- Home

- »

- Medical Devices

- »

-

Neurovascular Embolization Devices Market Report, 2030GVR Report cover

![Neurovascular Embolization Devices Market Size, Share & Trends Report]()

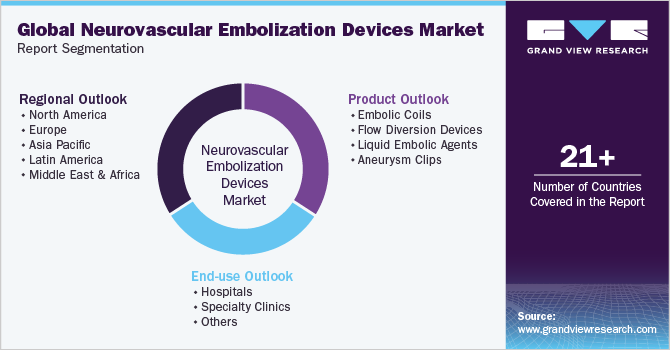

Neurovascular Embolization Devices Market Size, Share & Trends Analysis Report By Product (Embolic Coils, Flow Diversion Devices), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-131-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Neurovascular Embolization Devices Market Size & Trends

The global neurovascular embolization devices market size was estimated at USD 1.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.60% from 2023 to 2030. The primary factors contributing to the market growth include the increasing incidence of neurovascular diseases, technological advancements in the devices, improved diagnostic techniques, and greater awareness among both patients and healthcare professionals for the early detection and treatment of neurovascular diseases.

A rise in the prevalence of neurovascular illnesses has contributed to the growth of the market for neurovascular embolization devices. Aneurysms, arteriovenous malformations (AVMs), and ischemic strokes are a few examples of several conditions known as neurovascular diseases that have an impact on the blood arteries in the brain and spinal cord. For instance, as per the reports published by the National Library of Medicine in 2023, approximately 15% of the global population currently suffers from neurological illnesses, which are the most common cause of physical and cognitive disability.

Increasing collaborations among the industry's key players for the technological advancements of embolization devices has a positive impact on the growth of the market. For instance, in September 2022, to introduce the IndigoTM System with LightningTM Intelligent Aspiration to Japan, Penumbra and Asahi Intecc collaborated with a strategic agreement. Following regulatory approval, companies planned to introduce Penumbra's most advanced peripheral surgical thrombectomy technique to Japan. Lightning technique was developed for a one-time hemorrhaging removal in peripheral vein and artery systems, especially for disorders such as vein thrombosis, pulmonary embolism, and acute limb ischemia.

Early diagnosis and detection of neurovascular diseases gained benefits from improved diagnostic methods. Due to this, more patients are receiving these diagnoses, which increases the demand for neurovascular embolization devices. The ability to detect and assess neurovascular diseases has improved owing to better diagnostic procedures, such as cutting-edge imaging modalities (e.g., magnetic resonance angiography, CT angiography, and digital subtraction angiography). As a result, healthcare professionals are better able to arrange treatments that are specifically tailored to the needs of each patient.

The rising public knowledge of neurovascular disorders and the available treatments has been a top priority for healthcare organizations. This has helped with early detection and professional referrals for the right interventions. Increasing knowledge and training on neurovascular illnesses and the most recent treatment techniques are being provided to medical professionals. As a result, healthcare professionals are now better able to recognize and manage these illnesses.

On the contrary, the cost of the devices themselves and the procedures for neurovascular embolization can be very expensive for patients and healthcare systems. This may restrict access to certain therapies, particularly in low-income areas. For some neurovascular disorders, alternative treatments including surgery or radiation therapy are available. The demand for embolization devices may be impacted by the availability of various alternatives.

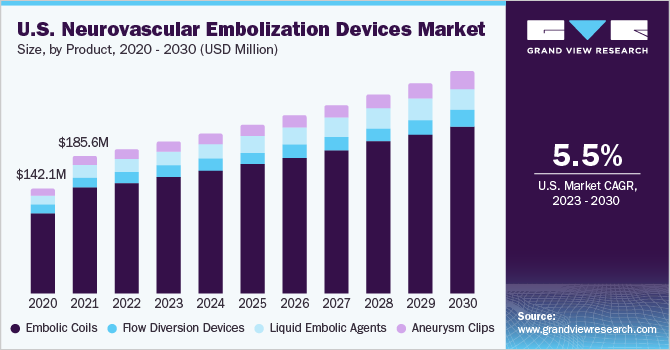

Product Insights

Based on product, the embolic coils segment dominated the market and accounted for the largest revenue share of 77.66% in 2022. Since embolization coils are among the earliest embolization devices presently in use and interventional radiologists are more skilled at using them than other embolization devices, their quick adoption and rising demand make them essential for a variety of embolization procedures.

