- Home

- »

- Smart Textiles

- »

-

Law Enforcement Personal Protective Equipment Market Report, 2028GVR Report cover

![Law Enforcement Personal Protective Equipment Market Size, Share & Trends Report]()

Law Enforcement Personal Protective Equipment Market Size, Share & Trends Analysis Report By Product (Protective Clothing, Respiratory Protection), By Region, And Segment Forecasts, 2019 - 2028

- Report ID: GVR-4-68038-961-6

- Number of Pages: 137

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Advanced Materials

Report Overview

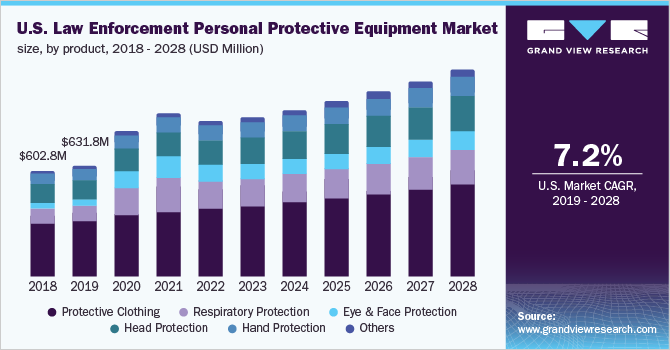

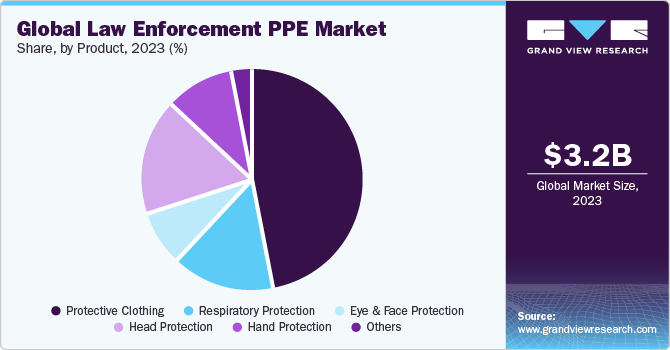

The global law enforcement personal protective equipment market size was valued at USD 3.28 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2019 to 2028. Safety of law enforcement officers while performing their duty to ensure safety and security and to detect, prevent, and prosecute violations expected to drive the demand for personal protective equipment over the forecast period. Police officers deployed on the ground level during the pandemic are exposed to the coronavirus, particularly when in direct contact with the public. Since the COVID-19 pandemic, the police force has played a critical role in assisting attempts to contain the disease and build safer communities. This has increased the demand for respiratory, hand, and eye protection used by officers.

The COVID-19 pandemic has increased the demand for law enforcement PPE such as protective clothes, respirator masks, face shields, surgical masks, and goggles. The demand for PPE, especially respiratory, hand, and eye protection PPE, continues to be high since the threat of the virus is still imminent. Since PPE continues to be an indispensable part of safety during the pandemic, the market is expected to observe growth in the coming years.

According to the Global Peace Index, civil unrest has more than doubled in the last decade because of escalating challenges such as police brutality and economic hardship. As of 2021, around 5,000 pandemic-related violent events from January 2020 to April 2021, and tensions were recorded as the coronavirus pandemic has a detrimental influence on civil rights and violence, political stability, and conflict.

Hi-Vis clothing, protective vests/body armors, coveralls/gowns, eye protection, head protection helmets, breathing devices, gloves, and footwear are examples of personal protective equipment (PPE) worn by law enforcement personnel during battle or training. These PPE are designed to protect enforcement personnel from biological, chemical, physical, and radioactive threats on duty.

In response to the COVID-19 pandemic, various government agencies relaxed rules relating to the value chain to ensure uninterrupted supply, boost production capacity, and control PPE export. Furthermore, the pandemic's long-term impact includes strategic stockpiling of vital supplies, a significant rise in various players' manufacturing capacity, and an increase in the number of mergers and acquisitions as well as new entrants.

Product Insights

The protective clothing segment led the market and accounted for over 40.0% share of the global revenue in 2020. Scientific advancements in materials used in protective clothing and the launch of innovative goods such as electrical technology integration and new energy absorption mechanism in body armor are projected to drive the demand for body armor.

The respiratory protection segment is estimated to expand at a CAGR of 9.9% over the forecast period on account of the increasing number of new coronavirus cases globally. As a response, several manufacturers, notably 3M and Honeywell International, Inc., collaborated with various government agencies to increase the manufacturing of these masks in order to address the scarcity of masks.

Eyewear offers protection to law enforcement personnel to prevent injuries during training and while controlling riots or protests. Military-grade eyewear also offers visibility enhancement, UV reduction, and ballistic protection in a tactile environment. The eye protection segment includes goggles, safety glasses, shields, night vision eyeglass, and sunglasses.

