- Home

- »

- Medical Devices

- »

-

Intracranial Aneurysm Market Size And Share Report, 2030GVR Report cover

![Intracranial Aneurysm Market Size, Share & Trends Report]()

Intracranial Aneurysm Market Size, Share & Trends Analysis Report By Type (Surgical Clipping, Endovascular Coiling), By End-use (Hospitals, Clinics), By Region (Asia Pacific, North America, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-416-1

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Intracranial Aneurysm Market Size & Trends

The global intracranial aneurysm market size was estimated at USD 1.17 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.08% from 2023 to 2030. An increase in the incidence of brain aneurysms as well as rising adoption of minimally invasive procedures are expected to drive market growth in the coming years. Intracranial aneurysm is a bulging in the wall of an artery in the brain. It results in abnormal ballooning, widening, or bleb. Factors contributing to the formation of brain aneurysms are injury/trauma to blood vessels, smoking, hypertension, and genetic predisposition. The treatment of brain aneurysm includes medical therapy, surgical clipping or endovascular therapy or coiling without or with adjunctive devices. The prevalence of various health disorders, including brain aneurysms, is increasing due to the growing geriatric population across the globe.

Older people are more likely to develop aneurysms. Brain aneurysms are significantly at risk of developing and rupturing due to hypertension. Rates of hypertension may rise as lives become more sedentary and diets less healthy, which could result in increased cases of aneurysms. For instance, according to the WHO Facts 2023, around 1.28 billion people worldwide have hypertension. The risk of developing a brain aneurysm can rise due to several causes, including a genetic predisposition, lifestyle decisions, and other medical conditions. For instance, as per the reports published by the University of Minnesota in March 2023, the Brain Aneurysm Foundation states that 1 in 50 Americans or approximately 6.7 million people-have an unruptured brain aneurysm. Every year, an aneurysm in the brain ruptures in about 30,000 people in the nation.

This equals about one rupture every 18 minutes. The key factors influencing the usage of minimally invasive procedures for brain aneurysms are the surgeries' faster recovery times and smaller incision sizes during the procedures. Moreover, in comparison to conventional open surgeries, minimally invasive treatments, like endovascular coiling and flow diversion, require smaller incisions or entry points. As a result, there is less damage to the surrounding tissues, less discomfort, and quicker patient recovery. When compared to open surgeries, minimally invasive procedures are associated with decreased rates of complications, such as infection and postoperative bleeding, which enhance patient outcomes and lower mortality rates. For instance, as per the article published by the Mayo Clinic in April 2022, the scientists stated that not all brain aneurysms require open surgery.

To obtain the greatest resolution images of the aneurysm and associated blood arteries, a minimally invasive treatment known as cerebral angiography may be suggested for select cases of brain aneurysms. These perspectives influence treatment choices. Therefore, such advantages are anticipated to boost the demand for minimally invasive procedures, thereby propelling the market growth. Smoking is regarded as a serious risk factor for the growth and rupturing of brain aneurysms.Smoking damages blood vessels in the brain as well as other blood vessels throughout the body. Blood arteries may become weaker and smaller as a result, which increases the risk of aneurysm formation. Smoking reduces the blood's ability to carry oxygen by raising the blood's carbon monoxide levels.

This may result in less oxygen reaching the brain, which could damage blood vessel walls and encourage the growth of aneurysms. Intracranial aneurysms are now easier to identify and diagnose due to advances in medical imaging techniques like CT angiography (CTA) and magnetic resonance angiography (MRA). By providing comprehensive images of the brain's blood arteries, these technologies make it simpler to spot aneurysms and determine their size and location. However, expensive medical treatment and craniotomy surgery difficulties pose significant obstacles to the market's expansion. During the projected period, it is anticipated that emerging economies like India, China, Mexico, and Brazil will generate new growth possibilities. For instance, growing medical tourism in India, where the cost of intracranial surgery is relatively inexpensive compared to other nations like the U.S., may create profitable opportunities for the market.

