- Home

- »

- Advanced Interior Materials

- »

-

HVAC Systems Market Size, Share & Growth Report, 2030GVR Report cover

![HVAC Systems Market Size, Share & Trends Report]()

HVAC Systems Market Size, Share & Trends Analysis Report By Product (Heating, Ventilation, Cooling), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-641-7

- Number of Pages: 134

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

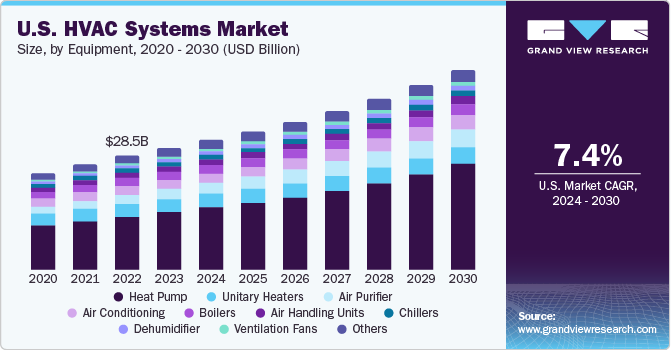

The global HVAC systems market size was valued at USD 136.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Varied climatic conditions and the need to maintain ambient environment in a building is a key trend expected to impact the heating, ventilation, and air conditioning (HVAC) systems market over the forecast period. In recent times, availability of smart features and energy efficiency have been key purchase criteria for most customers, and the trend is expected to gain traction over the next few years. Although the prospects look supportive, the supply chain shortages amidst the pandemic impacted the market for HVAC systems in 2020; however, the market entered recovery from H32020 onwards as manufacturing activities gradually resumed post a strict lockdown.

In the Asia Pacific, the market for HVAC systems is anticipated to witness healthy growth over the mid-term. An increase in multi-family and individual homeowners is creating avenues for future growth. The HVAC industry is gradually shifting focus on energy efficiency. Green initiatives are the focus area for several OEMs with an emphasis on saving money while reducing greenhouse emissions. Therefore, over the recent years, there has been a shift toward eco-friendly HVAC units. This includes products that consume less power and operate on renewable sources of energy thereby reducing energy costs.

As such over the last few years the use of geothermal cooling and heating equipment has been on a rise, subsequently reducing dependence on fuel-based equipment. Customer inclination towards comfort is creating avenues for growth. To meet the demand OEMs are developing products that are not just energy-efficient but also incorporate the latest technologies offering better connectivity. Today buildings constructed are “green” resulting in an increase in installations of thermostats, sensors, and smart meters that can be controlled from a smartphone or PC. The software enabled HVAC systems are also trending, and are expected to create opportunities over the forecast period. Technology is slowly making in-roads in the HVAC field, creating favorable long-term growth avenues.

Product Insights

The cooling segment dominated the market for HVAC systems and accounted for the largest revenue share of 54.8% in 2022. According to the data published by the International Energy Agency (IEA), cooling accounts for over 10% of the world’s electricity consumption. The statistics are huge and probably explain why the cooling segment has dominated the HVAC (Heating, ventilation, and air conditioning) equipment market over the years. Growing population and disposable incomes particularly in the hotter regions globally have instigated the usage of air conditioners, subsequently favoring the demand for cooling systems such as air conditioners (AC), unitary ACs, etc. The cooling segment from 2023 to 2030 is projected to grow at an approximate CAGR of 6.6%.

Apart from cooling, heating is also a major segment exhibiting gradual growth over the years. As of 2022, the segment captured over 28.2% share of the market. The segment over the long term is projected to gain traction as the market gradually transitions from a fuel-based working model to efficient low-carbon solutions. Further, the proliferation of solar-based heat pumps will also create avenues for segment growth over the forecast period.

