- Home

- »

- Advanced Interior Materials

- »

-

Industrial Fasteners Market Size And Share Report, 2030GVR Report cover

![Industrial Fasteners Market Size, Share & Trends Report]()

Industrial Fasteners Market Size, Share & Trends Analysis Report By Raw Material (Metal, Plastic), By Product (Externally Threaded, Internally Threaded, Non-threaded), By Application (Aerospace), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-351-5

- Number of Pages: 213

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global industrial fasteners market size was estimated at USD 91.73 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. The market is expected to be driven by the growing population, high investments in the construction sector, and rising demand for industrial fasteners in the automotive and aerospace sectors. Infrastructure development is one of the key parameters to be considered while tracking the regional development of the market. The construction industry notably impacts the demand for industrial fasteners as they are extensively used in buildings, bridges, walls, and roofs. Unlike other industries, fasteners used in construction are standardized and subject to stringent quality checks. Government intervention through a regulatory framework pressurizes the manufacturers to offer standardized products with superior performance characteristics.

The U.S. is one of the largest fasteners importing countries in the world and is likely to witness a similar trend over the forecast period on account of high product demand in automation, aerospace, and other industrial applications. Moreover, owing to the growing demand for lightweight vehicles and aircraft, companies are shifting from standard to customized fasteners, which in turn is expected to drive demand.

The market for industrial fasteners is characterized by intensive technological developments to produce advanced, lightweight products that find usage in automotive and other industrial applications. With the enhancement in technology, the rising demand for hybrid fasteners, which incorporate a combination of injection-molded plastic components with metal elements, is expected to drive the demand.

Increasing metal prices and the decelerating growth of these fasteners owing to their replacement by plastic fasteners, automotive tapes, and adhesives are expected to be key barriers for metal fastener manufacturers over the forecast period. Plastic fastener manufacturers are expected to gain an advantage owing to the rising demand for lightweight components from automotive manufacturers.

Companies engaged in the manufacturing of fasteners require significant capital investment owing to the high production volumes and stringent specifications concerning testing and labeling. Industrial fasteners such as bolts, screws, nuts, studs, and rivets are manufactured and distributed by different participants. Companies invest significantly in R&D activities, thus resulting in dynamic market conditions.

Raw Material Insights

Metal fasteners account for the largest market share of 91.2% in 2022. It includes various materials such as stainless steel, bronze, cast iron, superalloys, and titanium. The high mechanical strength is expected to be an important factor triggering their growth over the forecast period.

Plastic fasteners are growing at the fastest CAGR of 5.4% over the coming years. It is gaining importance in the automotive industry owing to its low-cost, lightweight, and superior chemical & corrosion resistance properties. These are manufactured using various raw materials, including polycarbonate, polyurethane (PUR), polyvinylchloride (PVC), polyacrylamide (PA), polystyrene (PS), polyethylene (PE), and nylon.

Plastic fasteners are witnessing high growth, in terms of demand, especially from the automotive and aerospace industries, owing to their superior corrosion and chemical resistant properties. In addition, characteristics such as low cost, availability in a wide variety, and lightweight are expected to be the key parameters driving demand for the product in the manufacturing of high efficiency and lightweight vehicles.

Product Insights

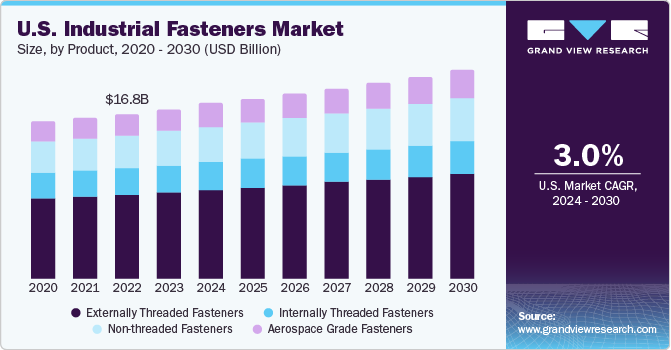

Externally threaded fasteners accounted for the highest revenue share of 48.4% in 2022.Bolts and screws are the most widely utilized type of externally threaded fasteners. Bolts hold a dominant share in the market owing to their availability in a wide variety and broad application scope.

Non-threaded fasteners accounted for the second largest revenue share of 25.3% in 2022 and are expected to drive the market at a CAGR of 4.2% over the forecast period. Rising demand for non-threaded fasteners in the construction industry for various applications such as subflooring, decking, and roofing is expected to have a positive impact on growth over the projected period.

Aerospace grade fasteners are expected to expand at the fastest CAGR of 5.9% from 2023 to 2030. This fastener varies significantly as compared to ordinary commercial-grade fasteners in terms of quality, performance, raw material, price, and other technical specifications.The most commonly used aerospace nuts include fiber inserts and castle nuts.

