- Home

- »

- Advanced Interior Materials

- »

-

Industrial Air Filtration Market Size & Growth Report, 2030GVR Report cover

![Industrial Air Filtration Market Size, Share & Trends Report]()

Industrial Air Filtration Market Size, Share & Trends Analysis Report By Product, By End Use (Cement, Food & Beverage, Metal, Power, Pharmaceutical), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-380-5

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global industrial air filtration market size was estimated at USD 7.0 billion in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 6.0% from 2023 to 2030. The rising need to control industrial air quality across various industries, including cement, food & beverage, metal, and power along with industrial air quality regulations, which is expected to augment market growth over the forecast period.

The COVID-19 pandemic has had a negative impact on several end-use sectors such as manufacturing, food & beverage, and cement, due to disruptions in the raw material supply chain and the temporary shutdown of production facilities across the globe. Following the pandemic, it is expected that supply chain normalization, the relaxation of strict measures, an increase in retail consumption, and stabilization of manufacturing activities will improve economic activity and thus increase demand for industrial air filtration.

Favorable government emission norms, combined with the enforcement of workforce safety and health regulations in several regions, are expected to drive the market over the forecast period. The Clean Air Act, for instance, is a federal law in the U.S. that is intended to control air pollution on a national scale. The expansion of industrial and manufacturing units resulted in the implementation of several industrial air filtration regulations.

Modern industrial air filtration products enable filtration system plant managers and designers to reduce operating costs and realize energy cost savings while meeting required quality standards. Various technologies are being developed to improve the performance and quality of industrial air filtration systems. The growing need to reduce energy consumption in a variety of industrial applications may increase the demand for an efficient industrial air filtration system.

Technological advancements in the industrial air filtration system are expected to provide opportunities for market growth over the forecast period. Furthermore, rising concerns over environmental health and reducing raw material resources are primarily expected to propel market growth over the forecast period.

The industrial air filtration system is used across several industries including power, food & beverage, cement, metals, and pharmaceuticals. However, high capital and operating costs associated with industrial air filtration systems are expected to hinder market growth. Purifying contaminated air requires advanced filtration equipment, resulting in increased capital investment. As a result, the overall system is costly to operate in terms of maintenance and energy consumption.

Product Insights

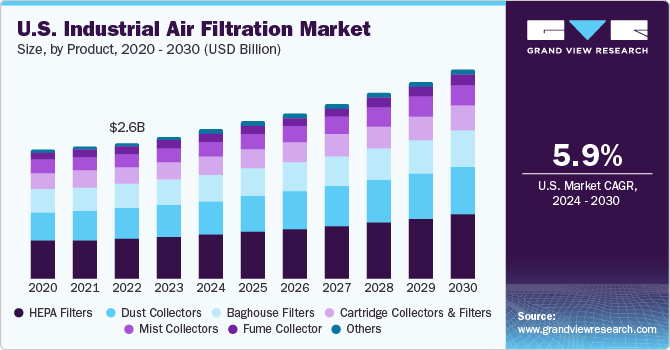

HEPA filters dominated the market and accounted for 29.5% of the global revenue share in 2022, owing to the presence of air filters with advanced efficiency that removes microscopic organisms that may cause serious harm and inorganic dust suspended in the air such as bacteria, mold spores, airborne viruses, dust mites, and pollen.

HEPA utilizes thick and pleated media instead of the flat fiberglass media used in standard types of filters. This is to considerably expand the surface area for filtration as well as the service life of the filters. HEPA filters are the standard filtration system in medical settings, such as clinics and hospitals.

The dust collectors product segment is expected to grow at a CAGR of 5.8% over the forecast period. Dust collectors provide several advantages, including increased productivity, pollution protection, compliance with health and air emission regulations, and environmental protection from manufacturing pollutants, among others.

Baghouse filters remove and can withstand acid gases, abrasive particles, mists, filter explosive dust, fumes, and fine powders, depending on the fabric filter and design. They are capable of collecting difficult-to-capture air pollutants as well as toxic airborne materials found in dust, welding fumes, and particulate residue.

