- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luxury Footwear Market Size, Share & Growth Report, 2030GVR Report cover

![Luxury Footwear Market Size, Share & Trends Report]()

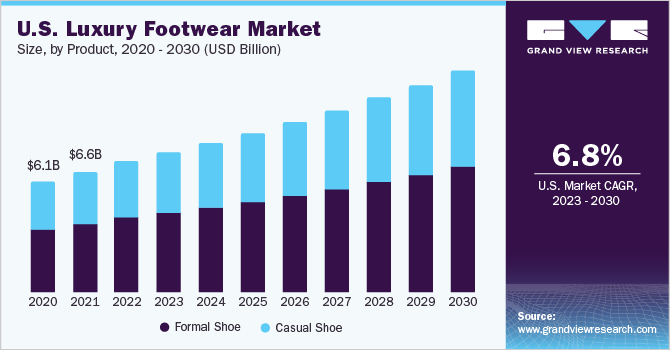

Luxury Footwear Market Size, Share & Trends Analysis Report By Product (Formal Shoe, Casual Shoe), By End-user (Men, Women, Children), By Distribution Channel (Online, Offline), By Region, and Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-106-6

- Number of Pages: 88

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

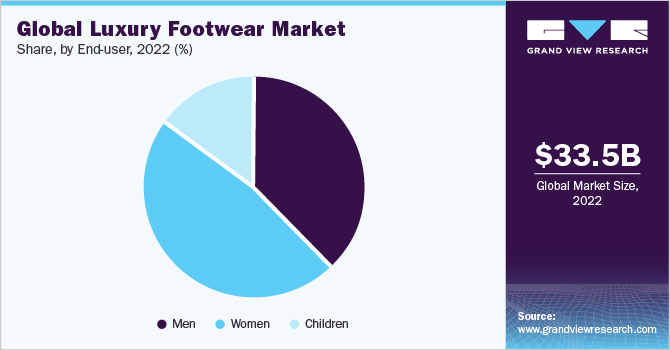

The global luxury footwear market size was valued at USD 33.52 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030. The market is driven by an increasing number of millionaires worldwide, especially among the millennial segment. According to a report by CNBC LLC, in 2019, in the U.S., there were 618,000 millennial millionaires, among which close to 93% of millennials hold a net wealth between USD 1 million to USD 2.5 million. Demand for luxury footwear has been rising among the millennials. This footwear is characterized by enhanced qualities, such as material, durability, uniqueness, and comfort, which is a prominent factor driving the market. Growing preference for attractive luxury footwear as a symbol of status as well as the inclination of consumers towards flaunting various international brands, such as Louis Vuitton, Gucci, Chanel, Burberry, and Prada, are driving the product demand.

COVID-19 has had a severe impact on the luxury footwear industry. Store closures due to quarantine and lockdown measures have resulted in grim consequences, with sales decreasing considerably from January to April 2020. According to a report by World Footwear, sales of footwear declined by close to 42% in the U.S. at the end of the first quarter of 2020. The pandemic disrupted production as well as the sales of luxury footwear across many countries through both online and offline channels due to social distancing and stay-at-home policies. In addition, the pandemic situation has goaded people to spend more judiciously and avoid frivolous purchasing. People have been refraining from buying luxurious footwear, which is usually way too costlier than normal footwear.

Major brands have been adopting lucrative ways to attract different consumer classes, including HENRYs (High-Earners-Not-Rich-Yet), who are digitally savvy and are big spenders. Manufacturers offer inclusive, individualized, and self-expressive products to onboard this demographic, which will fuel the market growth. For instance, Modello Domani, a luxury footwear company that specializes in handcrafted premium footwear, offers complete footwear customization with monograms and designs for men, women, and children that suit the consumer’s style and size.

Many manufacturers have been adopting sustainable manufacturing practices, given the rising popularity of ethically-sourced footwear around the world. According to a report by GlobeNewswire, Inc., in 2019, more than 25% of consumers consider sustainability factors while buying apparel and footwear with many people willing to pay a premium price for these products. This has led many designers of luxury footwear to focus on sustainability. For instance, in February 2019, Alfredo Piferi, head designer at Jimmy Choo, debuted his sustainable luxury footwear collection at Milan Fashion Week, consisting of composite sleek boots and curvy sandals made of recycled synthetics, recycled polyester, recycled lurex, and recycled plastic bottles.

