- Home

- »

- Consumer F&B

- »

-

Meal Kit Delivery Services Market Size & Share Report, 2030GVR Report cover

![Meal Kit Delivery Services Market Size, Share & Trends Report]()

Meal Kit Delivery Services Market Size, Share & Trends Analysis Report By Offering (Heat & Eat, Cook & Eat), By Service (Single, Multiple), By Platform (Online, Offline), Meal Type (Vegan, Vegetarian), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-224-2

- Number of Pages: 136

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global meal kit delivery services market size was USD 20.54 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.3% from 2023 to 2030. Increasing preference for home-cooked and chef-cooked food among millennials is a major factor contributing to the growth of the market. The delivery service has been gaining high popularity and adoption among Generation Y and Z. The increasing preference for the product is driven by the benefits of homemade meals, as they are more economical in comparison to take-outs and home delivery services. The COVID-19 pandemic has offered a huge opportunity to the meal kit delivery services market as almost all the restaurants, eateries, and hotels were shut down across the globe. People have started focusing on a healthy diet more than ever to increase their immunity and maintain a balanced diet. As a result, an increasing number of people have been looking for healthy and easy meal options.

Furthermore, key players in the market have witnessed a surge in sales during the pandemic as compared to 2019. Companies like Blue Apron have also reported a hike in global sales, followed by HelloFresh, which doubled its customer base in the U.S. with an increase of 66% in its Y-O-Y revenue.

The heat & eat segment has been gaining traction among U.S. consumers as several delivery service companies have been tapping into this segment by launching single and multiple servings for consumers. For instance, homemade food is more economical than eating at a restaurant. Furthermore, the product's availability has made homemade meals more time-saving compared to take-outs and home delivery services. Preparing food at home also gives full control over the ingredients one wishes to use and comes in handy for people who are allergic to certain food ingredients or are trying to avoid specific ingredients.

According to a survey conducted by HUNTER in April 2020, 54% of American consumers cook more than before, and 22% order prepared meal kits more frequently. Dining in is becoming more popular than dining out. Boomers and millennials increasingly prefer staying at home and cooking or ordering in rather than spending money at restaurants. Consumers are also making fewer restaurant visits and opting to stay at home.

One of the key factors contributing to this shift is the attitudes and behaviors of the two largest generational groups—boomers and millennials. While millennials have surpassed baby boomers in number, boomers remain a large population, and their behaviors significantly influence the marketplace that caters to cooking at home.

Meal kit delivery services are an ideal solution since meal planning in advance significantly helps reduce food wastage. Meal kits have ingredients in the exact quantity that is required to prepare a meal since each portion is pre-measured. Several delivery service companies offer larger portions but still provide calorie counts and nutritional information based on the portions.

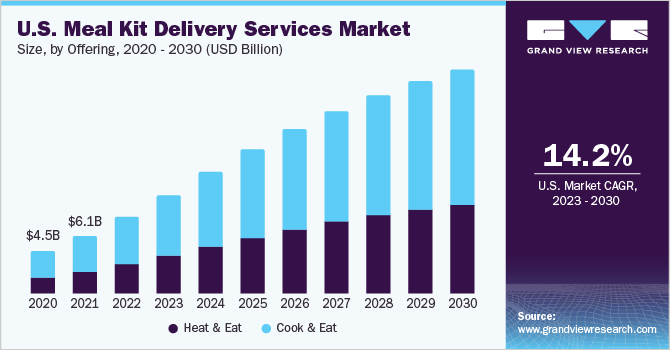

Offering Insights

Cook & eat meal kit delivery service held a larger market share of 60.6% in 2022 and is expected to maintain dominance over the forecast period. The dominance can be attributed to the popularity of gourmet-style home cooking amongst youngsters. It also lets one try new recipes or gourmet meals without spending extra money eating at restaurants. These recipes are more time intensive than the heat & eat segment but are a big-time saver than the conventional method of cooking. Further, it saves a lot of time going to supermarkets & grocery stores as all the ingredients come pre-portioned in the amount required for a single person or more.

However, the heat & eat segment is projected to register faster growth during the forecast period, with a CAGR of 15.7% from 2023 to 2030. Heat & eat meal kit delivery service providers offer meals prepared by chefs to consumers. The consumers can either choose their ingredients for the food or select from the already available recipes on the website. These kits have been gaining popularity across the globe owing to the comfort and accessibility of products. For instance, Freshly Inc. offers customized meals as well as its signature collection that includes Dijon Pork Chop and Traditional Beef Stew, among others. The average refrigerated shelf life of prepared these is around 3-5 days, and it takes around 5-15 minutes to heat and serve them.

Service Insights

The single delivery service contributed a share of 57.7% of the global revenue in 2022. The single delivery service segment is extremely convenient for bachelors who are studying, pursuing a degree, or are staying away from family and are working or involved in a particular job and are unable to invest enough time in cooking. Furthermore, most of these bachelors are not well versed in healthy cooking. Thus, service providers offer a complete solution to these issues of a single bachelor. Most of these single people have been looking for a healthier diet that benefits both body and mind.

