- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Human Milk Oligosaccharides Market Size Report, 2030GVR Report cover

![Human Milk Oligosaccharides Market Size, Share & Trends Report]()

Human Milk Oligosaccharides Market Size, Share & Trends Analysis Report By Type (2'FL, 6'SL), By Concentration, By Application (Infant Formula, Dietary Supplement), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-608-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Consumer Goods

Market Size & Trends

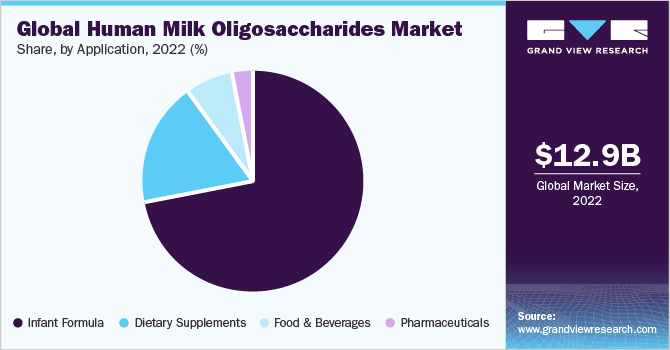

The global human milk oligosaccharides (HMO) market size was valued at USD 12,998.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.6% from 2023 to 2030. The rise in demand for dietary supplements and growing awareness among consumers about the importance of gut health are expected to fuel market growth. Human Milk Oligosaccharides (HMOs), which function as prebiotics in the human body, play a significant role in maintaining gut health. They facilitate the growth of beneficial bacteria, particularly bifidobacteria, in the gut, leading to improved metabolic activity.

Due to their antimicrobial protection and prebiotic properties, HMOs can be incorporated into a variety of food products, including infant formulas, pharmaceuticals, and medicinal foods.

The growth of the HMO market may be limited due to factors such as the absence of technology for large-scale production, high costs associated with research and development, and stringent government regulations. HMOs find their largest application in infant formula, which can help promote health and prevent diseases in infants. Additionally, they are crucial for brain development and memory enhancement in humans.

Human milk oligosaccharides are primarily responsible for preventing infections, providing sialic acid for brain development, and exhibiting prebiotic effects. However, oligosaccharide concentration in bovine milk-derived infant formulas is lower when compared to human milk-derived formulas.

The growth of the human milk oligosaccharides market may be hindered by the limited availability and high cost of enzymes and chemicals used in their production. Despite this, the demand for HMOs continues to rise due to their essential role in promoting optimal health and preventing diseases in both infants and adults. HMOs support various aspects of an infant's development, such as digestion, immunity, and brain function, while HMO supplements have been shown to increase beneficial gut bacteria in adults.

As breast milk is not always available, synthetic production methods have been developed to produce HMOs. In addition to infant formula, HMOs are increasingly being incorporated into functional food and beverages. This is particularly true for dairy products, which dominate the functional food market. There is a high demand for functional food and beverages that have prebiotic properties and can promote the growth of good bacteria while eliminating harmful bacteria like salmonella, listeria, and campylobacter.

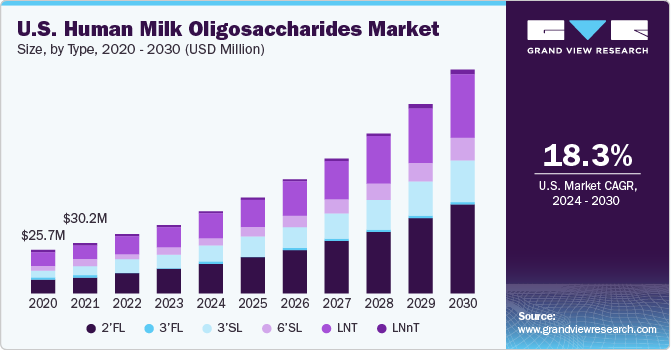

Type Insights

2’FL dominated the product type segment with a revenue share of over 35.69% in 2022. Several factors are driving the market for 2'FL. Firstly, there is a growing awareness among parents and healthcare professionals about the health benefits of HMOs in general, and 2'FL in particular. 2'FL can help support the development of a baby's immune system, improve gut health, and has cognitive benefits.

