- Home

- »

- Medical Devices

- »

-

Medical Disposables Market Size And Share Report, 2030GVR Report cover

![Medical Disposables Market Size, Share & Trends Report]()

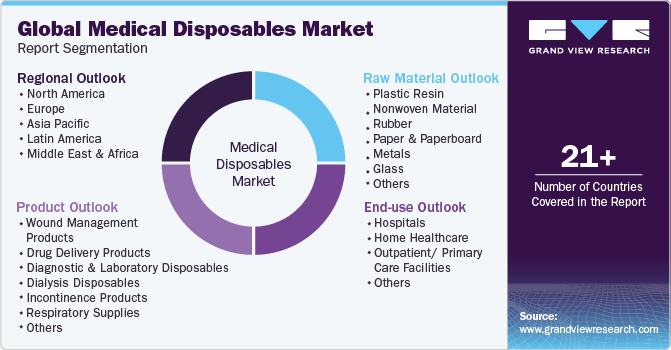

Medical Disposables Market Size, Share & Trends Analysis Report By Product (Wound Management Products, Drug Delivery Products), By Raw Material (Plastic Resin, Nonwoven Material), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-258-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Medical Disposables Market Size & Trends

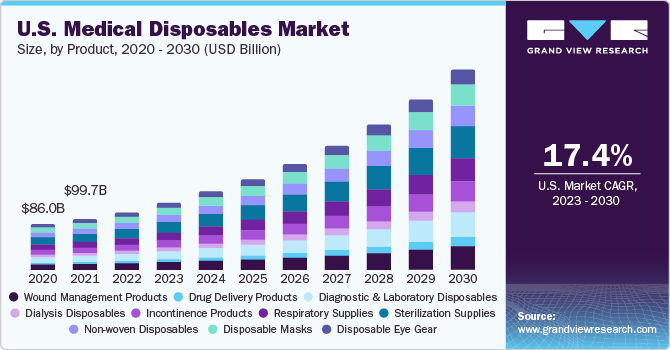

The global medical disposables market size was estimated at USD 426.85 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 17.2% from 2023 to 2030. The market is driven by various factors such as the rising incidence of Hospital Acquired Infections (HAIs), the increasing number of surgical procedures, the rising geriatric population globally, and the growing prevalence of chronic diseases leading to longer hospital admission.For instance, as projected by the American Heart Association, 45.1% of the U.S. population, or more than 130 million adults, are projected to suffer from some form of cardiovascular disease (CVD) by 2035. Moreover, about 655,000 Americans die from heart disease annually, that’s 1 in every 4 deaths. This, in turn, is expected to boost market growth in the near future.

Furthermore,the increasing healthcare expenditure, particularly in developed countries, has been a significant driver of the medical disposables market. With the growing aging population, there is a growing demand for healthcare services, including surgical procedures, diagnostic tests, and long-term care. This demographic shift has led to a surge in the use of medical disposables such as syringes, gloves, catheters, and wound care products. The need for these disposables to maintain hygiene standards and prevent cross-contamination in healthcare settings is contributing to the market growth.

Infection control has become a top priority in healthcare facilities globally, given the rise of healthcare-associated infections (HAIs) and the increasing prevalence of antibiotic-resistant bacteria. Regulatory authorities have implemented stringent guidelines and standards to ensure patient safety, which has mandated the use of single-use medical disposables to minimize the risk of infection transmission. This regulatory environment has compelled healthcare providers to adopt disposable products over reusable alternatives, further propelling market growth. For instance, in October 2022, RRCAT partnered with BD India to successfully launch the inaugural batch of medical devices sterilized using cutting-edge electron beam technology which is expected to drive the market growth in the near future.

