- Home

- »

- Clinical Diagnostics

- »

-

Laboratory Proficiency Testing Market Size Report, 2030GVR Report cover

![Laboratory Proficiency Testing Market Size, Share & Trends Report]()

Laboratory Proficiency Testing Market Size, Share & Trends Analysis Report By Industry (Clinical Diagnostics, Cannabis), By Technology (Cell Culture, PCR), By End-use (CROs, Hospitals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-287-3

- Number of Pages: 195

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global laboratory proficiency testing market size was estimated at USD 1.27 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Increasing focus on water testing, legalization of medical cannabis, growing number of cannabis testing laboratories, rising prevalence of foodborne illnesses, growing cases of chemical contamination of foods, and continuous introduction of new products & services are the key factors expected to propel the market growth. For instance, in March 2022, BIPEA launched a novel Proficiency Testing Scheme (PT 35d) dedicated to water microbiological testing laboratories. Moreover, the growing adoption of laboratory proficiency testing owing to stringent regulations is another factor estimated to boost market growth over the coming years.

Increasing focus on water testing to identify the presence of micropollutants, contaminants, and microorganisms in freshwater & wastewater is expected to boost the market. Laboratory proficiency testing (PT) is crucial in water testing, particularly in microbiology. It ensures that laboratories performing water quality analysis are proficient in accurately detecting and quantifying microbial contaminants. Moreover, PT is carried out to diagnose groundwater age with the help of tritium to map aquifer reserves & their vulnerability to surface pollution. According to the International Atomic Energy Agency (IAEA), half of the 78 laboratories carrying out this test meet the required analytical testing standards.

The legalization and growing acceptance of cannabis in numerous regions is anticipated to increase the need for rigorous testing to verify product quality, safety, and compliance with regulatory standards. PT is used to evaluate the competency of cannabis testing laboratories in diverse areas, such as potency determination, pesticide & residual solvent analysis, microbial testing, and heavy metal screening. Increasing demand for PT in the cannabis industry encourages market players to take favorable initiatives to grab market opportunities. For instance, in April 2023, S.C. Labs and ACT Laboratories launched a new program to standardize the protocols for testing the potency and purity of marijuana products.

Such initiatives are expected to drive the development and operation of proficiency testing programs in the market. Moreover, the increasing prevalence of foodborne illness due to the consumption of unsafe foods that contain viruses, bacteria, chemical substances, and parasites is anticipated to boost the market. According to the WHO, approximately 600 million people globally, or around 1 in 10 people, suffer from foodborne illnesses, leading to 420,000 deaths yearly. Furthermore, low- and middle-income economies are financially affected by a high incidence of foodborne illness, which is expected to increase the demand for proficiency testing for food products in emerging countries.

Approximately USD 110 billion is lost yearly in the production of drugs and medical expenses for treating foodborne illnesses. Furthermore, regulatory bodies, such as the U.S. FDA, EMA, and others, have implemented stringent guidelines for quality control in different end-use industries, highlighting the importance of laboratory proficiency testing. Compliance with these guidelines is crucial, as non-compliance can lead to penalties and recalls of products in the case of pharmaceutical & biotechnology companies. Hence, there is a growing demand for competent laboratories evaluating services as pharmaceutical companies strive to adhere to these regulatory requirements.

Industry Insights

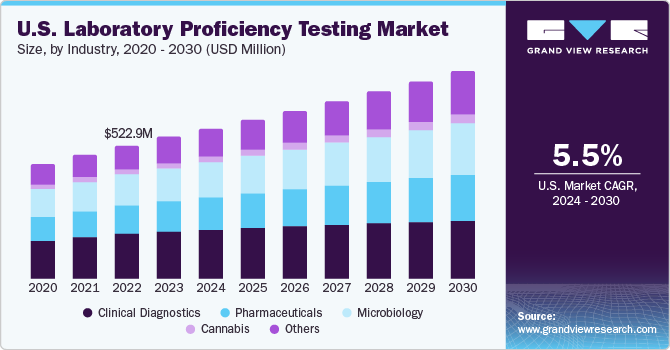

The clinical diagnostic segment held the largest market share of 33.72% in 2022 owing to the high adoption rate of proficiency testing to reduce error and maintain accurate results & quality of clinical diagnostic tests. PT holds significant importance in clinical diagnostics as it is often a prerequisite for CLIA certification, which is essential for the legal operation of laboratories. Moreover, recognizing the significance of PT, the Centers for Medicare and Medicaid Services (CMS) have proposed updates to the proficiency testing requirements for laboratories regulated under CLIA in July 2022.