The advancements in the products designed for the treatment of neurological disorders developed by the industry key players drives the growth of the market. For instance, in January 2023, the IMPASS embolic coil device, which may be utilized to treat chronic subdural hematomas (CSDH) on the outermost layer of the brain, has been successfully employed in in-vivo studies to embolize the middle meningeal artery (MMA). This information was made public by Fluidx Medical Technology, Inc.

The liquid embolic agents segment following aneurysm clips is anticipated to achieve the highest CAGR of approximately 7.70% during the forecast period. Arteriovenous malformations (AVMs), which are abnormal tangles of blood vessels that may be prone to bleeding, are frequently treated with liquid embolic agents. These substances aid in the blocking of abnormal blood vessels and reduce the chance of rupture.

Compared to other alternative embolization procedures, liquid embolic agents are usually considered to be safer and carry a lower risk of consequences. The precise and regulated distribution capabilities of liquid embolic agents make them useful for treating challenging neurovascular disorders. New and improved liquid embolic agents have been released with improved qualities, including quicker hardening times and higher visibility under imaging, as a result of ongoing research and development (R&D) activities.

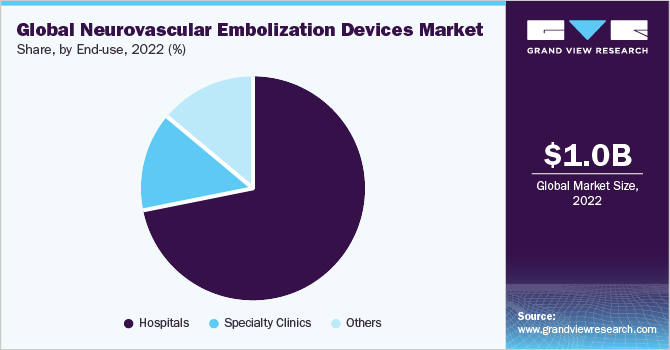

End-use Insights

Based on end-use, the hospital segment captured the largest revenue share of over 71.87% in 2022. Neurovascular embolization equipment is primarily used in hospitals. These hospitals offer an extensive array of medical treatments, including the identification and management of neurological diseases. Hospitalized neurosurgeons and neurointerventional radiologists employ embolization devices to carry out minimally invasive operations to treat aneurysms. The highly qualified and specialized medical staff that hospitals utilize such as neurointerventional radiologists, neurosurgeons, and vascular surgeons, are trained to use neurovascular embolization devices safely and successfully.

For instance, in May 2023, according to a study released in Stroke, reviewed by experts in the largest journal of the American Stroke Association, a branch of the American Heart Association, researchers successfully performed an in-utero surgery in the hospital to treat a severe vascular malformation, known as vein of Galen malformation, in a fetus's cerebral prior birth to cure a potentially fatal developmental condition.

The other segment is anticipated to witness a significant CAGR over the forecast period. The other segment includes ambulatory surgical centers (ASCs), research and academic institutes. Surgical clinics that offer ambulatory services can perform some neurovascular operations. In some cases, hospitals can be replaced by these facilities more practically and affordably. In some circumstances, ASCs might use neurovascular embolization devices. Moreover, many investigations are conducted by academic and research institutions on neurovascular illnesses, therapeutic approaches, and the development of novel embolization devices. They are vital in developing the knowledge and technology of the manufacturing industry which boost the industry growth.