The multiple delivery service segment is expected to register faster growth during forecast years, with a CAGR of 15.7% from 2023 to 2030. Families are becoming busier and more stressed as a large number of families feature two working parents. To reduce this burden, households opt for these delivery services that provide proper solutions to time and effort-intensive cooking tasks. Lack of time is typically the main reason for lack of participation in conventional cooking. The generation of millennials is known for being foodies and thus wants something that falls between conventional cooking and saving time. Thus, these multiple meal kit service providers offer the perfect solution to these problems.

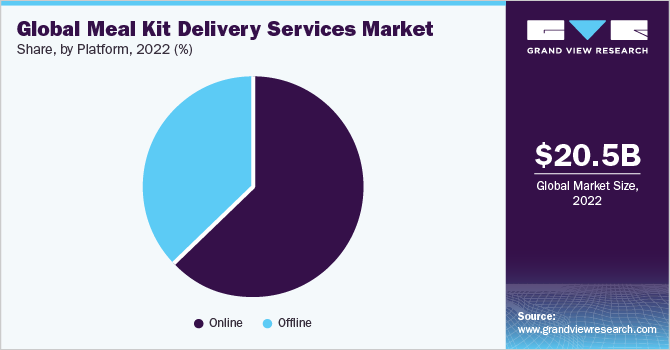

Platform Insights

The online platform accounted for a share of 63.2% of the global revenue in 2022. Companies have established online platforms that are capable of providing client service through greater flexibility by being available round the clock. The majority of companies offer their products through their websites to offer consumers convenience. Customers prefer to visit websites and find out about the weekly and monthly menu and the types of food subscriptions available instead of visiting the service provider in person or over a call. It also helps the companies to serve customers settled across a geographical area.

The offline platform is expected to register faster growth during forecast years, with a CAGR of 15.7% from 2023 to 2030. These products are available at Walmart, Kroger, Tesco, and other major retailers. Both small and large companies offer their products through this channel due to the large consumer base of these stores. Moreover, many consumers like to purchase these products with other grocery items, which is driving the demand through offline platforms. Several retailers such as Raley's, Walmart, and Meijer, Inc. have also begun launching their own meal kits featuring varieties of veg and non-veg dishes, owing to the rising consumer base that does not want the commitment of a subscription.

Meal Type Insights

Non-vegetarian meal kit delivery service held the largest market share of 63.5% in 2022 and is expected to maintain dominance over the forecast period. The segment’s growth can be attributed to the presence of protein and vitamins & minerals such as A, B6, B12, niacin, and thiamine in meat, making it appealing to consumers who want to include lean protein in their diets. Several product delivery service companies offer a diverse variety of fresh, value-added, and healthy meats, driving the consumption of non-vegetarian meal kits. Other factors drive product demand, such as growing awareness of the benefits of consuming non-vegetarian diets, including fish and chicken.

The vegetarian meal kits segment is expected to grow at a CAGR of 15.5% from 2023 to 2030. One of the main reasons why many people follow a vegetarian diet is that they prefer to consume a high proportion of fresh, healthful, plant-based foods, which provide antioxidants and fiber, along with various long-term health benefits. Most likely, the adoption of plant-based and cruelty-free diets is the factor responsible for the increase in the number of vegetarians across the globe. These figures indicate that the demand for vegetarian and vegan kits is expected to increase.

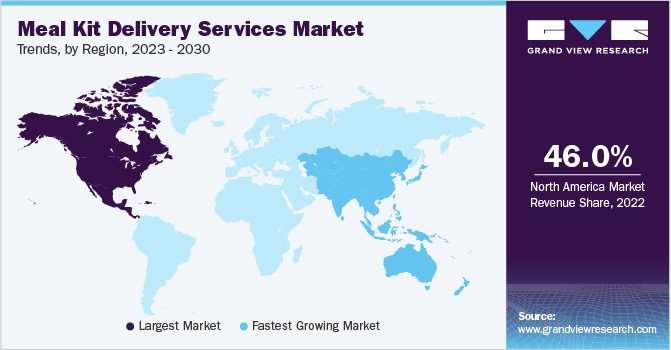

Regional Insights

North America made the largest contribution to the market at 46.01% in 2022. A large number of consumers purchase these kits in the region to save their time and effort. The product has become a healthier and inexpensive alternative to pre-cooked food items available in retail stores, delivery services, or restaurants. Furthermore, companies such as Blue Apron and Sun Basket have witnessed a sharp increase in product demand during the COVID-19 outbreak, as consumers feel it is safer to eat home-cooked food. In March 2020, Blue Apron experienced increased demand for its meal kits, reflecting, in part, changes in consumer behavior in response to the COVID-19 pandemic.

Asia Pacific is the fastest-growing market and is expected to witness a CAGR of 16.7% from 2023 to 2030. The market is expected to witness incredible growth in the region due to the convenience and freshness of the product. The increasing number of time-poor consumers in the region has been propelling the demand for these delivery services. China, Japan, and South Korea are the region's key markets. Furthermore, COVID-19 has increased the interest in home-cooked food and surged the demand for the product in the nation. Countries including Australia, Japan, China, Singapore, Sri Lanka, South Korea, and India are driving the vegetarian and vegan meal kits market.