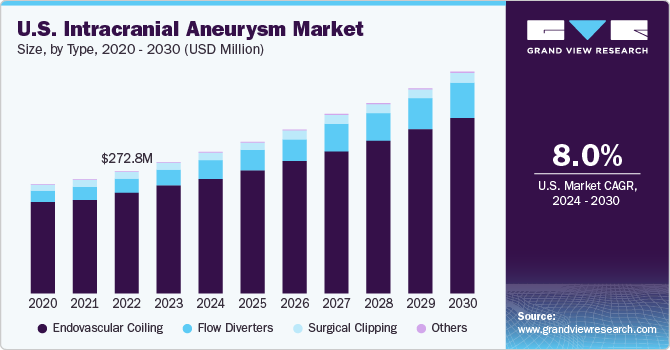

Type Insights

The endovascular coiling segment dominated the market and accounted for the largest revenue share of 84.82% in 2022. It is a minimally invasive technique that makes use of a catheter to locate the aneurysm in the brain. The catheter is passed from the groin area through the artery having an aneurysm. Coils that induce embolization (embolic coils or liquids) are placed to prevent blood flow into the aneurysm. Endovascular coiling offers advantages, such as easy access to the vertebrobasilar system & multiple aneurysms in distant areas and shorter recovery time, as compared with surgical clipping procedures. Thus, these benefits help drive the segment growth.

The advancements in the products designed for the treatment of neurological disorders developed by key players also drive the market growth. For instance, in January 2023, the IMPASS embolic coil device, which may be utilized to treat chronic subdural hematomas (CSDH) on the outermost layer of the brain, has been successfully employed in in-vivo studies to embolize the middle meningeal artery (MMA). This information was made public by Fluidx Medical Technology, Inc. The flow diverters segment is expected to grow at the fastest CAGR over the forecast period. The rise in the number of product approvals and demand for minimally invasive procedures are driving the segment growth.

Moreover, the growing partnership activities among the flow diverters manufacturers for product portfolio expansion support the segment growth. For instance, in June 2022, to treat brain aneurysms, Stryker and Carmeda announced a partnership that will combine their respective company’s well-established flow diverter technologies with active heparin coatings. Stryker's flow diverter uses the Carmeda covering to effectively decrease thrombin, a very effective platelet agonist and coagulation factor, at the device surface, displaying a marked decrease in clot formation in difficult bench models.

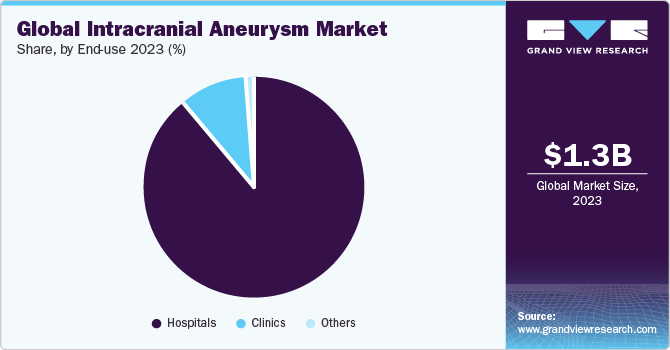

End-use Insights

The hospital end-use segment captured the largest revenue share of over 89.52% in 2022. This is attributed to the use of technologically advanced equipment in operation theaters and intensive care units, the increasing number of hospitals worldwide, and rising government funding for the hospitals. Technologically advanced devices are being used extensively in hospitals to provide better treatment. These devices are not only simplifying treatment procedures but are also helping provide better, faster, and more accurate results.

The segment is also anticipated to witness a significant CAGR over the forecast period. Intracranial aneurysm procedures are among the most critical and complicated surgeries that are dependent on high-quality and durable equipment, which are used in hospitals. Hospitals are also better equipped to handle any post-operative complications and they include facilities for physical rehabilitation post surgeries. Also, hospitals are widely preferred by patients in comparison to emergency clinics owing to better healthcare facilities and the availability of advanced equipment. Thus, these factors are significantly boosting the segment growth.

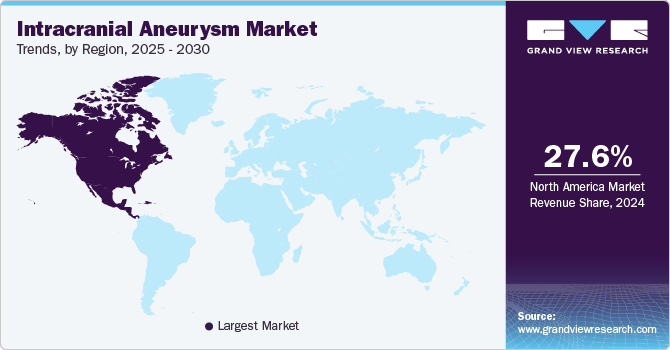

Regional Insights

North America dominated the market and accounted for the largest revenue share of 26.91% in 2022 owing to the presence of well-established healthcare facilities, the growing aging population, and the high incidence of hypertension and stroke. Furthermore, an increase in the prevalence of intracranial aneurysms and high demand for minimally invasive procedures are contributing to the market growth in the region. Furthermore, an increasing number of initiatives being undertaken by various organizations is expected to fuel market growth. For instance, The Bee Foundation (TBF), a nonprofit organization, is focused on spreading awareness and reducing the number of deaths caused by cerebral aneurysms through innovative research.

