- Home

- »

- Medical Devices

- »

-

Long-term Care Market Size, Share & Trends Report, 2030GVR Report cover

![Long-term Care Market Size, Share & Trends Report]()

Long-term Care Market Size, Share & Trends Analysis Report By Service (Nursing Care, Hospice & Palliative Care), By Payer (Public, Private), By Region (North America, Latin America), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-952-4

- Number of Pages: 155

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global long-term care market size was estimated at USD 1.05 trillion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.62% from 2023 to 2030. A rise in the global geriatric population majorly drives the long term care (LTC) market. Moreover, an increase in life expectancy impels the need for services. The unmet needs of older adults also contribute to the industry growth over the forecast period. According to the article published in the BMC Journal in December 2022, around 10.4% of the elderly population globally had unmet needs for healthcare, including LTC. With the provision of personal care at home, unnecessary hospitalization is avoided, thus preventing the patients from its high cost and degrading quality of life. An increase in the population of older individuals is a major concern in many countries globally.

This has increased the pressure on the governments of these countries to provide them with services. Governments of these countries are reforming their healthcare systems to provide the services needed by senior citizens at affordable prices. The U.S. government supports LTC for elders through Medicare and Medicaid systems. These factors are expected to fuel the growth of the market during the forecast period. Chronic disease prevalence is increasing at a significant pace globally. Along with general age-related disability, the elderly also suffer from chronic diseases, such as cancer, diabetes, Alzheimer’s, dementia, heart problems, and mental stress. Hospitalization for chronic diseases could be expensive and entail unnecessary use of resources, which patients in critical conditions can utilize.

Long-term care (LTC) provides specialized services required by the elderly, and increasing awareness about these centers, as well as their advantages over hospitals, is expected to impel market growth.Another key factor driving the industry's growth is technological advancement in healthcare delivery. Initially, durable medical devices, such as wheelchairs, walkers, and safety blankets, were predominantly used for care management. During the forecast period, the market wasled by the development of sophisticated, user-friendly products and services, such as internet-enabled home monitoring, telemedicine, and mobile health apps.The COVID-19 pandemic negatively impacted the industry as older people were more susceptible to the virus, and many nations reduced or banned activities in LTC centers.

COVID-19 long-term care market impact: 5.2% growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The pandemic had various impacts on different long-term services in most regions. Nursing homes are the sector most affected by the pandemic due to the shortage of nursing staff.

The market is expected to benefit from the growing adoption of various new technologies and strategic initiatives. Telehealth technologies can enable long-term care providers to avoid emergency admissions of their residents and provide medical aid by analysis of real-time patient data by doctors. Increasing adoption of telephonic consultation with doctors by patients during the COVID-19 pandemic is expected to create opportunities in the market

The home healthcare market consists of both products and services, each of which had a varied financial impact. Several home care monitoring products, such as pulse oximeters, blood pressure monitors, blood glucose meters, and body temperature monitors witnessed a surge in product demand.

Home healthcare has emerged as a cost-effective alternative during the pandemic, thus demand for these long-term care services is expected to witness lucrative growth during the forecast period.

According to the Organisation for Economic Co-operation and Development (OECD) article published in December 2021, around 40% of COVID-19 deaths in the OECD nations were at Long-term care (LTC) facilities. In addition, the nursing home sector was most affected by the pandemic due to the shortage of nursing staff. The market benefitted from the high adoption of various new technologies and strategic initiatives. Telehealth technologies can enable LTC providers to avoid emergency admissions of their residents and provide medical aid by analysis of real-time patient data by doctors. Increased adoption of telephonic consultation with doctors by patients during the COVID-19 pandemic createdgrowth opportunities in the market.

Service Insights

Based on services, the market is further segmented into nursing care, home healthcare, hospice & palliative care, assisted living facilities, and others. The nursing care segment dominated the market with the largest revenue share of 32.3% in 2022. This can be attributed to the preference for care by the elderly and high demand from developing countries. With the increasing geriatric population and rising incidence & prevalence of chronic diseases, such as heart problems, Alzheimer’s disease, and cancer, the need for nursing care is growing. The adoption of home healthcare is high among people older than 65 years of age, individuals recently discharged from hospitals, mentally challenged adults, mothers of newborns, and individuals who want medical assistance for their parents within their homes.

