- Home

- »

- Advanced Interior Materials

- »

-

Lignin Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Lignin Market Size, Share & Trends Report]()

Lignin Market Size, Share & Trends Analysis Report By Product (Lingo-sulfonates, Kraft Lignin, Organosolv Lignin, Others), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-422-2

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global lignin market size was estimated at USD 1.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Increasing demand for lignin in animal feed and natural products is anticipated to drive growth. The product is widely utilized in the production of macromolecules used in the development of bitumen, biofuels, and bio-refinery catalysts. This factor is likely to support market growth. COVID-19 had a negative impact on the market. This was because of the shutdown of the manufacturing facilities and plants owing to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. In other words, the industry faced a backlash owing to disruptions in the value chain, including workforce losses, raw material supply, trade and logistics, and uncertain consumer demand.

Manufacturers in the lignin market are making efforts to recover from the losses. However, the increase in production and demand for concrete additives and rising demand for lignin as an organic additive is a positive sign. The market's future is brighter owing to the increased proliferation of Internet and e-commerce channels.

Lignin is manufactured by traditional processes of blending certain specific chemicals to create lignin, cellulose, and sweet liquor from wood and their products. This process involves the use of biomass pretreatment process from all plant sources, including hardwood, softwood, sawdust, low-grade wood chips, and hemp. Extracting lignin from black liquor is one of the most convenient options to ensure that the capacity of the boiler does not hamper pulp production.

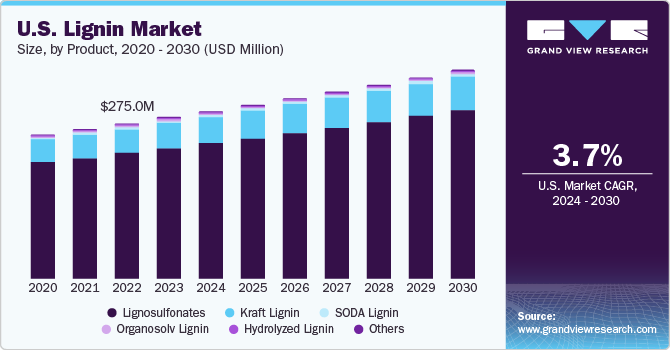

The market for lignin in North America is led by the U.S. owing to an extensively developed manufacturing industry and government initiatives. In the U.S., the demand for lingo-sulphonates accounted for the largest market share of 77.0% in 2022 and is expected to expand at a CAGR of 6.2% over the forecast period. In addition, the well-established market for the production of pulp and paper in North America is likely to support the market further.

The rising trend of using lignin as fuel for burning in multiple applications like dispersants, binders, and adhesives is anticipated to augment the market growth in the forthcoming years. On a macro-level, factors such as increasing construction expenditure and rising demand for automobiles, electronics, and equipment manufacturing are expected to support the demand for lignin.

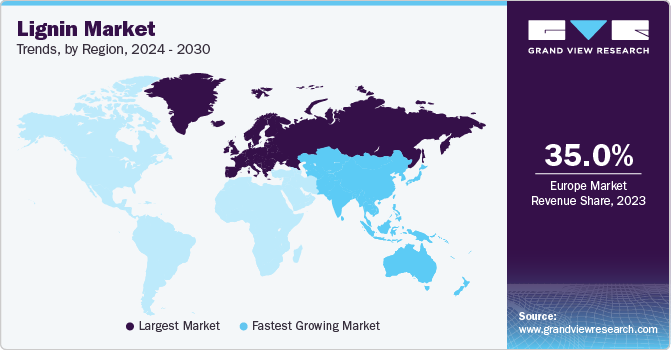

In Europe, a favorable regulatory framework for using lignin in various commercial applications is expected to be a key factor driving market growth. Asia Pacific, on the other hand, is anticipated to witness the fastest growth over the forecast period due to rapid industrialization and rising demand for electronics and automobiles.

Numerous players operating in the market engage in the complete service for lignin and its applications. For instance, Nippon Paper is engaged in pulp and paper manufacturing and derives lignin during the pulping process. In addition, the company is engaged in forest cultivation and industrial plantations.

Product Insights

Lignosulfonates emerged as the largest product segment in the market in 2022 and is estimated to maintain its dominance with a CAGR of 4.4% throughout the forecast period. Increased application of concrete mixtures in China, India, and the U.S. on account of improvements in the construction sector is anticipated to fuel demand for lignosulfonates, thereby supporting the growth of the product segment.

Kraft lignin demand is expected to be promoted as a raw material for the production of the aforementioned chemically derived products owing to its application as an intermediate to manufacture numerous compounds, including cement additives, biofuels, BTX, activated carbon, phenolic resins, carbon fibers, and vanillin. Increasing awareness towards reducing reliance on crude oil has forced chemical manufacturers manufacturing BTX, phenolic resins, and carbon fibers to deploy bio-based raw materials.