End-Use Insights

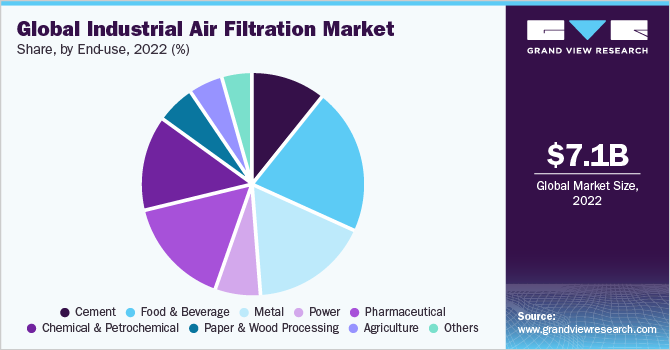

The food & beverage segment dominated the market and accounted for 21.4% of global revenue in 2022 owing to the legislations pertaining to food safety coupled with retailer manufacturing standards and codes of practice for high-risk food manufacturing that provides opportunities for industrial air filtration market growth.

The pharmaceutical end-segment is expected to witness a CAGR of 6.3% over the forecast period. Pharmaceuticals contain numerous chemical components that can be toxic depending on how they are inhaled. Furthermore, the manufacturing processes for products such as medical pills or medical equipment can generate byproducts that are medically dangerous or flammable. A proper air filtration system can help reduce risks while improving overall employee health, resulting in less downtime, increased profit, and ensuring the quality of your products.

Metal industries are distinguished by high operating temperatures, as well as a high concentration of smaller dust particles. These conditions necessitate maximum airflow, maximum dust filtration efficiency, and maximum dust loading capacity. For worker safety, health, and productivity, industrial air filtration systems remove dust and other contaminants from the facility.

Workers in chemical and petrochemical plants are exposed to toxic and combustible gases such as sulphur dioxide, and hydrogen sulphide, on a daily basis, where industrial air filtration equipment is used on a larger scale as it meticulously monitors and controls the air quality, which is critical for safety and efficiency.

Regional Insights

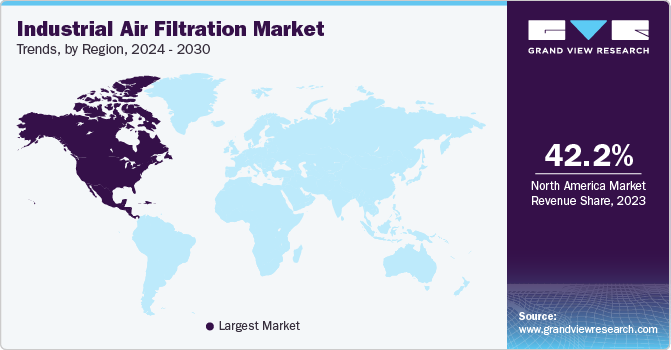

North America region dominated the market and accounted for over 40.0% share in 2022. Industrial users in this region strive to minimize health hazards with adoption of air filtration equipment that exhibit high performance capabilities such as effective removal of sub-micron particulates. In addition, manufacturers focus on minimizing the pressure drop in air filters that offers significant energy savings to the end-user and subsequently lower the total cost of ownership.

Asia Pacific is projected to grow at a CAGR of 6.8% over the forecast period. Rapid industrialization and increasing per capita income are expected to drive the market. China is expected to emerge as a worldwide hub for industrial air filtration equipment manufacturing owing to its low labor and infrastructure costs. Moreover, the region is presumed to witness the entry of several pharmaceutical companies to meet domestic export and import demands, thereby aiding regional growth.

The food industry in Europe is highly diversified and is characterized by the presence of several small-scale businesses. Food processing involves moving a variety of products; depending on the suitability of the application, there may be concerns with sanitary regulations, cross-contamination, and food handling regulations, which are expected to favorably impact market growth over the forecast period.

The growth of industrial air filtration in Central & South America is attributed to the growing metal industry. The rising emphasis on augmenting the indoor air quality in industrial establishments for worker safety and decreased health risks is expected to upsurge the demand for high efficiency filters. Dust collectors are widely used in metal processing industries as they remove industrial pollutants, thereby reducing operational costs.

Key Companies & Market Share Insights

The market features the presence of both large-scale and medium-scale industrial air filtration equipment manufacturers. The major players include Honeywell International, Inc.; MANN+HUMMEL; Daikin Industries, Ltd.; 3M; and SPX Corporation. These companies are aggressively investing in R&D activities to develop novel filters in order to sustain in the highly competitive market.

Furthermore, the key manufacturers are also emphasizing on strengthening their regional presence by collaborating with other players offering similar products and services to augment their market presence and achieve a competitive advantage over peers. Similarly, companies also implement inorganic growth strategies in order to enhance their product portfolio. Some prominent players in the industrial air filtration market include:

-

Honeywell International, Inc.

-

MANN+HUMMEL

-

Daikin Industries, Ltd.

-

Danaher

-

Donaldson Company, Inc.

-

SPX Technologies

-

Lydall, Inc.