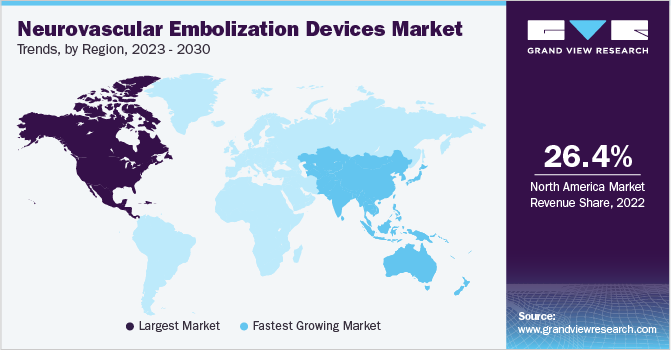

Regional Insights

North America dominated the neurovascular embolization devices market and accounted for the largest revenue share of 26.44% in 2022. Neurovascular embolization devices have a sizable market in North America, especially in the U.S. and Canada. These nations have advanced healthcare systems, rising medical costs, and a high incidence of neurovascular illnesses. The increased government efforts and manufacturer research and development (R&D) spending have a big impact on the expansion of the regional marketplace. Moreover, the novel product launch by the industry's key players for product portfolio expansion boosts the industry growth.

For instance, in June 2022, Pipeline Vantage with Shield Technology, a fourth-generation flow deflector with a CE mark by India Medtronic, was developed for endovascular therapy for cerebral aneurysms. A newly developed flow deflector called Pipeline Vantage features Shield technology has enhanced features of the design for both the delivery system and the implant. By developing a scaffold that promotes the development of cells in the innermost layer of the target blood vessel, these qualities make it easier and more reliable for doctors to deliver, deploy, and repair brain aneurysms and intracranial aneurysms.

The Asia Pacific market for neurovascular embolization devices is anticipated to witness the fastest CAGR over the forecast period. This is due to various factors such as rising target disease burden, technological advancements, and increasing prevalence of neurological disorders. Factors such as presence of key players and rising healthcare expenditure are also contributing to the region’s growth. Moreover, geographic expansion by key players and major untapped opportunities in Asia Pacific are anticipated to boost the market growth during the forecast period. China, India, and Japan are major contributors to the region’s neurovascular embolization devices industry.

Key Companies & Market Share Insights

The key players are focusing on growth strategies, such as new product launches, regulatory approvals, expansions, collaborations, acquisitions, and partnerships. For instance, in July 2023, MicroVention, Inc., a neurovascular corporation under Terumo Corporation, announced the release of 5-year monitoring data for WEB, their intrasaccular device. They also introduced two new sizes (SL 7x2 and SL 6x2) for Aneurysm Embolization Technology, making it versatile for aneurysms of varying sizes and types. The product is showcased at SNIS 2023 in San Diego (Booth 615). Due to such development, the demand for neurovascular embolization devices will increase over the forecast period. Some prominent players in the global neurovascular embolization devices market include:

-

Medtronic

-

Stryker

-

MicroVention Inc

-

Cerenovus

-

Integra LifeSciences

-

Penumbra Inc

-

Balt SAS

-

B. Braun Melsungen AG

-

Phenox GmbH

Neurovascular Embolization Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.12 billion

Revenue forecast in 2030

USD 1.76 billion

Growth rate

CAGR of 6.60 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; MicroVention Inc; Cerenovus; Integra LifeSciences; Penumbra Inc; Balt SAS; B. Braun Melsungen AG; Phenox GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neurovascular Embolization Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neurovascular embolization devices market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Embolic Coils

-

Flow Diversion Devices

-

Liquid Embolic Agents

-

Aneurysm Clips

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurovascular embolization devices market size was estimated at USD 1.05 billion in 2022 and is expected to reach USD 1.12 billion in 2023.

b. The global neurovascular embolization devices market is expected to grow at a compound annual growth rate of 6.60% from 2023 to 2030 to reach USD 1.76 billion by 2030.

b. North America dominated the neurovascular embolization devices market with a share of 26.44% in 2022. Neurovascular embolization devices have a sizable market in North America, especially in the U.S. and Canada. These nations have advanced healthcare systems, rising medical costs, and a high incidence of neurovascular illnesses. The increased government efforts and manufacturer R&D spending have a big impact on the expansion of the regional marketplace. Moreover, the novel product launch by the industry key players for the product portfolio expansion boosts the industry growth.

b. Some key players operating in the neurovascular embolization devices market include Medtronic; Stryker; MicroVention Inc; Cerenovus; Integra LifeSciences; Penumbra Inc; Balt SAS; B. Braun Melsungen AG; Phenox GmbH.

b. The primary factors contributing to the market growth include, increasing incidence of neurovascular diseases, technological advancements in the devices, and improved diagnostic techniques and greater awareness among both patients and healthcare professionals for the early detection and treatment of neurovascular diseases are also expected to spur the neurovascular embolization devices market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."