- Home

- »

- Advanced Interior Materials

- »

-

Mining And Oil & Gas Fasteners Market Size Report, 2030GVR Report cover

![Mining And Oil & Gas Fasteners Market Size, Share & Trends Report]()

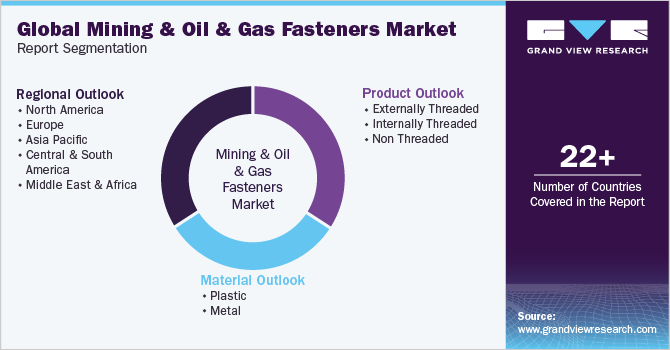

Mining And Oil & Gas Fasteners Market Size, Share & Trends Analysis Report By Material (Plastics, Metal), By Product (Externally Threaded, Internally Threaded, Non-threaded), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-091-5

- Number of Pages: 104

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Market Size & Trends

The global mining and oil & gas fasteners market size was estimated at USD 1.28 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 4.9% from 2023 to 2030. The mining and oil & gas fasteners Market is anticipated to be driven by growth in the mining and oil & gas industry, technological advancement, and increasing complexity of equipment. The global population is gradually increasing, thereby propelling energy needs. According to the United Nations Department of Economic and Social Affairs, the global population is expected to increase by 1.7 billion by 2045. This results in a total worldwide population of 9.5 billion by 2045, up from 7.8 billion in 2020. This is expected to boost the energy demand globally.

Fasteners are an important component of the mining and oil & gas sector and come in a variety of forms and sizes. They are also utilized in the construction of storage facilities and for flange and valve fastening in oil & gas pipelines. The growing oil & gas industry is likely to create upswings for market growth over the forecast period.

Metal fasteners are preferred over other materials in the oil & gas industry since oil rig operations feature some of the most stringent operational specifications of any industry. The remote, difficult-to-reach reserves situated beneath the seabed necessitate rapid and deep drilling. The key joints are subjected to ever-increasing shock, vibration, and temperature that metal fasteners can withstand, creating upswings for the metal fasteners for mining and oil & gas industry growth over the assessment period.

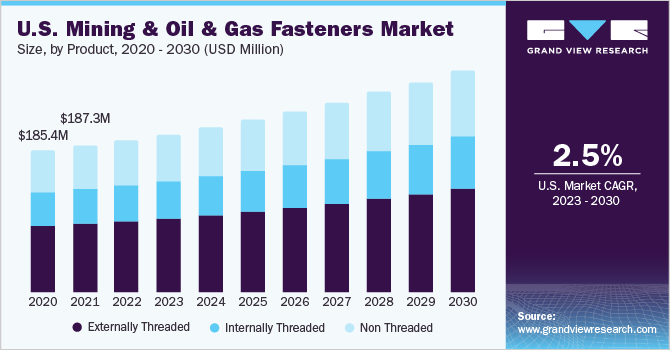

The U.S. is a key market for mining and oil & gas fasteners in North America owing to the presence of large mining and oil & gas fields. Moreover, U.S. is one of the major consumers of oil & gas across the globe. According to U.S. Energy Information Administration, approximately 98.8 million barrels per day of petroleum and liquids were consumed in July 2021 which was 6 million barrels per day more than the consumption of July 2020.

The mining industry plays a crucial role in the economic growth of the country. The U.S. is the largest producer of rare earth metal concentrates in the world, followed by China. According to the U.S. Geological Survey, the estimated value of minerals produced by the mines in the country accounted for USD 83.2 billion in 2020. Furthermore, there was a 36% increase in the production of rare earth minerals in 2020 in the country than the minerals produced in 2019.

Thus, the development in the U.S. mining industry is expected to drive the demand for fasteners for equipment such as cranes, masts, mud pumps, and engines. Fasteners are also used for flange and valve bolting in oil & gas pipelines. Growing petroleum-based E&P generation in the U.S. has been a major factor contributing to the increasing demand for oil & gas equipment used across various plants and their maintenance in the country.

