- Home

- »

- Medical Devices

- »

-

Intravenous Solutions Market Size & Share Report, 2030GVR Report cover

![Intravenous Solutions Market Size, Share & Trends Report]()

Intravenous Solutions Market Size, Share & Trends Analysis Report By Product (Total Parenteral Nutrition & Peripheral Parenteral Nutrition), By Nutrients (Carbohydrates, Vitamins & Minerals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-137-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global intravenous solutions market size was valued at USD 11.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8% from 2023 to 2030. The Increasing prevalence of malnutrition and the fast-growing geriatric population is anticipated to drive the market growth of intravenous solutions. In June 2021, WHO stated that about 45.0% of global deaths occur due to malnutrition in children aged under 5 years. Furthermore, the American Society for Parenteral and Enteral Nutrition (ASPEN) recognized the increasing risk of malnourishment in about 30% to 50% of hospitalized patients, increasing costs and readmission rates.

The presence of a large geriatric population with low immunity levels & susceptibility to neurological diseases, cardiovascular disorders, cancer, and spinal injuries is likely to remain a high-impact rendering driver of the intravenous solutions market over the forecast period. For instance, According to WHO, the global population aged 60 years and above increased significantly from around 1 billion in 2020 to about 1.4 billion in 2030 and is expected to almost double to around 2.1 billion by 2050. The number of elderly patients with critical illnesses has significantly increased in the past few years. The geriatric population is expected to avail themselves of the latest surgical treatments, which are expected to increase their life span and drive the need for intensive care & postoperative treatment, including parenteral nutrition products.

Moreover, the high prevalence of preterm births, especially in emerging economies such as India and China, is expected to drive market growth during the forecast period. According to WHO, 1 in 10 babies are born preterm, and this is a global concern. Thus, the high incidence of preterm births in emerging economies, improved healthcare infrastructure, and growing healthcare expenditure & patient awareness are expected to be high-impact rendering drivers of the market during the forecast period.

Furthermore, according to WHO, worldwide cancer incidence (cases per year) was nearly 18.1 million in 2018, which is expected to increase to 22.0 million by 2034. The increasing prevalence of gastrointestinal cancer, including esophageal, gastric, liver, colon, and pancreatic cancers, is further anticipated to drive the parenteral nutrition market over the coming years. According to WHO, 60 to 70 million people in the U.S. are affected by gastrointestinal disorders, boosting the need for parenteral nutritional products that contain glutamine, phospholipids, glucose, and amino acids. Furthermore, a common symptom associated with cancer is anorexia or unintentional weight loss, creating the need for parenteral nutrition due to its effectiveness, boosting market growth.

Product Insights

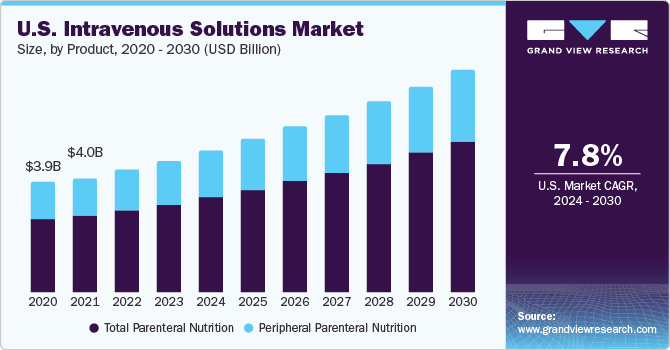

Based on the product, the market is segmented into Total Parenteral Nutrition (TPN) and Peripheral Parenteral Nutrition (PPN). In 2022, the TPN segment dominated the market, with a share of 66.1%. Moreover, the segment is expected to expand at the fastest CAGR of 8.2% during the forecast period. TPN is a comprehensive technique of administering most nutrients via IV technique. In addition, TPN solutions are highly concentrated than PPN solutions and are used predominantly in Surgical Intensive Care Units (ICU). According to the Society of Critical Care Medicine, more than 5 million patients are admitted annually to ICUs within the U.S.

The Peripheral Parenteral Nutrition (PPN) segment is expected to experience significant growth rate of 7.5% during the forecast period. According to MDPI, various benefits were observed in colorectal surgery patients undergoing early PPN. PPN supplementation and adherence to Enhanced Recovery After Surgery (ERAS) programs can reduce postoperative complications. Moreover, the patients receiving PPN had a lower risk of complications than those receiving conventional fluid therapy. PPN also decreases the likelihood of complications worsening or major complications developing.

