- Home

- »

- Advanced Interior Materials

- »

-

Lithium Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Lithium Market Size, Share & Trends Report]()

Lithium Market Size, Share & Trends Analysis Report By Product (Carbonate, Hydroxide), By Application (Automotive, Consumer Goods, Grid Storage, Glass & Ceramics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-581-6

- Number of Pages: 116

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

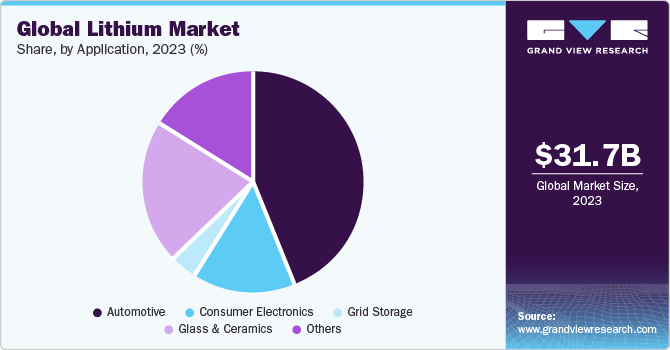

The global lithium market size was valued at USD 7.49 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030. Electrification of vehicles is projected to attract a significant volume of lithium-ion batteries, thus anticipated to drive the market over the forecast period. The automotive application segment is expected to witness substantial growth over the forecast period, driven by stringent regulations for ICE automakers imposed by government bodies to reduce carbon dioxide emissions from vehicles. This has shifted the interest of automakers toward producing electric vehicles (EVs), which is anticipated to benefit the demand for lithium and related products. Government subsidies for EVs, along with investments in this space, are likely to act as an additional booster to the growth of the market.

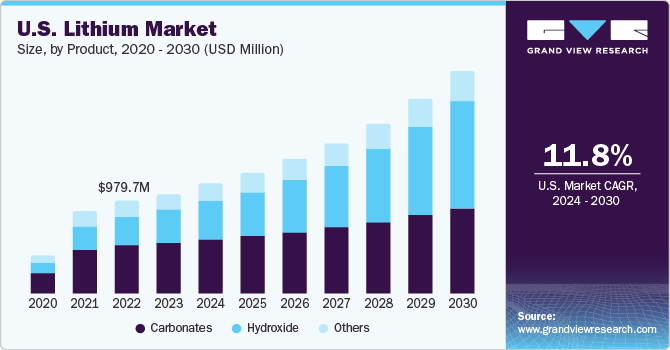

The U.S. holds major significance in battery production after China, which makes it one of the key lithium-consuming countries in the world. The country has huge reserves of this important metal. However, the country mines only about 1.0% of the total demand in the world. In 2022, the production took place at only one location in the U.S., which is a brine operation in Nevada. However, the country is expected to boost its mining capabilities in the industry over the coming years.

The market players in the U.S. are focusing on exerting control on the battery supply chain owing to the increasing production of EVs in the country and as transportation of batteries is dangerous. In 2018, the Interior Department listed lithium as a critical mineral, which paced up the mine permitting process. In January 2021, the Bureau of Land Management approved the Thacker Pass Mine proposed by Lithium Nevada Corporation. The mine is believed to serve as the largest source of commodity supply in the U.S. and is expected to produce about 60 kilotons of battery-grade carbonate by 2026.

Product Insights

The carbonate product segment dominated the market and accounted for the largest share of over 56.0% in 2022, in terms of volume. Lithium Carbonate (Li2CO3) is the most stable inorganic compound and is used in forming other compounds, such as LiOH and even pure metal. Carbonate products are also used in the treatment of the bipolar disorder. This compound is also used in batteries and has several applications in the construction sector for waterproofing slurries and as adhesives. LiOH is a white hygroscopic crystalline material and an inorganic compound mostly used by battery manufacturers; it is commercially available as anhydrous and monohydrate.

It has usage in transportation applications in the manufacturing of submarines and spacecraft. In addition, rapid development in battery technologies is propelling the demand for LiOH, thus, driving the market growth. Many automotive players are inclined to adopt LiOH for battery manufacturing, which is expected to benefit market growth positively. For instance, BMW Group signed an agreement with Ganfeng Lithium, a lithium extracting company in China, for supplying LiOH for battery cells owing to the rising penetration of EVs. Rising awareness regarding eco-friendly vehicles is driving the demand for EVs on account of which, BMW has planned to introduce 25 electrified models with Li-ion batteries.

Application Insights

The consumer electronics application segment is estimated to register the fastest CAGR of 17.0%, in terms of revenue, from 2023 to 2030. The segment is projected to grow owing to the increasing sales of electronic devices, such as mobile phones, laptops, cameras, portable radios, speakers, and Mp3 players, which make use of Li-ion batteries. Characteristics, such as low weight, large energy storage, and small size are driving the demand for batteries; thus, positively influencing the growth of the segment. Single-use, non-rechargeable Li-ion batteries are used in remote controllers, handheld games, cameras, and smoke detectors.

Rechargeable lithium-polymer cells are used in cell phones, laptops, toys, digital cameras, small and large appliances, tablets e-readers, and power tools. These batteries are made from critical materials, such as cobalt, graphite, and lithium, and need to be handled with safety and precautions. Various developed countries are investing increasingly in the deployment of energy storage systems based on Li-ion batteries; thus, fueling the growth of the market.

For instance, in June 2021, the U.K. launched a 50-megawatt energy system connected with the high-voltage transmission system of its National Grid. This project is a part of the USD 48.5 million Energy Superhub Oxford (ESO) plan for the country. The project is being led by Pivot Power and is backed by the U.K. government.

