- Home

- »

- Consumer F&B

- »

-

Meat Substitutes Market Size, Share & Growth Report, 2030GVR Report cover

![Meat Substitutes Market Size, Share & Trends Report]()

Meat Substitutes Market Size, Share & Trends Analysis Report By Source (Plant-based Protein, Mycoprotein), By Distribution Channel (Foodservice, Retail), By Region (Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-405-5

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

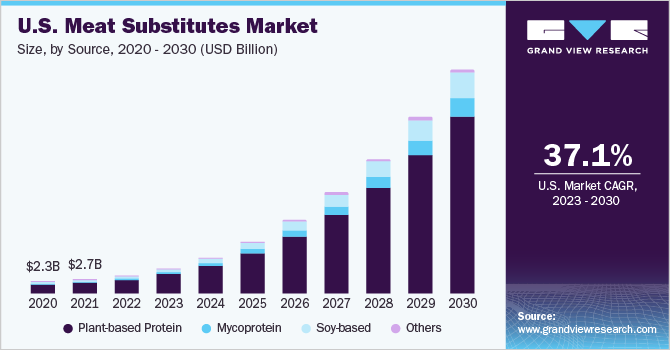

The global meat substitutes market size was estimated at USD 12.95 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 43.6% from 2023 to 2030. Intensive animal farming has faced criticism from certain segments of society due to its adverse impacts on both the environment and animal welfare. As a result, this has given rise to the emergence of diets that either exclude or restrict the consumption of animal products. This is expected to facilitate the market growth for meat substitutes. The outbreak of the COVID-19 pandemic has drastically impacted the consumption pattern of traditional meat due to rising health consciousness among the consumers. The fear of an increasing number of animal-borne diseases has raised health concerns among consumers, which has resulted in decreased intake of animal products.

The awareness among consumers regarding plant-based meat substitutes is increasing, as a rising number of individuals are seeking these alternatives due to their acknowledged health advantages. These benefits include the potential prevention of non-communicable diseases, digestive problems, and obesity. In the present era, consumers have become highly mindful of their health due to the high incidences of obesity and diseases like heart disease and diabetes. Consequently, consumers are actively transforming their dietary choices and embracing healthier eating habits, which is anticipated to stimulate the demand for meat alternatives.

The increasing awareness among consumers regarding the advantages of a vegan diet stands as a significant driver behind the global demand for plant-based products. Furthermore, the presence of cholesterol-free protein in these products serves as another crucial factor fueling their growth across various regions. The enormous growth in the meat alternatives market is due to a mix of customer concerns and ability of manufacturers to provide meat replacements with superior texture, flavor, and mouthfeel attributes. Gen Z and Millennials are driving demand for this industry, which is typically fueled by concern for health, climate change, and animal welfare.

Many manufacturers have been partnering with brands to offer products in this category. For instance, Next Meats, a company based in Tokyo, formed a partnership with Vegan Meat India in December 2021 to introduce meat-free products in the country. Consumers have access to a wide array of products, offering them greater choices and inventive flavors, all the while catering to their dietary requirements. Even non-vegetarian and non-vegan consumers are embracing plant-based alternatives for various reasons, including improved nutrition, weight management, concern for animal welfare, and long-term environmental sustainability.

In 2019, the Good Food Institute reported that 11.9% of American households purchased plant-based meat, indicating a rise from 10.5% the previous year. Another popular trend is the use of whole veggies and grains on ingredient lists. For health-conscious buyers, seeing known substances on product labels is becoming increasingly vital. Consumers are increasingly looking for packages with reputable third-party certificates. Producers of meat substitutes are now providing products with transparent labeling that show whether the product is non-GMO, gluten free, vegan, and kosher. As a result, the increasing demand for plant-based alternatives and substantial investments in innovative products are expected to continue to offer profitable opportunity for the expansion of the market.

Source Insights

The plant-based protein segment held the largest revenue share of 62.32% in 2022 and is expected to maintain dominance over the forecast period. Meat shortages in different regions of the world, environmental concerns, and a desire to eat a healthier diet are some of the reasons driving the growth of this segmentPlant-based patties, along with popular snacks, such as tofu and hummus, offer excellent choices for fulfilling daily protein needs. The global trend of plant protein is primarily driven by young, affluent customers, with wellness enthusiasts also contributing to the growth of this category. The products made from plant protein and mycoprotein possess the texture, flavor, and nutritional properties of meat but are made from non-animal sources.