Nutrients Insights

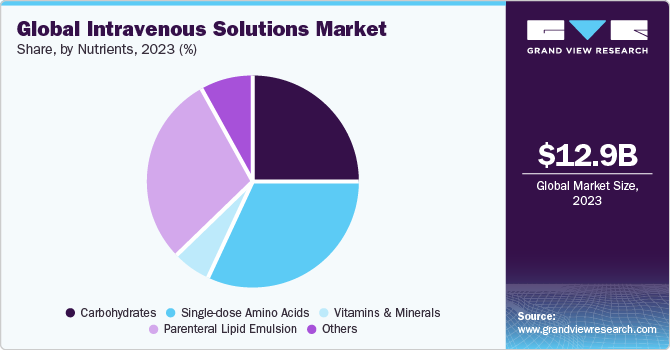

Based on nutrients, the market is segmented into carbohydrates, single-dose amino acid solutions, vitamins & minerals, parenteral lipid emulsion, and others. The single-dose amino acid solution segment dominated the market, with a share of 31.56% in 2022. Different studies have stated that single-dose amino acids provide a complete protein source, are customizable with other parenteral formulations, and can be easily administered.

The vitamins and minerals segment is expected to experience significant growth rate of 9.7% during the forecast period. Vitamins are vital for blood clotting, RBC formation, and maintaining mucus membranes. Deficiencies lead to anemia, beriberi, pellagra, and chronic mental conditions. Treatment involves parenteral or enteral nutrition. Minerals are essential organic chemicals that regulate metabolic pathways, including β-carotene, sodium chloride, magnesium, potassium, and phosphorous. Deficiency weakens the immune system and bones and causes fatigue due to poor mineral absorption. PN can be used for treatment in such cases.

Regional Insights

In 2022, North America dominated the global market, with a share of 41.2%. Growth in the region can be attributed to the presence of key players in the market, favorable rules & regulations, and strong reimbursement structure in countries such as the U.S. For instance, in 2022, Assure Infusions, Inc. announced an investment of USD 20 million to construct a state-of-the-art manufacturing facility in Bartow, Florida, to produce IV solutions. The company aims to mitigate the demand-supply gap for IV solutions in the U.S.

The Asia Pacific region is anticipated to witness a robust growth rate of 9.0% over the forecast period. The growing prevalence of chronic diseases due to unhealthy eating habits and rising demand for cost-effective care treatment are some of the factors expected to drive market growth. According to a UNICEF article in 2021, more than 375.8 million people were undernourished in Asia Pacific in 2020, which was nearly 54 million more than that in 2019.

Key Companies & Market Share Insights

New product development, geographic expansion, acquisition, and collaborations are the key strategic undertakings influencing the industry dynamics. For instance, in June 2023, Vifor Pharma received FDA approval for Injectafer. Injectafer is the only IV replacement therapy for adult patients suffering from heart failure & iron deficiency. Some of the key players operating in the intravenous solutions market include:

-

Fresenius Kabi AG

-

Pfizer Inc.

-

Otsuka Pharmaceutical Co. Ltd.

-

Baxter, B. Braun Melsungen AG

-

Vifor Pharma Management Ltd.

-

JW Life Science

Intravenous Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.9 billion

Revenue forecast in 2030

USD 22.0 billion

Growth rate

CAGR of 8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, nutrients, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Fresenius Kabi AG, Pfizer Inc.; Otsuka Pharmaceutical Co. Ltd.; Baxter, B. Braun Melsungen AG; Vifor Pharma Management Ltd.; JW Life Science

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Intravenous Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For study, Grand View Research has segmented the global intravenous solutions market based on product, nutrients, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Total Parenteral Nutrition

-

Peripheral Parenteral Nutrition

-

-

Nutrients Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrates

-

Vitamins and Minerals

-

Single Dose Amino Acids

-

Parenteral Lipid Emulsion

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intravenous solutions market size was estimated at USD 11.9 billion in 2022 and is expected to reach USD 12.89 billion in 2023.

b. The global intravenous solutions market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 22.0 billion by 2030.

b. The total parenteral nutrition segment dominated the intravenous solutions market with a share of 66.2% in 2022. This is attributable to rising the growing applications in the geriatric and pediatric population coupled with its requirement in the management of chronic diseases such as cancer and ulcerative colitis.

b. Some key players operating in the intravenous solutions market include Fresenius Kabi AG; B. Braun Melsungen AG; Hospira; Pfizer Inc.; Otsuka Pharmaceutical Co., Ltd.; Vifor Pharma Management Ltd.; JW Life Science; and Baxter.

b. Key factors that are driving the intravenous solutions market growth include increasing natality rate, risk of malnutrition, rising geriatric population base, and increasing incidence of cancer.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.