Internally threaded fasteners accounted for a significant share of the market. Stainless steel is the most common material used for manufacturing internally threaded industrial fasteners. Brass, alloy steel, and aluminum are the other materials used to manufacture these industrial fasteners. Innovations in the designs of internally threaded fasteners to provide better performance and high impact and vibration resistance are projected to have a positive impact on growth.

Application Insights

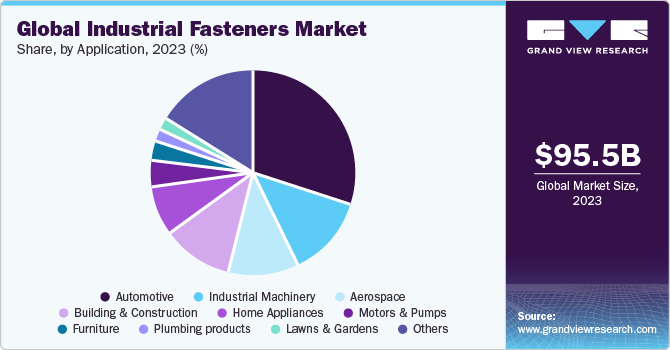

The automotive segment accounted for the largest revenue share of 30.2% in 2022 and is expected to expand at a CAGR of 3.8% during the forecast period. High production volumes of automotive vehicles across Asia Pacific have been a key factor driving industry growth over the past few years.

Fasteners are an essential component of the automotive industry and are available in numerous varieties, sizes, and shapes. The common fasteners used in the automotive industry include nuts, bolts, screws, rivets, studs, bits, anchors, and panel fasteners. Metal fasteners have been dominating the fastener industry traditionally, and this trend is likely to continue over the projected period.

Aerospace has been a major application segment in the global industrial fasteners market as it consumes high volumes of prime-grade fasteners. The aerospace industry is considered to be a key market for industrial fasteners, as the quantity used in the manufacturing of an aircraft is significantly higher in comparison to any other applications, including automotive, industrial machinery, and railways.

Building & construction applications of industrial fasteners accounted for about USD 9.75 billion in 2022. Increasing investments in commercial constructions such as hotels, hospitals, and educational institutes in the regions are projected to have a positive impact on the industry growth projected period.

The demand for industrial fasteners in industrial machinery is expected to grow at a CAGR of 5.1% from 2023 to 2030. The rapid growth of heavy machine-driven industries, including textiles, food & beverage, and chemicals, is expected to propel the demand for industrial machinery, thus driving the demand for industrial fasteners over the coming years.

Regional Insights

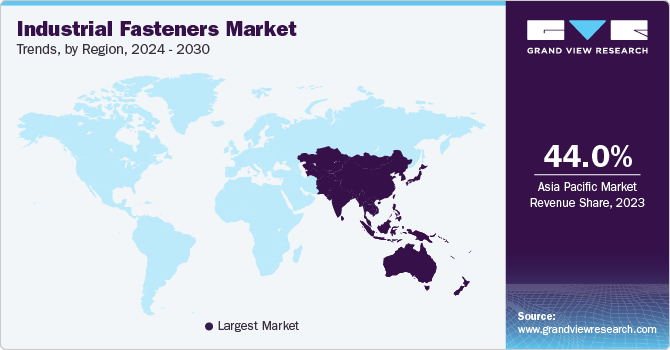

North America market accounted for 24.2% of the global revenue share in 2022. In North America, the U.S. has been dominating the industrial fasteners industry in terms of consumption owing to the presence of a wide manufacturing base of automotive, electronics, and aerospace companies which makes it a key consumer of automotive fastener. The region is expected to have a positive impact on industry growth over the forecast period.

The Asia Pacific is the fastest-growing region in the world, accounting for 43.6% of the market share in 2022 and is expected to expand at a CAGR of 5.9% from 2023 to 2030. The industrial fasteners industry in the region is primarily driven by automotive, industrial machinery, electronics, and construction applications. Economic growth in the Asia Pacific has increased the need for improved public infrastructures such as roads, harbors, airports, and rail transportation networks which is likely to drive the market in the Asia Pacific.

The growing geriatric population in the economies such as China is expected to drive the need for expansion of transportation infrastructure. Moreover, the ongoing construction of railway infrastructure in developing economies such as India including bullet trains and metro rails is expected to drive the demand for construction material. These trends are projected to drive the demand for Bolts as it is widely used in the construction of rail and roadways infrastructure.

Europe accounted for a significant revenue share of the global market for industrial fasteners in 2022. The rising product demand to manufacture residential and commercial furniture, ready-to-assemble (RTA) products, and small accent items is expected to have a positive impact on the industry growth over the projected period.

Central & South America market accounted for about USD 5.91 billion in 2022. It is expected to witness growth on account of rising demand for industrial fasteners in agricultural, commercial, and residential projects and industrial practices. Furthermore, the aerospace sector is expected to witness high growth owing to improvements in defense practices of Argentina and Brazil, thus influencing the demand for aerospace-grade fasteners in the region.