The TBF invites proposals for a brain aneurysm research grant, which is likely to help the organization achieve its aim of reducing mortality due to brain aneurysms. These nations have advanced healthcare systems, high medical costs, and a high incidence of neurovascular illnesses. The increased government efforts and R&D spending by manufacturers have a big impact on the expansion of the regional marketplace. In Asia Pacific, the market is anticipated to witness the fastest CAGR over the forecast period. This is attributed to factors, such as the growing aging population, high lifestyle stress, rising incidence of hypertension, improvement in the quality of diagnosis, and increasing patient affordability.

All the above-mentioned factors have together resulted in a significant number of intracranial aneurysm procedures in Asia Pacific. Moreover, lucrative growth opportunities in developing countries, such as Brazil, India, and China, are likely to contribute to the regional market growth. For instance, increasing medical tourism in India due to the relatively low cost of intracranial surgeries in comparison with other developed countries, such as the U.S., is expected to fuel the market growth. The average cost of aneurysm surgery in India is around USD 7,000 as compared to USD 30,000 in the U.S.

Key Companies & Market Share Insights

The key players are focusing on growth strategies, such as new type launches, regulatory approvals, expansion, collaborations, acquisitions, and partnerships. For instance, in May 2023, the privately held, commercial-stage medical device company Cerus Endovascular Ltd., which designs and develops neuro-interventional equipment used in the therapy of intracranial aneurysms, was acquired by Stryker. The Neqstent Coil Assisted Flow Diverter and the Contour Neurovascular System, two CE-marked products from Cerus Endovascular, will add to Stryker’s current line-up of aneurysm treatment options. Thus, due to such initiatives, the market is expected to grow in the years to come. Some of the prominent players in the global intracranial aneurysm market include:

-

Medtronic

-

Stryker

-

MicroPort Scientific Corporation

-

Johnson & Johnson Services, Inc.

-

MicroVention Inc.

-

Integra LifeSciences

- B. Braun Melsungen AG

Intracranial Aneurysm Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.27 billion

Revenue forecast in 2030

USD 2.33 billion

Growth rate

CAGR of 9.08% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; MicroPort Scientific Corporation; Johnson & Johnson Services, Inc.; MicroVention Inc.; Integra LifeSciences; B. Braun Melsungen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

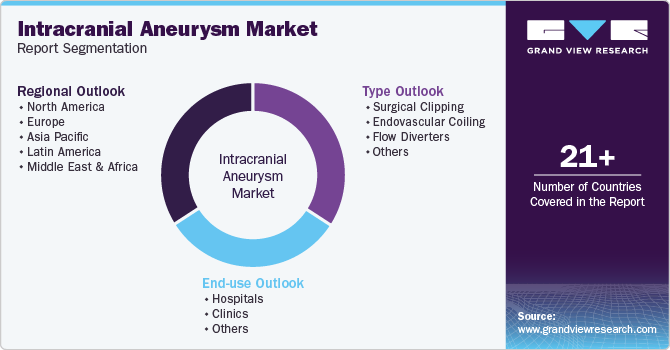

Global Intracranial Aneurysm Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the intracranial aneurysm market report on the basis of type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Clipping

-

Endovascular Coiling

-

Flow Diverters

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intracranial aneurysm market was estimated at USD 1.17 billion in 2022 and is expected to reach USD 1.27 billion in 2023.

b. The global intracranial aneurysm market is expected to grow at a compound annual growth rate of 9.08% from 2023 to 2030 to reach USD 2.33 billion by 2030.

b. North America dominated the intracranial aneurysm market with a share of 26.91% in 2022. This is attributable to the increasing cost of treatment, rising aging population, and a greater incidence of hypertension and stroke in the region.

b. Some key players operating in the intracranial aneurysm market include Medtronic, Microport Scientific Corporation, B. Braun Melsungen AG, Stryker Corp, Johnson & Johnson Inc, Microvention, Inc, and Codman Neuro.

b. Key factors that are driving the intracranial aneurysm market growth include the increasing prevalence of hypertension and aneurysm among the aging adult population as well as technologically advanced products by key players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.