- Home

- »

- Advanced Interior Materials

- »

-

High-speed Production Inkjet Printer Paper Market Report, 2030GVR Report cover

![High-speed Production Inkjet Printer Paper Market Size, Share & Trends Report]()

High-speed Production Inkjet Printer Paper Market Size, Share & Trends Analysis Report By Product (Coated Paper, Treated Paper, Uncoated Paper, Offset Paper), By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-120-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

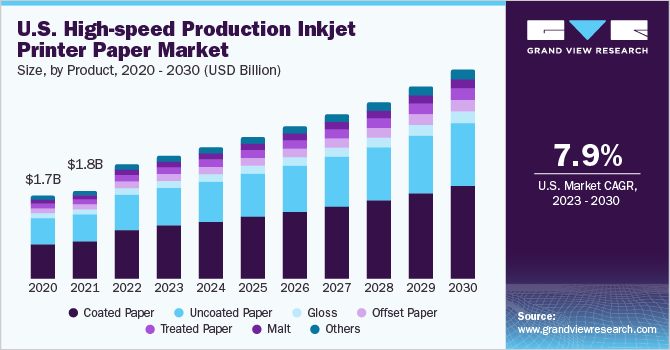

The global high-speed production inkjet printer paper market size was estimated at USD 2.30 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The growth of the market can be attributed to the increasing use of inkjet technology in various commercial printing applications. The shift from traditional printing to digital printing methods, including high-speed inkjet printing, is gaining traction owing to reduced production time, comparatively lower cost, and the ability to provide customizations, offered by the latter.

The U.S. is a key market for high-speed production inkjet printer paper in North America. There were approximately 25,000 commercial printing companies present in the U.S. as of 2022, generating revenue worth USD 900 billion. The adoption of advanced printing technologies is expected to increase in the country over the forecast period owing to their use in media and communication applications. Along with that, privacy issues and digital platform oversaturation experience are also expected to fuel the growth of commercial printing in comparison to web-to-print technology in the country. This, in turn, surges the demand for high-speed production inkjet printer paper in the U.S.

Manufacturers of high-speed production inkjet printer paper have partnerships with merchants and distributors to ensure the timely supply of this paper to their consumers. Some paper distributors in the market purchase papers in large quantities from the paper mills and supply them to retailers and printing companies. In addition, manufacturers often have tie-ups with various paper mills to cater to a variety of requirements of their customers.

High-speed inkjet printing also allows customized and personalized printing. It makes this printing technology highly prominent in targeted printing projects such as personalized promotional materials and marketing campaigns. Thus, high-speed inkjet printing is the preferred choice for businesses that aim to engage their customers. This is expected to increase the usage of high-speed production printer papers in the coming years.

Product Insights

The coated paper product segment led the market and accounted for the largest share of 42.2% in 2022. Coated high-speed production inkjet printer paper is a type of specialized paper that is designed to work with high-speed inkjet printers. It is coated with thin layers of chemical formulations, which include a variety of commercial and non-commercial coatings, such as titanium oxide, calcium carbonate, and silicates, which are used to enhance print quality. The coated paper provides numerous benefits, including high print resolution, improved ink absorption, reduced drying time, the ability to print high-quality graphics, and enhanced color representation. The high adoption of coated paper in commercial printing applications is expected to increase its demand over the forecast period.

The treated high-speed production inkjet printer paper segment was valued at USD 127.1 million in 2022. Treated paper undergoes various chemical treatments, such as microporous coatings, polymer coatings, UV inhibitors, resin coatings, dye and pigment receptors, acid-free treatments, and scratch-resistant coatings. These coatings enhance the performance of treated papers when used with inkjet printers and produce excellent color vibrancy and superior-quality prints. These factors are expected to drive the demand for treated paper.

