- Home

- »

- Clothing, Footwear & Accessories

- »

-

Jewelry Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Jewelry Market Size, Share & Trends Report]()

Jewelry Market Size, Share & Trends Analysis Report By Product Type (Necklace, Ring, Earring, Bracelet, Others), By Material (Gold, Platinum, Diamond, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-106-1

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global jewelry market size was valued at USD 340.69 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. Increasing disposable income and innovative jewelry designs offered by manufacturers are expected to drive product demand. Changing lifestyles and perceptions of jewelry as a status symbol are expected to boost growth. COVID-19 has had a positive effect on jewelry sales, with 30% of consumers in a recent poll reporting they purchased more jewelry during the pandemic, according to a study from the supplier group the Plumb Club. The survey entitled “The Plumb Club Industry & Market Insights 2021,” also noticed that 49% of consumers bought as much jewelry as they always did, while 21% purchased less.

The increasing acceptance of jewelry among men is also propelling the market. Products such as cufflinks, plain gold chains, tie bars, cartography necklaces, and signet rings are some of the products commonly in demand among men.

A vast client base makes it possible for manufacturers to cater to a large market and earn profits. The introduction of new designs and emerging fashion trends are attracting customers and manufacturers are leveraging this frequent change in fashion to design unique products to attract customers.

Bridal jewelry also plays a significant role in driving the market. In countries like India, high expenditure on wedding ceremonies and celebrations are expected to positively impact market growth. Women are focusing on the latest trends when it comes to jewelry and accessories. The availability of customization for such products is an important factor among consumers and is likely to bode well for the market.

Additionally, rising awareness about the authenticity of the metals and gems used in the jewelry pieces is driving the market. Manufacturers are not only adhering to authenticity and quality standards but also educating consumers through advertising campaigns.

Diamonds are becoming increasingly popular due to an increase in consumer disposable income and spending capacity. Diamonds are considered to be one of the earth’s most impressive natural materials due to their stunning attributes and are perceived as a reflection of one’s financial status.

The jewelry market is also expected to witness significant growth via the online channel as major players are focusing on using their websites to announce product launches, sales, and other relevant information. However, rising e-commerce frauds and a lack of knowledge about the hallmarks on jewelry are expected to hinder market growth.

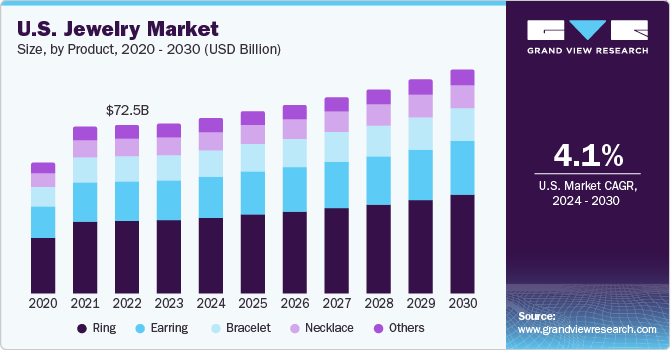

Product Type Insights

In terms of value, the market is segmented into five categories, namely necklaces, rings, earrings, bracelets, and others. Rings emerged as the largest segment in 2022, with a market share of 33.7%. This segment is likely to retain its pole position throughout the forecast period to claim a market share of 34.5% by 2030.

The rising sales of rings worldwide are principally driven by the increasing demand for wedding rings, coupled with the growing preference for corporate dressing. A key trend that has been gripping the market in recent years is the rising sale of rings within the male consumer segment. This can be attributed to improvements in men’s jewelry designs and rising fashion awareness among men around the world.

There has also been a change in the way consumers perceive rings. Younger generations with a less-traditional viewpoint on marriages, tend to build a strong connection between love and rings, be it commitment rings, engagement rings, or promise rings. In the near future, jewelers are expected to increasingly target younger consumers worldwide owing to their growing affinity for rings.

The bracelets segment is projected to progress at a CAGR of 3.9% over the forecast period. The rising popularity of cross-cultural designs in bracelets is among the key factors augmenting product demand around the world. In this respect, jewelry inspired by Egyptian, European, and Italian cultures is likely to gain traction in the foreseeable future.

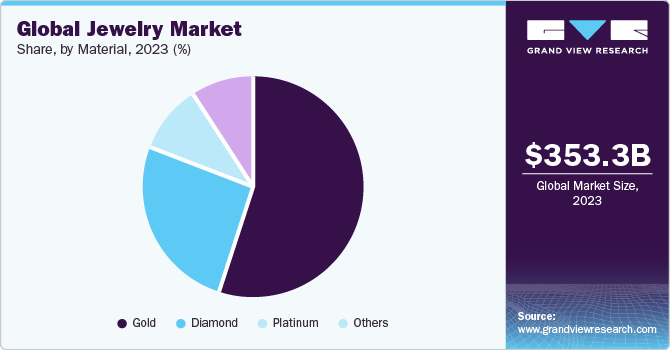

Material Insights

The market for gold jewelry held the largest market share as the material is the most popular metal used in the making of all sorts of jewelry across the world. The segment was valued at USD 185.83 billion in 2022 and is expected to exhibit a CAGR of 4.9% during the forecast period to maintain its leading position during the forecast period.

