- Home

- »

- Electronic Devices

- »

-

Industrial Refrigeration Systems Market Share Report, 2030GVR Report cover

![Industrial Refrigeration Systems Market Size, Share & Trends Report]()

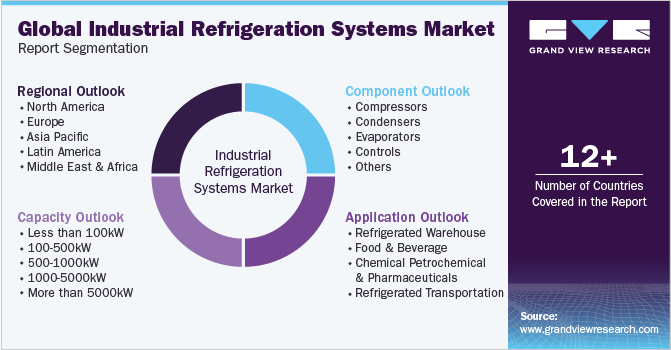

Industrial Refrigeration Systems Market Size, Share & Trends Analysis Report By Component (Compressors, Condensers, Evaporators, Controls, Others), By Capacity, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-101-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global industrial refrigeration systems market size was estimated at USD 19.73 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The rising usage of processed and packaged foods & drinks also the need to prevent spoilage are surging the demand for the industrial refrigeration system. Concerns over global warming have forced manufacturers to focus on natural refrigerants over harmful coolants. In recent years, the market for genuine refrigerant-based equipment has been overgrown due to natural refrigerants being inexpensive to produce and climate-neutral. In the forecast period, the market is expected to be impacted by the emergence of enhanced and improved cold chain systems across the globe.

Industrial refrigeration systems are used for refrigeration across various industries such as pharmaceuticals, food & beverage, processing, and chemicals. These systems are generally used in places such as cold food storage, beverage production, dairy processing, ice rinks, and heavy industry. It helps remove heat from materials and large-scale processes by reducing the temperature to a required value.

E-commerce grocery sales are growing faster throughout the world than physical grocery sales. Additionally, cold chains play an integral role by minimizing harvest spoilage using technologies such as evaporator/passive coolers and absorption refrigerators. High temperatures and excessive heat, in addition to agro-climatic conditions, contribute to market growth. In developing countries, however, cold chain deployments are low due to the fewer budgets allocated for advanced equipment.

Leading players in the market are focusing on technological advancements to provide simplified solutions. In June 2022, Emerson Electric Co. announced that it achieved a milestone for installing 200.0 million Copeland compressors worldwide, as Copeland compressors are used for both commercial as well as residential air conditioning working under ideal conditions achieving lower GWP and higher efficiency.

Companies are focusing on environmentally friendly technology such as Active Magnetic Regenerative refrigeration. The technology requires a magnetic solid, which acts as a refrigerant using the magnetocaloric effect and reduces energy consumption by almost 30%. Besides this technology Artificial Intelligence, next-generation technology, and the Internet of Things create opportunities for manufacturers. Johnson Controls demonstrated how they make residential energy efficiency more affordable and accessible for homeowners with the help of robust financing options and rebates in September 2022.

Natural refrigerants such as Co2, hydrocarbons, and ammonia pose threats of toxicity and inflammation. However, their use has reduced the emission of greenhouse gases. Manufacturers are steadily switching to natural refrigerant options as they focus on the refrigerants’ Global Warming Potential and Ozone Depletion Potential due to the increasing awareness among consumers.

For instance, in October 2022, Danfoss and Beijer Ref AB renewed their partnership contract which helped them to focus on new circularity practices and also provide high endurance, high utilization, and high material recirculation in products and service offerings.

The outbreak of COVID-19 globally impacted the industrial refrigeration systems market negatively to some extent due to the complete lockdown imposed by governments. Many industries were shut down during the period due to work stoppage, slowing down the growth of the market. Construction and transportation operations and supply chains were hindered on a global scale, leading to decreased refrigeration device manufacturing, which directly impacted the industrial refrigeration sector.

However, the market witnessed a demand for its products due to the global need for preserving vaccines in vast quantities to fight the extent of the pandemic. The U.S. Centers for Disease Control and Prevention (CDC) have suggested using pharmaceutical or specially designed refrigerators or freezers, to properly store vaccines. The guidelines for storage of vaccines indicated storage temperatures between 2°C and 8°C for refrigerators and -50°C and -15°C for freezers. As a result, the need for storing and distributing vaccines and effectual pharmaceuticals preserved the market.