Moreover, factors like the growing preference for attractive luxury footwear as a symbol of status and inclination toward flaunting luxury brands among their social groups are driving the demand for luxury sneakers. Furthermore, Europe is home to some of the largest fashion houses in the world.

For European consumers, buying high-priced luxury items satisfies their psychological needs for status and exclusivity, which has resulted in the increased popularity of luxury brands in the region. According to FootActive, Gucci is one of the most well-known luxury shoe brands in Europe, with 215,000 online searches. It was the most popular shoe brand among 31 countries, including France, Russia, and Spain, according to a ranking of the top 10 companies. Valentino is the most popular shoe brand in the U.K., with over 12,000 searches. Valentino shoes were the most sought for in countries like Italy, Bulgaria, and Croatia.

Product Insights

Formal shoe luxury footwear led the market and accounted for 58.2% share of the global revenue in 2022. The rising importance of luxury footwear as a reflection of one’s professionalism at the workplace, particularly in corporate and fashion industries, is expected to remain a prominent factor in augmenting product demand. Growing demand for luxury footwear in this segment has led manufacturers to offer personalization options in the product. For instance, Girotti SRL, an Italy-based luxury shoe company, offers customization in formal shoes in terms of premium leather selection, designs, color, size, and personalized message.

The casual shoe segment is anticipated to be the fastest-growing segment with a CAGR of 7.2% from 2023 to 2030. Shifting trends from conventional to luxury footwear among people is playing a crucial role in expanding customer reach. Casual luxury footwear offers an attractive look, elegance, unique design, and flexibility to be worn on multiple occasions, including concerts, parties, and other public gatherings, which is among the main factors driving the segment. Moreover, the growing preference for attractive luxury sneakers as a symbol of status and inclination toward flaunting luxury brands among their social groups are driving the demand for casual shoes over the forecast period.

End-user Insights

The women segment led the market and accounted for a 47.0% share of the global revenue in 2022. Increasing spending on designer and branded luxury footwear by millennials and the working-class population has fueled the growth of the market worldwide. The women segment is expected to maintain its lead over the forecast period owing to an increase in the number of women in the workforce. According to the data from the European Union, close to 67.7% of women were in employment in the European Union’s 28 countries, including France, Germany, Greece, Hungary, Ireland, and Italy, in 2021. Moreover, the increasing number of fashion events conducted by companies influences women to purchase luxury products. For instance, in February 2022, Gucci X Adidas launched their gazelle sneakers at Milan fashion week.

The men's segment is anticipated to be the fastest-growing segment with a CAGR of 7.3% from 2023 to 2030. Celebrity endorsements play a crucial role in influencing millennials to adopt the latest fashion trends. Major brands such as Giorgio Armani, Burberry, Prada, and Dolce & Gabbana significantly spend on celebrity endorsements as a large group of people worldwide are remarkably influenced by celebrities. For instance, in April 2019, Giorgio Armani, a renowned luxury brand, officially announced Wu Muye, an international piano artist, as its new brand ambassador for Greater China and the Asia Pacific.

Distribution Channel Insights

Offline distribution channels dominated the market and accounted for a 75.7% share of the global revenue in 2022. Brick-and-mortar stores including boutique shops and independent luxury footwear stores are popular among consumers. These stores are quick to adapt to the fashion trends in the luxury products market and tend to offer exclusive deals to their customers, thereby boosting sale growth. Multi-brand luxury footwear stores are among other popular distribution channels. These stores allow customers to choose from numerous brands before making a purchase.

The online distribution channel is expected to witness the fastest growth during the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market owing to a wider distribution network and greater product availability. Such factors influence manufacturers to sell their products through online channels. Amazon.com, Inc. and Herring Shoes Limited are some of the major online retailers of luxury footwear across the globe. For instance, in January 2020, Amazon.com, Inc. announced its plan to launch a platform exclusively for luxury fashion. The company added that this new platform would give luxury brands complete control to customize the look of their online space.

