- Home

- »

- Homecare & Decor

- »

-

Home Fragrance Market Size, Share & Growth Report, 2030GVR Report cover

![Home Fragrance Market Size, Share & Trends Report]()

Home Fragrance Market Size, Share & Trends Analysis Report By Product (Scented Candles, Sprays, Essential Oils, Incense Sticks), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Store), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-915-9

- Number of Pages: 82

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Home Fragrance Market Size & Trends

The global home fragrance market size was valued at USD 10.23 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. The market growth is attributed to growing interest in home decor and ambiance, and the popularity of aromatherapy. Moreover, consumers' rising ability to spend discretionary money is boosting their propensity to buy diverse scent goods. The development of new, visually beautiful goods, their personalization, and their use of natural substances like oils are what are driving the home fragrances industry across the globe. The pandemic has also led to increased hygiene concerns among consumers, which has affected the packaging and delivery of home fragrance products. Companies are implementing new safety protocols, such as contactless delivery and increased sanitation measures, to address these concerns and reassure customers.

Consumers are increasingly concerned about the impact of their purchasing decisions on the environment. As a result, there is a growing demand for natural and eco-friendly home fragrance products. Companies are responding by creating products made from natural ingredients and using sustainable packaging. For instance, in March 2023, Grove Collaborative Holdings, Inc., a top manufacturer of environmentally friendly consumer goods, launched of its new Grove Co. Fresh Horizons Limited Edition Collection with Drew Barrymore.

Essential oils are becoming more popular in the home fragrance industry as consumers seek out natural and holistic products. Many people believe that essential oils have therapeutic properties and can help to promote relaxation and wellness. Moreover, consumers are looking for unique and innovative fragrances in home fragrance products. As a result, companies are developing new and interesting scent combinations to differentiate their products in the market. For example, some companies are blending unexpected scents like coffee and leather to create a unique and appealing fragrance profile.

Technology integration is a growing trend in the home fragrance industry, with companies developing products that are compatible with smart home technology. For example, some companies are developing scent diffusers that can be controlled through a smartphone app, allowing consumers to adjust the scent intensity and schedule fragrance delivery. For instance, March 2020, Air Wick launched a new scented oil diffuser that use Bluetooth and can be operated with an iPhone.

The business has also been boosted by the increased awareness of house fragrances spread through different media like YouTube, television commercials, and others. For instance, Godrej Aer, an Indian company that provides car, home and bathroom perfumes, introduced a new TVC campaign in 2022 called "If Bathrooms Could Talk" for its Godrej Aer Power Pocket collection of bathroom fragrances. Innovative graphics and animation methods were used to create the TVC, which Creativeland Asia conceptualised, making it aesthetically appealing to draw consumers' attention.

Product Insights

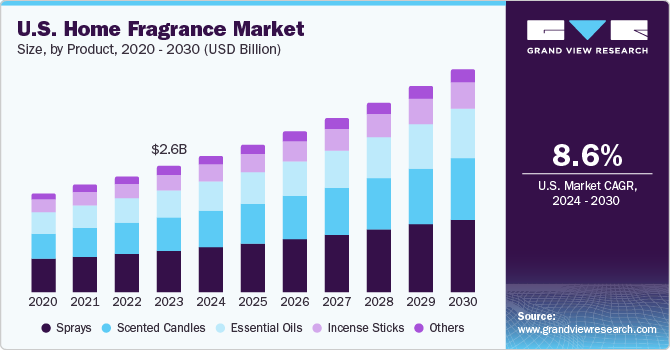

In terms of revenue, the sprays segment led the market and accounted for a 34.03% share of the global revenue in 2022. Home fragrance systems have been a popular choice among consumers for many years. They are easy to use and can quickly freshen up a room with a burst of fragrance. The demand for home fragrance sprays has remained steady over time, with some fluctuations due to changing consumer preferences and market trends.