Target plant proteins isolated from plants, are put through hydrolysis to increase their functionality. Plant proteins are combined with components, such as flour, food adhesives, and plant-based oil, to create a meat texture. Protein inputs for new plant-based meat are plentiful and reasonably priced. Hence, the volume of meat substitutes from plant-based protein source is high and is the main factor for the dominance of the segment. However, the mycoprotein segment is projected to register the fastest CAGR of 44.8% from 2023 to 2030. Owing to higher content of nutrients like fiber that helps in controlling blood cholesterol and blood sugar, consumers prefer mycoprotein food.

Furthermore, mycoprotein makes feel fuller than some animal proteins like chicken. Thus, help prevent overeating and weight gain. In addition, mycoprotein provides all essential amino acids which is rarely found in other protein sources. Quorn, a mycoprotein brand offer super-protein, healthy, meals for consumers. For vegans and vegetarians, meat alternatives were earlier limited to soya chunks and mushrooms, and cottage cheese. Because of its texture and adaptability, jackfruit, as a newcomer to the market, has been generating a lot of buzz and gaining popularity. Because of its distinct qualities, the fruit is commonly referred to as a superfood because of its numerous nutritional benefits.

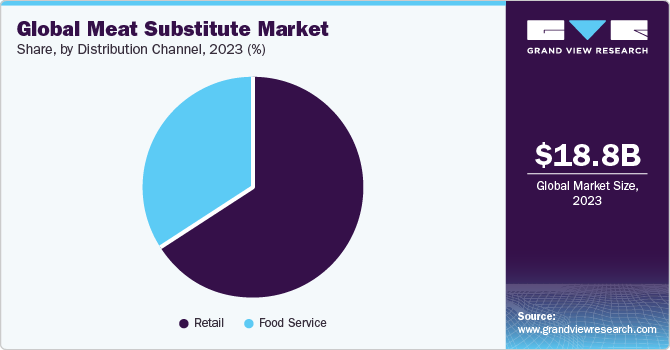

Distribution Channel Insights

The retail segment led the market and accounted for the largest revenue share of 66.06% in 2022. The segment includes all retail outlets, such as hypermarkets, supermarkets, convenience stores, mini markets, and departmental stores. Consumers prefer these stores as they offer huge discounts and offers. Furthermore, majority of the brands launch their product through big chains of supermarkets, such as Walmart and Target, to reach maximum customers. The foodservice segment is anticipated to register the fastest CAGR of 44.0% from 2023 to 2030. The category includes outlets, such as restaurants, lounges, and hotels.

The COVID-19 pandemic has led to shutdowns and lockdowns across the world. This has led to a reduction in sales from these channels. However, reopening of economic activities across the world, with people focusing on socializing, and parties are likely to increase sales through this distribution channels. One of the key factors driving the global foodservice market is the growing demand for customization and innovation in food menu options. Consumers enjoy a broad selection of choices when it comes to personalizing their meals to suit their individual tastes, dietary requirements, and budgetary considerations.

Plant proteins are experiencing huge demand, with retailers offering plant-based protein products and restaurants introducing plant-protein menu innovations. Consumers throughout the world, including vegetarian, non-vegetarian, and flexitarian, are responding with eagerness and enthusiasm for innovative products, such as meat-like plant protein lattes, plant protein burgers, and plant-based protein meal kits. Consumers benefit from manufacturers' enthusiastic response to the trend in two ways: availability and price obstacles are reducing as more plant-based protein products are launched in specialty, conventional supermarket, and foodservice channels.

Regional Insights

Europe made the largest contribution in the global market accounting for the maximum revenue share of 39.60% in 2022. The region has been witnessing high demand, both from young and elder consumers. This is primarily due to an increase in vegan & flexitarian consumer base and rise in awareness among consumers regarding animal welfare. 10 years ago, meat alternatives were virtually non-existent in Germany. However, with the entrance of renowned processed food companies, Germans have caught up with Americans in terms of their consumption of meat substitutes. The collaboration between McDonald's and Nestlé, a prominent player in the meatless industry, to introduce a vegan burger in Germany is not a coincidence.

North America accounted for the second-largest revenue share of 33.8% in 2022. The majority of people rely on meat products for their daily protein needs in the region. There has been a significant shift in consumer attitudes towards plant-based diets and sustainability. More people in North America are adopting vegetarian, vegan, or flexitarian lifestyles, seeking healthier and more environmentally friendly food choices. This growing consumer demand is driving the expansion of the market. Many consumers are becoming more health-conscious and are actively seeking out alternatives to traditional meat products.