-

Alfa Laval

-

PARKER HANNIFIN CORP

Recent Developments

-

In June 2023, MANN+HUMMEL a major stake in the Suzhou U-Air Environment Technology for making expansion in its air filtration business.

-

In May 2023, Honeywell International Inc. unveiled Honeywell Forge for buildings, and enhancement in sustainability-focussed applications to assist operators and owners optimize the indoor air quality.

-

In October 2022, PARKER HANNIFIN CORP announced its partnership with Fraunhofer Institute for Microengineering and Microsystems (IMM). The purpose is to improve fuel cell technology which is essential for the clean energy and industrial air filtration sector.

-

In March 2022, Alfa Laval launched the latest AC65 brazed plate heat exchanger. Heat exchangers play a significant role in applications including industrial air filtration to improve environmental performance, and energy efficient in industrial processes.

-

In December 2021, SPX Technologies completed the acquisition of Cincinnati Fan & Ventilator Co. Ltd. to offer a comprehensive range of air quality solutions, and expand its presence in the industrial air filtration sector.

Industrial Air Filtration Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.43 billion

Revenue forecast in 2030

USD 11.27 billion

Growth rate

CAGR of 6.0% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; France; U.K.; China; India; Japan; Australia; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc., SPX Corporation, Lydall Inc., AAF International, Industrial Air Filtration, Inc, Parker Hannifin Corporation, Camfil Group, Freudenberg & Co. Kg., Filtration Group, Testori SpA, Eaton Corporation plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Air Filtration Market Report Segmentation

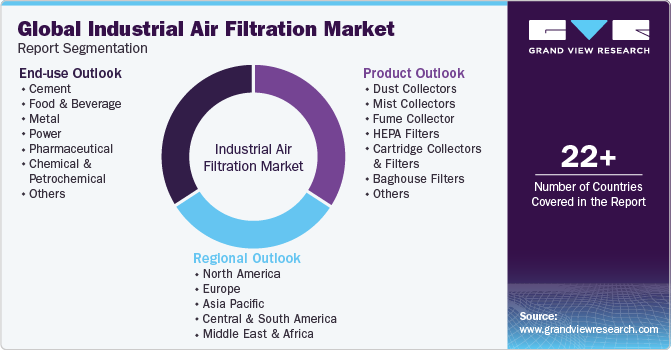

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2023 to 2030. For the purpose of this study, Grand View Research has segmented the industrial air filtration market based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Dust Collectors

-

Mist Collectors

-

Fume Collectors

-

HEPA Filters

-

Cartridge Collectors & Filters

-

Baghouse Filters

-

Others

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Cement

-

Food & Beverage

-

Metal

-

Power

-

Pharmaceutical

-

Chemical & Petrochemical

-

Paper & Wood Processing

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Rest of Asia Pacific

-

-

Central & South America

-

Brazil

-

Argentina

-

Rest of Central & South America

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial air filtration market size was estimated at USD 7,064.9 Million in 2022 and is expected to be USD 7,433.4 Million in 2023.

b. The industrial air filtration market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 11,279.8 Million by 2030.

b. North America dominated the industrial air filtration market with a revenue share of 42.3% in 2022. Industrial users in this region strive to minimize health hazards with the adoption of air filtration equipment that exhibits high-performance capabilities such as effective removal of sub-micron particulates.

b. Some of the key players operating in the industrial air filtration market include: Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc., SPX Corporation, Lydall Inc., AAF International, Industrial Air Filtration, Inc, Parker Hannifin Corporation, Camfil Group, Freudenberg & Co. Kg., Filtration Group, Testori SpA, Eaton Corporation plc

b. Key factors that are driving the industrial air filtration market growth include the rising need to control industrial air quality across various industries, including cement, food & beverage, metal, and power along with industrial air quality regulations

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry, once thriving with increased investments, has been severely affected by the suspension of the construction activities in the wake of the ongoing pandemic. Shortage of labors coupled with potential supply chain bottlenecks of materials and equipment is expected to cause project delays in the ongoing funded projects and may lead to reduced spending in the upcoming projects. Uncertainty around the actual duration of the prevailing lockdown makes it hard to anticipate how a recovery in the construction industry will unfold. On similar lines, the HVAC industry has been adversely affected by the COVID-19 outbreak due to the shutting down of several component manufacturing facilities across China, European countries, Japan, and the U.S. This has consequently led to a significant slowdown in the production of HVAC equipment. Lockdowns imposed by the governments in the wake of the Covid-19 outbreak has not only affected manufacturing but also pegged back the consumer demand for HVAC equipment. The report will account for COVID-19 as a key market contributor.