The scented candles segment is anticipated to expand at a CAGR of 9.8% from 2023 to 2030. Scented candles offer a wide variety of fragrance options, catering to different consumer preferences. There are floral scents, fruity scents, spicy scents, and many others, allowing consumers to find a scent that they enjoy and that suits their personal taste. Moreover, the increasing popularity of the scented candles as a gift item, especially during the holiday season. They are often given as hostess gifts, housewarming gifts, or as a small token of appreciation. This has contributed to the overall demand for scented candles.

Distribution Channel Insights

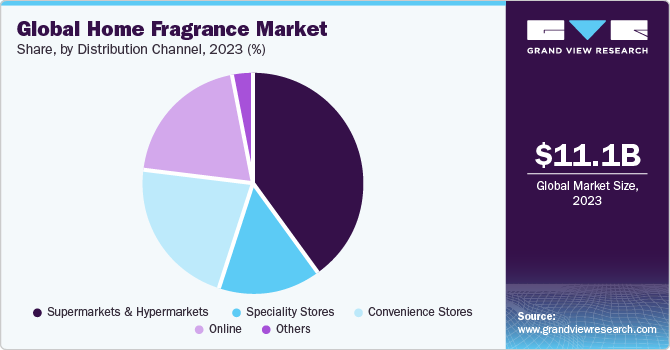

The sales of home fragrance through supermarkets and hypermarkets distribution channels made the largest revenue contribution of around 40% in 2022. Supermarkets and hypermarkets play a significant role in the home fragrance industry by offering a diverse range of products at competitive prices, providing convenience and accessibility to consumers, and promoting and raising awareness of home fragrance products. In the forecast term, these reasons are likely to boost the segment.

The online distribution channel is projected to expand at a CAGR of 10.3% from 2023 to 2030. This distribution channels offer consumers a convenient and easy way to shop for home fragrance products. With the increase in online shopping and the convenience it provides, it is expected that online distribution channels will continue to play a significant role in the home fragrance industry. Furthermore, Bath & Body Works offers a wide variety of home fragrance products, including candles, room sprays, and diffusers, on its e-commerce website. The website provides a seamless shopping experience, with easy navigation, product descriptions, and customer reviews.

Regional Insights

Europe made the largest revenue contribution of around 35% to the global market in 2022. Consumers in Europe are becoming more health-conscious and are looking for products that can provide a sense of well-being. The UK home fragrance market valued at USD 634.1 million in 2022 owing to rising demand for the natural and ecofriendly home fragrance. Home fragrance products that contain natural ingredients such as essential oils are seen as a healthier alternative to synthetic fragrances. Germany home fragrance market size was valued at USD 474.3 million in 2022. The increasing urbanization in the Germany has led to an increase in small living spaces, such as apartments and condos, where home fragrance products are used to create a pleasant and relaxing atmosphere.

Asia Pacific is expected to expand at a CAGR of 10.3% from 2023 to 2030. The regional market has been fueled by the rapid rise of emerging economies such as India, China, and Australia. Moreover, in many countries of the Asia-Pacific region, home fragrance products are deeply rooted in culture and tradition. For example, incense sticks and scented oils are commonly used in religious ceremonies and rituals. Additionally, in terms of revenue, China home fragrance market accounted for USD 776.2 million market size in Asia Pacific home fragrance market, in 2022.

India home fragrance market contributed USD 320.7 million in 2022 on account of the increased consumer sophistication, brand awareness, rising disposable income, rising demand from middle-class consumers, and low-cost fragrance in the form of scented candles, sprays, essential oils, and other items. Moreover, Australia home fragrance market valued USD 195.3 million in 2022 owing to increasing demand for fresh, customized and visually beautiful home fragrance products, and products made with natural substances like oils.

The North America region accounted for a market share of around 30% of the global revenue in 2022. Growing popularity of aromatherapy in North America, with consumers using home fragrance products to promote relaxation, reduce stress, and improve overall well-being is further anticipated to boost the demand for the product. The U.S. home fragrance market valued USD 2,568.4 million in 2022 and held the largest share of North America home fragrance market in 2022. The dominance is majorly attributed to the significant growth of unique and personalized fragrances in the country.

