- Home

- »

- Catalysts & Enzymes

- »

-

Industrial Enzymes Market Size, Share & Growth Report, 2030GVR Report cover

![Industrial Enzymes Market Size, Share & Trends Report]()

Industrial Enzymes Market Size, Share & Trends Analysis Report By Product, By Source (Plants, Animals), By Application (Food & Beverages, Detergents, Animal Feed), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-844-2

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

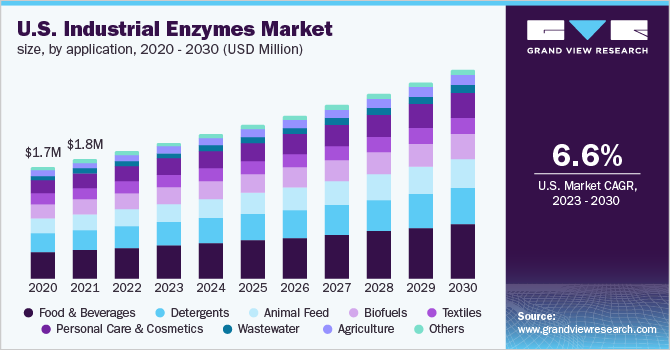

The global industrial enzymes market was valued at USD 6.95 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Increasing global consumption of bakery products and fruit juices is expected to fuel the demand for industrial enzymes. This factor is anticipated to contribute to the growth of the industry in the forthcoming years.

Industrial enzymes are frequently used in the food and beverage sector to increase product quality and shelf life. They are utilized in the food and beverage business in the brewing and baking processes, as well as in the dairy, starch, and sugar products that people regularly consume in large quantities. They are employed in baking applications to provide flour or dough particular qualities. They help in reducing the protein content of flour in biscuits and crackers, while their usage in bread enhances or standardizes its quality and guarantees uniform browning.

Industrial enzymes are extensively used in the food & beverage industry and since food is a basic necessity, the demand for the product expands constantly at a brisk pace. Moreover, the growing worldwide population is also projected to boost the market growth. By 2050, the world's population is expected to exceed 9.7 billion, and by 2100, it may be close to 11 billion, according to the United Nations Department of Economic and Social Affairs (UN DESA). Such factors are anticipated to prosper global industry demand over the forecast period.

The U.S. is expected to dominate the North America industrial enzymes market due to the high demand for the product from the food & beverage sector, increasing consumer awareness about health, and growing consumer inclination for functional foods. The product market in the U.S. is expected to witness notable growth on account of the extensive growth of the pharmaceutical and nutraceutical sectors in the country. Asia Pacific enzymes market, led by India, South Korea, China, and Japan is expected to observe significant growth due to the growth of detergent and pharmaceutical industries in the region.

The rising consumption of industrial enzymes in the U.S. is attributable to growing awareness regarding green technologies that improve productivity, handle environmental challenges, and improve product value. This promotes growth in the research and development sector. Furthermore, various industrial enzyme producers such as Associated British Foods plc, BASF SE, Novozymes, DuPont Danisco, and DSM, are backward integrated and are involved in the production of raw materials. This helps in reducing operating costs while maintaining the quality of the finished product. Various distribution channels, including direct supply, agreements with third parties, and online portals, are used by industry participants to distribute their products.

The COVID-19 pandemic affected several application sectors worldwide and caused a supply-demand gap. With the demand-supply gap and the global shutdown of the automotive industry, the demand for the product in biofuel and textiles was slightly impacted. However, the overall product market saw a positive demand during the pandemic on account of the rising adoption of enzymes from numerous industries including animal feed, food, and cleaning products. With the growing consumer awareness of health and lifestyle, there is a shift in demand for healthier food products, which in turn, is expected to positively impact the industrial enzymes industry.

Product Insights

The carbohydrase product segment dominated the market with the highest revenue share of 48.2% in 2022. This is attributable to its increasing use in numerous industries including animal feed, pharmaceuticals, and food & beverages among others. It is mainly used as a catalyst for converting carbohydrates into sugar syrup such as fructose and glucose which are further used in the pharmaceutical and food & beverage industries. It is used for manufacturing artificial sweeteners and prebiotic products such as isomaltose for juices and wines.