Furthermore, continuous technological advancements and increasing number of contracts are also driving market growth. Innovations such as advanced materials, improved manufacturing processes, and the integration of smart technologies into disposable medical devices have enhanced their performance, durability, and usability. For instance, the development of self-adhesive and antimicrobial dressings has revolutionized wound care, promoted faster healing, and reduced the risk of infection. These innovations not only drive market growth but also improve patient outcomes. For instance, on July 25, 2022, Quipt Home Medical Corp. made a significant announcement regarding the signing of a contract with Cardinal Health at Home, a division of Cardinal Health, Inc. Under this agreement, Quipt committed to providing disposable medical supplies across the nation, while Cardinal Health committed to supplying and distributing these essential medical products.

Product Insights

In terms of product, the sterilization supplies segment dominated the market in 2022 with a share of over 10.82%. Infection control is of paramount importance in healthcare facilities. Contaminated medical instruments and equipment can lead to healthcare-associated infections (HAIs), which pose significant risks to patients and increase healthcare costs. Sterilization supplies, such as autoclaves, sterilization pouches, and chemical indicators, are crucial for ensuring that medical devices and instruments are free from pathogens and safe for patient use. This emphasis on patient safety and infection prevention drives the demand for sterilization supplies.

The diagnostic and laboratory disposables segment is anticipated to witness the fastest CAGR of 19.3% during the forecast period. The demand for diagnostic tests has increased significantly due to factors such as an aging population, the prevalence of chronic diseases, and increased awareness of preventive healthcare. Diagnostic and laboratory disposables play an important role in providing accurate and safe testing procedures. Products such as disposable test tubes, sample collection containers, and pipette tips are essential for specimen collection, transport, and analysis, contributing to the growth of this segment.

Raw Material Insights

In terms of raw material, the plastic resin segment dominated the market in 2022 with a revenue share of 57.58% as these are more cost-effective to produce than alternative materials like glass or metal. This cost advantage makes plastic resins an attractive choice for manufacturers of medical disposables, as it helps keep production costs low, allowing for competitive pricing in the market. Moreover, plastic disposable products are lightweight, which makes them easy to handle for healthcare professionals.

The nonwoven material segment is projected to witness the fastest CAGR of 18.1% during the forecast period.Nonwoven materials are highly effective in providing a barrier against the transmission of microorganisms, making them essential for infection prevention and control in healthcare settings. Nonwoven products such as surgical gowns, masks, drapes, and sterilization wraps are designed to reduce the risk of cross-contamination, making them integral to healthcare practices.

End-use Insights

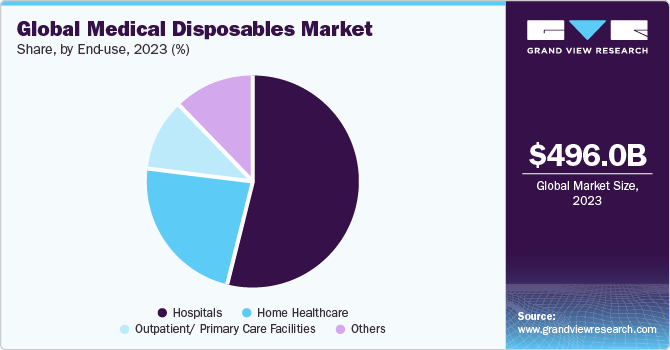

In terms of end-use, the hospitals segment dominated the market in 2022 with a revenue share of 53.65% as they offer a wide range of medical services and treatments, covering various medical specialties and procedures. Each of these specialties and procedures often requires specific medical disposable products tailored to the clinical requirements. As a result, hospitals need a diverse array of disposable products to support their varied services, thus driving market growth.

The home healthcare segment is anticipated to witness the fastest CAGR of 17.8% over the forecast period. This is due to growing preference for in-home healthcare services and the increasing aging population. With an aging demographic in many regions, there is a heightened demand for home healthcare services, driving the need for disposable medical supplies to facilitate care for elderly patients. This market encompasses a wide range of disposable medical products designed for use in home healthcare settings, ensuring convenience, safety, and hygiene for patients receiving medical care in the comfort of their homes. Furthermore, patients increasingly favor receiving medical treatment at home, and advancements in technology have made it feasible to provide complex care in a home setting, necessitating the use of disposable medical products.