Meat substitutes offer a plant-based protein option that is often lower in saturated fat and cholesterol compared to animal meat. They can also provide additional nutritional benefits, such as being a good source of fiber and containing various vitamins & minerals. According to a survey by International Food Information Council, the consumption of products that possess the same flavor and texture of animal protein but are made with only plant products was reported by nearly two out of three people (65%). In particular, 20% respondents claimed that they consumed these products at least weekly, and a slightly higher percentage (22%) reported that they did so every day.

Asia Pacific is the fastest-growing market and is expected to witness a CAGR of 48.6% from 2023 to 2030. Countries like China and Australia contribute most of the share in the region. Rising health consciousness and social media influence have led to increased consumption of such products in these countries.As the trend moves away from consuming animal protein and towards adopting a plant-based diet, there has been a significant increase in the demand for top-notch plant-based alternatives. In the past, there were limited options available for high-quality vegetarian and vegan substitutes, often relying on unhealthy and heavily processed ingredients.

As a result of the COVID-19 pandemic, Asian consumers exhibit heightened concerns regarding food safety, health, and environmental impact, leading many to proactively modify their diets to embrace healthier and more sustainable lifestyles. The potential for introducing new and delectable food options in Asia is undoubtedly substantial, with customers desiring these choices as their primary preference rather than mere alternatives. In April 2021, ADM marked the inauguration of its state-of-the-art plant-based innovation laboratory at the Biopolis research hub in Singapore. This development aims to meet the growing food and beverage demands in the region. The laboratory's focus is on developing cutting-edge, trendy, and nutritious products.

Key Companies & Market Share Insights

The market has the presence of companies with strong network and are still developing. New entrants as well as other key players are launching new products due to the increasing health concerns as a result of rising animal-borne diseases across the globe. Some of the initiatives undertaken are:

-

In January 2022, KFC launched Beyond Fried Chicken made of plant-based meats at different location globally

-

In December 2021, ITC Ltd. launched plant-based meat products, in anticipation of the burgeoning demand for meat substitutes and vegan meals in India

Some of the prominent players in the global meat substitutes market include:

-

Amy’s Kitchen, Inc.

-

Beyond Meat

-

Impossible Foods Inc.

-

Quorn Foods

-

Kellogg Co.

-

Unilever

-

Meatless B.V.

-

VBites Foods Ltd.

-

SunFed

-

Tyson Foods, Inc.

Meat Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.78 billion

Revenue forecast in 2030

USD 234.66 billion

Growth rate

CAGR of 43.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Amy’s Kitchen Inc.; Beyond Meat; Impossible Foods Inc.; Quorn Foods; Kellogg Co.; Unilever; Meatless B.V.; VBites Foods Ltd.; SunFed; Tyson Foods, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat Substitutes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the meat substitutes market report based on source, distribution channel, and region:

-

Source Outlook (Revenue, USD Billion, 2017 - 2030)

-

Plant-based Protein

-

Mycoprotein

-

Soy-based

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Foodservice

-

Retail

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global meat substitutes market size was estimated at USD 12.95 billion in 2022 and is expected to reach USD 18.78 billion in 2023.

b. The global meat substitutes market is expected to grow at a compounded growth rate of 43.6% from 2023 to 2030 to reach USD 234.66 billion by 2030.

b. Plant-based protein dominated the global meat substitutes market with a share of 63.32% in 2022. This is attributed to meat shortages in different regions of the world, environmental concerns, and a desire to eat a healthier diet.

b. Some key players operating in the meat substitutes market include Amy’s Kitchen Inc.; Beyond Meat; Impossible Foods Inc.; Quorn Foods; Kellogg Co.; Unilever; Meatless B.V.; VBites Foods Ltd.; SunFed; Tyson Foods, Inc.

b. Key factors that are driving the meat substitutes market growth include rising consumer awareness of the environmental impact of meat production, growing health consciousness and concerns regarding animal welfare.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Amidst the global pandemic crisis and the indefinite lockdown across nations, the consumer food & beverage industry first witnessed high demand for household staples, healthy food items, and consumables with longer shelf lives. The demand for frozen food products, fruits & vegetables, eggs, flour, and whole grains, among others, witnessed a considerable increase during the early stages of the crisis. Presently, most companies in the industry are faced with low consumption of their products and supply chain challenges. The companies are focusing more on altering their supply chains in order to reinforce their online presence and delivery measures, in an attempt to adapt to the present business environment. The changes in consumer buying behavior and the dynamic shifts towards online and D2C distribution channels may have serious implications on the near future growth of the industry. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.