- Home

- »

- Electronic Devices

- »

-

IP Camera Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![IP Camera Market Size, Share & Trends Report]()

IP Camera Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By Product Type, By Connection Type, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-006-2

- Number of Pages: 230

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Semiconductors & Electronics

Report Overview

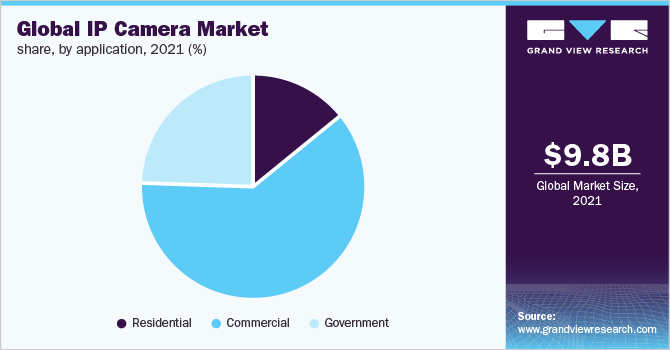

The global IP camera market size was estimated at USD 9,809.2 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of around 14.1% from 2022 to 2030. The rising demand for security surveillance has recently gained popularity due to the increasing number of home burglaries and squatting; residential security has become the top priority of homeowners. This factor is anticipated to drive the growth of the internet protocol (IP) camera industry over the forecast period. Home surveillance has become popular due to the rising population in metropolitan cities. Interactive product releases, new product launches, ongoing research and development, and innovation activities in the technologies of cameras and networking are a few of the essential strategic steps for manufacturers.

Homeowners are adopting IoT technologies that also support the market's growth. Effectively consumers are shifting their preference from traditional mountable Wi-Fi cameras to deploying smart IP cameras to increase the security of their premises. This promises robust growth for players in the internet protocol (IP) camera market. The introduction of infrared cameras and the widespread use of IoT in video monitoring has significantly increased the demand for IP cameras. The growing trend of smart homes, the increased usage of these cameras in commercial buildings, and the requirement for security in residential applications are projected to drive the IP camera market throughout the forecast period. The residential market is driven by the rising number of smartphone users and the availability of attractive installment policies for security systems.

A digital system built around an existing WI-FI or internet network can be integrated with other systems running on the same network. An IP security camera CCTV system has various advantages over an analog format. IP security cameras are compatible with a wide range of options and technologies, allowing users to record video in HD, accommodate dynamic light-weight levels during the day, and even remotely focus the user's camera. HD analog technology, image sensor, PTZ technology, HD resolution, frame rates, Video compression, remote focus lens, and camera Iris are advanced camera features.

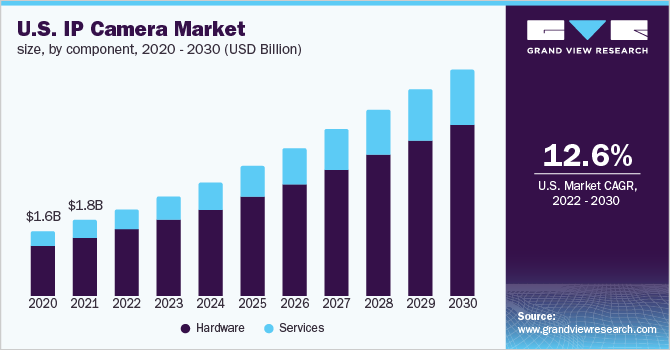

Component Insights

Hardware components accounted for a market share of around 77.0% in 2021, as the advancement of hardware systems in the market over the past years has provided convenience. Manufacturers to launch new products with technological advancement and better features enabled by AI and IoT, such as face detection and body detection technologies, are being used by a few government organizations to recognize people.

The service segment to have the most considerable CAGR during the forecast period of 2022-2030 due to the innovation and development of IP camera system technology manufacturers and service providers are catering to the market demand for better solutions. The manufacturers are expanding their portfolio to cater to the market demand for IP camera systems.

Product Type Insights

Infrared cameras will account for around 43.0% of the worldwide market share in 2021, driven by increased demand for infrared solutions in industrial sectors such as military & defense, government facilities, and BFSI. The adoption rate of this type of camera has grown owing to the enhanced security and safety of commercial, residential, or public facilities in low light and visibility circumstances by utilizing this type of video traffic & surveillance units used to monitor precisely at night.

The Pan-Tilt-Zoom (PTZ) product type is expected to grow at a higher CAGR during the forecast period. PTZ allows to control the needed field of view and can move anywhere between zero pan/tilt and complete 360-degree pan/180-degree tilt. PTZ cameras can be used with stationary cameras to improve monitoring capabilities. It also contains optical and digital zoom functions that are particularly beneficial for seeing objects from a long distance and focusing on details vital for surveillance.

Connection Type Insights

Distributed systems are expected to grow at a CAGR of roughly 15.0% over the forecast period, owing to the rising number of video surveillance solutions deployed in facilities. Distributed solutions have built-in storage capabilities that allow data to be saved in a digital media storage device such as network-attached storage (NAS), flash drives, SD cards, or hard disc drives, lowering the expense of acquiring other video recorders. Enterprises rely on decentralized solutions for enhanced flexibility and dependability while operating in multi-server setups with only two or three cameras.