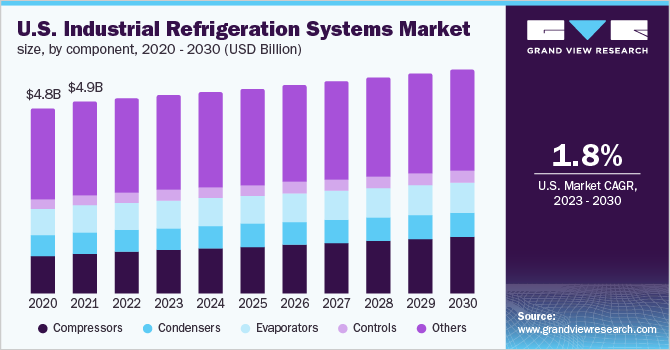

Component Insights

The compressor segment accounted for a substantial revenue share in 2022 and is expected to retain its dominance throughout the forecast period, growing at a significant CAGR of around 7% from 2023 to 2030. The compressor systems are used for maintaining the required lower temperature and pressures and eliminating the vapor. The ability of this equipment to control the load over the evaporators makes it a significant unit in the industrial refrigeration system. The introduction of innovative compressor solutions by market players to meet efficiency and refrigerant regulations associated with industrial refrigeration is expected to create lucrative growth opportunities for the market.

The compressor segment growth is accounted for industrialization, automation, and a surge in demand for oil-free compressors in the HVAC industry due to environmental concerns. An increase in the need for reliable and energy-efficient systems evaporators is also expected to grow significantly in the future.

Capacity Insights

The 500kW-1000kW capacity segment had the highest revenue share of around 32.0% of the entire market in 2022. The cooling capacity range under this segment is majorly used by food & beverage storage as well as processing, especially for perishable and processed products. These cooling capacity ranges are also used by daily plants to keep the items stored for a longer period without contamination.

The 1000-5000kW segment is estimated to grow at a significant rate as the cooling capacity ranges are also used in warehouse refrigeration for cold storage purposes of other items such as vaccines, petrochemicals, and other items that can deter due to the lack of cool storage premises. The temperature range in the inner infrastructure of high-scale power plants is between 50-100 degrees Celsius. As these refrigeration systems ranging between 1,000kW-5,000kW capacities neutralize the effect of high temperatures on the shop floors, the demand for the same is set to grow in the future.

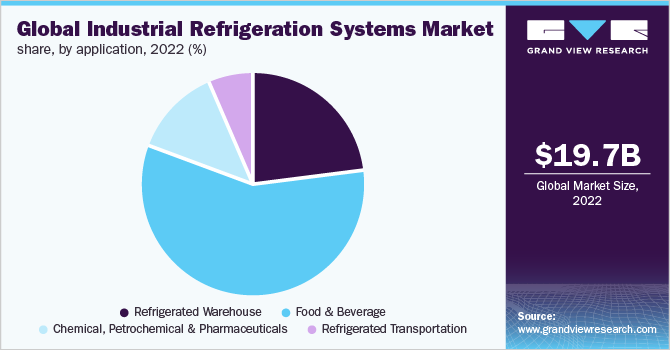

Application Insights

The food & beverage segment captured the largest revenue share in 2022 and is likely to maintain its dominance over the forecast timeframe. The segment accounted for the largest share of more than 57.0% of the market in 2022, and it is expected to dominate the market in the forecast period. The increasing disposable income and growing working professional base have resulted in an unprecedented demand for frozen and processed food products.

The chemical, petrochemical, and pharmaceutical application segments are expected to attain higher growth during the forecast period. The augmented demand for vaccinations to diminish coronavirus infections has witnessed an upsurge during the past year, in an attempt to get rid of this pandemic. The vaccinations require higher-level cooling units to store and distribute across the globe. Such demand for a cold system in the COVID-19 crisis has led to an increase in the deployment of industrial refrigeration systems, thereby exponentially spurring the revenue generation of this application area in the longer run.

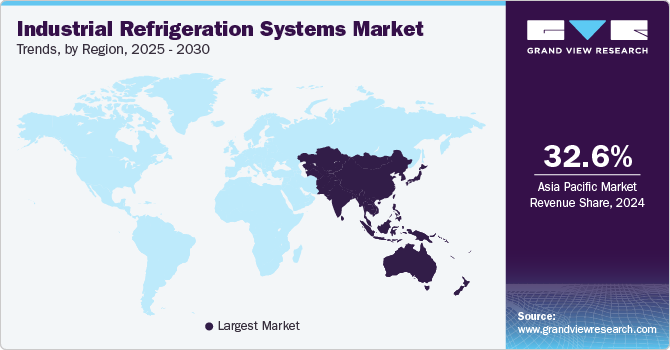

Regional Insights

North America accounted for the largest revenue share of above 32.0% in 2022 and is expected to maintain steady growth during the forecast period. The main factor contributing to the market development is the expansion of the e-commerce platform. E-commerce has impacted consumer buying behavior as online grocery has become a lifestyle requirement. Furthermore, retailers must store perishables at a standard temperature set by HACCP thus increasing the need for suitable refrigerated storage systems. In addition, clinical trials and research aimed at slowing the spread of COVID-19 across North America are driving the market's growth.

Asia Pacific is expected to expand at the fastest pace because of the significant expansion possibilities of cold chain storage facilities in the nations such as Japan, India, and China. China is the world's greatest producer of fruits and vegetables, followed by India. China and India sell crops to numerous places across the world. The different governments have launched several projects to extend cold storage management and improve refrigeration and refrigerated warehouse management in their respective nations.

