- Home

- »

- Specialty Polymers

- »

-

Lactic Acid Market Size And Share Analysis Report, 2030GVR Report cover

![Lactic Acid Market Size, Share & Trends Report]()

Lactic Acid Market Size, Share & Trends Analysis Report By Raw Material (Sugarcane, Corn, Cassava), By Application (Industrial, Food & Beverages, Pharmaceuticals, Personal Care, Polylactic Acid), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-126-9

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Lactic Acid Market Size & Trends

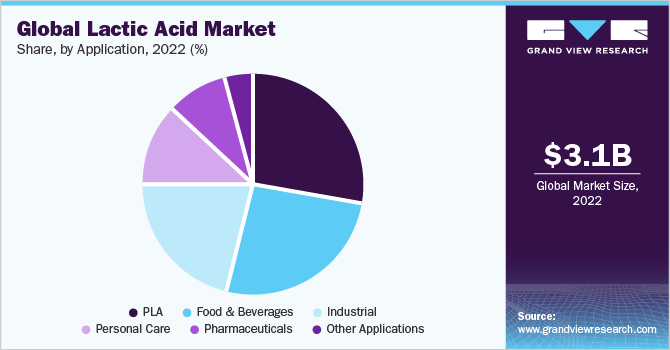

The global lactic acid market size was valued at USD 3.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. The usage of this product in various end-use industries including pharmaceuticals, food & beverages majorly in emerging economies such as India, China, and Indonesia are anticipated to drive the demand for this product over the forecast period.

This product is majorly used in the production of PLA, which is a biodegradable polymer, compostable thermoplastic made from renewable sources such as lactic acid produced via fermentation processes. This chemical is Generally Recognized As Safe (GRAS) and has great market potential in the food industry being recognized as harmless By the United States Food & Drug Administration. It can be alternatively produced by chemical synthesis or fermentation.

The product is considered as one of the well-known organic acids having wide range of industrial applications. The four main applications of this product are in food, chemical, pharmaceutical, and cosmetics industries. This product is a lactic acid bacteria which refer to a large group of beneficial bacteria having probiotic properties. Additionally, this acid plays a crucial role in the preparation of wine making, pickling, sausages, curing fish, meat, vegetables baking, and preparation of fermented dairy products.

The product is not only a significant ingredient in fermented foods, including, canned vegetables, yogurt, and butter, but is also used as a preservative and acidulant in pickled vegetables and olives. This naturally occurring organic acid, is used in a variety of applications, including food & beverages, pharmaceuticals, cosmetics, chemicals, and industrial.

This product in one of the large-scale organic acid produced, the most commonly used feedstock are carbohydrates obtained from different sources such as sugarcane, corn starch, and others. As compared to mineral acids, organic acids does not completely dissociate in water.

Raw Material Insights

The sugarcane segment dominated the market and accounted for the largest revenue share of 38.9% in 2022. This high share is attributable to the abundant biomass materials availability. Raw sugar extracted from sugar beet or sugarcane is one of the major feedstock used in the manufacture of lactic acid. Sugarcane contributes notably to the development of bioplastics and also contributes to the food and biochemical industries.

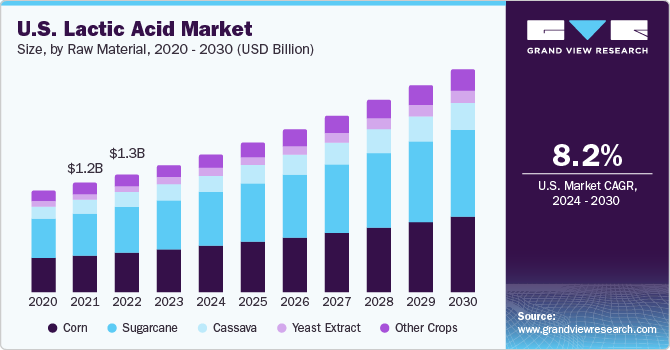

Corn has emerged as a prominent raw material segment and has accounted for a significant share in 2022. This share is attributable owing to its low cost, sustainability, and abundance in nature. Rising environmental concerns, sustainable processing practices, and a limited supply of petroleum feedstock are anticipated to augment the demand for corn-based lactic acid products over the forecast period.

Yeast extract is one of the most commonly used ingredients for the production of lactic acid. However high production cost associated with this process gave rise to an alternative namely Corn Steep Liquor (CSL) derived from corn as a by-product of the corn steeping process. The demand for corn-based lactic acid in the food & beverages industry as a pH regulator, microbial activity enhancer, as an acidulant, and others are expected to market growth over the coming years.

Other numerous inexpensive raw materials used in the production of lactic acid are starchy & cellulosic materials such as cassava, sweet sorghum, potato, wheat, rye-barley, rice, xylan, galactan, lignin, and other filamentous fungi such as Lactic Caid Bacteria (LAB), and Rhizopus. PLA is witnessed to constitute a significant application share in the market.

Application Insights

The polylactic acid segment dominated the market and accounted for the largest volume share of 28.7% in 2022. This high share is attributable to its durability, mechanical strength, and transparency as compared to other bio-degradable plastics. Rising demand for bio-degradable plastic materials, the constant growth of the automotive industry, and increasing demand from end-use industries are the major driving factors for this application segment.

In transportation and automotive sector, numerous vehicle interior components such as interior trim, under-the-hood components, and engine components are produced using lightweight materials. The lightweight components reduce the weight of the vehicle and enhance performance, this has led to a rise in demand for sustainable bioplastic material to increase fuel economy and toughness which in turn will propel the market demand for PLA.