The growing demand for minerals is expected to boost the demand for fastening products in the mining industry. Mining support fasteners are used in the construction and maintenance of tunnels, entrances, and exits to the mines. Furthermore, mining and excavation fasteners are used in plant and equipment and repair & maintenance. They are also used in crushing machines, quarry and opencast, conveyor equipment, drilling, and screeners among others.

Product Insights

Based on product, the externally threaded segment commanded the largest share of 47.3% in the mining and oil & gas industry. This is owing to ease of installation, high clamping force, and availability in a wide range of sizes and materials. The externally threaded fasteners are majorly preferred because they can be easily installed and removed using simple tools, which makes them a popular choice for a wide range of products. Also, it provides a high clamping force when tightened, which is important in products where a secure, tight join is necessary.

Externally threaded fasteners include bolts, screws, studs, tie rods, and pins. The types of fasteners used in the mining industry include bolts such as eye, anchor, and structural. Types of rods include rock, elevator, sag, and tie. Materials used in the manufacturing of externally threaded fasteners for mining and oil & gas include carbon steel, titanium, stainless steel alloy steels, and construction steel.

Inserts and nuts are the most common internally threaded fasteners. Nuts dominate the segment of internally threaded fasteners. The oil & gas and mining industries play a vital role in global and regional economic growth. Geoscience and innovation remain important focuses for the mineral exploration and mining industry. Increasing investments from multinational players and favorable government policies for mine explorations and development is expected to drive the growth of mining, bolstering growth for the fasteners market.

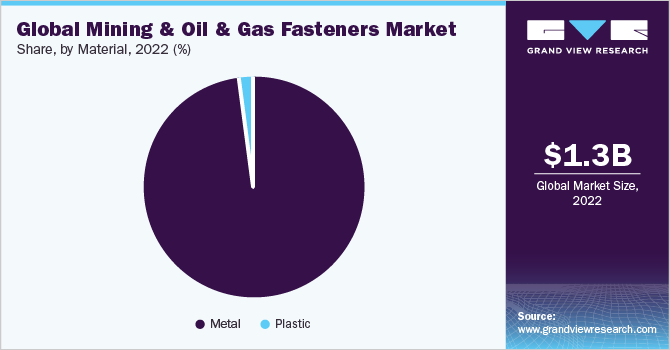

Material Insights

The metal segment accounted for the highest revenue share of 98.0% in the material segment of the mining and oil & gas industry. Metal fasteners are known for their strength and durability, which makes them ideal for use in mining sites and oil & gas fields. They can withstand heavy loads and are resistant to wear and tear. Moreover, metal fasteners are largely available and can be purchased from a variety of suppliers. This makes it easy to obtain the right fasteners for a specific mining or oil & gas project.

Metal fasteners made from stainless steel, carbon steel, copper, aluminum, alloy steel, nickel, and titanium are used in the mining industry. These fasteners come in a variety of sizes, shapes, and diameters. Stainless steel has around 10% chromium which enables the formation of a thin coating of chromium oxide on the material's outer surface. This successfully prevents any corrosion that occurs due to oxidation or other chemical processes. Stainless steel is also resistant to internal and external hydrogen embrittlement, making it the most popular material for fastener manufacturing.

However, the growth of plastic fasteners is higher than metal fasteners. Plastic fasteners are much lighter than their metal counterparts, which can be beneficial in mining and oil & gas applications where weight is a concern. In addition, plastic fasteners are highly resistant to corrosion, making them ideal for use in harsh environments where metal fasteners may corrode and fail. Thus, the demand for plastic fasteners is rising.

Plastic is a nonconductor and therefore, ideal for heat-sensitive, electronic, or electrical applications. Fasteners are used in crushing machines, quarry and opencast equipment, conveyor equipment, and drilling equipment, and screeners. Resistance to vibrations and corrosion is a critical requirement for fasteners in mining and excavation industries, which is demonstrated exceptionally well in plastic fasteners.