Regional Insights

North America dominated the market for luxury footwear and accounted for a 29.0% share of the global revenue in 2022. The presence of a large number of wealthy individuals with high disposable income in this region has been one of the important factors driving the regional market. According to the Wealth-X report High Net Worth Handbook 2019, North America is home to 41% of the High-net-worth individuals (HNWIs) in the world. Thus, an increase in the number of HNWIs is boosting the demand for luxury products, including footwear.

Followed by North America, Europe is expected to emerge as the second-largest regional market for luxury footwear during the forecast period. The product demand has been increasing due to the high concentration of buyers who prefer luxury footwear with unique characteristics and brand value in developed countries, including Germany, France, Italy, and the U.K. The growing influence of casual and streetwear on high-end fashion is also responsible for the rise of luxury sneakers in Europe, where it is now increasingly acceptable to pair sneakers with a tailored suit. Luxury brands like Kering, Prada, and Balenciaga are launching striking and expensive designs in sneakers, putting them in direct competition with large sportswear players like Asics, Nike, Puma, New Balance, and Adidas.

Key Companies & Market Share Insights

Prominent market players are likely to focus on establishing their business in the Asia Pacific owing to the rapidly expanding customer base in countries, such as India and China. In this respect, key market participants are expected to invest in research & development activities to remain competitive during the forecast period.

Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

-

In August 2022, Chanel Ltd. unveiled two sneaker styles for its Fall/Winter 2022/2023 Pre-Collection, presented in two autumnal colorways each.

-

In August 2022, Louis Vuitton Malletier SAS launched sustainable sneakers designed by Virgil Abloh, an American fashion designer and entrepreneur. It is a new version of LV trainer made from 90% recycled and organic material

-

In June 2022, Adidas AG and Guccio Gucci S.p.A. planned to release their highly anticipated footwear collection centering around the Gazelle silhouette

-

In March 2022, Burberry plc announced the opening of a new flagship store on Rue Saint-Honoré, Paris, the first freestanding store in the region to feature Burberry’s new global design concept

Some of the prominent players in the global luxury footwear market include:

-

LVMH

-

Chanel Limited

-

Burberry Group PLC

-

Silvano Lattanzi

-

Prada S.p.A

-

A.Testoni

-

Dr. Martens

-

Base London

-

John Lobb Bootmaker

-

Salvatore Ferragamo

-

Lottusse - Mallorca

-

Adidas AG

Luxury Footwear Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.82 billion

Revenue forecast in 2030

USD 57.78 billion

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, distribution Channel

Regional scope

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

LVMH, Chanel Limited; Burberry Group PLC; Silvano Lattanzi; Prada S.p.A; A.Testoni; Dr. Martens; Base London; John Lobb Bootmaker; Salvatore Ferragamo; Lottusse - Mallorca; Adidas AG.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Luxury Footwear Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global luxury footwear market based on product, end-user, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Formal Shoe

-

Casual Shoe

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury footwear market size was estimated at USD 33.52 billion in 2022 and is expected to reach USD 35.82 billion in 2023.

b. The global luxury footwear market is expected to grow at a compounded growth rate of 7.0% from 2023 to 2030 to reach USD 57.78 billion by 2030.

b. The formal luxury shoe segment dominated the global luxury footwear market with a share of 58.2% in 2022. The rising importance of luxury footwear as a reflection of one’s professionalism at the workplace, particularly in corporate and fashion industries, is expected to remain a prominent factor in augmenting product demand.

b. Some key players operating in the luxury footwear market include LVMH, Chanel S.A., Burberry, Silvano Lattanzi, Prada S.p.A, A.Testoni, Dr. Martens, Base London, John Lobb Bootmaker, Salvatore Ferragamo, Lottusse - Mallorca, Adidas AG.

b. Key factors that are driving the luxury footwear market growth include a growing number of millionaires worldwide, increasing spending on designer & branded luxury footwear by millennials, and a rising preference for attractive luxury footwear as a symbol of status among both men and women.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."