamination and workers from chemical hazards.

Regional Insights

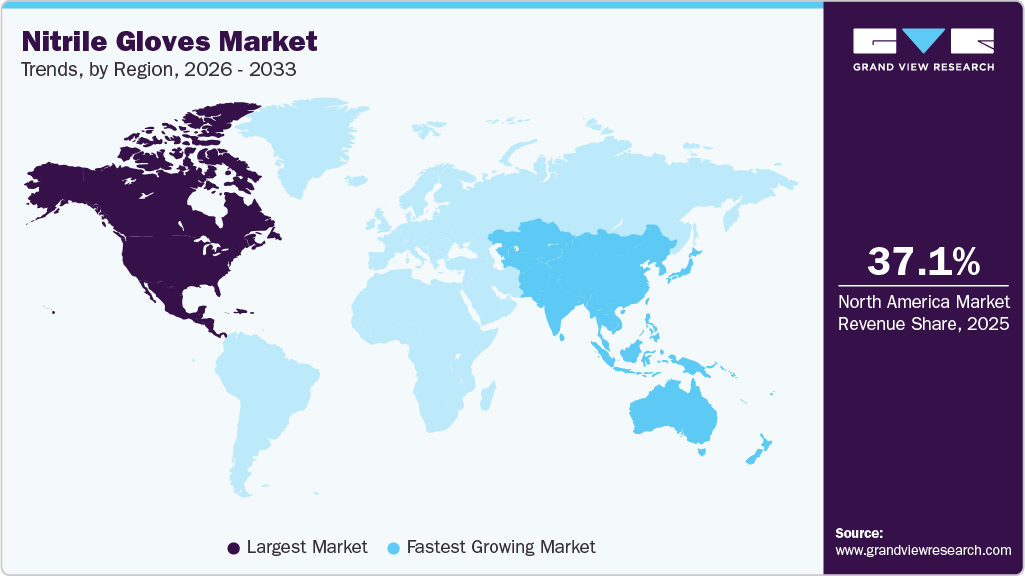

North America held a majority share of the market and accounted for a 35.2% share of global revenue in 2022. Factors responsible for the demand include rising healthcare expenditure coupled with the increasing elderly population and growing awareness pertaining to healthcare-acquired infections among healthcare workers.

An increasing number of occupational injuries coupled with the growing requirement for highly effective protective gloves in the majority of core industries such as food & beverage, metal manufacturing, oil & gas, automotive, and chemical is expected to augment nitrile gloves penetration in Europe over the forecast period.

The Asia Pacific nitrile gloves market is anticipated to expand at a CAGR of 6.3% over the forecast period on account of the rapid spread of coronavirus across various countries including India, Japan, and Indonesia. Furthermore, improving hygiene and safety standards across several healthcare settings in developing countries coupled with rapid industrialization are further expected to have a positive impact on industry growth.

Medical & healthcare industry in China is expected to grow at a rapid pace owing to several factors including an aging population, urbanization, improving the standard of living, and expanding healthcare infrastructure. Rising healthcare expenditure is expected to contribute to the growth of the healthcare sector in the country which in turn is expected to complement industrial growth.

Key Companies & Market Share Insights

In order to cater to the increasing demand from various industries, companies have started expanding their business through mergers, acquisitions, the establishment of new production plants, and geographic expansion strategies. The industry also focuses on research & development activities to develop new technologies for the manufacturing of nitrile gloves.

In March 2020, Hartalega Holdings Berhad announced the purchase of land to expand its glove production facilities in Sepang, Malaysia, as the demand for hand protection has surged owing to the COVID-19 pandemic. The acquisition is expected to empower the company to progressively increase its capacity to meet the growing global demand for gloves. Some prominent players in the global nitrile gloves market include:

-

Ansell Ltd

-

Top Glove Corporation Bhd

-

Hartalega Holdings Berhad

-

Unigloves (UK) Limited

-

Adenna LLC

-

Kossan Rubber Industries Bhd

-

Superior Gloves

-

MCR Safety

-

Supermax Corporation Berhad

-

Ammex Corporation

-

Cardinal Health

-

Medline Industries, Inc.

Nitrile Gloves Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.93 billion

Revenue forecast in 2030

USD 10.19 billion

Growth Rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; France; U.K.; Italy; Russia; Spain; China; India; Japan; South Korea; Australia; Indonesia; Brazil; Argentina; Colombia; Chile; Peru; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Ansell Ltd; Top Glove Corporation Bhd; Hartalega Holdings Berhad; Unigloves (UK) Limited; Adenna LLC; Kossan Rubber Industries Bhd; Superior Gloves; MCR Safety; Supermax Corporation Berhad; Ammex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitrile Gloves Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nitrile gloves market report based on type, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Powdered

-

Powder Free

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Durable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical & Healthcare

-

Examination

-

Surgical

-

-

Automotive

-

Oil & Gas

-

Food & Beverage

-

Metal & Machinery

-

Chemical & Petrochemical

-

Pharmaceutical

-

Cleanroom

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Mexico

-

Chile

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nitrile gloves market size was estimated at USD 6.55 Billion in 2022 and is expected to reach USD 5.93 Billion in 2023

b. The nitrile gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 10.19 billion by 2030

b. North America dominated the nitrile gloves market with a revenue share of 35.2% in 2022, on account of rising healthcare expenditure coupled with growing awareness pertaining to healthcare-acquired infections among healthcare workers

b. Some of the key players operating in the nitrile gloves market include Top Glove Corporation Bhd, Hartalega Holdings Berhad, Unigloves (UK) Limited, Kossan Rubber Industries Bhd, Superior Gloves, MCR Safety, Supermax Corporation Berhad, Ammex Corporation, Cardinal Health, Medline Industries, Inc.among others

b. The key factors that are driving the nitrile gloves market include rising healthcare expenditures, the growing importance of safety at workplaces, coupled with a significant increase in demand due to COVID-19

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."