The growing demand for personalized Long-term care at home, and their cost-effectiveness drive the growth of the home healthcare segment. The rising healthcare expenditure has made home healthcare the de facto for many patients who need attention. With an increasing demand for home healthcare, suppliers are introducing newer, advanced technologies and software to enhance the quality of services being provided. The hospice segment is anticipated to witness the fastest CAGR over the forecast period due to the increasing prevalence of chronic diseases and the growing need for 24-hour medical attention. According to a report published by the WHO in 2020, only about 14% of people who needed palliative care received it. Around 56.8 million people need palliative care each year, of which, 98% live in low- and middle-income countries.

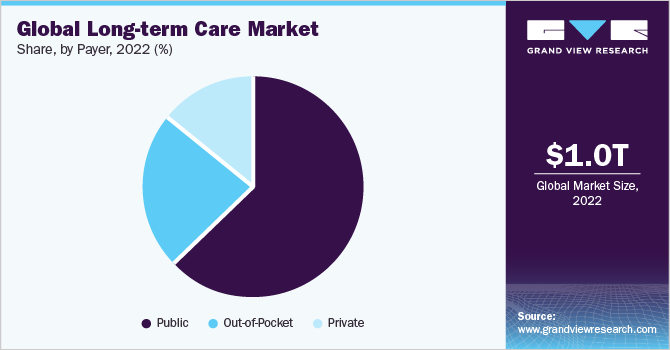

Payer Insights

Based on payers, the market is further categorized into public, private, and out-of-pocket. The public segment held the largest revenue share of 63.5% in 2022. This share of the segment can be attributed to the high public spending by the U.S., and European countries. For instance, in the U.S. more than half of the LTC cost is covered under Medicaid, which varies from state to state. According to the Commonwealth Fund statistics, in 2020, Medicaid paid around USD 200 billion on LTC in the U.S. The private segment is expected to witness the fastest growth rate over the forecast period. Private Long-term care (LTC) insurance providers are entering many major country-level markets owing to the increasing opportunities to complement the provision of basic public services.

Hence, the segment is expected to witness the fastest growth. According to the 2022 Milliman Long Term Care Insurance Survey, in the U.S., more than 140,000 individuals purchased LTC policies in 2021 compared to 2020. The out-of-pocket segment held a significant share in 2022. In many major countries, Long term care is provided through a mix of private, out-of-pocket, and public spending. The out-of-pocket spending is expected to decrease over the forecast period, as many countries are launching several initiatives to decrease these costs. For instance, China launched the 14th Five-Year-Plan from 2021 to 2025 for the establishment of an LTC insurance scheme in the country.

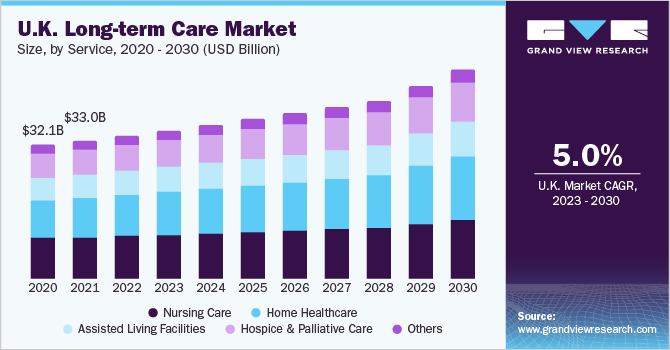

Regional Insights

North America held the largest revenue share of 49.3% in 2022 due to the availability of Long-term care (LTC) centers, improving reimbursement framework, and favorable government policies. According to the Kaiser Family Foundation, in 2020, an estimated 5.8 million people in the U.S. used paid LTC services and supports at home and community-based care, and around 1.9 million individuals used in institutional settings. According to the Commonwealth Fund Statistics, in 2021, around 69% of adults used LTC in the U.S. as they age. The industry is still in its infancy in several countries in the AsiaPacific region; thus, the region is expected to have lucrative growth in the coming years. This is due to an increase in chronic conditions, such as heart disease, diabetes, and respiratory problems.