Protease is primarily used in the catalytic hydrolysis of protein peptides to amino acids, which is essential for protein breakdown in a wide range of applications including animal feed, chemicals, detergents, food, and photography. The most often encountered proteases include aspartate, cysteine, serine, threonine, papain, glutamic acid, and metalloprotease. Global protein intake has increased as a result of consumers' rising nutritional awareness, which is anticipated to boost the need for proteases in the food industry over the forecast period.

Lipases are used for the catalytic hydrolysis of fats or lipids. They are used for transporting, digesting, and processing dietary lipids such as fats, oils, and triglycerides. It finds versatile applications in the food industry in cheese and yogurt fermentation, baking, and detergents. It is also used for biodiesel production, which implies the processing of glycerides and fatty acids through esterification and transesterification.

The polymerase is used for synthesizing nucleic acid polymers, while a nuclease is used for cleaving the phosphodiester bonds between the nucleotide subunits. It is utilized in Polymerase Chain Reaction (PCR) for forensic, medical, and research purposes. PCR is used in healthcare applications to characterize and find viruses that cause infectious diseases such as the Human Immunodeficiency Virus (HIV) and Tuberculosis (TB). The need for PCR is anticipated to increase in the near future due to the rising incidence of AIDS and TB. This, in turn, is projected to boost product demand in the coming years.

Application Insights

The food and beverage application segment dominated the market with the highest revenue share of 20.9% in 2022. This is attributable to the increasing utilization of enzymes in the production of food and beverage items. Cheese processing, vegetables and fruits processing, oils and fats processing, grain processing, and various other food processing sectors like baking, dairy, and brewing employ both customized enzyme solutions and proprietary enzyme products. The food and beverage sector predominantly uses proteases, lipases, and carbohydrases.

Proteases, lipases, and amylases are extensively used in detergent formulations. Proteases are the widely used enzymes in detergents. It helps to remove protein stains such as human sweat, grass, eggs, and blood. Amylases are mostly used to remove stains from starchy food products including chocolate, custards, mashed potatoes, gravies, oatmeal porridge, and spaghetti. These are used in laundry detergents and dishwashing detergents that don't include chlorine.

The increasing prevalence of diseases such as Porcine Epidemic Diarrhea (PED) and Bovine Spongiform Encephalopathy (BSE) has forced livestock producers to utilize high-quality feed. In addition, growing global meat production coupled with rising health concerns regarding meat quality has augmented the demand for animal feed. They strengthen the digestibility of contemporary animal feeds, improving the feed-to-gain ratio for monogastric and ruminant animals. As a result, the demand for the product in animal feed is expected to increase over the forecast period.

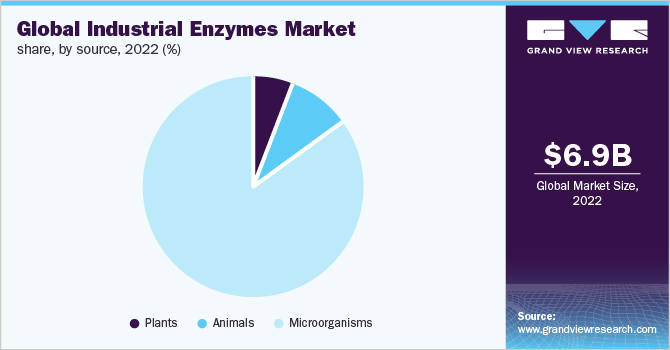

Source Insights

The microorganisms source segment dominated the market with the highest revenue share of 85.4% in 2022. This is attributable to the low production cost and easy availability of microorganisms to enzyme manufacturers. Enzymes derived from microorganisms can be classified into three groups: bacterial, fungal, and yeast enzymes. Most of these products are employed in detergent, food, and medicinal applications.