Regional Insights

Based on region, North America held the largest market share of about 33.38% in 2022. North America has a highly developed and advanced healthcare infrastructure, hospitals, clinics, and medical facilities. This infrastructure is well-equipped to offer a wide range of medical services, including surgeries, diagnostics, and specialized treatments, all of which require various medical disposable products.Intense market competition, driven by both domestic and international players, has fostered innovation in materials and manufacturing processes, leading to the development of advanced, high-performance medical disposables.

Middle East & Africa region, on the other hand, is estimated to grow at the fastest CAGR of 18.3% from 2023 to 2030. The MEA region has a rapidly growing population, which is contributing to higher healthcare needs. Awareness about the importance of infection control in healthcare settings has been on the rise, especially in the wake of global health crises like the COVID-19 pandemic. This has led to greater demand for disposable personal protective equipment (PPE) and other medical disposables. Furthermore, advances in materials and manufacturing technologies have allowed for the development of more advanced and efficient disposable medical products in this region, thus driving market growth.

Key Companies & Market Share Insights

Companies are increasingly emphasizing research and development efforts to create cutting-edge products that can give them a competitive advantage. In addition to this, they are actively pursuing partnerships, mergers, and acquisitions as strategic initiatives to bolster their product offerings, expand their manufacturing capabilities, and establish competitive differentiation in the market. For instance, in May 2023, Indegene expanded its partnership with ConTIPI Medical, a company specializing in non-invasive and disposable solutions for women experiencing diverse pelvic floor disorders. This extended partnership aims to introduce a novel device to the market. Furthermore, in March 2022, FMCNA's Renal Therapies Group launched the CombiSet SMARTECHTM, a groundbreaking single-use bloodline with an integrated Crit-Line blood chamber (CLiC), simplifying hemodialysis by reducing manual connections. This innovation enhances renal care, especially when used with 2008 series hemodialysis machines. Some prominent players in the global medical disposables market include:

-

Medline Industries, Inc.

-

Smith & Nephew PLC

-

Bayer AG

-

BD

-

3M

-

Cardinal Health

Medical Disposables Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 496.01 billion

The revenue forecast in 2030

USD 1,510.08 billion

Growth rate

CAGR of 17.2% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material,end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Medline Industries, Inc.; Smith & Nephew PLC; Bayer AG; BD; 3M; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Disposables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the medical disposables market based on product, raw material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Management Products

-

Drug Delivery Products

-

Diagnostic and Laboratory Disposables

-

Dialysis Disposables

-

Incontinence Products

-

Respiratory Supplies

-

Sterilization Supplies

-

Non-woven Disposables

-

Disposable Masks

-

Disposable Eye Gear

-

Disposable Gloves

-

Hand Sanitizers

-

Gel

-

Foam

-

Liquid

-

Other

-

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Resin

-

Nonwoven Material

-

Rubber

-

Paper and Paperboard

-

Metals

-

Glass

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

Rest of MEA

-

Frequently Asked Questions About This Report

b. The global medical disposables market size was estimated at USD 426.85 billion in 2022 and is expected to reach USD 496.01 billion in 2023.

b. The global medical disposables market is expected to grow at a compound annual growth rate of 17.2% from 2023 to 2030 to reach USD 1,510.08 billion by 2030.

b. North America dominated the medical disposables market with a share of 33.3% in 2022. This is attributable to the presence of a well-established healthcare infrastructure, and growing awareness regarding the effects of cross-contamination and infection control measures.

b. Some key players operating in the medical disposables market include 3M, Johnson & Johnson Services, Inc., Abbott, Becton, Dickinson & Company, Medtronic, B. Braun Melsungen AG, Bayer AG, Smith and Nephew, Medline Industries, Inc., and Cardinal Health.

b. Key factors that are driving the medical disposables market growth include increased general healthcare awareness, increasing prevalence of lifestyle-associated and other chronic diseases, and rising awareness regarding the infection prevention control norms post-pandemic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.