A combat helmet is an essential piece of law enforcement equipment, which is employed to improve the impact protection of officers. Combat helmets are being widely adopted by police agencies to protect personnel from machine-gun bullets, IED blasts, and shrapnel that may cause severe head injuries. The market is expected to be driven by the rising demand for lightweight helmets that reduce fatigue and tactical helmets.

Regional Insights

North America led the market and accounted for over 30.0% share of the global revenue in 2020. Current state and federal occupational health and safety protocols, coupled with an increase in protests in a demonstration in the U.S. that have led to escalated police confrontation and violence, are driving the demand for PPE for frontline law enforcement officers.

In response to the COVID-19 pandemic, the Mexican government declared a health emergency and implemented measures to curb the spread of the virus. In addition, criminal investigations, which are vital to public safety, necessitate officers interviewing victims, witnesses, and suspects and arresting and processing suspects, thereby requiring them to use PPE to protect themselves from the virus, in turn, driving the market demand.

Asia Pacific is likely to expand at the fastest CAGR of 9.9% over the forecast period. This can be attributed to the growing demand for law enforcement PPE for police forces in left-wing extremism-affected regions in countries such as India that have witnessed an increased attack on security personals with improvised guerilla tactics and IED blasts.

The rising number of protests in countries such as India, Thailand, and Australia is boosting the demand for personal protective equipment for frontline law enforcement officers. For instance, the ongoing public protest in Australia against unemployment and increased lockdown measures have increased protesters’ police confrontation. This, in turn, is anticipated to boost the demand for law enforcement PPE in the Asia Pacific over the forecast period.

Key Companies & Market Share Insights

The market is characterized by the presence of large- and small-scale manufacturers across the globe, thereby, resulting in a significant level of concentration. The competition in the market is intense and is marked by the demand for innovative and reliable protective solutions. The majority of manufacturers are engaged in offering products by implementing the most innovative and state-of-the-art technologies to ensure optimum comfort, durability, and protection to end-users working in different professional fields. Major players in the market compete based on product differentiation and diversified product offerings. For instance, in October 2021, DuPont introduced Core Matrix Technology that improves fragmentation and ballistic performance in armors, thereby improving the safety of law enforcement officers on duty. Some prominent players in the global law enforcement personal protective equipment market include:

-

3M

-

The SAFARILAND Group

-

MSA Safety

-

Honeywell International Inc.

-

DuPont de Nemours Inc.

-

XION Protective Gear

-

ArmorSource LLC

-

Lakeland Industries, Inc.

-

Ansell Protective Solutions

-

Avon Rubber PLC

-

COFRA SRL

-

Point Blank Enterprises Inc.

-

Ballistic Body Armour Pty

-

Craig International Ballistics Pty. Ltd.

Law Enforcement Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.69 billion

Revenue forecast in 2028

USD 5.24 billion

Growth Rate

CAGR of 8.3% from 2019 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2019 - 2028

Quantitative units

Revenue in USD million and CAGR from 2019 to 2028

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

The SAFARILAND Group; 3M; MSA Safety; Honeywell International Inc.; DuPont de Nemours Inc.; XION Protective Gear; ArmorSource LLC; Lakeland Industries, Inc.; Ansell Protective Solutions; Avon Rubber PLC; COFRA SRL; Point Blank Enterprises Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global law enforcement personal protective equipment market report on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Protective Clothing

-

Hi-Vis Clothing

-

Protective Vests/Body Armors

-

Coveralls/Gowns

-

General Use

-

-

Respiratory Protection

-

Respiratory Masks

-

Air Purifying Respirators

-

Others

-

-

Eye & Face Protection

-

Head Protection

-

Hand Protection

-

Disposable Gloves

-

Durable/Tactical Gloves

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global law enforcement personal protective equipment market size was estimated at USD 3.28 billion in 2020 and is expected to reach USD 3.69 billion in 2021

b. The global law enforcement personal protective equipment market is expected to grow at a compound annual growth rate of 8.3% from 2019 to 2028 to reach USD 5.24 billion by 2028

b. North America dominated the law enforcement personal protective equipment market with a revenue share of around 32% in 2020. Current state and federal occupational health and safety protocols coupled with an increasing protest in the demonstration in the U.S. resulted in the escalation of police confrontation and violence thereby boosting the demand for PPE for frontline law enforcement officers.

b. Some of the key players operating in the law enforcement PPE market include The SAFARILAND Group, 3M, MSA Safety, Honeywell International Inc., DuPont de Nemours Inc., XION Protective Gear, ArmorSource LLC, Lakeland Industries, Inc., Ansell Protective Solutions, Avon Rubber PLC, COFRA SRL, and Point Blank Enterprises Inc. among others

b. The key factors that are driving the law enforcement personal protective equipment market include the rise in asymmetric warfare in various countries, increasing focus on ensuring police survivability, and an increasing number of law and order situations including riots, protests, internal disturbances across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."