For instance, in April 2023, Three new exclusive scents, "Free To Be," "Sunroof's Open," and "Free Spirit," were introduced by Friday Collective, a Newell Brands brand, as part of its collection at Target. The bold lifestyle brand offers a selection of scented candles that, via their brilliant colors and daring aroma combinations, express optimism and joy. These candles may be used to set the tone, raise energy levels, or even just refresh a person's mood.

Key Companies & Market Share Insights

The home fragrance the market includes both international and regional participants. Key market players are focusing on product innovation to enhance their portfolios.

-

In December 15, 2022, IRIS Home Fragrances, a lifestyle and health division of Cycle Pure Agarbathies, has introduced a brand-new glitter collection to brighten up the Christmas season. The company's latest holiday line features the exotic scents Gold Musk and Romance.

-

In October 19, 2022, Shefar launched scented candle product line that includes Liela Candle and Mullan Candle.The candles were created with a carefully calibrated composition that preserves the fragrance's potency while also producing great combustion efficiency and little soot emission.

Some of the prominent players in the global home fragrance market include: -

-

Reckitt Benckiser Group PLC

-

The Procter & Gamble Company

-

Seda France

-

S. C. Johnson & Son, Inc.

-

Newell Brands Inc.

-

Voluspa

-

Scent Air

-

NEST Fragrances

-

The Estée Lauder Companies Inc.

-

Bougie & Senteur

-

Bath & Body Works LLC

Home Fragrance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.12 billion

Revenue forecast in 2030

USD 20.28 billion

Growth Rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S. Canada; Mexico; Germany; UK; Italy; Spain; France; China; India; Japan; Australia; South Korea; Brazil; Argentina; Colombia; Saudi Arabia; UAE; South Africa

Key companies profiled

Reckitt Benckiser Group PLC; The Procter & Gamble Company; Seda France; S. C. Johnson & Son, Inc.; Newell Brands Inc.; Voluspa; Scent Air; NEST Fragrances; The Estée Lauder Companies Inc.; Bougie & Senteur; Bath & Body Works LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Fragrance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global home fragrance market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Scented Candles

-

Sprays

-

Essential Oils

-

Incense Sticks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Store

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The home fragrance market was estimated at USD 10.23 billion in 2022 and is expected to reach USD 11.12 billion in 2023.

b. The home fragrance market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 20.28 billion by 2030.

b. Europe dominated the home fragrance market with a share of around 35% in 2022. This is owing to Increasing interest in aromatherapy, which helps people feel less stressed, and the rising use of candles as home décor items by consumers in the region.

b. Some key players operating in the home fragrance market include Reckitt Benckiser Group PLC, The Procter & Gamble Company, Seda France, S. C. Johnson & Son, Inc., Newell Brands Inc., Voluspa, Scent Air, NEST Fragrances, The Estée Lauder Companies Inc., Bougie & Senteur, and Bath & Body Works LLC.

b. Key factors that are driving the home fragrance market growth include the growing expenditure on interior decoration, growing interest in home decor and ambiance, and growing demand for natural and eco-friendly home fragrance products.

b. The U.K. home fragrance market was estimated at USD 634.1 million in 2022 and is expected to reach USD 685.5 million in 2023.

b. The China home fragrance market was estimated at USD 776.2 million in 2022 and is expected to reach USD 851.0 million in 2023.

b. The India home fragrance market was estimated at USD 320.7 billion in 2022 and is expected to reach USD 358.0 billion in 2023.

b. The Australia home fragrance market was estimated at USD 195.3 billion in 2022 and is expected to reach USD 216.0 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The Beauty and Personal Care (BPC) industry has witnessed a decline in the wake of the Covid 19 pandemic, but the impact is not as severe as seen in other industries. Although discretionary spending has reduced, the BPC market has witnessed a consumer behavioral shift towards safe and reliable products. Products that have a lower risk of contamination owing to automation and longer shelf lives helping the rationing of consumer supplies are expected to stand out in the near future. Brands are also focusing on improving their supply lines in terms of strengthening their E-commerce channel along with offering at-home wellness products, which are highly suited in this volatile business environment. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.