In addition, there is a growing demand for infant formula that contains HMOs, particularly in regions where breastfeeding rates are low. As a result, manufacturers of infant formula are increasingly incorporating 2'FL into their products.

According to a study published by the Nestlé Nutrition Institute, new infant formula with 2′-fucosyllactose (2′FL) had similar gastrointestinal symptoms to a formula without 2′FL. However, infants who received the formula with 2′FL had a lower incidence of infections, which suggests that 2′FL may support the developing immune system in infants.

3'SL type is expected to witness significant growth with a CAGR of 18.3% by revenue over the projected period. 3'SL can enhance immune function, protect against pathogens, and support brain development in infants. These benefits have led to increased demand for 3'SL-type HMOs as an ingredient in infant formula and other nutritional products.

In addition, advances in biotechnology and manufacturing processes have made it easier and more cost-effective to produce 3'SL-type HMOs on a large scale. This has led to an increase in supply and a reduction in prices, making 3'SL-type HMOs more accessible to manufacturers of infant formula and other products.

Concentration Insights

The acidic concentration is expected to grow at a CAGR of 18.06% from 2022 to 2030. The growing awareness among consumers about the importance of nutrition for infants has led to an increased demand for products that contain HMOs. In addition, various research into the health benefits of acidic HMOs has led to the development of new products that are designed to target specific health concerns in infants.

The neutral concentration dominated the market with a market share of 51.69% in 2022. Neutral HMOs are those that do not have any charged groups, such as carboxyl or sulfate groups, and have a neutral pH. These HMOs are the most abundant type found in breast milk, and they serve as a source of energy for the infant and play a role in promoting the growth of beneficial gut bacteria.

Application Insights

The infant formula was the dominant application in the global market, making up 71.94% of the total revenue in 2022. The demand for HMOs in designing infant formulas is increasing due to their beneficial properties, such as improving gut health, memory enhancement, brain development, prevention of infection, and prebiotic effects.

The dietary supplement was the second-largest application segment, contributing to over 17.7% of the market revenue in 2022. As HMOs offer various health benefits, their consumption of functional food and beverage formulations is expected to increase significantly over the forecast period, leading to a surge in demand.

The use of HMOs in dietary supplements provides immune support, protection against bacterial and viral infections, digestive comfort, and support for brain function. The food supplements industry is witnessing growth due to increasing healthcare costs, changing lifestyles, and a rise in the geriatric population. Moreover, rising consumer health awareness and increasing disposable incomes further support this trend.

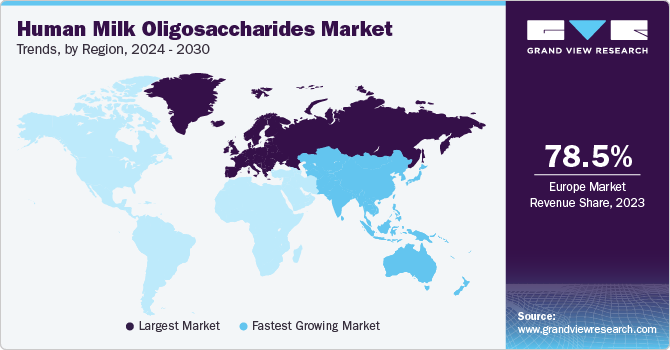

Regional Insights

North America held a revenue share of 12.1% in 2022. The infant formula and baby food industry are poised for growth in the upcoming years, fueled by the presence of several major manufacturers and advancements in technology.

Europe is expected to expand at a CAGR of 13.0% during the forecast period. Europe is expected to experience a surge in market growth due to the rising demand for infant food, a significant number of manufacturers of human milk oligosaccharides (HMOs), and the regulatory clearance for HMOs as a constituent of infant formula. The UK has the lowest rate of breastfeeding, which can be attributed to a reduction in public health funding, limited awareness about the health benefits of breast milk, and societal stigmas surrounding public breastfeeding. This presents a significant opportunity for the industry to penetrate the UK market.

Asia Pacific is expected to expand at a CAGR of 15.6% during the forecast period. The growth of the Asia Pacific HMO industry is forecasted to be influenced by various factors such as an expanding population, increased mortality rates, higher disposable income, and greater consumer awareness concerning health and hygiene. This region is witnessing a surge in the prevalence of chronic ailments such as gut diseases, diabetes, high blood pressure, and rickets, leading to rising demand for functional food and beverages, consequently propelling the regional market for human milk oligosaccharides.

