- Home

- »

- Biotechnology

- »

-

Liquid Handling Technology Market Size, Share Report, 2030GVR Report cover

![Liquid Handling Technology Market Size, Share & Trends Report]()

Liquid Handling Technology Market Size, Share & Trends Analysis Report By Product (Small Devices, Consumables), By Type (Manual, Automated), By End-use, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-114-6

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global liquid handling technology market size was estimated at USD 4.94 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. In recent years, the market has shown significant expansion potential due to the global growth of pharmaceutical and biotechnology industries, particularly in the R&D sector and life science research. In addition, there has been a rapid increase in assays being performed for various research purposes, such as target screening, which has further driven the demand for liquid handling technologies. The COVID-19 outbreak led to a surge in demand for diagnostic testing, vaccine development, and research related to the viruses. This increased demand for liquid handling solutions, such as automated liquid handlers, pipettes, and dispensers.

These technologies are crucial for efficient and accurate sample processing, which was essential during the pandemic. The urgent need for diagnostics, treatments, and vaccines for COVID-19 prompted a rapid increase in research and development activities. Liquid handling technologies played a vital role in automating and streamlining laboratory workflows, enabling scientists to process a large number of samples and conduct experiments more efficiently. The development of advanced liquid handlers enhances clinical research by reducing the development cost and facilitating the rapid launch of drugs. As a result, pharmaceutical companies are geared toward the adoption of advanced liquid handling systems for quick drug approval.

Manufacturers have developed workstations based on different technologies to dispense the droplets from the dispensing tool by overcoming surface adhesion. These technologies include ultrasound, piezoelectric, and solenoid. For instance, LABCYTE Inc. uses Echo acoustic liquid handling technology in its products to offer non-contact dispensing. In addition, effective miniaturization of the assay platforms reduces workflow expenditure, thereby decreasing the usage of expensive reagents. These miniaturized platforms are specifically designed for highly precise liquid handling in various processes, such as plate washing, bulk dispensing, and liquid transfer. Some of the prominent suppliers of compact benchtop workstations include Hamilton Company, PerkinElmer, Beckman Coulter, and LABCYTE Inc.

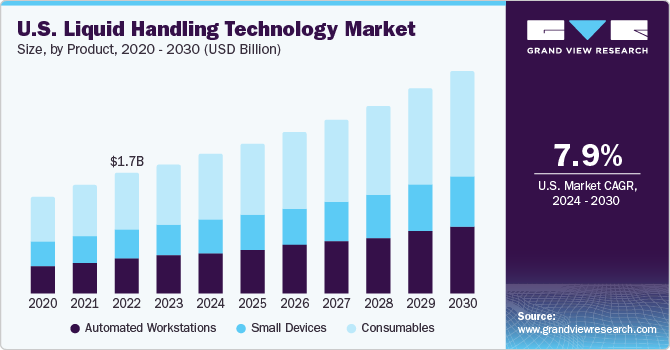

Product Insights

The consumables segment dominated the market in 2022 with a revenue share of 47.02% due to the substantial volume of sample inputs required and the frequent usage of these products. The repetitive purchasing of consumables by laboratory professionals leads to increased expenses, consequently driving revenue growth in this segment. In addition, advancement in R&D, development of biotechnology and pharmaceutical industries, and increasing adoption of personalized medicine are some of the factors responsible for the high consumption of consumables.

The automated workstations segment is expected to grow at the fastest CAGR of 9.4% over the forecast period. Companies are actively innovating by developing advanced automated workstations, incorporating cutting-edge technologies, such as acoustic energy and Digital Microfluidics (DMF), to meet the increasing demand for automated solutions within research communities. This is expected to significantly contribute to the market growth.

Type Insights

The semi-automated liquid handling segment dominated the market in 2022 with a revenue share of 41.40%. This is due to the cost-effectiveness of semi-automated liquid handling systems compared to fully automated ones. They offer a balance between automation and manual control, offering a more affordable option for laboratories with budget constraints or specific needs that don't necessitate full automation. In addition, semi-automated liquid handling systems streamline liquid handling processes, significantly reducing the time and effort required for repetitive tasks.

This heightened efficiency and increased throughput enables laboratories to handle larger sample volumes, boost productivity, and expedite research timelines. The automated liquid handling segment is expected to grow at a significant CAGR of 9.5% over the forecast period. This growth is attributed to the introduction of novel automated liquid-handling workstations for non-contact dispensing. Over the years, contact dispensing has gained wide acceptance due to its reliability, simplicity, and low cost. However, the liquid handling needs have evolved with decreasing sample volume.

Application Insights

The drug discovery & ADME-Tox research segment dominated the market in 2022 with a revenue share of 37.86% due to its crucial role in advancing the development of new drugs. Various applications in drug discovery and ADME-Tox research include stepwise serial dilution over a wide concentration range, selection and transfer of compounds for retesting, and confirmatory and further analysis. Liquid handling workstations are extensively used for plate-to-plate dilutions, plate replications, and plate reformatting in drug discovery and ADME-Tox research.

The cancer & genomic research segment is anticipated to grow at the fastest CAGR of 10.0% over the forecast period primarily because liquid handling plays a crucial role in cancer and genomic research. This is due to the necessity of dispensing protein or DNA solutions onto substrates or microwells. Moreover, the subsequent steps involving synthesis and analysis often require dispensing additional solutions. The use of manual liquid handling techniques for these tasks becomes impractical and tedious.

