- Home

- »

- Medical Devices

- »

-

In Vitro Fertilization Market Size And Share Report, 2030GVR Report cover

![In Vitro Fertilization Market Size, Share & Trends Report]()

In Vitro Fertilization Market Size, Share & Trends Analysis Report By Instrument (Disposable Devices, Culture Media), By Procedure Type (Fresh Nondonor, Frozen Nondonor), By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-823-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global in vitro fertilization market size was estimated at USD 23.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.72% from 2023 to 2030. Rising repro tourism and the increasing cases of male & female infertility are the key factors driving the market growth. Infertility is one of the major health concerns faced by individuals globally. According to the WHO, around 17.5% of the adult population worldwide experiences infertility. This shows the necessity to enhance accessibility to affordable and top-notch fertility care globally.

According to the American Pregnancy Association, male infertility accounts for 30% of infertility cases and contributes to around one-fifth of infertility cases. The average age of women and men getting married and having their first child is increasing. This trend has increased the number of women seeking IVF treatment. Moreover, to focus on their career, many women freeze their eggs to have the child at a later stage. The rising dependence on fertility treatments will support market growth. The availability of funds is leading to a rise in the adoption of in vitro fertilization (IVF) procedures.

To increase the success rate of IVF, techniques, such as assisted hatching, vitrification, egg/sperm freezing, Percutaneous Epidydimal Sperm Aspiration & Testicular Sperm Extraction (PESA and TESE), are being introduced along with the development of new products. In May 2023, AIVF Ltd., a company specializing in AI-based solutions for IVF clinics, joined forces with Genea Biomedx, a medical device provider for IVF laboratories, to introduce a comprehensive and cost-effective integrated systems solution for personalized IVF care. The collaboration brought together Genea Biomedx’s Geri time-lapse incubator and AIVF Ltd.’s EMA AI platform, creating a powerful suite that offers widespread access to personalized and optimized IVF treatments.

To compete in the modern business environment, all organizations (manufacturers, clinics, and hospitals) must develop their virtual presence to increase awareness about infertility, infertility treatment, and their services. As infertility is a sensitive issue, people are reluctant to discuss it openly, particularly in developing countries. Hence, developing authenticity and trust through digital platforms is a key challenge for service providers. The providers can take an initial step to gain a center’s or manufacturer’s trust by displaying the hospital’s or approval committee’s certificates, introducing the doctors or scientists, and sharing their coordinates to establish & authenticate their identity.

Procedure Type Insights

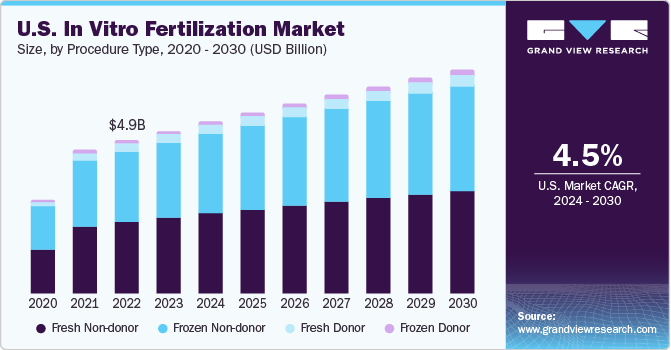

Based on type, the market is categorized into frozen non-donor, fresh non-donor, fresh donor, and frozen donor. The frozen non-donor segment dominated the market with the largest revenue share of 47.2% in 2022 and is expected to witness the fastest growth over the forecast period. Certain factors contributing to the high share are the cost-effectiveness as compared to fresh nondonor and the less invasive nature of the procedure. The fresh donor segment is expected to grow significantly over the forecast period. As per the 2020 National ART Summary report, around 1,477 ART cycles were performed using fresh donors, with around 53.9% of transfers resulting in live-birth deliveries in the U.S.

Although some centers offer risk-sharing plans and refunds only for three cycles, the Advanced Fertility Center of Chicago has designed the IVF reimbursement plan to provide a 100% refund for up to four cycles with fresh embryos. The Human Fertilization and Embryology Act 1990 does not cover fresh sperm donation, and hence, there is rising concern about sperm donors not being screened before donation. The HEFA does not guarantee sperm donation services, which are unlicensed. Hence, HEFA has revised its guidelines, wherein fresh sperm must be quarantined for 180 days for HIV screening. NHS funds a smaller proportion of fertility treatment using donated gametes to homosexuals and single parents.