The cannabis segment is anticipated to grow at the fastest CAGR over the forecast period. The rapidly growing cannabis industry, increasing approval of cannabis-based products, and the increasing number of laboratories offering cannabis PTs are key factors supporting the market growth. To further establish standards and ensure quality control in the cannabis industry, several initiatives and partnerships have been formed. For instance, in May 2022, AOAC INTERNATIONAL and Signature Science collaborated to develop PT materials for the cannabis proficiency testing program.

Technology Insights

The cell culture segment dominated the market with a revenue share of 27.37% in 2022 and is expected to maintain its dominance throughout the forecast period. The high market share of the segment can be attributed to its high usage in the detection of infectious microorganisms. Moreover, growth in the adoption of cell culture-based products has led to an increase in the adoption of this technology to achieve maximum production from microbial strain cultures. These tests are valuable tools for maintaining the accuracy & integrity of laboratory processes, ensuring the safety & efficacy of cell culture-based products, and meeting regulatory requirements in the pharmaceutical & healthcare industries.

However, the chromatography segment is projected to experience the fastest growth rate over the forecast period. Reliability & safety for quality control in pharmaceutical & biotechnology are increasing the segment demand, motivating key market players to adopt chromatography technology to offer laboratory proficiency testing services. For instance, the PHARMASSURE scheme provided by LGC offers High-Performance Liquid Chromatography (HPLC) proficiency testing tailored to meet the specialized demands of the pharmaceutical industry

End-use Insights

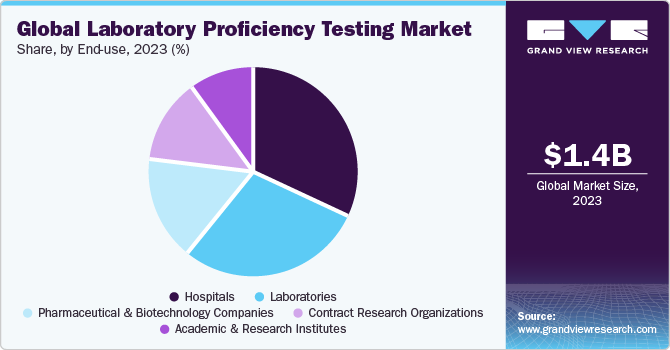

The hospitals segment dominated the market with a revenue share of 31.86% in 2022 owing to the increasing need for regular competence evaluation in hospitals. Hospital laboratories are required to deliver accurate results, making regular competence evaluation crucial. Moreover, the increasing number of tests offered by hospitals is further expected to drive the demand for PT. Moreover, developed countries commonly practice proficiency testing programs, with hospitals offering convenient insurance coverage, making them the preferred choice for patients. Moreover, regular participation in proficiency testing enables laboratories to validate evaluating methodologies, identify areas for improvement, and uphold the highest standards of accuracy in diagnostic procedures.

The contract research organizations segment is projected to witness the fastest growth rate over the forecast period. Increasing adoption of out-source services in the healthcare industry, growing emphasis on R&D, and stringent regulatory guidelines for clinical trials are key factors significantly increasing demand for laboratory proficiency evaluation in CROs. Moreover, emerging economies like India and China have emerged as prominent hubs for CRO activities, which is anticipated to increase the demand for PT in the coming years.

Regional Insights

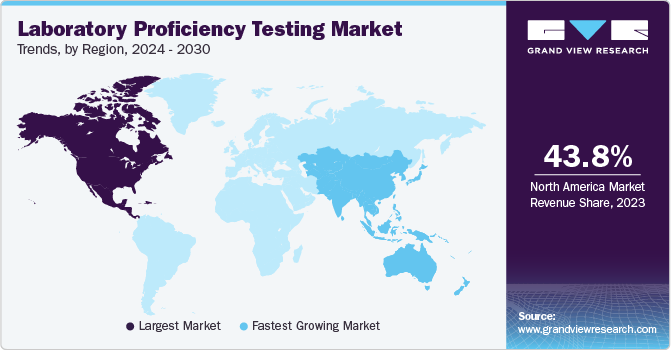

North America dominated the global market with a revenue share of 44.12% in 2022. The region’s dominance can be attributed to the existence of established pharmaceutical & diagnostics industries, stringent regulatory framework related to laboratory accreditation, and the growing adoption of laboratory competence evaluation. Moreover, the presence of leading market players such as the American Proficiency Institute, College of American Pathologists, and Bio-Rad Laboratories, Inc., and well-established healthcare infrastructure are key drivers for the market in the region.