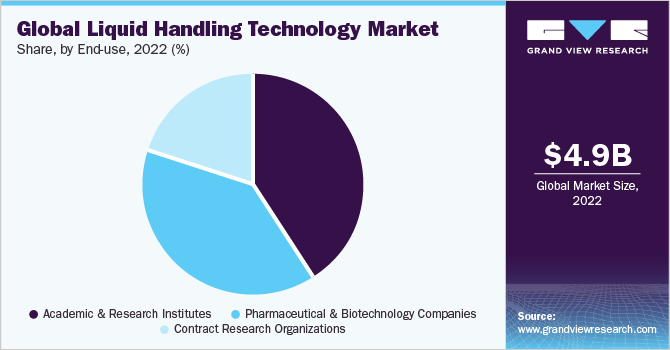

End-use Insights

The academic & research institutes segment dominated the market in 2022 with a share of 41.49%. These institutes play a crucial role in life science experiments, particularly those related to gene sequencing, antibody testing, drug screening, and protein crystallization, which often require handling very small sample volumes. As a result, there is a growing demand for automated methods, such as sensor-integrated robotic systems, to facilitate these tasks, thereby driving revenue growth for the academic and research institutes segment.

The contract research organization (CRO) segment is projected to register the highest CAGR of over 9.6% over the forecast period. This growth is driven by the increasing trend of outsourcing drug manufacturing processes. Furthermore, CROs are currently facing heightened pressure to improve productivity and adhere to strict timelines, leading to a positive effect on the adoption of liquid handling solutions by CROs in the near future.

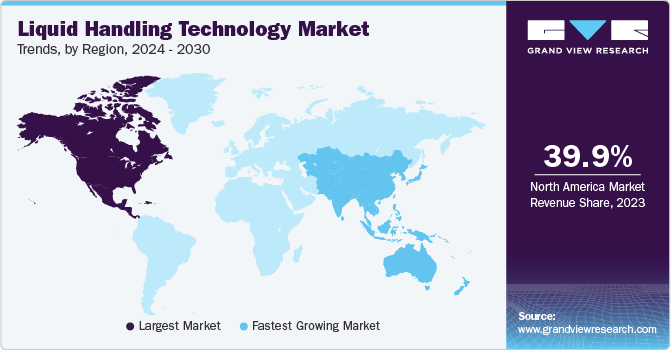

Regional Insights

North America accounted for the largest share of around 40.0% in 2022. This dominance can be attributed to the well-established distribution networks of major market players and the adoption of advanced automation solutions in the region. In addition, competitors in North America have forged partnerships with prominent academic universities and research centers in Europe to bolster their revenue streams. This collaboration comes as a response to the significant concentration of academic and research institutes in Europe.

Asia Pacific is estimated to grow at the fastest CAGR of 10.7% over the forecast period. Factors responsible for the fastest growth include the rapid advancements made by biopharma and biotechnology companies, as well as Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) in countries like Japan and China.Furthermore, substantial investments by Japan and China in life science sectors, including omics research, advanced healthcare, microbiology, drug development, and clinical diagnostics, are expected to drive the market growth.

Key Companies & Market Share Insights

Key players focus on the development of cutting-edge products, expansion of product portfolios, and strategic collaborations, all aimed at securing a competitive advantage in the market.Some of the key players in the global liquid handling technology market include:

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies, Inc.

-

Danaher Corp.

-

Gilson, Inc.

-

PerkinElmer

-

Tecan Group Ltd.

-

Hamilton Company

-

Eppendorf AG

Liquid Handling Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.36 billion

Revenue forecast in 2030

USD 9.63 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; Danaher Corp.; Agilent Technologies; Gilson, Inc.; PerkinElmer; Tecan Group Ltd.; Hamilton Company; Eppendorf AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Handling Technology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid handling technology market report on the basis of product, type, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automated Workstations

-

Standalone Workstations

-

Integrated Workstations

-

-

Small Devices

-

Pipettes

-

Electronic Pipettes

-

Manual Pipettes

-

Pipette Controllers

-

-

Burettes

-

Dispensers

-

Others

-

-

Consumables

-

Regents

-

Disposable Tips

-

Tubes & Plates

-

Others

-

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automated Liquid Handling

-

Manual Liquid Handling

-

Semi-automated Liquid Handling

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery & & ADME-Tox Research

-

Cancer & Genomic Research

-

Bioprocessing/Biotechnology

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. On the basis of product, the consumables segment accounted for the largest share of 47% in 2022. The large share is mainly attributed to high demand and recurrent usage of consumables.

b. A few of the key market players include Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Gilson, Inc., PerkinElmer, Tecan Group Ltd., Hamilton Company, and Eppendorf AG.

b. An increase in investment in drug development, clinical trials, and life sciences R&D and rapid adoption of automation are some of the key factors driving the market growth.

b. The global liquid handling technology market size was estimated at USD 4.94 billion in 2022 and is expected to reach USD 5.36 billion in 2023.

b. The global liquid handing technology market is expected to grow at a compound annual growth rate of 8.72% from 2023 to 2030 to reach USD 9.63 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Biopharmaceutical innovators are at the forefront of the human response to the coronavirus pandemic. A significant number of major biotech firms are in the midst of a race to investigate the Sars-Cov-2 genome and prepare a viable vaccine for the same. As compared to the speed of response to SARS/MERs etc, the biotech entities are investigating SARs-Cov-2 at an unprecedented rate and a considerable amount of funds are being put into the R&D. With multiple candidates in trial, the public and private sectors are anticipated to work in unison for the foreseeable period, until a vaccine is developed for Covid-19. The report will account for Covid19 as a key market contributor.