- Home

- »

- Clinical Diagnostics

- »

-

Neurological Biomarkers Market Size & Share Report, 2030GVR Report cover

![Neurological Biomarkers Market Size, Share & Trends Report]()

Neurological Biomarkers Market Size, Share & Trends Analysis Report By Application (Alzheimer’s, Parkinson’s, Multiple Sclerosis, Autism), By Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-823-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global neurological biomarkers market size was valued at USD 7.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2023 to 2030. Some of the major factors expected to drive the market are the increasing prevalence of neurological diseases and growing awareness about the condition among physicians & patients. Furthermore, technological advancements and growing R&D efforts for neurological diseases drugs development are further propelling the overall market.

According to a WHO article, published in February 2023, every year nearly 5 million people across the world are diagnosed with epilepsy. Increasing cases of Alzheimer’s disease in older people is expected to fuel market growth. For instance, according to WHO, globally, about 10 million new cases are reported every year and approximately 50 million people have dementia. Furthermore, according to Alzheimer’s Association, approximately 13.8 million people aged 65 and above are estimated to suffer from Alzheimer’s dementia by 2050. According to a WHO report, in March 2023, it was estimated that about 55 million people around the world are living with Alzheimer’s dementia.

Companies such as AbbVie, Biogen, AC Immune, Novartis AG, TauRx, Eli Lilly & Co., and others are highly active in developing novel therapies for the treatment of AD. Several companies have their candidate drugs in phase lll, which may be launched over the forecast period. Furthermore, growing incidence of neurological diseases presents significant unmet needs. Thus, the demand for biomarkers is increasing for drug development, diagnosis, and disease progression research in neurological diseases.

Furthermore, growing research and innovation to help diagnose Parkinson’s disease using antigen-antibody binding techniques is fueling market growth. For example, according to an article by NCBI, in 2022, diagnosis of Parkinson's disease by investigating the inhibitory effect of serum components on P450 inhibition assay requires immunoblotting analysis, and it demonstrates that P450 inhibition assay can discriminate between sera from healthy individuals and patients with Parkinson’s disease. Moreover, this technique is easier to perform and is faster than other assays, as it does not require any pretreatment.

Blood Based Biomarkers (BBBMs) play a crucial role in selecting appropriate therapies and tracking disease progression. This can be evidenced by research initiatives and clinical studies that are being conducted in hospitals for developing biomarker tests, which, in turn, is anticipated to fuel market growth. For instance, Fundació Institut de Recerca de l’Hospital de la Santa Creu i Sant Pau is studying circulating microparticles to develop new biomarkers, such as BBBMs, for neurological prognosis of patients.

Type Insights

Proteomic biomarkers accounted for the largest share of 30.48% of the neurological biomarkers market in 2022. Increasing product launches is expected to drive the neurological biomarkers market. For instance, in December 2021, Olink Holding AB launched Olink Explore 3072. It offers ~3000 assays covering all major biological tests, including neurological tests. It can run 96 or 384 samples per run—this further enables the measurement of high concentration of protein in the sample than in the previous version of the platform.

The others segment which includes digital biomarkers is anticipated to witness significant growth over the forecast period. Digital biomarkers offer various biopharmaceutical and pharmaceutical firms supplemental and contextual data to conclude clinical trial decisions. For instance, IXICO plc is entering into collaborations with major biopharmaceutical firms to authenticate clinically digital biomarkers and use them in clinical trials. Such initiatives are expected to boost the segment during the forecast period.