Key Companies & Market Share Insights

The industry is fragmented and highly competitive in nature, with various large and small-scale manufacturers in China, Taiwan, Thailand, and Japan. The key players operating in the global market are Arconic Fastening Systems and Rings, Acument Global Technologies, Inc, ATF, Inc., Dokka Fasteners A S, and LISI Group - Link Solutions for Industry.

The increasing demand for innovative and application-specific industrial fastener designs is expected to present opportunities for new players. Increasing raw material prices and high-volume production by the existing players are expected to be key barriers to new entrants over the forecast period. Moreover, Technological know-how and an established buyer base are likely to offer major fastener manufacturers a competitive advantage over the small-scale players. Some prominent players in the global industrial fasteners market include:

-

Arconic Fastening Systems and Rings

-

Acument Global Technologies, In

-

ATF, Inc.

-

Dokka Fasteners A S

-

LISI Group - Link Solutions for Industry

-

Nippon Industrial Fasteners Company (Nifco)

-

Hilti Corporation

-

MW Industries, Inc.

-

Birmingham Fasteners and Supply, Inc.

-

SESCO Industries, Inc.

Recent Developments

-

In July 2023, DEWALT, a subsidiary of Stanley Black & Decker inc., introduced next-gen FLEXTORQ® Impact Driver Bits. These are engineered for durability, and designed with fasteners, thus making advancements and improvements in driver bits technology for fastening applications

-

In June 2023, MW Components, a division of MW Industries, acquired Western Wire Products Company to strengthen its position in the wire form market by making expansion in metal components including industrial fasteners

-

In January 2023, Birmingham Fasteners and Supply Inc. acquired Pacific Coast Bolt Corp. to expand its manufacturing diversity. The purpose is to strengthen its position in the industrial fasteners market, and offer customer services to partners across America

Industrial Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 95.46 billion

Revenue forecast in 2030

USD 131.28 billion

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Spain; China; India; Japan; Malaysia; Indonesia; South Korea; Thailand; Brazil; UAE; Argentina; Saudi Arabia; South Africa

Key companies profiled

Arconic Fastening Systems and Rings; Acument Global Technologies, Inc; ATF, Inc.; Dokka Fasteners A S; LISI Group - Link Solutions for Industry; Nippon Industrial Fasteners Company (Nifco); Hilti Corporation; MW Industries, Inc.; Birmingham Fasteners and Supply, Inc.; SESCO Industries, Inc.; Elgin Fastener Group LLC; Rockford Fasteners, Inc.; Slidematic; Manufacturing Associates, Inc.; Eastwood Manufacturing; Brunner Manufacturing Co., Inc.; Decker Industries Corporation; Penn Engineering &Manufacturing Corporation; EJOT; Illinois Tool Works, Inc.; Stanley Black & Decker, Inc.; KOVA Fasteners Pvt. Ltd.; Standard Fasteners Ltd.; Precision Castparts Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Fasteners Market Report Segmentation

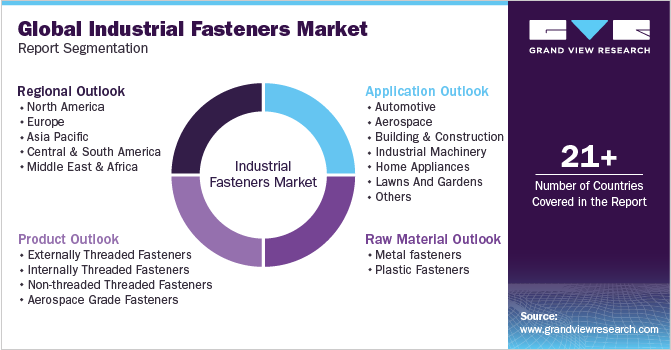

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial fasteners market report based on raw material, product, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Fasteners

-

Plastic Fasteners

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Externally Threaded Fasteners

-

Internally Threaded Fasteners

-

Non-threaded Threaded Fasteners

-

Aerospace Grade Fasteners

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Building & Construction

-

Industrial Machinery

-

Home Appliances

-

Lawns And Gardens

-

Motors And Pumps

-

Furniture

-

Plumbing Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial fasteners market size was estimated at USD 91.73 billion in 2022 and is expected to reach USD 95.46 billion in 2023.

b. The industrial fasteners market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 131.28 billion by 2030.

b. Asia Pacific dominated the industrial fasteners market with a share of 43.6% in 2022 owing high production volumes of automotive vehicles across key economies in the region.

b. Some of the key players operating in the industrial fasteners market include Arconic Fastening Systems and Rings, Acument Global Technologies, Inc, ATF, Inc., Dokka Fasteners A S, LISI Group – Link Solutions for Industry, Nippon Industrial Fasteners Company (Nifco), Hilti Corporation, MW Industries, Inc., Birmingham Fasteners and Supply, Inc., SESCO Industries, Inc.

b. The key factor that are driving the industrial fasteners include the rapidly developing automotive and aerospace defense sector in the developing countries

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for COVID-19 as a key market contributor.