Furthermore, the burgeoning markets for dietary supplements and baby food in countries like India and China are expected to contribute significantly to the growing demand for HMO products in the coming years.

Key Companies & Market Share Insights

Manufacturers are dedicating resources to research and development to create cost-effective methods for producing HMOs on a large scale. While the HMO industry is currently considered niche, there is significant potential for growth in areas such as functional foods and beverages, as well as dietary supplements. A considerable portion of HMOs produced currently is utilized in infant formula. In response to the increasing demand for HMOs, manufacturers are utilizing tactics such as forging partnerships, making agreements, and expanding production capacity.

Prominent market participants have invested in R&D activities over the years to innovate their product offerings. For instance, in November 2020, Abbott launched Similac Pro-Advance infant formula in Canada with an ingredient that supports a baby's immune system and feeds good bacteria in the digestive tract. Some prominent players in the global human milk oligosaccharides market include:

-

Inbiose NV

-

Elicityl S.A.

-

Jennewein Biotechnologie GmbH

-

Medolac Laboratories

-

Glycom A/S

-

ZuChem Inc.

-

Glycosyn LLC

-

Abbott

-

Dextra Laboratories Ltd

-

DuPont

Human Milk Oligosaccharides Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15,276.43 million

Revenue forecast in 2030

USD 47,587.77 million

Growth rate

CAGR of 17.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in metric tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Market forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, concentration, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Australia and New Zealand; South Korea; Japan; Australia; Brazil; Argentina; South Africa; UAE

Key companies profiled

Inbiose NV; Elicityl S.A.; Jennewein Biotechnologie GmbH; Medolac Laboratories; Glycom A/S, ZuChem Inc.; Glycosyn LLC; Abbott; Dextra Laboratories Ltd; DuPont

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

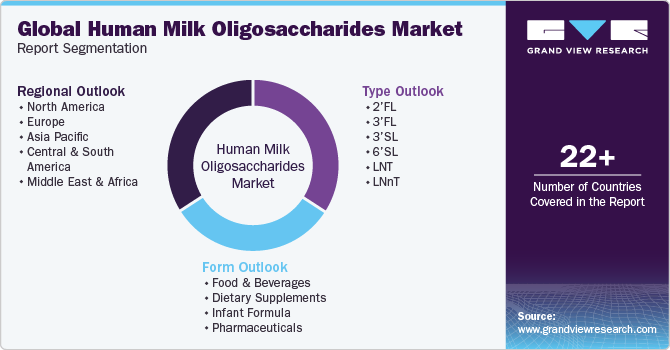

Global Human Milk Oligosaccharides Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global human milk oligosaccharides market report based on type, concentration, application, and region:

-

Type Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

2'FL

-

3'FL

-

3'SL

-

6'SL

-

-

Concentration Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Neutral

-

Acidic

-

-

Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Infant Formula

-

Dietary Supplements

-

Food & Beverages

-

Pharmaceuticals

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Australia and New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global human milk oligosaccharides market size was estimated at USD 12,998.6 million in 2022 and is expected to reach USD 15,276.43 million in 2023.

b. The global human milk oligosaccharides market is expected to grow at a compound annual growth rate of 17.6% from 2023 to 2030 to reach USD 47,587.77 million by 2030.

b. Europe dominated the human milk oligosaccharides market with a share of 41% in 2022. This is attributable to the presence of numerous prominent infant formula and baby food manufacturers along with technological advancements.

b. Some key players operating in the human milk oligosaccharides market include Inbiose NV, Elicityl S.A., Jennewein Biotechnologie GmbH, Medolac Laboratories, Glycom A/S, ZuChem Inc., Glycosyn LLC, Abbott, Dextra Laboratories Ltd, and DuPont.

b. Key factors that are driving the human milk oligosaccharides market growth include increasing concerns among consumers regarding gut health and the growing consumption of dietary supplements by end-users.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The demand for nutraceuticals & functional foods is expected to witness an upward surge owing to consumers opting for immunity boosting supplements during the COVID-19 pandemic. Furthermore, a decline in the consumption of poultry, meat and seafood products across the globe is expected to increase the demand for plant and animal-based protein supplements in the near future. The report will account for Covid19 as a key market contributor.