The consolidated product type is expected to achieve a considerable market share in 2021 as it employs a central control server that houses a master database. The master database receives all configuration data for the cameras, NVRs, and DVRs that make up the system and all content for later access and analysis. Furthermore, in a distributed architecture, the system has the data dispersed throughout, usually close to where it is produced or used. Only if the solution is based on a distributed architecture will the true benefit of IP-based surveillance be achieved.

Application Insights

The commercial application of IP cameras is expected to generate a market revenue of around USD 6,500 million in 2021, owing to increased demand for advanced security technologies in the banking and financial sectors, accelerating the commercial industry and thus impacting the growth of the IP camera market. The surge in retail theft encourages implementing contemporary video solutions that can notify and inform security staff about unlawful access and entrance into the premises. Several manufacturers in the market are working on providing security solutions that are especially suited for business use.

Residential applications are going to have a significant impact on the market in the coming years. The increasing usage of IoT in smart homes is also driving market expansion. To strengthen the protection of their premises, consumers are migrating away from typical CCTV cameras and toward implementing IP cameras with new innovative capabilities. These innovative smart home security cameras have various advantages, encouraging their installation in many families.

Regional Insights

North America is a prosperous region experiencing rapid expansion in the IP camera business. The region is attaining a CAGR of around 12.5% during the forecast period due to industrial sectors expanding and developments in features and technologies, as well as video surveillance cameras, impacting total market growth in the region. According to a report by BuiltWorlds Inc., in the U.S., only 20 locations are anticipated to host 50% of all construction projects between 2019 and 2023. Houston, New York, Dallas, Los Angeles, and Washington are expected to have the highest demand for IP cameras from those cities.

Asia Pacific had a market revenue of around USD 4,700 million in 2021. Besides, the internet protocol (IP) camera market is expected to show a significant share in 2030 owing to the rising adoption of current security technologies for various applications such as traffic monitoring, home security, and city surveillance. Furthermore, increased government, private sector, and academic investments in innovation and R&D on developing technologies linked to administration are likely to enhance the market in the area.

Key Companies & Market Share Insights

Key players in the internet protocol (IP) camera market are focusing on introducing new technology and innovative products and services, which will help them gain more customer momentum and boost their sales and revenue.

In May 2021, Hangzhou Hikvision Digital Technology Co. Ltd released AX PRO wireless alarm system. Motion detectors in the AX PRO line are divided into single-element and dual-tech detectors. Single-element sensors detect moving encroachers and activate alarms in real time using microwave or passive infrared (PIR) technologies. Dual tech systems combine several PIR, microwave, or camera technologies to validate intrusion risks and reduce false positives. The plans also include the AX PRO hub, linking up to 210 detectors to satisfy clients' security needs.

Sony Electronics Inc. launched ILME-FR7, a full-frame picture sensor, a built-in pan/tilt/zoom (PTZ) feature, and an interchangeable E-mount lens. New creative possibilities in live production, studio, and movie settings are made possible by its cinematic characteristics and configurable remote control. Some prominent players in the global IP camera market include:

-

3DEYE Inc.

-

Arecont Vision Costar LLC.

-

Avigilon Corporation

-

Belkin International Inc.

-

Bosch Security Systems GmbH

-

CAMERAFTP

-

CAMCLOUD

-

D-Link Corporation

-

EOS Digital Services

-

GEOVISION Inc.

-

Hangzhou Hikvision Digital Technology Co. Ltd.

-

Honeywell International Inc.

-

Johnson Controls

-

Kintronics Inc.

-

Matrix Comsec

-

Panasonic Corporation

-

PRO-VIGIL

-

Samsung Electronics Co. Ltd.

-

Schneider Electric SE

-

Sony Corporation

-

Stealth Monitoring

-

TYCO

-

Vivotek Inc.

IP Camera Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 11,359.1 million

Revenue forecast in 2030

USD 32.63 billion

Growth rate

CAGR of 14.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product type, connection type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; China; India; Japan; South Korea; Mexico; Brazil

Key companies profiled

3DEYE Inc.; Arecont Vision Costar LLC.; Bosch Security Systems GmbH; D-Link Corporation; Honeywell International Inc.; Panasonic Corporation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IP Camera Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IP camera market report based on component, product type, connection type, application, and region:

-

Component Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Services

-

-

Product Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Pan-Tilt-Zoom (PTZ)

-

Infrared

-

-

Connection Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Consolidated

-

Distributed

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Government

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the IP camera market growth include rising demand for security surveillance due to the increasing number of home burglaries and squatting; residential security, thus becoming the top priority of homeowners.

b. The global IP camera market size was estimated at USD 9,809.2 million in 2021 and is expected to reach USD 11,359.1 million in 2022.

b. The global IP camera market is expected to grow at a compound annual growth rate of 14.1% from 2022 to 2030 to reach USD 32.63 billion by 2030.

b. Infrared camera in the product type dominated the IP camera market with a share of more than 43% in 2021. This is attributable to the increased demand for infrared solutions in industrial sectors such as military & defense, government facilities, and BFSI.

b. Some key players operating in the IP camera market include 3DEYE Inc., Arecont Vision Costar LLC., Bosch Security Systems GmbH, D-Link Corporation, Honeywell International Inc., and Panasonic Corporation among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."