Increasing demand for manufacturing various potential products, including activated carbon, carbon fiber, phenol derivatives, vanillin, and phenolic resins, will boost organosolv lignin demand over the next seven years. However, the lack of industrial processes for manufacturing organosolv lignin is expected to hamper growth. Rising R&D related to the product in developing countries, including India and China, is expected to boost organosolv lignin demand over the forecast period.

Increasing demand for manufacturing various potential products, including activated carbon, carbon fiber, phenol derivatives, vanillin, and phenolic resins, is expected to fuel the demand for kraft lignin over the forecast period. An increase in the manufacturing of carbon fiber, activated carbon, vanillin, phenol derivatives, and phenolic resins is expected to boost the demand for organosolv lignin.

Application Insights

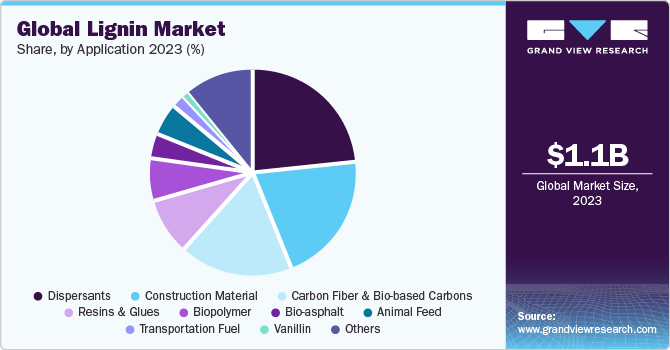

Based on applications, the dispersants segment led the market with a revenue share of 24.4% in 2022, and the segment is forecasted to expand at a CAGR of 3.3% from 2023 to 2030. Lignin-based dispersants are stabilizers and dispersants in concrete, ceramics, and drilling fluids. The dispersant properties of lignin are due to its unique chemical structure, which allows it to interact with and disperse particles in a variety of environments.

Europe and North America are the leading markets for lignin-based dispersants due to their well-established pulp and paper industries, which generate large quantities of lignin as a byproduct. The availability of lignin in these regions has led to significant research and development to find new use cases for this material, which is expected to enhance market growth over the forecast period.

The transportation fuel application segment is forecasted to grow at the fastest CAGR of 8.2% over the coming years. Lignin is becoming an increasingly popular alternative to petroleum-based products as it is abundant and renewable. As the second most abundant biopolymer in nature after cellulose, lignin is widely available as a byproduct of the paper and pulp industry. This makes it a sustainable and renewable material that can produce a wide range of products; this is expected to boost its market demand.

Lignin demand is increasingly being seen in construction applications due to its unique properties that make it a valuable ingredient in building materials. In recent years, there has been a growing interest in using lignin as a sustainable alternative to synthetic materials in construction applications. Using lignin in construction materials can reduce reliance on synthetic materials derived from non-renewable resources and have a significant environmental impact.

Regional Insights

Europe was the largest market for lignin consumption in 2022, with a revenue share of 38.8%, and is anticipated to ascend at a CAGR of 4.3% over the estimated period. Regulatory norms for restricting greenhouse gas emissions coupled with the prominent production base of biopolymers in France, Belgium, Germany, and the Netherlands are anticipated to fuel the demand. Increasing demand for lightweight motor vehicles coupled with the presence of significant vehicle manufacturing facilities is expected to influence the regional product demand positively. Additionally, ascending aromatic applications and extensive R&D by prominent players are expected to benefit the growth.

The U.S. Environmental Protection Agency (EPA) has announced financial assistance to promote the growth of biopolymers and bio-refinery, which is expected to fuel the demand for lignin. Moreover, shifting trends in the chemical manufacturing industry for using bio-based raw materials in manufacturing processes is projected to promote the application of bio-refinery and, thus, fuel the demand for lignin as a catalyst.

Asia Pacific is expected to register the fastest CAGR of 5.0% from 2023 to 2030. Rising trends for the manufacturing of products through bio-based sources are predicted to drive regional demand in the forthcoming years. Prominent market players in the region are producing pulp and paper products, which is anticipated to augment lignin production.

In Central & South America, high-grade lignin is expected to proliferate over the forecast period. Growing demand for vanillin for the manufacture of fragrances, flavorings, cosmetics, and skin-care products on account of the growing demand for natural ingredients in the food & beverages and skin-care industry is expected to benefit the market demand over the forecast period. In addition, Latin American countries have substantial forest covers that strengthen the raw material supply and drive the market growth of lignin in the region.

Key Companies & Market Share Insights

The market players are expected to witness a low threat of new entrants owing to the capital-intensive nature of the market. The key players are well-equipped with innovative technologies and advanced machinery to offer engineering solutions, which requires a high initial investment. However, the rising demand for innovative solutions will open new avenues for market entrants.