Regional Insights

Asia Pacific dominated the global market in 2022 and accounted for the largest volume share of more than 58.0% owing to the rapidly developing automotive, glass, and consumer goods industries in countries, such as China, Japan, South Korea, and India. The region will expand further maintaining the dominant growth at the fastest CAGR, in terms of volume, over the forecast period. The ongoing investments in the region to advance the battery technology sector is anticipated to drive market growth over the forecast period. To meet the plans and targets pertaining to EV and battery sectors, various countries in the region are witnessing developments in the industry.

In July 2020, Khanij Bidesh India Ltd. (KABIL), a joint venture between NALCO; Mineral Exploration; and Hindustan Copper signed a start-up agreement with Jujuy Energia y Mineria Sociedad del Estado (JEMSE) for the production & exploration of lithium. This agreement was in line with India’s efforts to establish a battery supply chain to meet EV targets. Europe accounted for the second-largest share of global revenue in 2021 and is projected to witness steady growth from 2022 to 2030. The growth of the market in Europe can be attributed to the increasing production of EVs in the region. Europe surpassed China in terms of EV production and became the largest manufacturer of EVs in the world in 2020. The flourishing EV market in Europe has attracted foreign companies to invest in the region.

Key Companies & Market Share Insights

The global market is consolidated with production concentrated in the hands of a few key manufacturers. Albemarle; SQM; Livent Corp.; Orocobre Ltd.; Ganfeng Lithium Co., Ltd.; and Tianqi Lithium are among the key producers in the world. The manufacturers are mainly located in the Americas, Asia, and Australia. The market players compete against product quality, reliability, in terms of supply and customer service, and diversity in the product portfolio.

Furthermore, market players are investing in the battery sector, which is the key application of lithium. For instance, in June 2021, Albemarle announced the opening of an Innovation Center at its site in Kings Mountain, North Carolina, U.S. The center will aid in supporting the company’s carbonate and hydroxide products, and advanced energy storage materials product portfolio. Some prominent players in the global lithium market include:

-

Albemarle Corporation

-

Ganfeng Lithium Co., Ltd.

-

SQM S.A.

-

Tianqi Lithium Corporation

-

Livent Corporation

-

Lithium Americas Corp

-

Pilbara Minerals

-

Orocobre Limited Pty Ltd

-

Mineral Resources

Recent Development

-

In May 2023, SQM and Ford Motor Company announced a long-term strategic agreement to solidify the supply of top-notch lithium products for the production of electric vehicles (EVs). The partnership guarantees a stable supply of battery-grade lithium carbonate and lithium hydroxide, paving the way for the creation of high-performance EV batteries. By securing this critical component, both companies are poised to play a vital role in driving the growth of the global electric mobility market

-

In July 2023, SQM revealed a significant long-term agreement with LG Energy Solution, solidifying their collaboration to contribute to global decarbonization efforts. Under this new partnership, SQM will supply over 100,000 metric tons of battery-grade lithium carbonate and lithium hydroxide to LG Energy Solution from 2023 to 2029. This strategic alliance aims to bolster the stability of lithium supply, empowering both companies to play a pivotal role in advancing sustainable solutions for a greener future

-

In November 2022, Livent Corporation and Nanyang Technological University, Singapore announced a research collaboration aimed at spearheading advancements in sustainable lithium battery technologies. Through this partnership, both entities seek to expand their R&D efforts, fostering a conducive environment for enhanced innovation and pushing the boundaries of what can be achieved in the field of lithium batteries

-

In November 2021, Livent Corporation announced its proprietary LIOVIX™ lithium metal product which is an innovative solution that offers a distinctive printable formulation of lithium metal and other specialized materials, presenting a transformative opportunity to enhance lithium-ion battery performance significantly. Moreover, LIOVIX™ enables cost reduction in battery manufacturing processes and plays a vital role in unlocking the potential of the next generation of battery technology

Lithium Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.20 billion

Revenue forecast in 2030

USD 18.99 billion

Growth rate

CAGR of 12.3% from 2023 to 2030

Market size volume in 2023

389.7 kilotons

Volume forecast in 2030

880.3 kilotons

Growth rate

CAGR of 11.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; China; India; Japan; South Korea

Key companies profiled

Albemarle Corp.; Ganfeng Lithium Co., Ltd.; SQM S.A.; Tianqi Lithium Corp.; Livent Corp.; Lithium Americas Corp.; Pilbara Minerals; Orocobre Ltd. Pty. Ltd.; Mineral Resources

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium Market Report Segmentation

This report forecasts volume & revenue growth at global, country & regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global lithium market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbonates

-

Hydroxide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Grid Storage

-

Glass & Ceramics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global lithium market size was estimated at USD 7.49 billion in 2022 and is expected to reach USD 8.20 billion in 2023.

b. The global lithium market is expected to grow at a compound annual growth rate of 12.3% from 2023 to 2030 to reach USD 18.99 billion by 2030.

b. Based on region, Asia Pacific was the largest market with a revenue share of over 57.0% in 2022, owing to increasing investments in advanced battery technologies coupled with the rising penetration of electric vehicles.

b. Some of the key players operating in the lithium market include Albemarle Corporation, Ganfeng Lithium Co., Ltd., SQM S.A., Tianqi Lithium Corporation, Livent Corporation, Lithium Americas Corp, Pilbara Minerals, Orocobre Limited Pty Ltd, and Mineral Resources.

b. Key factors that are driving the lithium market are rising demand for lithium-ion batteries in electric vehicles and electronic products such as smartphones, laptops, portable speakers, and tablets.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."