Key Companies & Market Share Insights

Key players in the industrial refrigeration systems market are focusing on introducing new technology and innovative products and concentrating on the advancement and acquisition of the components to gain a competitive edge. In January 2023, Johnson Controls announced that it acquired Hybrid Energy A/S for aiming the focus on heat pumps for district heating and industrial process. In November 2022, Daikin Industries Ltd. established their new factory in Indonesia for manufacturing residential air conditioners which helped the company to fulfill the growing demand for air conditioners in Indonesia. In May 2021, Emerson Electric Co. donated the company’s sustainable refrigeration technology to Gem City Market, a grocery store in Ohio to offer fresh food to address food insecurity in the city.

Additionally, companies are continually spending lots of resources researching and developing new features and technology. In November 2020, Güntner GmbH & Co. KG launched its UV-C installed Güntner Cubic VARIO Air Cooler, which claims to eliminate over 99.0% of the airborne germs in less than a few hours. Güntner GmbH & Co. KG teamed with biologists from Fraunhofer Institute for Process Engineering and Packaging to test its UV-C emitter technology and prove its efficacy. The tests were conducted in their lab in Fürstenfeldbruc. Some of the key players in the global industrial refrigeration systems market include:

-

Johnson Controls

-

Emerson Electric Co.

-

Dan Foss

-

GEA Group Aktiengesellschaft

-

MAYEKAWA MFG Co. Ltd.

-

BITZER Kuhlmaschinenbau GmbH

-

DAIKIN Industries Ltd.

-

EVAPCO Inc.

-

Guntner GmbH & Co. KG

-

LU-VE S.p.A

Recent Developments

-

In July 2023, BITZER completed the acquisition of OJ Electronics A/S. The aim of this acquisition was to develop a centre of excellence for HVAC&R electronic components in Denmark.

-

In June 2023, Johnson Controls announced that it has acquired M&M Carnot with an aim to leverage a sustainable industrial refrigeration system portfolio. This strategic business deal addresses the accentuating need for ultra-low global warming potential technologies in refrigerants with the help of its unique CO2 technology to achieve net zero emissions.

-

In June 2023, BITZER announced the expansion of collaboration with Beijer Ref. The objective of this deal was to deliver the companies’ customers energy-efficient solutions by adopting natural refrigerants.

-

In May 2023, Johnson Controls announced plans to acquire Gordon Brothers Industries for augmenting growth in the company’s industrial refrigeration segment in Australia. This transaction was planned to deliver large sustainability-driven projects in the country and enhance the service offerings.

-

In October 2022, GEA introduced the GEA G-Plex – an electronic module delivering automatic, built-in, optimal volume ratio and performance monitoring of the company’s screw compressors in industrial refrigeration & heating equipment applications.

-

In November 2021, Emerson unveiled the launch of new open-path gas detectors– Rosemount 935 and 936. The two new detectors were purposed to offer performance reliability and reduce downtime in extreme environments, including large-scale refrigeration systems, oil and gas, refining, chemical, and mining operations.

Industrial Refrigeration System Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 20,484.8 million

The revenue forecast in 2030

USD 27,664.0 million

Growth rate

CAGR of 4.4% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Component, application, capacity, region

Country scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Johnson Control; Emerson Electric Co; Dan Foss; DAIKIN Industries Ltd.; GEA Group Aktiengesellschaft; MAYEKAWA MFG Co. Ltd.; BITZER; EVAPCO Inc.; Guntner GmbH & Co. KG; LU-VE S.P.A

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Refrigeration System Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels in addition to provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial refrigeration systems market report based on the component, capacity, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressors

-

Rotary Screw Compressor

-

Centrifugal Compressor

-

Reciprocating Compressors

-

Diaphragm Compressors

-

Others

-

Condensers

-

Evaporators

-

Controls

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 100kW

-

100-500kW

-

500-1000kW

-

1000-5000kW

-

More than 5000kW

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Warehouse

-

Food & Beverage

-

Chemical Petrochemical & Pharmaceuticals

-

Refrigerated Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Asia Pacific

-

Japan

-

China

-

India

-

Latin America

-

Brazil

-

Mexico

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the industrial refrigeration systems market growth include increasing adoption of natural refrigerant-based refrigeration systems owing to strict regulatory policies, and the growing need for refrigeration for freezing, cooling, and chilling of food at large owing to the growth in food production.

b. The global industrial refrigeration systems market size was estimated at USD 19.73 billion in 2022 and is expected to reach USD 20.48 billion in 2023.

b. The global industrial refrigeration systems market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 27.66 billion by 2030.

b. North America dominated the industrial refrigeration systems market with a share of 32.94% in 2022. This is attributable to the rising demand for beverages, fresh food products, and medicines, and government initiatives to phase out HCFCs refrigerants and adopt natural refrigerants in various refrigeration applications.

b. Some key players operating in the industrial refrigeration systems market include Johnson Controls, Emerson Electric Co., Danfoss, GEA Group Aktiengesellschaft, MAYEKAWA MFG. CO., LTD., BITZER Kühlmaschinenbau GmbH, DAIKIN INDUSTRIES, Ltd., EVAPCO, Inc., Güntner GmbH & Co. KG, and LU-VE S.p.A.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."