- Home

- »

- Advanced Interior Materials

- »

-

In-Mold Labels Market Size, Share And Trends Report, 2030GVR Report cover

![In-Mold Labels Market Size, Share & Trends Report]()

In-Mold Labels Market Size, Share & Trends Analysis Report By Material (PP, PE, PVC, ABS), By Process, By Printing Technology, By Printing Inks, By End-use, By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455986

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Data: ---

- Industry: Advanced Materials

In-Mold Labels Market Size & Trends

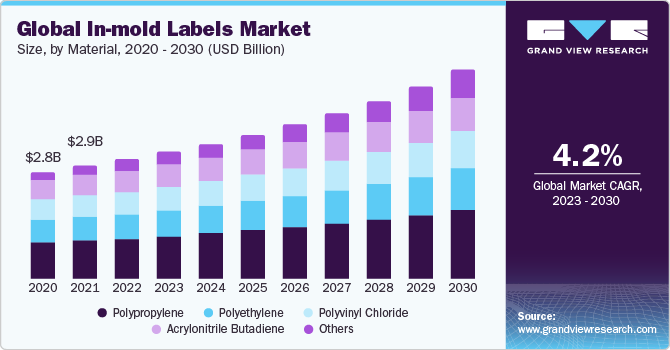

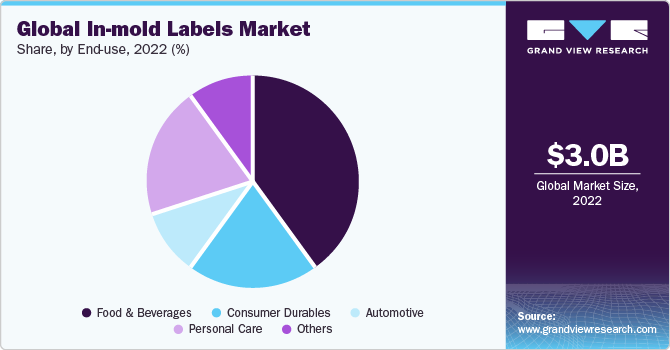

The global in-mold labels market was valued at USD 3.0 billion in 2022 and is anticipated to propel at a CAGR of 4.20% over the projected period. The increasing focus on the presentation of product, along with the rising demand for aesthetically appealing packaging, and rising consumer preference for sustainable packaging, are a few key factors propelling the sprouting of the market.

Whilst the impact of COVID-19 during 2020, many countries witnessed lockdown situation imposed to contain the spread of the virus. Due to the introduction of new risk-reduction procedures, as well as the deployment of social isolation and lockout measures, players were forced to decrease capacity or temporarily halt output. The scarcity of laborers and technicians had a negative impact on the market growth during the year. Furthermore, due to labor shortages, restrictions on vehicle travel, and disruption in the supply chain management, various businesses experienced losses during this outbreak.

The in-mold labels have a seamless appearance since they are permanent packaging components. Due to the lack of additional adhesives & labeling, the packaging design remains simple and uncluttered. In addition to aesthetic packaging appearance, these in-mold labels have a longer lifespan and are highly resistant to moisture, chemicals, and abrasion. Owing to their higher toughness, these labels are suitable for utilization across adverse conditions such as low temperature conditions, liquid exposure, among others. This further helps keeping intact the important description such as usage instruction, key ingredients, and other details on the product.

Material Insights

Based on the material, the In-mold labels market is segmented into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and Acrylonitrile butadiene styrene (ABS). The polypropylene (PP) segment held the largest market share in 2022. Since polypropylene possesses higher toughness, chemical resistance, and adaptability, it is highly utilized for the manufacturing of in-mold labels utilized across industries including packaging, food & beverages, household good, personal care, and others.

Process Insights

Based on process type the market is segmented into injection molding process, extrusion blow molding process, and thermoforming. Injection molding process was the largest process segmentations in 2022. This process provides higher visual appearance and durability to the packaging solutions to the end product, hence has gained traction for the manufacturing of in-mold labels. Furthermore, it injection molding offers high precision and consistency, ensuring the accuracy of the placement of the label on the product, and secure bond during the manufacturing process, propelling the market growth.

Printing Technology Insights

Based on printing technology, the In-mold labels market is segmented into offset printing, gravure printing, flexographic packaging, and digital printing. Offset printing segment dominated the printing technology segmentation in 2022. Since the offset printing provides precise and high-quality image production, ensuring detailed and vibrant designs on the in-mold labels, it is suitable for industries such as food & beverages, personal care, and medical & pharmaceuticals which require informative and clear labels to attract customers and provide them with the details of the product.

Printing Inks Insights

Based on printing inks, the In-mold labels market is segmented into UV curable, thermal cured inks, and water-soluble. Water-soluble printing ink segment dominated the printing inks segmentation in 2022. Water-soluble inks dry quickly, making them essential for the in-mold label manufacturing to ensure that the ink adheres to the label material and doesn't smear during handling and molding. Furthermore, water-soluble inks contain fewer volatile organic compounds (VOCs) compared to solvent-based inks, making them more environmentally friendly.

End-use Insights

Based on end-use, the In-mold labels market is segmented into consumer durables, food & beverage, personal care, and automotive. Food & beverage segment dominated the end-use segmentation in 2022. Since in-mold labels have a longer lifespan, possess resistance to chemicals & moisture, and can withstand high & low temperature conditions, these are highly suitable for products across the food & beverages.

Regional Insights

North America dominated the largest market share in 2022. The region has the presence of major food & beverage manufactures such as PepsiCo, The Coca‑Cola Company, Nestlé USA, Inc, The Kraft Heinz Company, Mars, among others. This enables a strong food & beverage market share across the regions, hence has provided the in-mold manufacturers an opportunity to grow across North America and is anticipated to boost the market growth during the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are Constantia Flexibles Group GmbH; CCL Industries, Inc.; Huhtamaki Group; Coveris Holdings S.A.; among others have entered the In-mold labels market. These key manufacturers are anticipated to witness propulsive growth during the forecast period by utilizing strategic initiatives to widen their presence and increase the sales and revenue. The following are some instances of strategic initiatives:

-

In September 2022, Muller Technology, a molds and automation solutions across thin wall packaging announced their in-mold labelling (IML) automation technology utilized across sustainable injection molded packaging. This technology is introduced for the production of 100% monomaterial container made of completely recyclable polypropylene along with a wrap around and bottom polypropylene-based label.

-

In December 2020, Huhtamäki Oyj, a manufacturer and supplier of food packaging, announced their expansion across Russia to cater the customer requirements form the country This enabled the in-mold label manufactures to increase their production and capture the marketU

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."