In addition, foreign LTC facilities are investing in countries, such as India and Japan. In the Asia Pacific region,LTC is majorly provided by family members. According to the Asian Development Bank Report 2022, in Thailand, around 90% of the elderly people in need of care receive it from family members. Latin America is expected to grow at the fastest CAGR over the forecast period due to therising aging population. However, it currently needs better-regulated LTC services in most countries. The inadequate presence of facilities and their nonuniform geographical distribution can lead to a greater burden on unpaid caregivers, such as family. Brazil has a comparatively better market scenario due to its low cost of services, which is attracting baby boomers from the U.S. and Canada.

Key Companies & Market Share Insights

The market is fragmented owing to the presence of several profit & nonprofit players. Competitors in these markets are increasing their share through a variety of marketing strategies, including new service launches, geographic expansions, partnerships, and mergers & acquisitions. For instance, in May 2023, Omega Healthcare acquired 18 skilled nursing home facilities in West Virginia for USD 233 million. Some of the prominent players in the global long-term care market include:

-

Brookdale Senior Living, Inc.

-

Kindred Healthcare, Inc. (Knight Health Holdings, LLC)

-

Almost Family, Inc. (LHC Group, Inc.)

-

Atria Senior Living Group

-

Sunrise Carlisle, LP (Sunrise Senior Living, LLC)

-

Extendicare, Inc.

-

Sonida Senior Living (Capital Senior Living)

-

Diversicare

-

Genesis HealthCare

-

Home Instead, Inc.

-

Amedisys

Long-term Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.11 trillion

Revenue forecast in 2030

USD 1.74 trillion

Growth rate

CAGR of 6.62% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, payer, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Brookdale Senior Living, Inc.; Knight Health Holdings, LLC (Kindred Healthcare, Inc.); Almost Family, Inc. (LHC Group, Inc.); Sunrise Carlisle, LP (Sunrise Senior Living, LLC); Atria Senior Living Group; Extendicare, Inc.; Sonida Senior Living (Capital Senior Living); Diversicare; Genesis HealthCare; Home Instead, Inc.; Amedisys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

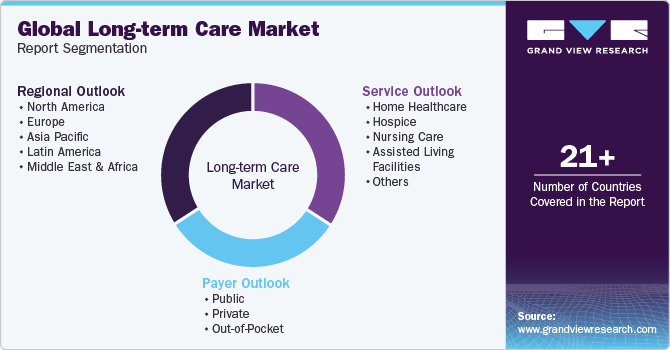

Global Long-term Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global long-term care market report on the basis of service, payer, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Healthcare

-

Hospice & Palliative Care

-

Nursing Care

-

Assisted Living Facilities

-

Others

-

-

Payer Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Out-of-Pocket

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global long-term care market size was estimated at USD 1.05 trillion in 2022 and is expected to reach USD 1.11 trillion in 2023.

b. The global long-term care market is expected to grow at a compound annual growth rate of 6.62% from 2023 to 2030 to reach USD 1.74 trillion by 2030.

b. North America dominated the global LTC market in 2022 owing to the high percentage of the geriatric population, greater government funding, and implementation of a streamlined regulatory framework.

b. Major players in the market for LTC include Brookdale Senior Living, Inc., Knight Health Holdings, LLC (Kindred Healthcare, Inc.), Almost Family, Inc. (LHC Group, Inc.), Sunrise Carlisle, LP (Sunrise Senior Living, LLC), Atria Senior Living Group, Extendicare, Inc., Sonida Senior Living (Capital Senior Living), Diversicare, Genesis HealthCare, Home Instead, Inc., and Amedisys

b. The market for long-term care is expected to boom owing to aging baby boomers, increasing disabilities among the geriatric population, the dearth of skilled nursing staff, government funding, and increased collaborations of private insurers with various governments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.