The European meal kit delivery services market is expected to grow at a CAGR of 15.3% from 2023 to 2030. The market growth in Europe is driven by several factors, including changing consumer lifestyles, the desire for convenient and healthy meal options, and the increasing adoption of online delivery services. The COVID-19 pandemic has further accelerated the market's growth in Europe, as the pandemic has caused a considerable shift in consumer behavior for cooking at home, resulting in a rise in demand for meal kit delivery services.

Due to this emerging trend, companies operating in this space have witnessed significant increases in their revenues in 2020 and 2021. For instance, HelloFresh, a publicly traded meal kit company, has seen a 140% rise in sales for 2020 and a further 61.5% rise in sales in 2021 in the UK. Moreover, many new companies have entered the market over the past few years, such as AllPlants, based in the UK; Frichti, a French startup; and Les Commis, based in Belgium. This is also expected to drive the Europe regional market during the forecast period.

Key Companies & Market Share Insights

The meal kit delivery services market is characterized by the presence of a few well-established players and several small and medium players. Mergers, acquisitions, and product launches remain one of the key strategic initiatives in the industry. For instance:

-

In August 2021, Freshly Inc. launched its first-ever plant-based prepared meals line – ‘Purely Plant’, including six new meals featuring plant-based proteins made with clean, whole-food ingredients to cater to ongoing demand for variety, taste, nutrition, plant-based meal options and convenience among consumers. Meals can be heated and served in three minutes with no preparation required.

-

In November 2020, HelloFresh acquired Factor75, LLC for USD 277 million. The acquisition was aimed at strengthening HelloFresh’s position in the U.S. market and increasing its consumer base across the country.

-

In October 2020, Nestlé acquired Freshly Inc. for USD 950 million. This acquisition aimed to boost the growth opportunities for Freshly Inc. and allowed Nestlé to enter the fast-growing industry in the U.S.

Some of the key players operating in the global meal kit delivery services market include:

-

Blue Apron, LLC

-

Freshly Inc.

-

HelloFresh

-

Sun Basket

-

Relish Labs LLC (Home Chef)

-

Gobble

-

Marley Spoon Inc.

-

Purple Carrot

-

Fresh n' Lean

-

Hungryroot

Recent Developments

-

In April 2023, Blue Apron and Dashmart by DoorDash unveiled the extension of their partnership, enabling the widespread delivery of Blue Apron's Heat & Eat meals in 11 markets, including New York City, through DashMart. This strategic move exemplifies the companies' commitment to expanding their customer base and enhancing product accessibility by leveraging DashMart's platform beyond the successful initial pilot program in Philadelphia

-

In January 2022, Home Chef strategically joined forces with renowned chef and Skinnytaste founder, Gina Homolka, to introduce fresh and nutritionally balanced meals to households across the nation. Throughout the collaboration, Home Chef seamlessly integrated three rotating Skinnytaste recipes into its weekly offerings, presenting customers with a diverse selection of health-conscious and delectable choices, aligning with their goal to cater to the demand for convenient and well-balanced meal options

-

In December 2022, Rachael Ray collaborated with Home Chef to deliver her meal kits to the public, providing pre-portioned ingredients and easy-to-follow instructions. Rachael Ray Home Chef meal kits come with pre-portioned ingredients and user-friendly instructions similar to Blue Apron and Hello Fresh. Home Chef released new Rachael Ray meal kits weekly until March 2023, offering customers a range of convenient and delicious options to try

Meal Kit Delivery Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.29 billion

Revenue forecast in 2030

USD 64.27 billion

Growth rate

CAGR of 15.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updtaed

May 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, service, platform, meal type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia and New Zealand; Brazil

Key companies profiled

Blue Apron, LLC; Freshly Inc.; HelloFresh; Sun Basket; Relish Labs LLC (Home Chef); Gobble; Marley Spoon Inc.; Purple Carrot; Fresh n' Lean; Hungryroot

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meal Kit Delivery Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global meal kit delivery services market report based on offering, service, platform, meal type, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Heat & Eat

-

Cook & Eat

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Single

-

Multiple

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Meal Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Vegan

-

Vegetarian

-

Non-Vegetarian

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia and New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global meal kit delivery services market size was estimated at USD 20.54 billion in 2022 and is expected to reach USD 26.29 billion in 2023.

b. The global meal kit delivery services market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 64.27 billion by 2030.

b. The single service kits captured the largest share of more than 57% in 2022 in the meal kit delivery services market.

b. The online platform accounted for the largest share of more than 63% in 2022, in the global meal kit delivery services market.

b. North America held the largest share of 46.01% in the meal kit delivery services market in 2022. A large number of consumers purchase these kits in the region to save their time and effort.

b. The meal kit delivery services market in the U.K. was valued at USD 896.0 million in 2022 and is expected to grow at a CAGR of nearly 15.9% during the forecast period to reach a market valuation of nearly USD 3 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."