- Home

- »

- Advanced Interior Materials

- »

-

Linerless Labels Market Size, Share & Trends Report, 2030GVR Report cover

![Linerless Labels Market Size, Share & Trends Report]()

Linerless Labels Market Size, Share & Trends Analysis Report By End-use (Retail, Logistics & Warehousing, Food & Beverages), By Region (North America, Asia Pacific, Europe, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-143-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

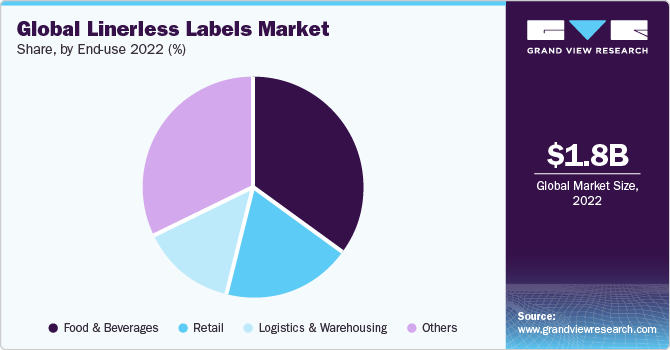

The global linerless labels market size was estimated at USD 1.81 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% in terms of revenue from 2023 to 2030. This growth can be attributed to its sustainability advantages, cost-effectiveness, and operational efficiency. Rising demand for linerless labels in various industries, including food & beverage, retail, logistics and warehousing, and pharmaceuticals, is further expected to fuel the growth of the market. Linerless labels increase efficiency by printing more labels per roll and requiring fewer roll changes while reducing environmental effects by eliminating the usage of release liners, using less material, and saving on transportation expenses. Their increased print quality, industry-wide adaptability, and space-efficient storage all contribute to the growth of the market.

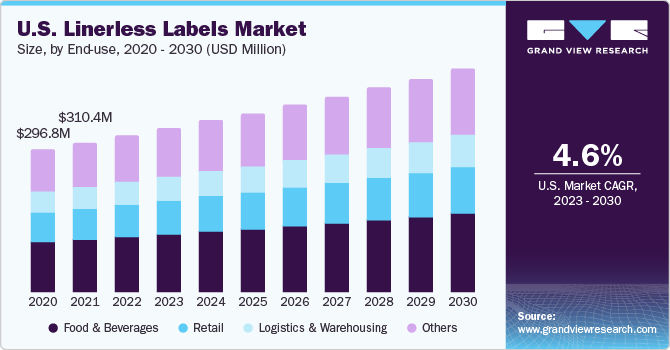

The demand for linerless labels in the U.S. is increasing due to its environmental benefits, cost-efficiency, regulatory compliance, and operational efficiency. Linerless labels eliminate release liners, reduce waste, and are suitable for businesses and consumers. They also meet stringent regulations in industries such as food and pharmaceuticals and offer more labels per roll, reducing downtime for roll changes. The retail and logistics sectors benefit from these advantages. Advancements in printing technology have also improved the print quality of linerless labels. These factors are expected to fuel the demand for linerless labels in the U.S. in the coming years.

The market faces several challenges, including limited adoption compared to traditional labels, high costs for specialized printing technology, and complexity in application due to the absence of a liner. While linerless labels can reduce long-term waste and costs, initial setup and per-label expenses can be higher. Regulatory compliance, market awareness, waste management, and supply chain integration are also areas that require careful consideration. Despite these challenges, linerless labels hold promise for a more sustainable labeling solution, but they require further adaptation. Advancements in linerless label technology include specialized adhesives for adhesion and silicone release coatings for easy separation.

These technologies allow for efficient wounding into rolls without traditional liners, reducing material waste and enhancing eco-friendliness. This adhesive-release coating combination is crucial for the success of linerless labels, offering sustainability, cost-efficiency, and operational ease across various industries. Manufacturers of linerless labels use various distribution strategies to reach their target markets. They are collaborating with distributors and suppliers, establishing direct relationships with key customers, and using digital marketing and e-commerce platforms. They are focusing on product innovation, sustainability, and competitive pricing to meet evolving customer demands. They are also emphasizing the environmental benefits of the product, attracting eco-conscious consumers and businesses.

End-use Insights

The food & beverage end-use segment led the market and accounted for the largest share of 35.2% in 2022, and it is expected to grow at a significant rate over the forecast period. The food and beverage industry is increasingly adopting linerless labels due to their environmental benefits, cost-efficiency, and clear display of essential product information. Moreover, the e-commerce industry is growing rapidly, which has increased the demand for linerless labels in the food packaging industry as they are lightweight, durable, and can be used on a variety of surfaces.