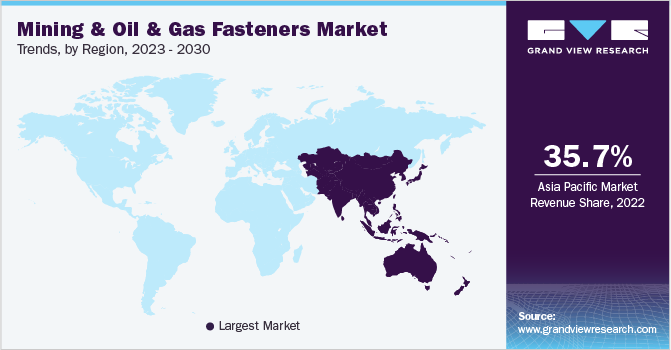

Regional Insights

Asia Pacific dominated the mining and oil & gas fasteners market and accounted for the largest revenue share of 35.7% in 2022. Rapid industrialization in developing economies of Asia Pacific coupled with rising investments in oil & gas and mining projects is expected to contribute to the overall growth of the mining and oil & gas fasteners market in the region.

According to the International Association of Oil & Gas Producers, the region's upstream oil & gas industry is battling to recover from its downturn and is currently rebounding. From a demand standpoint, energy demand in the Asia Pacific is expected to remain constant and is expected to see new investments as a result of economic expansion in emerging nations in the region and OECD countries.

Furthermore, exploration companies are currently keeping track of oil & gas price patterns and exploration expenditures. In addition, Southeast Asian countries such as Thailand, Indonesia, and Malaysia governments are framing supportive policies to promote investments in the extraction of natural resources, including crude oil and natural gas. Thus, driving the demand of market of fasteners

The energy scenario in North America is changing significantly owing to the increasing number of oil & gas exploration activities in the U.S. and Canada that have led to the establishment of new oil & gas plants in the region. The increase in the usage of tight oil and unconventional natural gas resources presents the potential to boost global economic growth and increase its competitiveness.

Key Companies & Market Share Insights

The global mining and oil & gas fasteners market is a highly competitive market owing to the presence of a considerable number of manufacturers. Although fasteners comprise a very small percentage of the overall cost incurred in the mining and oil & gas industry, their prices play a major role in estimating the replacement cost and replacement period as they are consumed in bulk quantities.

In addition, fluctuating raw material prices for oil & gas also play a major role in the overall production cost of the final product. Furthermore, fastener failure can lead to the shutting down of machinery and hamper production capacity. As a result, the market for fasteners used in oil & gas machinery is highly competitive. The fasteners market is closely correlated to industrial manufacturing and is majorly dependent on OEM and MRO markets. Some of the prominent players in the global mining and oil & gas fasteners market include:

-

National Bolt & Nut Corporation

-

American Fastener Technologies Corporation

-

Hague Fasteners Limited

-

Master Bolt, LLC

-

Dale Fastener Supply

-

Elgin Fastener Group LLC

-

Power Gen Components

-

LSP Holding (UK) LTD

-

STANLEY Engineered Fastening

-

MW Industries, Inc.

-

Dokka Fasteners A S

Mining And Oil & Gas Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.34 billion

Revenue forecast in 2030

USD 1.88 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany, France, UK, Italy, Spain, Singapore; Australia; Indonesia; Brazil; Argentina; Chile

Key companies profiled

National Bolt & Nut Corporation; American Fastener Technologies Corporation; Hague Fasteners Limited; Master Bolt, LLC; Dale Fastener Supply; Elgin Fastener Group LLC; Power Gen Components; LSP Holding (UK) LTD; STANLEY Engineered Fastening; MW Industries, Inc.; Dokka Fasteners A S

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining And Oil & Gas Fasteners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global mining and oil & gas fasteners market report on the basis of material, product, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Externally Threaded

-

Internally Threaded

-

Non Threaded

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

Singapore

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global mining and oil & gas fasteners market size was estimated at USD 1.28 billion in 2022 and is expected to reach USD 1.34 billion in 2023.

b. The global mining and oil & gas fasteners market is expected to grow at a compound annual growth rate a CAGR of 4.9% from 2023 to 2030 to reach USD 1.88 billion by 2030.

b. The metal material segment accounted for the largest revenue share in 2022 on account of its qualities such as mechanical strength, are resistant to impact, and less vulnerable to high temperature and pressure.

b. Some key players operating in the mining and oil & gas fasteners market include National Bolt & Nut Corporation; American Fastener Technologies Corporation; Hague Fasteners Limited; Master Bolt, LLC; Dale Fastener Supply; Elgin Fastener Group LLC; Power Gen Components; LSP Holding (UK) LTD; STANLEY Engineered Fastening; MW Industries, Inc.;Dokka Fasteners A S

b. The key factors driving the market growth include the fast paced development in the mining and oil & gas sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."