- Home

- »

- Medical Devices

- »

-

Medical Washer Disinfector Market Size, Share Report, 2030GVR Report cover

![Medical Washer Disinfector Market Size, Share & Trends Report]()

Medical Washer Disinfector Market Size, Share & Trends Analysis Report By Type (Floor Standing, Benchtop, Others), By Application (Medical, Dental, Laboratories, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-122-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global medical washer disinfector market size was valued at USD 13.76 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.10% from 2023 to 2030. Preserving proper cleanliness is crucial, specifically in dental and medical practice. Here, medical washer disinfectors play a vital role. In recent years, there has been a uniform rise in the adoption of washer disinfectors for cleaning & disinfecting medical instruments in many healthcare settings before they go for sterilization. Thus, the development and launch of new medical washer disinfector devices are anticipated to drive market growth over the coming years.

Furthermore, infection control is a hot topic due to the rising threat of usual seasonal illnesses to contend with during the colder months. Thus, it is important that infection control remains a top priority. Here, medical washer disinfectors play a crucial role in providing next-level protection to instruments from contamination and offer safety to medical practitioners and staff at hospitals from hospital-acquired infections. The U.S. FDA has long recommended the classification of the general use of medical washer disinfectors into Class II to clean, disinfect, and dry surgical instruments, including anesthesia equipment and other medical devices. Thus, supportive regulatory policies are anticipated to boost the market for medical washer disinfectors over the forecast period.

Rising awareness regarding innovations in medical washer devices and their benefits among healthcare settings such as hospitals and dental facilities are expected to contribute to market growth positively. For instance, in June 2022, Innova announced a new presentation for the company’s glassware washer and water purification system in Mexico. This presentation was aimed at improving awareness about the company’s products in the scientific community and establishing supplier partnerships with Mexican market players, thereby driving market growth.

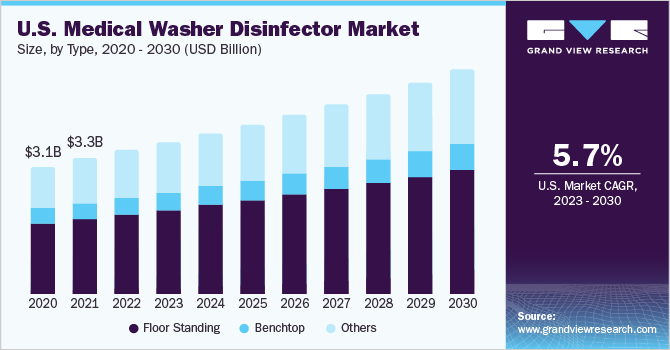

Type Insights

The floor-standing segment accounted for the largest market share of 54.38% in 2022. This can be attributed to the availability of a wide range of floor-standing washer disinfector products and a strong global manufacturer presence. Key players such as Steris plc, Skytron, and others offer durable and easy-to-handle heated medical washer disinfector devices. Notable floor medical washer disinfectors include AMSCO 7053HP, AMSCO 5052, RELIANCE VISION, STERLING P1000, and others. The development and introduction of innovative, technologically advanced floor-standing medical washer disinfectors play a significant role in fostering growth in this segment.

Based on type, the market has been segmented into floor standing, benchtop, and others. The others segment is expected to witness significant growth during the forecast period due to the commercialization of new devices such as built-in, mobile, undercounter, and wall-mounted medical washers. For instance, in October 2022, Miele Professional introduced its newest PG 8592 and PG 8582 Medical Undercounter washer disinfectors for cleaning and disinfecting surgical and medical instruments in hospitals in Canada. Thus, the introduction of other types of medical washers is projected to propel segment growth during the forecast period.

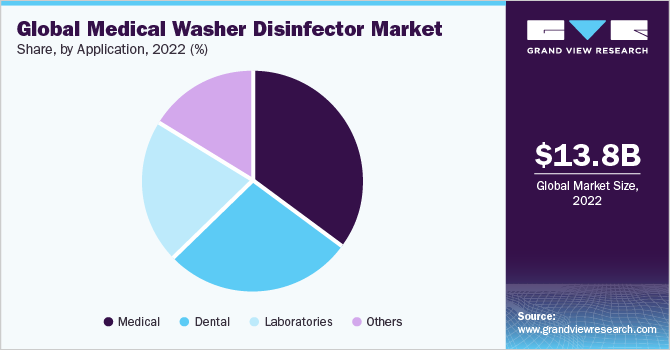

Application Insights

The medical application segment accounted for the largest market share of 34.67% in 2022. This can be attributed to the increased adoption of medical washer devices in hospitals for cleaning and disinfecting medical instruments. According to the American Hospital Association, as of May 2023, around 6,129 hospitals were there in the U.S. Thus, an increase in the number of healthcare facilities such as hospitals spurs the demand for medical washer disinfector devices. Based on application, the medical washer disinfector industry has been segmented into medical, dental, laboratories, and others.