Linerless labels are gaining popularity in the retail industry, and they will account for USD 341.2 million in 2022 due to their sustainability, cost-efficiency, versatility, and ability to create informative product packaging. They are used in various retail applications, including promotional labeling, barcoding, and pricing. They can be customized with high-quality printing, ensuring eye-catching packaging, which helps in product differentiation and consumer engagement. It is gaining popularity in the retail industry due to the above-mentioned factors.

The demand for linerless labels is increasing in the logistics and warehousing industries at a significant rate over the coming years, owing to their cost-efficiency, space-saving design, and durability. It reduces material usage, offers more labels per roll, and reduces downtime for roll changes and labeling expenses. It also ensures critical shipping information remains intact in challenging conditions, making it a crucial tool in logistics operations. Moreover, the logistics and warehousing industry is increasingly using this label to streamline operations, reduce costs, and improve labeling efficiency, which is further expected to fuel the demand for linerless labels during the forthcoming years.

Regional Insights

The Asia Pacific region is expected to experience the fastest growth in demand for linerless labels due to the expanding retail and e-commerce sectors. In countries such as China and India, the product offers cost-effective and efficient labeling solutions for various products, including clothing and electronics. The growing focus on sustainability and environmental responsibility aligns with linerless labels' reduced waste footprint, making them attractive for eco-friendly packaging standards. The diverse manufacturing landscape in the Asia Pacific region, including electronics, automotive, and food production, also finds the product versatile and adaptable, and this is driving the demand for the product as a sustainable, cost-effective, and flexible labeling solution.

The market for linerless labels in North America was valued at USD 417.4 million in 2022. The demand is growing due to sustainability and cost-efficiency reasons. Major retail chains such as Walmart are adopting linerless labels for their product packaging to reduce waste and minimize their environmental footprint. These labels eliminate the liner, reducing non-recyclable waste during packaging. Moreover, strict government regulations to promote sustainability and waste have resulted in the implementation of various recycling programs for waste products, including paper and plastic. It can help businesses comply with these regulations.

The demand for linerless labels in Europe is increasing due to the region's emphasis on sustainability and regulatory compliance. The use of the product eliminates liner waste, aligning with the EU's environmental goals. Food manufacturers using linerless labels not only comply with labeling regulations but also reduce their carbon footprint. The cost-efficiency and operational advantages of the product make them attractive for businesses seeking to optimize their processes. As sustainability and efficient resource use continue to drive European markets, the demand for the industry is expected to grow across various industries, including food & beverages, logistics & warehousing, and retail.

Key Companies & Market Share Insights

The global market exhibits high competition owing to the presence of several established players in this industry. The competitors in the industry opt for various strategies such as maintaining direct relationships with key customers, product innovation, partnerships, and collaborations to gain market share in the industry. The market players are also promoting sustainability as a selling point and highlighting the advantages of linerless labeling for the environment to attract customers and businesses. Furthermore, competitive pricing and quality assurance remain critical in maintaining a strong market presence and driving the market growth. Some prominent players in the global linerless labels market include:

Key Linerless Labels Companies:

- 3M

- AVERY DENNISON CORPORATION

- Skanem

- Gipako UAB

- SATO Europe GmbH

- UPM Global

- Hub Labels

- Optimum Group

- R.R. Donnelley & Sons Company

- Coveris

Linerless Labels Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.89 billion

Revenue forecast in 2030

USD 2.54 billion

Growth Rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

3M; Avery Dennison Corp.; Skanem; Gipako UAB, SATO Europe GmbH; UPM Global; Hub Labels; Optimum Group; R.R. Donnelley & Sons Company; Coveris

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Linerless Labels Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the linerless labels market report on the basis of end-use and region

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Retail

-

Logistics & Warehousing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global linerless labels market size was estimated at USD 1.81 billion in 2022 and is expected to reach USD 1.89 billion in 2023.

b. The global linerless labels market is expected to grow at a compound annual growth rate, a CAGR of 4.3% from 2023 to 2030, to reach USD 2.54 billion by 2030.

b. The food & beverage segment of linerless labels market accounted for the largest revenue share of 35.02% in 2022. The food and beverage industry is increasingly adopting linerless labels due to their environmental benefits. Moreover, growing e-commerce industry is growing rapidly has increased the demand for linerless labels in the food packaging industry.

b. Some key players operating in the linerless labels market include 3M, AVERY DENNISON CORPORATION, Skanem, Gipako UAB, SATO EUROPE GMBH, UPM Global, Hub Labels, Optimum Group, R.R. Donnelley & Sons Company, and Coveris.

b. Key factors that are driving the market growth include its sustainability advantages, cost-effectiveness, and operational efficiency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."