Sales Channel Insights

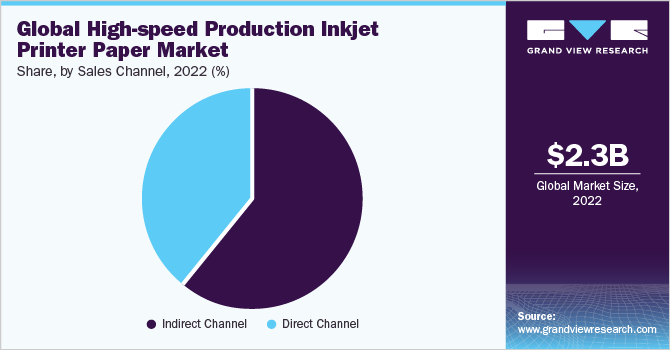

The indirect sales channel segment is expected to expand at a CAGR of 7.7% over the forecast period. In the indirect distribution sales channel, high-speed inkjet printer paper is sold to consumers through various channels that involve intermediaries, such as distributors and paper merchants. Indirect channels allow manufacturers to offer their products to a wider customer base as distributors have access to various markets. Moreover, an indirect distribution channel is beneficial for small-scale manufacturers, as they do not have enormous warehouses to manage inventory. These factors are expected to fuel the growth of the indirect sales channel segment in the coming years.

The direct sales channel segment is expected to grow at the highest CAGR of 8.2% in terms of revenue over the forecast period. In the direct sales channel, the manufacturers of high-speed inkjet printer paper sell their products directly to the end users without involving a middleman. In this type of sales channel, the end users generally purchase high-speed inkjet printer paper in larger quantities, as manufacturers prefer customers who deal in bulk quantities instead of making smaller purchases. It also ensures a smooth flow of high-speed inkjet printer paper for printing agencies. This, in turn, is anticipated to fuel the adoption of direct sales channels over the forecast period.

Regional Insights

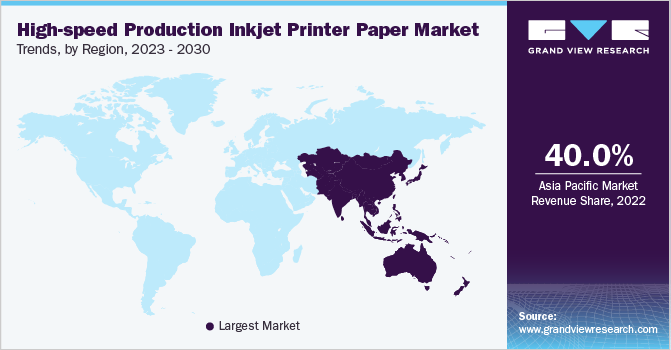

Asia Pacific has dominated the high-speed production inkjet printer paper market and accounted for USD 920.8 million in 2022. The growth of the market in this region can be attributed to its flourishing commercial printing industry. The rising demand for printed marketing collaterals and advertisements such as posters, flyers, brochures, and pamphlets is leading to the growth of the commercial printing industry in Asia Pacific. Moreover, the surging demand for customized and personalized printed materials is also driving the growth of the industry in this region. This, in turn, is leading to the rise in demand for high-speed production inkjet printer paper in Asia Pacific.

The commercial printing output of North America plunged from 2020 to 2022 owing to the impact of the COVID-19 pandemic. The pandemic shifted the paradigm from print to web-to-print in the region. However, in 2023, it is expected that industry players will capitalize on printing opportunities due to the growing applications of digital printing. This, in turn, is anticipated to fuel the demand for high-speed production inkjet printing paper in North America as it is an ideal print solution for mail owners to lower operating costs and generate higher revenues.

The Middle East & Africa region is expected to grow at a CAGR of 7.5% over the forecast period. The printing industry in the region is experiencing technological advancements, with digital printing technology gaining traction owing to its advantages, such as low wastage of ink, low cost, superior color, and speed. Furthermore, players in the Middle East & Africa printing industry are investing in the adoption of advanced technologies to achieve superior products at low cost, leading to the emergence of high-speed production inkjet printers, thereby boosting the growth of the market.

Key Companies & Market Share Insights

The high-speed production inkjet printer paper market exhibits high competition owing to the presence of established players in this industry. The competitors in the industry opt for various strategies such as product portfolio expansion, partnerships, and collaborations to gain market share in the industry.