End-use Insights

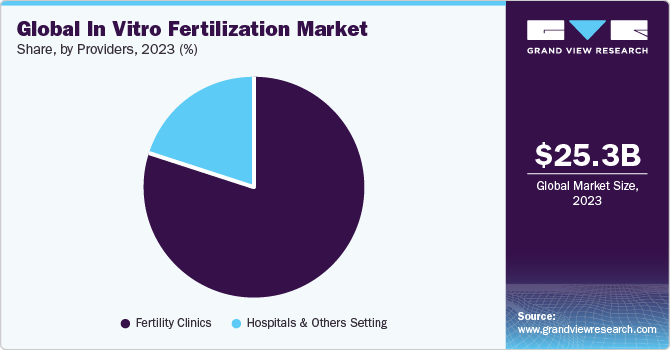

The fertility clinics segment dominated the market with the largest revenue share of 79.8% in 2022 and is expected to witness the fastest growth over the forecast period. This can be attributed to a rise in demand for ART treatments; the number of fertility clinics and ART centers is increasing considerably. Factors, such as cost-effectiveness, availability of specialists, and minimal or no chances of Hospital-Acquired Infections (HAIs), are anticipated to drive the growth of the fertility clinics segment. IVF treatments are also performed in hospitals.

The hospitals and other settings segments is expected to grow at a significant CAGR over the forecast period. Numerous multispecialty hospitals provide infertility treatments, including In Vitro Fertilization (IVF). The growing accessibility and availability of these treatments have contributed to a greater inclination toward hospitals for infertility care. However, hospital IVF treatments cost more than fertility clinics. This is partly due to the need for highly skilled physicians and staff to perform these intricate procedures. Consequently, having a dedicated IVF staff in hospitals is considered a less favored approach due to the expenses related to their employment, remuneration, and training. These costs can be particularly high in developed countries like the U.S. and the UK.

Instrument Insights

Based on instruments, the market is further segmented into culture media, capital equipment, and IVF disposable devices. The culture media segment dominated the market with the largest revenue share of 41.1% in 2022. This can be attributed to factors, such as the availability of funding and an increase in research activities to improve the culture media. In July 2022, FUJIFILM Irvine Scientific launched a mineral oil for embryo culture, Heavy Oil for Embryo Culture. It is a sterile mineral oil that addresses major concerns in IVF procedures, including pH, osmolality changes, and media preservation, owing to its ideal weight viscosity.

The disposable devices segment is expected to grow at the fastest CAGR during the forecast years. The growth of this segment is owing to the industry players introducing disposable devices, such as needles, slides, and chambers, to meet sterility and regulatory requirements. Such developments are expected to increase the adoption of disposable IVF devices. Disposable slides for sperm counting, an imaging-based tracking system to isolate the best motile sperm, and the use of disposable microchips are some of the innovations witnessed by the market in recent years.

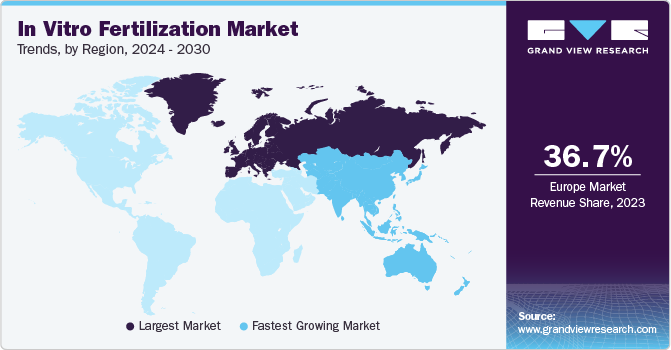

Regional Insights

Europe dominated the market with the largest revenue share of 37% in 2022. This can be attributed to factors, such as a noticeable surge in medical tourism, with an increasing number of Americans choosing to travel to the Czech Republic for more cost-effective IVF treatments. Moreover, individuals who cannot afford to travel abroad are now seeking IVF treatments within the United States at around one-third of the cost charged by clinics in the country. In July 2022, Fairtility obtained approval from the European Union to use AI for embryo assessment. The EU's new medical device regulation standards have enabled the development of a commercially available AI tool, which holds the potential to boost the success rate of IVF procedures.