However, Asia Pacific is estimated to witness the fastest growth over the forecast period due to improvement in healthcare infrastructure and increasing involvement of regulatory bodies to improve healthcare services. Moreover, increasing healthcare awareness, a rising number of laboratories going for international accreditations, and the increasing number of pharmaceutical & biotechnology companies in the region are anticipated to fuel the demand for laboratory proficiency evaluating services.

Key Companies & Market Share Insights

Key market players are adopting market strategies, such as new product launches, collaborations, and geographical expansions, to increase their global footprint. For instance, in January 2023, BIPEA introduced a novel proficiency test in surface microbiology, expanding its range of offerings. This new test allows professionals in the field to enhance their expertise and proficiency in surface microbiology analysis. In April 2022, NSI Lab partnered with Spex and USP testing, offering a comprehensive solution for professionals to evaluate their capabilities & meet regulatory requirements in the pharmaceutical industry. Some of the key players in the global laboratory proficiency testing market include:

-

LGC Limited

-

Bio-Rad Laboratories, Inc.

-

Randox Laboratories Ltd.

-

QACS - The Challenge Test Laboratory

-

Merck KGaA

-

Weqas

-

BIPEA

-

NSI Lab Solutions

-

Absolute Standards, Inc.

-

INSTAND

Laboratory Proficiency Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.36 billion

Revenue forecast in 2030

USD 2.13 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Industry, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

LGC Ltd.; Bio-Rad Laboratories, Inc.; Randox Laboratories Ltd.; QACS - The Challenge Test Laboratory; Merck KGaA; Weqas; BIPEA; NSI Lab Solutions; Absolute Standards, Inc.; INSTAND

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Proficiency Testing Market Report Segmentation

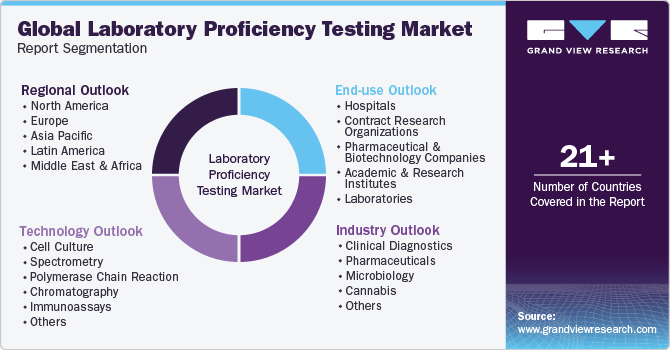

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the laboratory proficiency testing market report on the basis of industry, technology, end-use, and region:

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostics

-

Clinical chemistry

-

Immunochemistry

-

Hematology

-

Oncology

-

Molecular Diagnostics

-

PCR

-

Others

-

-

Coagulation

-

Others

-

-

Pharmaceuticals

-

Biological Products

-

Vaccines

-

Blood

-

Tissues

-

-

Others

-

-

Microbiology

-

Pathogen Testing

-

Sterility Testing

-

Endotoxin & Pyrogen Testing

-

Growth Promotion Testing

-

Others

-

-

Cannabis

-

Medical

-

Non-Medical

-

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Culture

-

Spectrometry

-

Polymerase Chain Reaction

-

Chromatography

-

Immunoassays

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Laboratories

-

Independent Laboratories

-

Specialty Laboratories

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global laboratory proficiency testing market size was estimated at USD 1.27 billion in 2022 and is expected to reach USD 1.36 billion in 2023.

b. The global laboratory proficiency testing market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 2.13 billion by 2030.

b. Clinical diagnostics dominated the laboratory proficiency testing market with a share of 33.72% % in 2022. This is attributable to laboratory proficiency testing procedures being a common practice for quality management of clinical diagnostics.

b. Some key players operating in the laboratory proficiency testing market include LGC Limited, American Proficiency Institute, College of American Pathologists, QACS - The Challenge Test Laboratory, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., RCPA, and Merck & Co., Inc.

b. Key factors that are driving the laboratory proficiency testing market growth include increasing focus on water testing, legalization of medical cannabis & growing number of cannabis testing laboratories, increasing outbreaks of foodborne illnesses, and rising cases of chemical contamination of foods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."