The dental application segment is expected to grow significantly during the forecast period due to the increasing number of dental procedures being carried out globally. The ability of washer disinfectors to handle large instrument capacities makes them the most efficient and highly demanded devices in dentistry. According to the American Academy of Implant Dentistry, over a million people receive dental treatment annually, equivalent to 2.5 million dental implants, in the U.S. Hence, huge opportunities are available for medical washer disinfector devices in the dental segment.

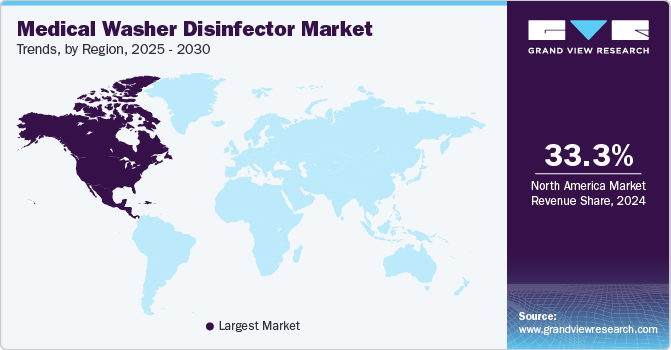

Regional Insights

North America accounted for the largest market share in medical washer disinfectors with 31.42% of the overall revenue in 2022. This can be attributed to the strong presence of companies engaged in developing, manufacturing, and commercializing medical washers to treat disinfected instruments in hospitals in the region. Notable companies that offer this product in the North American region include Steris, Olympus, Belimed, and Getinge, among others. The development & commercialization of new medical washer disinfector devices in the U.S. and Canada are anticipated to contribute to regional growth.

The Asia Pacific region is expected to witness the fastest growth over the forecast period. The growth can be linked to several factors, including a rising population, higher disposable incomes, advancements in medical technology, and an increasing awareness of healthcare services. This has led to a notable increase in the demand for high-quality healthcare services, medical devices, pharmaceuticals, and innovative treatment options. Moreover, both governmental bodies and private enterprises are channeling investments into healthcare infrastructure, thereby adding to the market expansion in the Asia Pacific region. Medical washer disinfector helps healthcare settings overcome certain hygiene and cleaning challenges, such as contamination of surgical instruments, thereby driving demand in the coming years.

Key Companies & Market Share Insights

Development of new products, major investments in R&D, and product modifications are among the key strategies market players adopt to gain a competitive edge. In June 2023, Olympus launched its Olympus ETD endoscope washer disinfector with two versions, ETD Premium and ETD Basic, for endoscopic device reprocessing. This launch will help users enhance usability and streamline the processes for a reduced workload. Some prominent players in the global medical washer disinfector market include:

-

STERIS plc

-

MELAG Medizintechnik GmbH & Co. KG

-

Olympus

-

Belimed

-

SHINVA MEDICAL INSTRUMENT CO., LTD.

-

Getinge

-

Ecolab

-

SKYTRON

-

SMEG

-

AT-OS

-

SciCan Ltd.

Medical Washer Disinfector Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.59 billion

Revenue forecast in 2030

USD 22.08 billion

Growth rate

CAGR of 6.10% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

STERIS plc.; MELAG Medizintechnik GmbH & Co. KG; Olympus; Belimed; SHINVA MEDICAL INSTRUMENT CO., LTD.; Getinge; Ecolab; SKYTRON; SMEG; AT-OS; SciCan Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

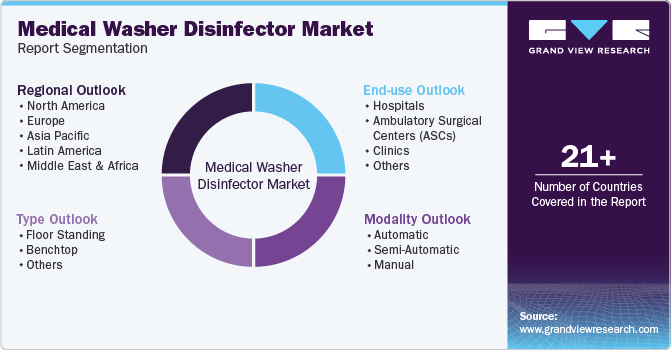

Global Medical Washer Disinfector Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical washer disinfector market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Floor Standing

-

Benchtop

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Dental

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical washer disinfector market size was estimated at USD 13.76 billion in 2022 and is expected to reach USD 14.59 billion in 2023.

b. The global medical washer disinfector market is expected to grow at a compound annual growth rate of 6.10% from 2023 to 2030 to reach USD 22.08 billion by 2030.

b. Floor-standing dominated the type segment of medical washer disinfector market with a share of 54.38% in 2022. This is attributable to to the availability of wide range of floor-standing washer disinfector products and presence of their manufacturers worldwide.

b. Some key players operating in the medical washer disinfector market include STERIS plc.; MELAG Medizintechnik GmbH & Co. KG Olympus; Belimed; SHINVA MEDICAL INSTRUMENT CO., LTD.; Getinge; Ecolab; SKYTRON; SMEG; AT-OS, SciCan Ltd.

b. Key factors that are driving the medical washer disinfector market growth include the growing incidence of hospital-acquired infections, technological advancement, improvements in public and private hospital infrastructure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."