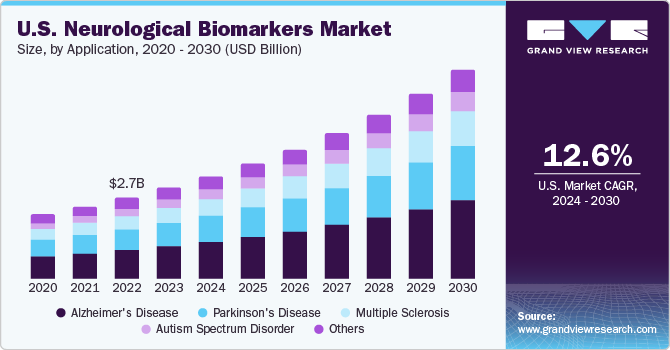

Applications Insights

Alzheimer’s disease accounted for the largest share of 35.60% of the market in 2022 and is expected to dominate the market over the forecast period due to rise in the prevalence of the disease and increasing awareness for early diagnosis and timely treatment. According to Alzheimer’s Association, globally, approximately 55 million individuals are living with dementia, which is anticipated to rise by 98 million by 2030 and around 139 million by 2050. Moreover, in the U.S., approximately 6.5 million individuals are estimated to live with AD in 2022.

Parkinson’s disease segment is expected to grow at a fastest CAGR during the forecast period. Increasing R&D activities in biomarkers may offer new opportunities for Parkinson’s therapeutics. For instance, according to an article published in Pharmaceutical Technology, in October 2022, a research study identified a novel cerebrospinal fluid biomarker for Parkinson’s disease, strengthening the scope of possible drug targets. Hence, neurological biomarkers may open new avenues for treatment of Parkinson’s disease and are projected to drive the market during the forecast period.

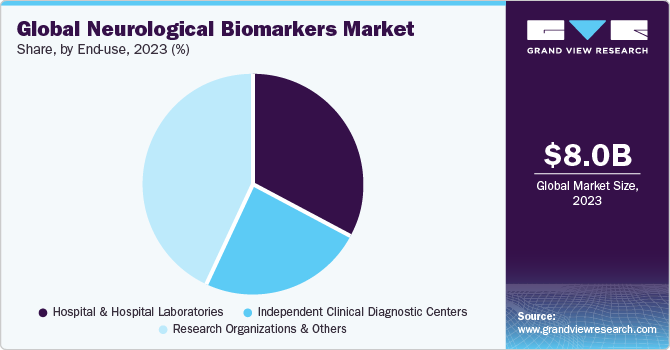

End-Use Insights

Research organizations and others segment accounted for a significant share of 43.05% of the market in 2022.Research institutes, such as the National Institute of Neurological Disorders and Stroke (NINDS), have been providing funding for biomarker discovery, validation, and qualification of various neurological disorders. In May 2022, Amprion Inc. received an additional research grant of USD 730,000 from NINDS for continued validation of the SYNTap Biomarker Test to diagnose neurological diseases or disorders.

Hospital & Hospital Laboratories and others segment is and is expected to grow at a fastest CAGR over the forecast period owing to an increase in hospitalization. Research initiatives and clinical studies are being conducted in hospitals for developing biomarker tests, which is anticipated to fuel market growth. For instance, Fundació Institut de Recerca de l’Hospital de la Santa Creu i Sant Pau is studying circulating microparticles to develop new biomarkers for neurological prognosis of patients

Regional Insights

North America region commanded the highest share of around 41.63% of the market in 2022 and is expected to witness a significant growth rate over the forecast period. Growth of the region can also be attributed to the increasing understanding of significant potential of biomarkers in drug development. The local presence of regulatory entities in the region is also expected to fuel growth of biomarker-based drug development in the near future. This is mainly because these entities play a pivotal role in creating awareness among the population about the potential of biomarker-based therapies in disease management.

Asia Pacific is expected to grow at the highest CAGR from 2023 and 2030. The need for early diagnosis of neurological disorders, which would further aid to reduce treatment costs& mortality, is expected to fuel growth of the market in the region. The local presence of leading biomarker companies supported increase in R&D investments driving development of novel biomarkers to meet the rising demand for early diagnosis in the region.