Key players are also engaged in research and development (R&D) to increase the usage of sustainable materials to manufacture high-speed production inkjet printer papers, thereby resulting in high competition and creating barriers to the entry of new players. A few major manufacturers, such as UPM, Mondi, and Sylvamo Corporation are vertically integrated. It helps them to ensure the easy availability of raw materials and reduces their dependence on suppliers. This also lowers the overall production cost of paper, thereby increasing the profit margins of manufacturers. Some prominent players in the global high-speed production inkjet printer paper market include:

-

UPM

-

Mondi

-

PaperOne

-

Finch Paper, LLC

-

DREWSEN SPEZIALPAPIERE GmbH & Co. KG

-

Sylvamo Corporation

-

Boise Paper

-

Arctic Paper

-

Nine Dragons Worldwide (China) Investment Group Co., Ltd.

-

Burgo Group S.p.A.

-

Domtar Corporation

-

Pixelle

-

Billerud

-

MOORIM

-

Stora Enso

-

Crown Van Gelder International B.V.

High-speed Production Inkjet Printer Paper Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.47 billion

Revenue forecast in 2030

USD 4.21 billion

Growth Rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, sales channel, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

UPM, Mondi; PaperOne; Finch Paper LLC; DREWSEN SPEZIALPAPIERE GmbH & Co. KG; Sylvamo Corporation, Boise Paper; Arctic Paper; Nine Dragons Worldwide (China) Investment Group Co. Ltd.; Burgo Group S.p.A.; Domtar Corporation; Pixelle, Billerud; MOORIM; Stora Enso; Crown Van Gelder International B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-speed Production Inkjet Printer Paper Market Segmentation

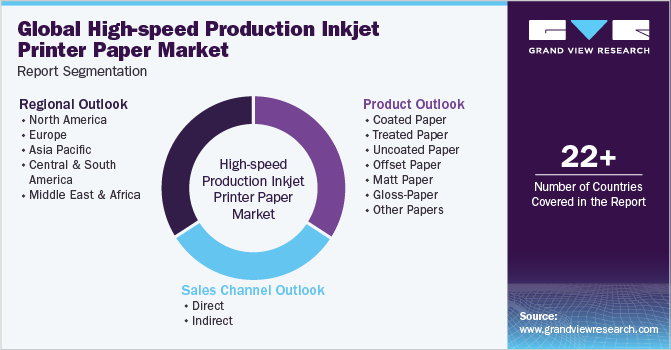

This report forecasts revenue growth at the regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the high-speed production inkjet printer paper market report based on product, sales channel, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coated Paper

-

Treated Paper

-

Uncoated Paper

-

Offset Paper

-

Matt Paper

-

Gloss-Paper

-

Other Papers

-

-

Sales Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct

-

Indirect

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global high-speed production inkjet printer paper market size was estimated at USD 2.30 billion in 2022 and is expected to reach USD 2.47 billion in 2023.

b. The global high-speed production inkjet printer paper market is expected to grow at a compound annual growth rate, a CAGR of 7.9% from 2023 to 2030, to reach USD 4.21 billion by 2030.

b. The coated paper segment of high-speed production inkjet printer paper market accounted for the largest revenue share of 42.2% in 2022. Coated paper provides numerous benefits, including high print resolution, improved ink absorption, reduced drying time, ability to print high-quality graphics, and enhanced color representation, which is expected to fuel its demand over the coming years.

b. Some key players operating in the high-speed production inkjet printer paper market include UPM, Mondi, PaperOne, Finch Paper, LLC, DREWSEN SPEZIALPAPIERE GmbH & Co. KG, Sylvamo Corporation, Boise Paper, Arctic Paper, and Nine Dragons Worldwide (China) Investment Group Co., Ltd.

b. Key factors that are driving the market growth include the rising demand of high-speed production inkjet printer paper in commercial printing applications such as books, newspapers, magazines, and marketing collaterals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."