Major players have a significant market share, in terms of revenue, through domestic and international projects. Players adopt collaboration strategies to increase the reach of their products in the market and increase the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include UPM Biochemicals and Sweetwater Energy. Some prominent players in the global lignin market include:

-

Stora Enso

-

West Fraser

-

UPM Biochemicals

-

Sweetwater Energy

-

Borregaard LignoTech

-

Rayonier Advanced Material

-

Domsjo Fabriker

-

Changzhou Shanfeng Chemical Industry Co Ltd

-

Domtar Corporation

-

Nippon Paper Industries Co., Ltd

-

Metsa Group

-

The Dallas Group of America, Inc

-

Liquid Lignin Company

-

Burgo Group S.p.A

-

Valmet Corporation

Recent Developments

-

In May 2023, UPM Biochemicals along with URSA announced the introduction of more eco-friendly building insulation to help limit CO2 emissions and energy consumption. As per this deal, URSA was entrusted with producing sustainable glass wool developed with an advanced binder incorporating UPM’s BioPiva™ lignin.

-

In May 2023, Metsä Group’s Metsä Fibre, in cooperation with ANDRITZ, planned to develop a modified lignin product demonstration plant. The aim of this initiative was to build the process to detach lignin from black liquor in the production of pulp and to further fabricate it for new application areas.

-

In March 2023, Metsä Group announced plans to co-develop a new renewable product associated with the forest industry with Kemira, by 2027. The goal of this transaction was to curate a fossil-free raw material that is in line with the strategic sustainability of Metsä with targets to achieve zero fossil emissions in production and have absolutely fossil-free products by 2030.

-

In February 2023, Nippon Paper Industries Co., Ltd. entered into a strategic collaboration with Sumitomo Corporation and Green Earth Institute Co., Ltd. for the first commercial production of cellulosic bioethanol produced from woody biomass and its development into biochemical products in Japan. The collaboration was aimed at utilizing Japan's profuse forest resources to safeguard energy security and self-sufficiency while contributing to the country's efforts for building a decarbonized society.

-

In February 2023, Stora Enso announced that it has collaborated with Valmet to leverage next-gen product & process development of lignin. This transaction was aimed to boost the lignin-driven businesses of Stora Enso and further enhance the performance of LignoBoost technology by Valmet.

-

In February 2023, Nippon Paper Industries Co., Ltd. announced its plans to develop a manufacturing & sales subsidiary in Hungary. The new facility was planned to produce carboxymethyl cellulose (CMC), which is one of the materials used in Li-ion battery anodes in electric vehicles.

-

In December 2022, Stora Enso announced the commencement of its new lignin granulation & packaging plant in Finland. According to the firm, granulation in lignin was aimed at assisting the end-users to utilize lignin in a more resourceful way compared to wet or dry powder lignin.

Lignin Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.08 billion

Revenue forecast in 2030

USD 1.47 billion

Growth Rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; Japan; India; Indonesia; Japan; Malaysia; Brazil, South Africa.

Key companies profiled

Stora Enso; West Fraser; UPM Biochemicals; Sweetwater Energy; Borregaard LignoTech; Rayonier Advanced Material; Domsjo Fabriker; Changzhou Shanfeng Chemical Industry Co Ltd; Domtar Corporation; Nippon Paper Industries Co., Ltd; Metsa Group; The Dallas Group of America, Inc.; Liquid Lignin Company; Burgo Group S.p.A; Valmet Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lignin Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global lignin market based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Lingosulfonates

-

Kraft Lignin

-

Organosolv Lignin

-

Hydrolyzed Lignin

-

SODA Lignin

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Construction Material

-

Transportation Fuel

-

Biopolymer

-

Polyurethane Foam

-

Others

-

-

Bio-asphalt

-

Resins & Glues

-

Dispersants

-

Carbon Fiber & Bio-based Carbons

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lignin market size was estimated at USD 1.04 billion in 2022 and is expected to reach USD 1.08 billion in 2023.

b. The global lignin market is expected to grow at a compound annual growth rate a CAGR of 4.9% from 2023 to 2030 to reach USD 1.47 billion by 2030.

b. Europe dominated the lignin market with a share of 38.8% in 2022. This is attributable to the presence of a favorable regulatory framework for the use of lignin in a wide array of commercial applications.

b. Some of the key players operating in the Lignin market include Stora Enso, West Fraser, UPM Biochemicals, Sweetwater Energy, Borregaard LignoTech, Rayonier Advanced Material, Domsjo Fabriker, Changzhou Shanfeng Chemical Industry Co Ltd, Domtar Corporation, Nippon Paper Industries Co., Ltd, Metsa Group, The Dallas Group of America, Inc., Liquid Lignin Company, Burgo Group S.p.A, and Valmet Corporation

b. Key factors driving the lignin market growth include the increasing demand for lignin in dust control applications and construction activities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.