Key Companies & Market Share Insights

Companies are adopting strategies that allow them to use their resources to aid in the development of new products and enhance their supply chain. For instance, in March 2023, Abbott Laboratories announced the FDA clearance ofAlinity i laboratory traumatic brain injury (TBI) blood test, the first of its kind, which would assist medical professionals in evaluating indiviuals with mild TBIs. Furthermore, in July 2023, Quanterix announced the launch of LucentAD, a biomarker blood test to assist in the diagnosis of Alzheimer’s disease in individuals. Some prominent players in the global neurological biomarkers market include:

-

Abbott

-

Thermo Fisher Scientific, Inc.

-

Merck & Co., Inc.

-

Bio-Rad Laboratories, Inc.

-

Johnson & Johnson Services, Inc.

-

DiaGenic ASA

-

BANYAN BIOMARKERS, INC.

-

Quanterix

-

Alseres Pharmaceuticals, Inc.

-

Rules-Based Medicine

Neurological Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.05 billion

Revenue forecast in 2030

USD 18.75 billion

Growth Rate

CAGR of 12.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; BANYAN BIOMARKERS, INC.; DiaGenic ASA; Banyan Biomarkers, Inc.; Rules-Based Medicine; and Quanterix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

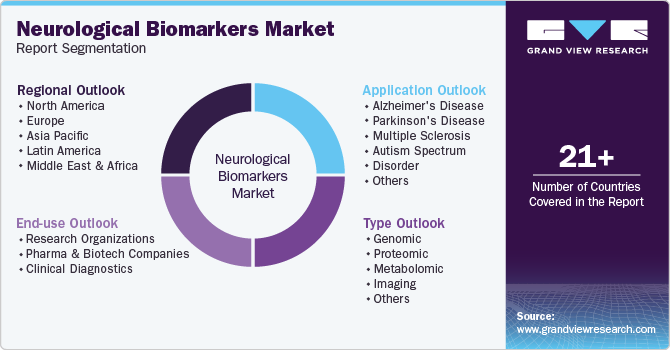

Global Neurological Biomarkers Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the market trends in each of the sub-markets from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the neurological biomarkers market on the basis of type, application, end-use, and region:

-

Type Outlook (USD Million; 2018 - 2030)

-

Genomic

-

Proteomic

-

Metabolomic

-

Imaging

-

Others

-

-

Application Outlook (USD Million; 2018 - 2030)

-

Alzheimer's Disease

-

Parkinson's Disease

-

Multiple Sclerosis

-

Autism Spectrum Disorder

-

Others

-

-

End-use Outlook (USD Million; 2018 - 2030)

-

Hospital & Hospital Laboratories

-

Independent clinical diagnostic centers

-

Research Organizations and Others

-

-

Regional Outlook (USD Million; 2018 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurological biomarkers market size was estimated at USD 7.2 billion in 2022 and is expected to reach USD 8.0 billion in 2023.

b. The global neurological biomarkers market is expected to witness a compound annual growth rate of 12.8% from 2023 to 2030 to reach USD 18.75 billion in 2030.

b. Based on application, Alzheimer's Disease segment held the largest share of 35.02% in 2022, owing to high prevalence of the disease and availability of a higher number of products for clinical use.

b. Some key players operating in the neurological biomarkers market include Abbott; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; BANYAN BIOMARKERS, INC.; Myriad Genetics, Inc.; DiaGenic ASA; and Quanterix Corporation.

b. The major factors driving neurological biomarkers market growth are the increasing prevalence of neurological diseases, technological advancements, and the need for early diagnosis of neurological disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The most common concern for the governments of all Covid-19 hit nations is the excruciating need to screen for and test large numbers of patients for possible Sars-Cov-2 infection. As a result, most of them are facing major shortages in the supply for diagnostic kits to test for the virus. Diagnostics virology entities are under immense pressure to provide reliable testing kits, and there is a surge in demand for in-vitro or point-of-care testing capacities by labs across a large number of countries. The report will account for Covid19 as a key market contributor.