Food & beverages emerged as the second-largest application segment in the year 2022. This product has the ability to enhance flavor and increase the shelf life of food & beverage products by controlling the development of pathogenic microorganisms. Owing to these properties the demand for this product is anticipated to surge with its growing penetration in seafood, poultry, and meat industries.

Lactic acid serves as a vital feedstock in the production of PLA, which is further used to manufacture biodegradable plastic. These biodegradable plastics are used in numerous industries such as packaging and chemical. This product is a natural solvent used as a metal cleaning agent as well as in mechanical cleaning applications.

The pharmaceutical industry has been a key component in the growth of this product market over the past few years on account of its increasing application in drug manufacturing and as an electrolyte in intravenous solutions used for supplementing the required bodily fluids. Properties of lactic acid such as metal sequestration, pH regulator, effectiveness in being a natural body constituent, and chiral intermediate in pharmaceutical products are expected to be the key factors for its growth in the pharmaceutical industry. The personal care application segment is expected to be a key driver for this product, which can be attributed to increasing product use in skincare products. Lactic acid-based skin moisturizers improve dry skin, remove acne scars, improve discoloration, and prevent damage to skin tissues.

Regional Insights

North America region dominated the lactic acid market and accounted for the largest revenue share of more than 45.2% in 2022. This high share is attributable to the growing personal care, pharmaceutical, and food & beverages industries. The expanding pharmaceutical industry in the U.S. as a result of increasing expenditures on medicines is anticipated to have a positive impact on the market in this region.

The North America market is expected to grow on account of the presence of various personal care and cosmetic companies such as Maybelline New York, Procter & Gamble, Colgate-Palmolive Company, Avon, Unilever, and Johnson & Johnson Private Limited. Moreover, the robust manufacturing base of global cosmetic manufacturers such as Procter & Gamble, Unilever, and Johnson & Johnson Private Limited in the U.S. is expected to promote the demand for personal care products.

Rising demand for PLA, owing to the U.S. government's efforts toward reducing carbon footprint, high demand from packaging applications, and growth of pharmaceutical and personal care industries is expected to propel the growth of the market over the forecast period.

Key Companies & Market Share Insights

Companies are engaging in mergers, and acquisitions, with an aim to strengthen their manufacturing capacities, and product portfolio and offer a competitive product range. For instance, in April 2019, Corbion and Total announced a joint venture to build a PLA bioplastic plant in Europe. The plant is expected to have an annual production capacity of 100,000 tons and will be operational from 2024. Corbion also appointed IMCD (a prominent distributor of food ingredients and specialty chemicals) in New Zealand and Australia. The strategy is anticipated to benefit lactic acid distribution in the Asia Pacific region, especially to the manufacturers of beverages, confectionery, sauces, baked goods, condiments, dressings, and prepared foods.

In January 2017, ThyssenKrupp AG announced to establish a manufacturing facility in Changchun, China, for producing 10,000 tons of PLA. This strategic initiative was aimed at reducing the company’s dependency on petroleum-based plastics. Based on its patented technology PLAneo, this commercial plant commenced its manufacturing operations from the first quarter of 2018.

Manufacturing companies operating in the market emphasize mainly on expanding their global footprints in an attempt to increase market shares and drive their revenues. They are expanding production facilities in various regions such as North America, Asia Pacific, and Europe owing to the easy availability of raw materials and close proximity to raw material suppliers. Some of the prominent players in the lactic acid market include:

-

BASF SE

-

Galactic

-

Musashino Chemical (China) Co., Ltd.

-

Futerro

-

Corbion

-

Dow

-

TEIJIN LIMITED

-

NatureWorks LLC

-

Henan Jindan Lactic Acid Technology Co. Ltd.

-

thyssenkrupp AG

-

Cellulac

-

Jungbunzlauer Suisse AG

-

Vaishnavi Bio Tech

-

Danimer Scientific

Lactic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.37 billion

Revenue forecast in 2030

USD 5.80 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; CSA, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Netherlands; China; India; Japan; Indonesia; Malaysia; Philippines; Brazil

Key companies profiled

Futerro; BASF SE; Galactic; Henan Jindan Lactic Acid Technology Co. Ltd.; Musashino Chemical (China) Co., Ltd.; Corbion; thyssenkrupp AG; Dow; Cellulac; Jungbunzlauer Suisse AG; Vaishnavi Bio Tech; TEIJIN LIMITED; Danimer Scientific; NatureWorks LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lactic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global lactic acid market report on the basis of raw material, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corn

-

Sugarcane

-

Cassava

-

Other Crops

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care

-

PLA

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Netherlands

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Malaysia

-

Philippines

-

Rest of Asia Pacific

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global lactic acid market size was estimated at USD 3.1 billion in 2022 and is expected to reach USD 3.37 billion in 2023.

b. The global lactic acid market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 5.80 billion by 2030.

b. The sugarcane raw material segment dominated the global lactic acid market and accounted for the largest revenue share of over 38% in 2022.

b. The polylactic acid application segment led the global lactic acid market and accounted for the largest revenue share of more than 28% in 2022.

b. North America dominated the lactic acid market with a share of 45% in 2022. This is attributable to rising consumer awareness regarding recyclability and green packaging.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Lactic acid prominently used across food and beverage, cosmetics, production of polylactic acid, which in turn is used for food packaging and medical implants & devices. A sudden increase in demand for ventilators and supporting medical equipment, has triggered the demand for bioplastics in the midst of the pandemic. PLA being a prominent bioplastic, is expected to provide traction to lactic acid consumption. However, as the coronavirus crises entail significant ramifications in the agriculture industry, the supply of raw material for producing lactic acid might observe an adverse impact. The updated report will account for COVID-19 as a key market contributor.