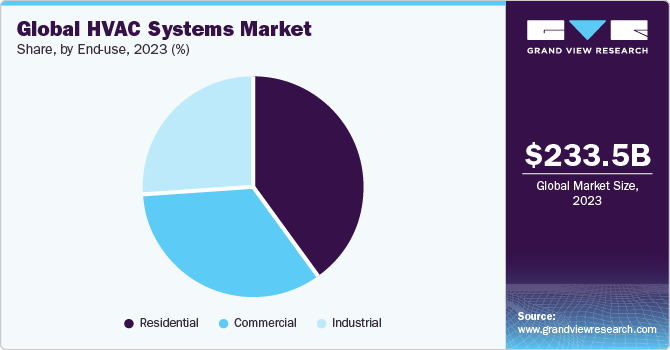

End Use Insights

The residential segment dominated the market for HVAC systems and accounted for the largest revenue share of 39.9% in 2022. An increase in multi-family and individual homeowners is creating avenues for the residential HVAC segment. As such in 2021 the segment was approximately valued at more than USD 50.0 billion. In developed parts of the world, the demand for residential HVAC (Heating, ventilation, and air conditioning) is expected to be more or less stagnant; however, the demand from newer markets particularly developing markets will be slightly on a higher end. This is primarily ascribed to the growing population in emerging markets and market maturity in developed markets.

-

Commercial HVAC space offers huge opportunities for growth. The segment is projected to grow at a CAGR exceeding 6.8% from 2023 to 2030. Several trends including green & smart technology to automated systems are expected to play a pivotal role in shaping the future of commercial HVAC market. As the COVID-19 pandemic becomes an endemic, and permanent WFH models slowly transitions to a hybrid working model, the demand for HVAC in commercial settings is anticipated to witness an uptick.

Regional Insights

Asia Pacific dominated the HVAC systems market and accounted for a revenue share of 46.3% in 2022. Increasing urbanization, growing population, and increasing consumer disposable income are key success factors to the region's tremendous growth over the years. Lately, the commercial sector has been growing creating prospects for future regional growth.

North America, closely followed by Europe was the second-largest consumer of HVAC systems in 2022. The market for HVAC systems as such has reached maturity; however, replacement sales due to aging infrastructure or retrofit projects are creating alternate revenue streams for OEMs apart from expansion into the services and maintenance category. The region is anticipated to witness a CAGR exceeding 6.1% over the forecast period.

Key Companies & Market Share Insights

Inorganic growth strategies have been the go-to-market strategy for vendors in this space. The focus to increase market expanse and beat competition is achieved through partnerships and M&As. Technology and energy efficiency are two buzz words OEMS are aimed at targeting over the short-term to stay relevant and profitable. Apart from growing the company's size and reach, market players emphasize research and development to develop technologically advanced and differentiated products to gain a competitive edge.

Companies are also focusing on developing products that comply with regional regulation norms to eliminate the risk of losing out business because of regulation violations. For instance, in December 2019, Lennox International, Inc. expanded its ultra-low emission gas furnace line by introducing four furnaces, namely SL297NV, SL280NV, EL195NE, and EL180NE. The new products were developed to comply with the new California South Coast Air Quality Management District’s Rule 1111 and San Joaquin Valley Air Pollution Control District Ultra Low NOx Rule 4905, which are focused on the reduction of nitrogen oxide emission. Some of the prominent players in the HVAC systems market include:

-

Carrier Corporation

-

Daikin Industries, Ltd.

-

Emerson Electric Co.

-

Hitachi Ltd.

-

Johnson Controls International plc

-

Lennox International, Inc.

-

Trane Technologies

Recent Development

-

In May 2023, Carrier Corporation introduced i-Vu Pro v8.5 for upgrading controller firmware, improving serviceability for customers, and reducing downtime of connected HVAC equipment. The latest enhancements are expected to help customers with Internet of Things (IoT) connectivity, robust security, and leading serviceability features.

-

In May 2023, Toshiba Carrier Corporation (TCC) unveiled its new Digital Invertor (DI) series in China. The DI series is ductless split air-conditioning system designed for commercial uses and is easy to install and is energy efficient.