Enzymes derived from mushrooms or fungi include phenol oxidases, esterases, and hydrolases. Fungi-based enzymes are in greater demand because of their expanding use across a wide range of end-use industries. They are essential in the preparation and manufacturing of many food items, including soy sauce, beer, baked foods, processed fruits, and dairy products.

The most sources of animal-based enzymes are the pancreatic and stomach of cattle and pigs. These are ineffective in the digestive tract because they only function within a small pH range. They become unstable in an acidic (low pH level) environment, which leads to their demise before the necessary function is carried out. As a result, the body receives animal-based enzymes enclosed in an enteric coating that can tolerate stomach acid.

Plant-based enzymes are anticipated to have strong growth throughout the projection period as they prove to be a viable alternative. Due to the accessibility of cutting-edge technology to produce enzymes through plants with very low investment, the industry will grow quickly. The product is present in a wide range of meals outside fruits and vegetables. Foods made from plants contain a lot of enzymes and can be consumed raw or cooked. Due to its use as an anti-inflammatory, as a protein-digesting aid, and as a tool for wound debridement, bromelain is in great demand. Plant-based diets are popular as they fasten digestion and reduce stress on the small intestine.

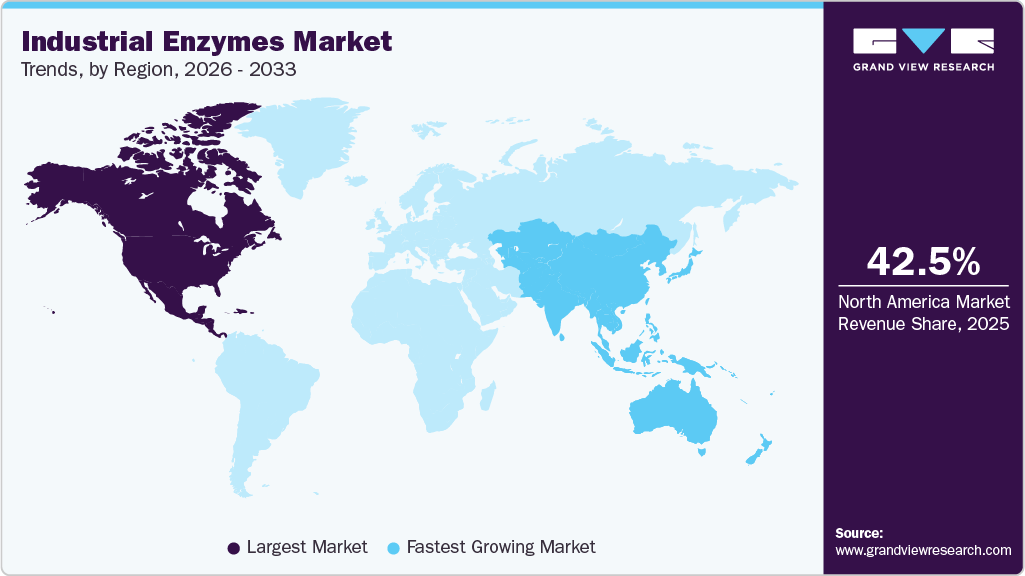

Regional Insights

The North America region dominated the market with the highest revenue share of 37.6% in 2022. This is attributable to a prominent market for industrial enzymes due to the strong presence of various end-use companies in the food & beverage, laundry detergent, pharmaceuticals, and personal care & cosmetics industries along with high scope for R&D activities in major countries of the region. For instance, genetically modified organism strains remanufactured by food enzymes are sourced from microorganisms with the help of technological advancements. These strains improve the efficiency of the product in food items.

The European Commission’s inclination toward reducing greenhouse emissions and promoting the production of biofuels is expected to have a positive impact on the growth of the market over the forecast period. Russia is expected to witness a significant increase in meat production due to improving economic conditions. The product is extensively used in meat processing to improve the tenderness of the meat. The region is also a prominent consumer of meat products and is anticipated to positively influence product demand in the coming years.