Depending on the product type of alloy used, jewelry made with yellow, white, rose, and green gold is available in various designs and shapes. For instance, yellow gold is alloyed with silver, copper, and zinc. White gold is an alloy of gold and at least one white metal, usually nickel, silver, or palladium. Rose gold is a mixture of gold, copper, and silver, and green gold is a mixture of gold and silver, with traces of copper and other metals.

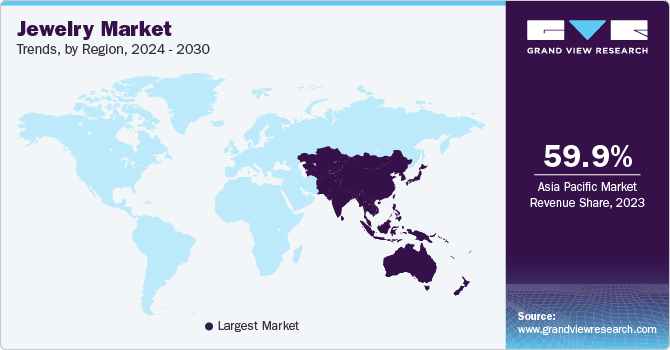

Regional Insights

Asia Pacific had the greatest share of the worldwide market, contributing more than 60%. This whopping market share is mainly attributed to the high demand for jewelry from densely populated countries in the region including India and China, where gold is consumed on large scale. China was the leading country in the market owing to its increased spending power of the population and swiftly developing economy.

The region is also present with a large number of top key players such as Malabar Golds and Diamonds, Tanishq, Queelin, Wallace Chan, and among others with a vast distribution network. For instance, according to the Indian Brand Equity Foundation (IBEF), data published in July 2020, the Indian jewelry and gem sector was estimated to be one of the largest contributors to the global market and is anticipated to have 29% of the global consumption.

Key Companies & Market Share Insights

The global jewelry industry is characterized by the presence of a number of well-established players such as Tiffany & Co., Pandora, Chow Tai Fook, and Louis Vuitton SE, in addition to several small players and mid-sized players such as Richemont, GRAFF, Signet Jewelers Limited, H. Stern, and Malabar Gold & Diamonds. The competition in the market is intense as some of the players are among the well-known manufacturers of jewelry items and accessories

Looking to enhance their consumer base, leading players in the industry are trying to increase their presence in Asia Pacific owing to the growing middle-class population with high disposable income. Asia presents over 50% of the global jewelry market and is expected to showcase high growth in the luxury jewelry segment in the coming years. These companies are primarily focusing on expansion and partnerships with established online retailers in the region to gain a competitive advantage.

-

In September 2019, luxury brand Cartier, a subsidiary of Richemont, announced its partnership with Alibaba Group to launch an online store on the Tmall Luxury Pavilion platform of Alibaba, which is a Chinese language website for business-to-consumer for online retail. Through this deal, the company plans to attract young consumers in the country, who, in recent years, have shown the willingness to shift from offline to online purchases of luxury jewelry. The company has launched exclusive products on Tmall, including the Juste un Clou, a small model bracelet with diamonds, and a Guirlande chain wallet bag.

Some of the key players operating in the global jewelry market include: -

-

Tiffany & Co

-

Pandora

-

Chow Tai Fook

-

Louis Vuitton SE

-

Richemont

-

GRAFF

-

Signet Jewelers Limited

-

H. Stern

-

Malabar Gold & Diamonds

-

Swarovski AG

Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 353.26 billion

Revenue forecast in 2030

USD 482.22 billion

Growth Rate (Revenue)

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany, UK; France; China; India; Brazil; Saudi Arabia; UAE (Dubai)

Key companies profiled

Tiffany & Co.; Pandora; Chow Tai Fook; Louis Vuitton SE; Richemont; GRAFF; Signet Jewelers Limited; H. Stern; Malabar Gold & Diamonds; Swarovski AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Jewelry Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global diamond jewelry market report based on product, material, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Dubai

-

-

Frequently Asked Questions About This Report

b. The global jewelry market size was estimated at USD 340.69 billion in 2022 and is expected to reach USD 353.26 billion in 2023.

b. The global jewelry market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 482.22 billion by 2030.

b. Asia Pacific dominated the jewelry market with a share of 59.5% in 2022. The growth of this region is attributable to the high consumption of gold and diamond in countries such as India and China.

b. Some key players operating in the jewelry market include Tiffany & Co., Pandora, Signet Jewellers, H. Stern, Chow Tai Fook, Swarovski, Cartier, and Buccellati.

b. Key factors that are driving the jewelry market growth include the emerging trend of bridal jewelry, rapidly changing consumer lifestyle, and growing acceptance of jewelry among men, most notably in Asian countries such as India and China.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The clothing, footwear, & accessories industry is anticipated to witness checkered growth throughout 2020, as a result of the unprecedented supply chain disruptions caused by the COVID-19 outbreak worldwide. The expected decline in the global sales of clothing, footwear, & accessories is attributable to massive supply chain disruptions across significant export markets, including China and India. However, the industry is likely to recover over the forecast timeframe, given the rising popularity of online/e-commerce sales. From a manufacturing standpoint, the sustainable or ethical fashion trend is expected to favor market growth throughout the forecast timeframe. Luxury apparel is another lucrative space for prospective manufacturers to target, given the mushrooming number of affluent and fashion-conscious consumers across the globe. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.