-

In April 2023, Toshiba Carrier Corporation expanded its Heatcle Air light commercial total heat exchanger series in Japan provide high-quality ventilation solutions and enhance indoor air quality with design flexibility and higher energy efficiency.

-

In February 2023, Hitachi launched air365 Max an end-to-end solution for architects, HVAC professionals, and building owners, integrated with Hitachi's original SmoothDrive 2.0 technology to reduced CO2 emissions.

-

In June 2021, Hitachi with Johonson Controls launched airCloud Home which provides comfort, price competitive, and is energy efficient.

-

In June 2021, Hitachi introduced PRIMAIRY system in North America, a line of high-efficiency single-zone mini-split systems.

HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 150.93 billion

Revenue forecast in 2030

USD 234.94 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; Latvia; China; India; Japan; South Korea; Australia; Brazil; Argentina; Chile

Key companies profiled

Carrier Corporation; Daikin Industries, Ltd.; Emerson Electric Co.; Hitachi Ltd.; Johnson Controls International plc; Lennox International, Inc., Trane Technologies

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global HVAC Systems Market Report Segmentation

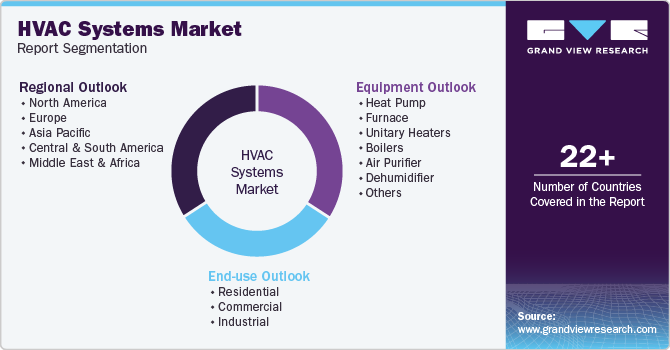

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global HVAC systems market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heating

-

Ventilation

-

Cooling

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Latvia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global HVAC systems market size was estimated at USD 136.3 billion in 2022 and is expected to be USD 150.93 Billion in 2023.

b. The HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 234.94 Billion by 2030.

b. The residential product segment dominated the Heating, Ventilation and Air conditioning Systems Market with a share of 39.9% in 2022.

Which region held the largest share in the Heating, Ventilation and Air conditioning Systems Market?b. Asia Pacific accounted for a significant market revenue share of 46.3% in 2022. Increasing urbanization, growing population, and increasing consumer disposable income are key success factors to the region's tremendous growth over the years. Lately, the commercial sector has been growing creating prospects for future regional growth.

b. The cooling product segment dominated the Heating, Ventilation and Air conditioning Systems Market with a share of 54.8% in 2022. This is attributable to the rising demand from the commercial sector and changing climatic conditions worldwide.

b. Some key players operating in the HVAC systems market include Emerson Electric Co.; Johnson Controls International plc; Lennox International, Inc.; Carrier Corporation; Hitachi Ltd.; Trane Technologies; and Daikin Industries Ltd.

b. Key factors that are driving the market growth for HVAC systems include increasing urbanization, the introduction of energy-efficient HVAC systems, incentives & rebate programs offered by the governments, and growing spending in the construction sector worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry, once thriving with increased investments, has been severely affected by the suspension of the construction activities in the wake of the ongoing pandemic. Shortage of labors coupled with potential supply chain bottlenecks of materials and equipment is expected to cause project delays in the ongoing funded projects and may lead to reduced spending in the upcoming projects. Uncertainty around the actual duration of the prevailing lockdown makes it hard to anticipate how a recovery in the construction industry will unfold. On similar lines, the HVAC industry has been adversely affected by the COVID-19 outbreak due to the shutting down of several component manufacturing facilities across China, European countries, Japan, and the U.S. This has consequently led to a significant slowdown in the production of HVAC equipment. Lockdowns imposed by the governments in the wake of the COVID-19 outbreak has not only affected manufacturing but also pegged back the consumer demand for HVAC equipment. The report will account for COVID-19 as a key market contributor.