In Asia Pacific, the demand for industrial enzymes is anticipated to rise at a significant rate on account of the growing meat production across the region, especially in China. The United Nations Food and Agriculture Organization estimates that China produced 77.92 million tons of beef in 2020. The government authorized the export of frozen and chilled Australian beef in 2017, which increased the demand for industrial enzymes in the meat processing sector.

Key Companies & Market Share Insights

The industrial enzymes industry is highly influenced by dominated supply from BASF SE, Novozymes, DuPont Danisco, and DSM. The market is characterized by investment-intensive and long enzyme development cycles by key product manufacturers. As a result, raw material suppliers and manufacturers have significant opportunities to provide uniform and high-quality enzymes through a reviewed supply chain.

Market participants frequently participate in merger and acquisition activities to broaden both their worldwide reach and product offerings. For example, Novozymes purchased Microbiome Labs, a provider of probiotic and macrobiome solutions, to increase its product portfolio. To satisfy the rising demand, businesses like BASF SE boosted the capacity of their German plant's enzyme manufacturing. Some prominent players in the global industrial enzymes market include:

-

BASF SE

-

Novozymes

-

DuPont Danisco

-

DSM

-

NOVUS INTERNATIONAL

-

Associated British Foods Plc

-

Chr. Hansen Holding A/S

-

Advanced Enzyme Technologies

-

Lesaffre

-

Adisseo

-

BioProcess Algae, LLC

-

Koninklijke DSM N.V.

Industrial Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.42 billion

Revenue forecast in 2030

USD 11.42 billion

Growth Rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Rest of Europe; China; India; South Korea; Indonesia; Japan; Australia; Rest of Asia Pacific; Brazil; Argentina; Rest of CSA; Saudi Arabia; Turkey; Rest of MEA

Key companies profiled

BASF SE; Novozyme; DuPont Danisco; DSM; Novus International; Associated British Foods plc; Chr. Hansen Holding A/S; Advanced Enzyme Technologies; Lesaffre; Adisseo; Enzyme Development Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

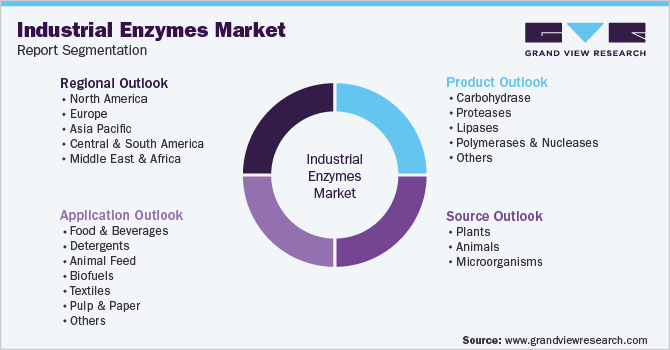

Global Industrial Enzymes Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial enzymes market report based on product, source, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrase

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plants

-

Animals

-

Microorganisms

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceutical

-

Personal Care & Cosmetics

-

Wastewater

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global industrial enzymes market size was estimated at USD 6.95 billion in 2022 and is expected to reach USD 7.42 billion in 2023.

b. The global industrial enzymes market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 11.42 billion by 2030.

b. North America dominated the industrial enzymes market with a share of 37.6% in 2022. This is attributable to the strong presence of several end-use industries such as food & beverage, pharmaceuticals, laundry detergent, and personal care & cosmetics.

b. Some key players operating in the industrial enzymes market include BASF SE, DuPont Danisco, Novozymes, DSM, Associated British Foods plc, Adisseo, Novus International, Advanced Enzyme Technologies, Chr. Hansen Holding A/S, Enzyme Development Corporation, and Lesaffre among others.

b. Key factors that are driving the industrial enzymes market growth include increasing demand from food & beverage along with growing product penetration in the animal feed sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Disruptions in chemical manufacturing activities due to the COVID-19 pandemic had a considerable influence on the growth patterns of enzymes and other catalysts. Key players across the value chain are also expected to realign their supply channels to cater to the demand for catalysts in specific areas of the chemical industry which are witnessing an unusual level of activity allied with pharmaceuticals and biotechnology. The report will account for COVID-19 as a key market contributor.