These regulations pave the way for advanced AI technologies to be introduced in the market, providing fertility clinics and healthcare professionals with innovative tools to enhance IVF outcomes. The AI tool's focus includes aiding in embryo selection, grading, and predicting the optimal embryo implantation. Asia Pacific is expected to witness the fastest growth over the forecast period. This can be attributed to a surge in the demand for IVF treatment due to several factors. Fertility tourism, foreign investment targeting economically developing countries, and evolving regulatory conditions contribute to this growth.

In addition, lifestyle changes, including increased obesity, stress, lack of exercise, improper eating habits, insufficient nutrition, rise in pollution, and the prevalence of medical conditions like diabetes, have led to a higher incidence of infertility in the region. North America is also expected to witness increasing demand for fertility treatment in the coming years. Standardization of procedures through automation, regulatory reforms, government funding for egg/sperm storage, and the introduction of more IVF treatments by industry players are among the major factors contributing to the growth of the regional market.

Key Companies & Market Share Insights

Geographical expansions, mergers, and product innovations & commercialization are the key strategies adopted by the market players. For instance, in June 2023, Progyny, Inc. and Quantum Health, Inc. entered a partnership to introduce Quantum Health’s Comprehensive Care Solutions platform for family building and fertility solutions. Some of the prominent players in the global in vitro fertilization market include:

-

Bayer AG

-

Boston IVF

-

Cook Medical LLC

-

EMD Serono, Inc.

-

Ferring B.V.

-

FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

-

Genea Biomedx

-

EMD Serono, Inc. (Merck KGaA)

-

Merck & Co., Inc.

-

OvaScience, Inc.

-

Progyny, Inc.

-

The Cooper Companies, Inc.

-

Thermo Fisher Scientific, Inc.

-

Vitrolife

In Vitro Fertilization Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 25.3 billion

Revenue forecast in 2030

USD 37.4 billion

Growth rate

CAGR of 5.72% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, procedure type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; France; Germany; Italy; Spain; UK; Belgium; The Netherlands; Switzerland; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Bayer AG, Boston IVF; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corp.); Genea Biomedx; Merck & Co., Inc.; OvaScience, Inc.; Progyny, Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Vitro Fertilization Market Report Segmentation

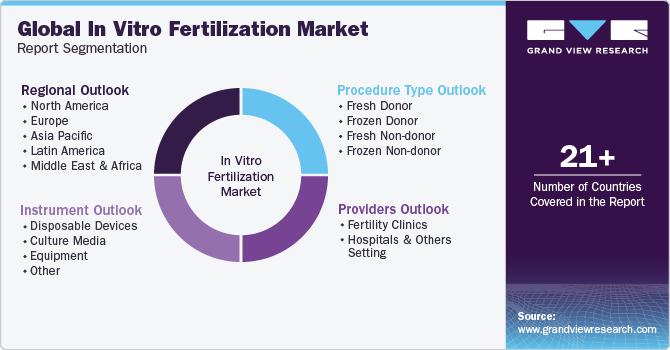

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the in vitro fertilization market report on the basis of instrument, procedure type, end-use, and region:

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Capital Equipment

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Others Setting

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

Belgium

-

The Netherlands

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global in vitro fertilization market is expected to grow at a compound annual growth rate of 5.72% from 2023 to 2030 to reach USD 37.4 billion by 2030.

b. Europe dominated the IVF market with a share of around 37% in 2022. This is attributable to it being the first region to come up with the in-vitro fertilization procedure, to remove the title experimental from cryopreservation of eggs, and the first one to legally approve the three parent’s IVF or the mitochondrial transfer technique.

b. Some key players operating in the IVF market include OvaScience; EMD Serono Inc.; Vitrolife AB; Irvine Scientific; Cook Medical Inc.; Cooper Surgical Inc.; Genea Biomedx; Thermo Fisher Scientific Inc.; Progyny, Inc.; and Boston IVF.

b. Key factors that are driving the in vitro fertilization market growth include an increase in cases of infertility and the development of advanced technologies such as lensless imaging of the sperms.

b. The global in vitro fertilization market size was estimated at USD 23.6 billion in 2022 and is expected to reach USD 25.3 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With COVID-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for COVID-19 as a key market contributor.